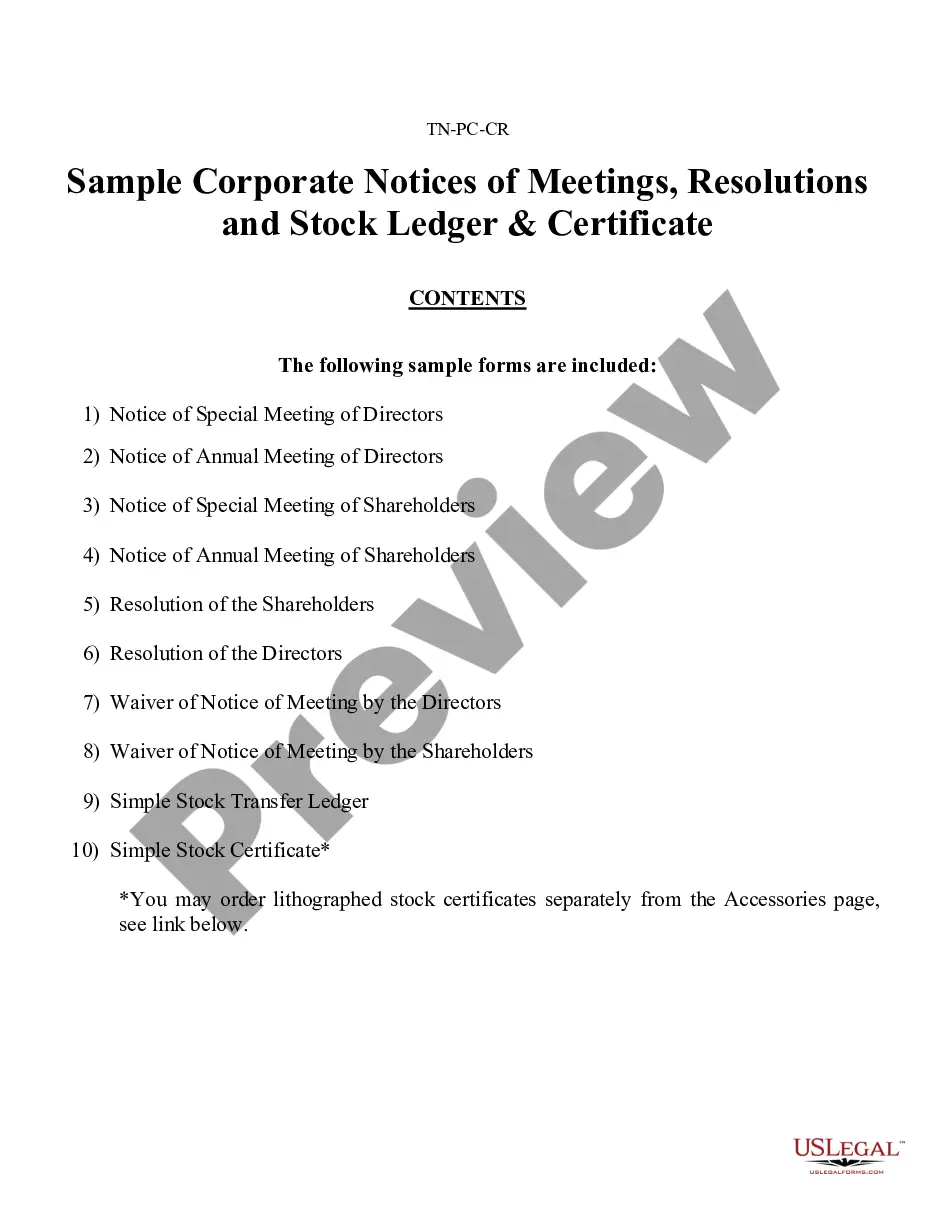

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

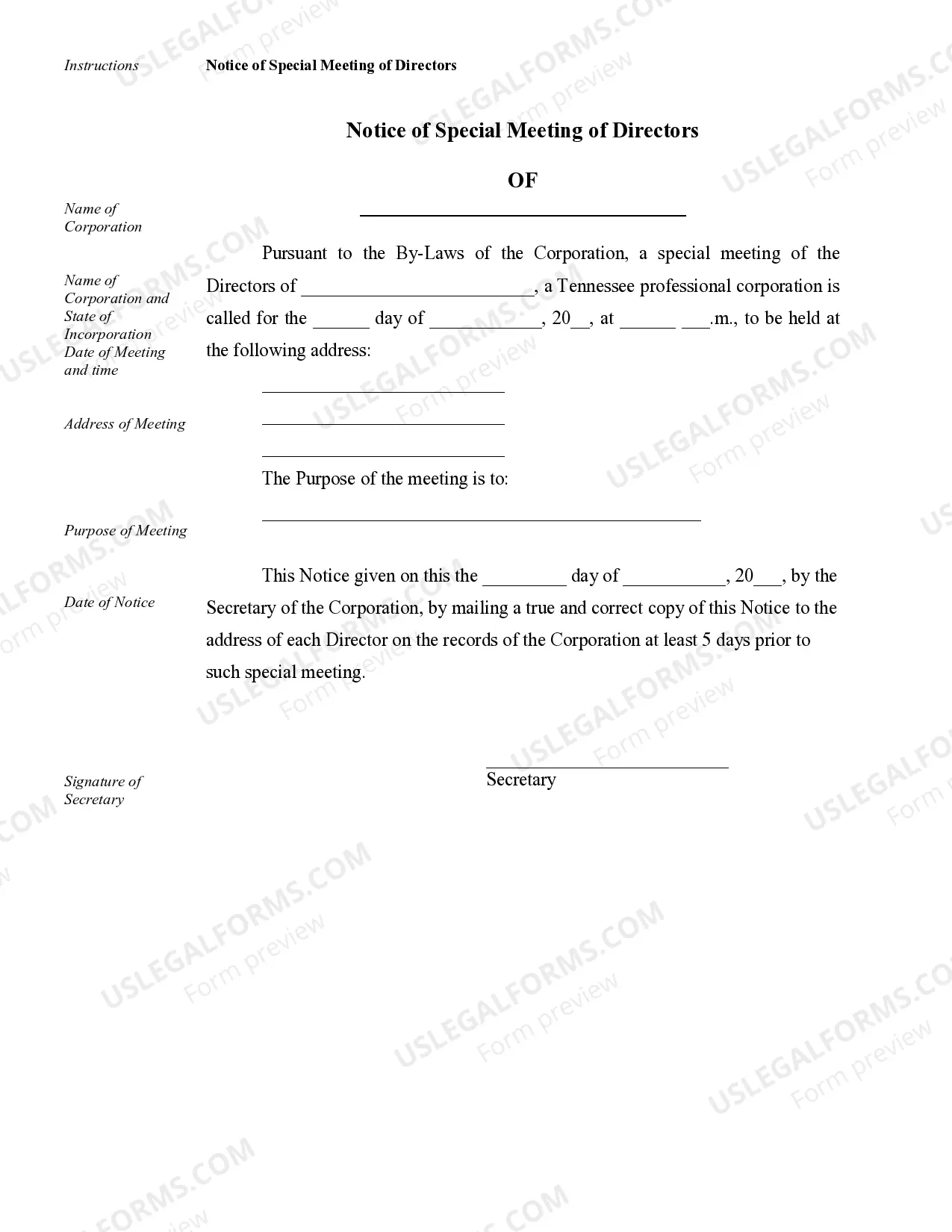

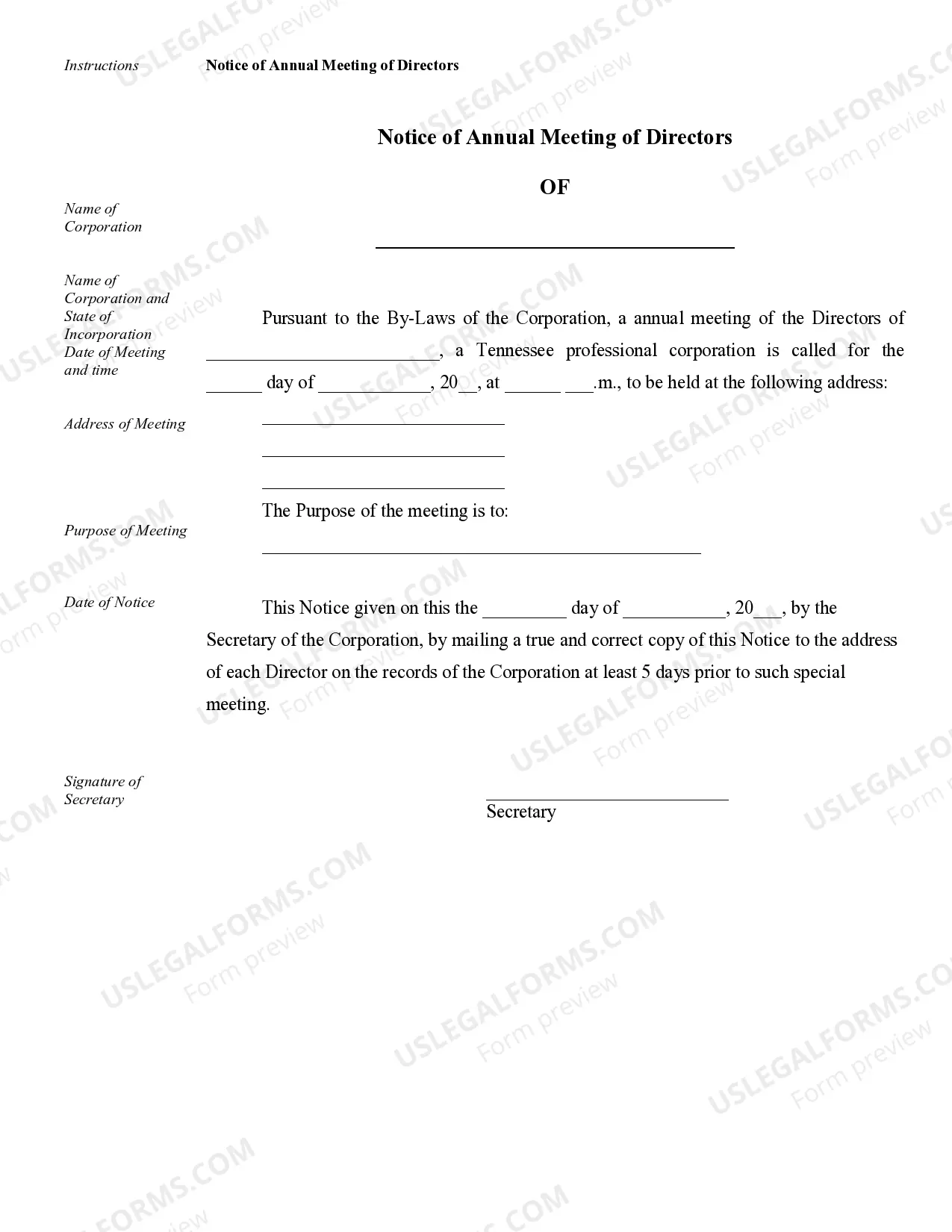

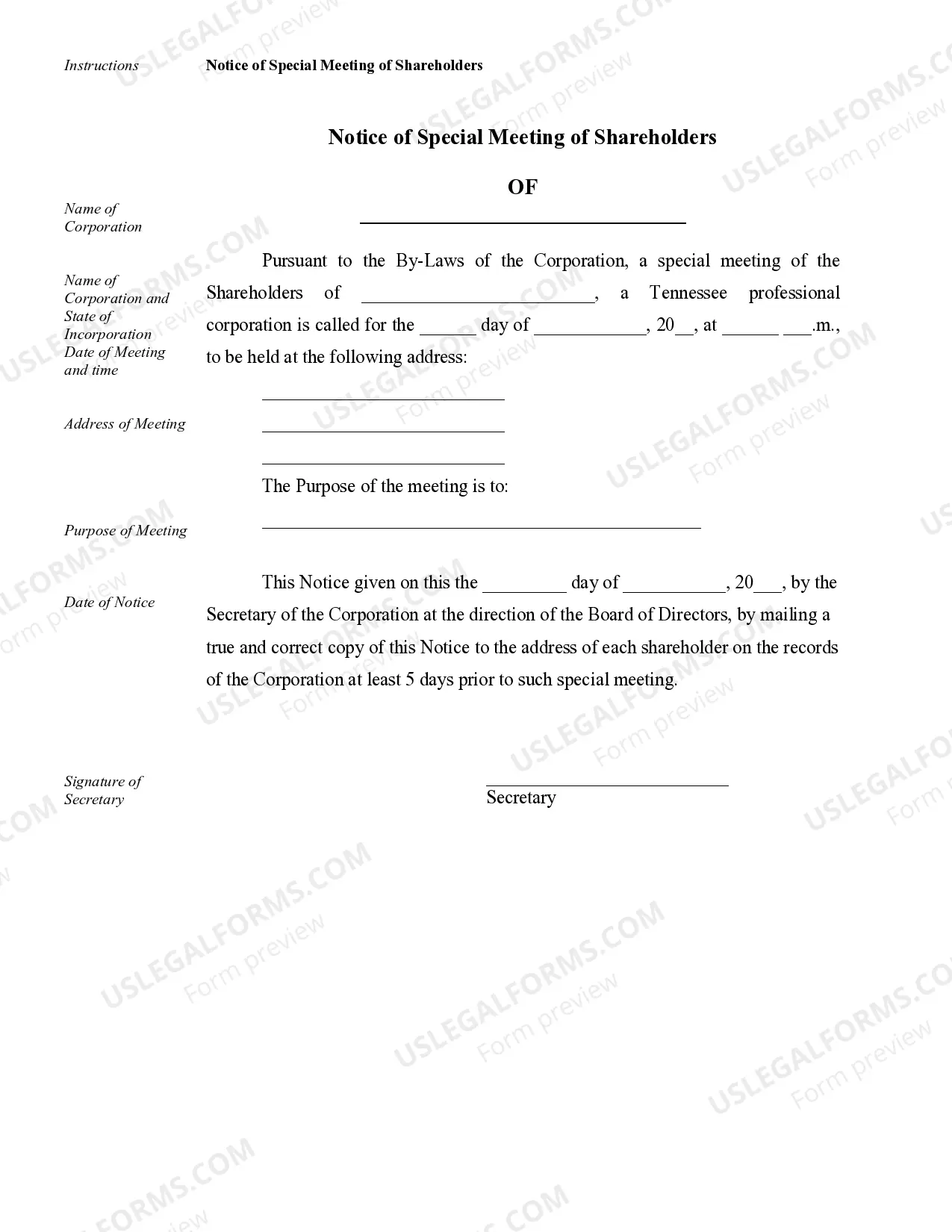

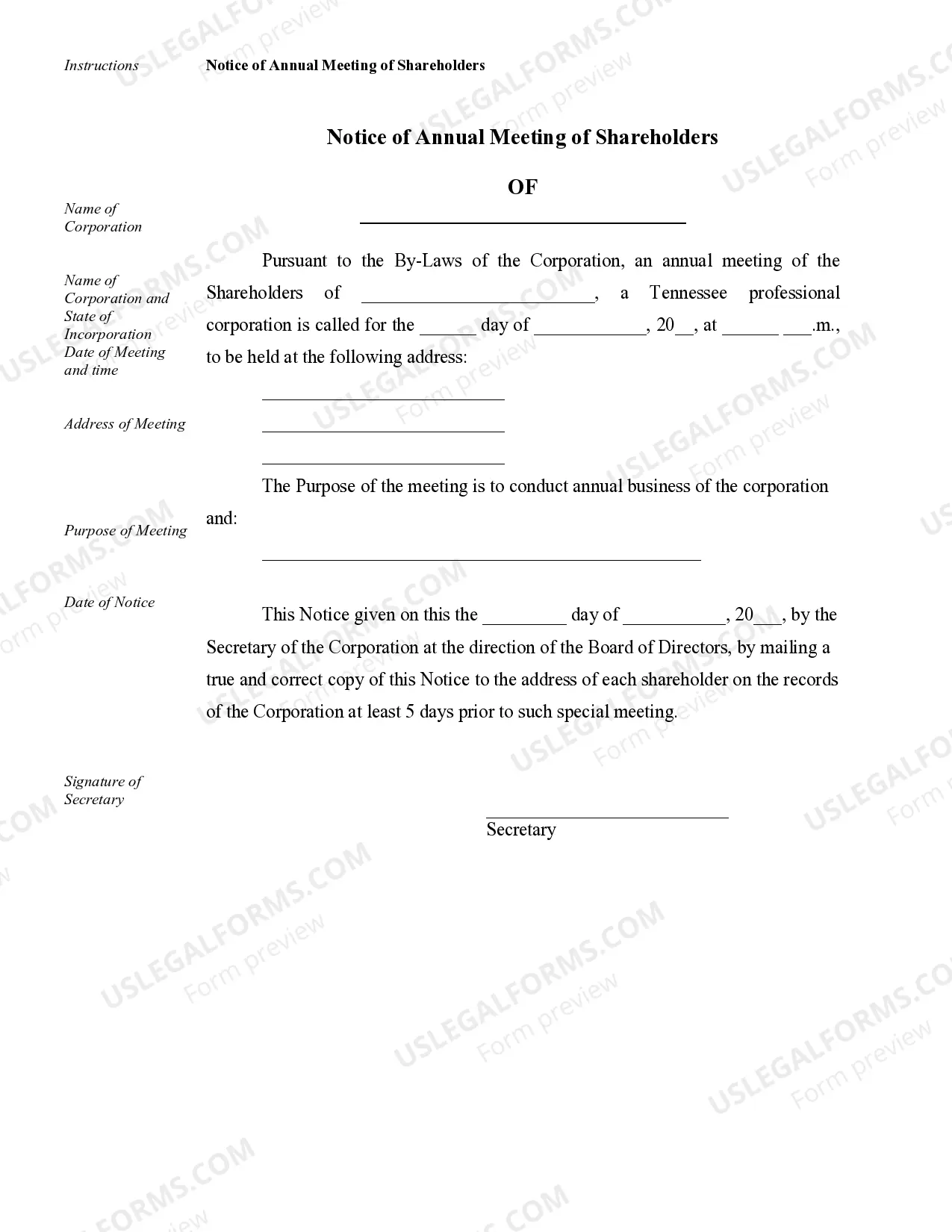

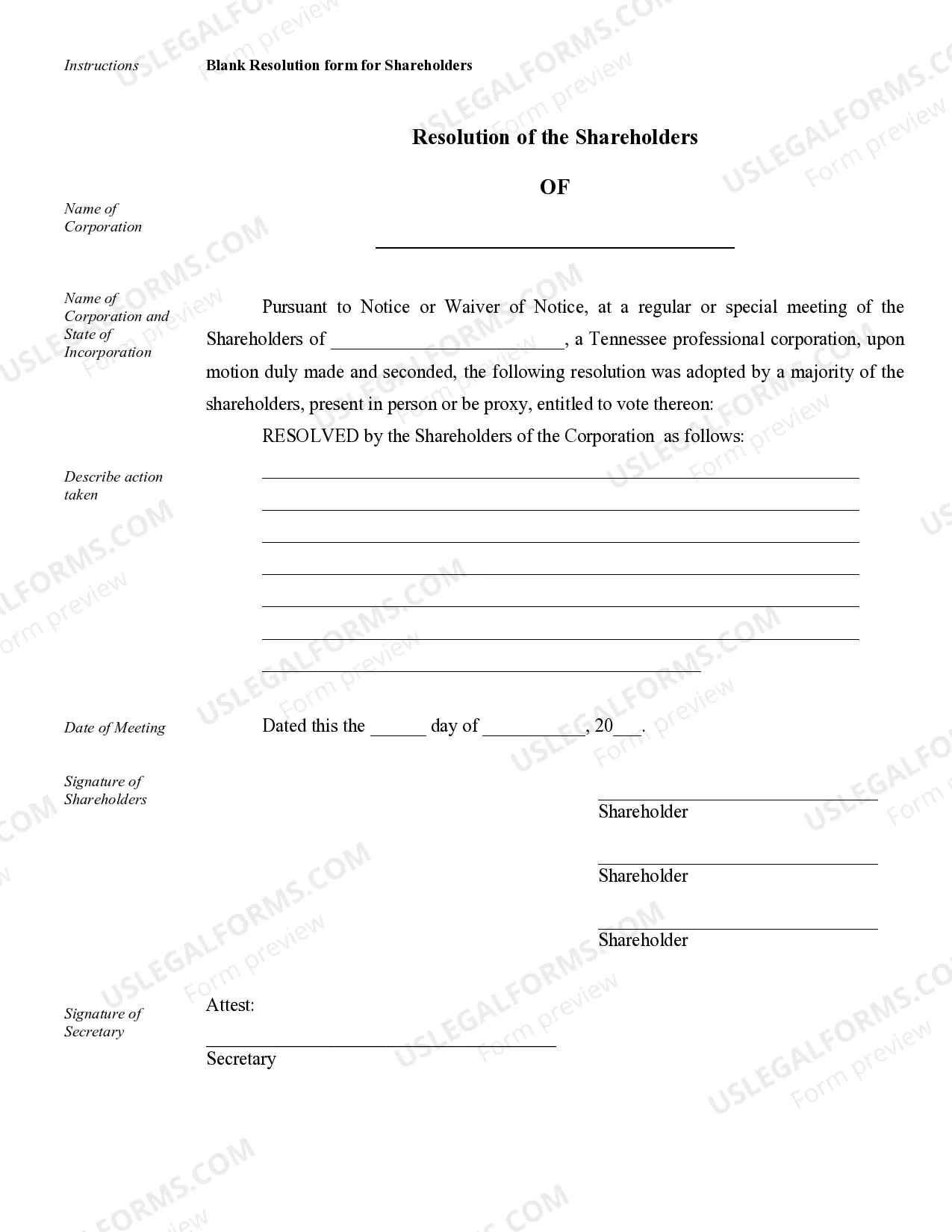

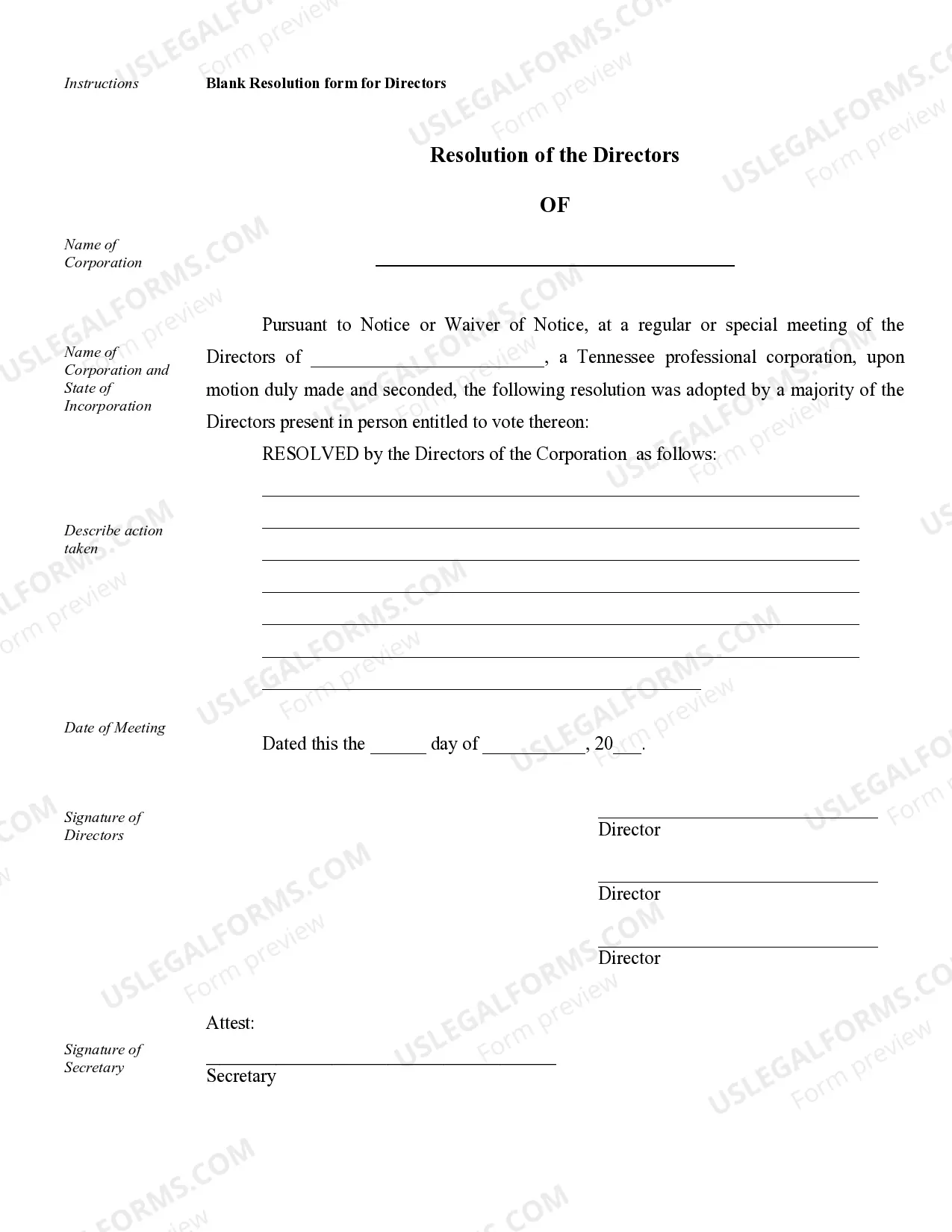

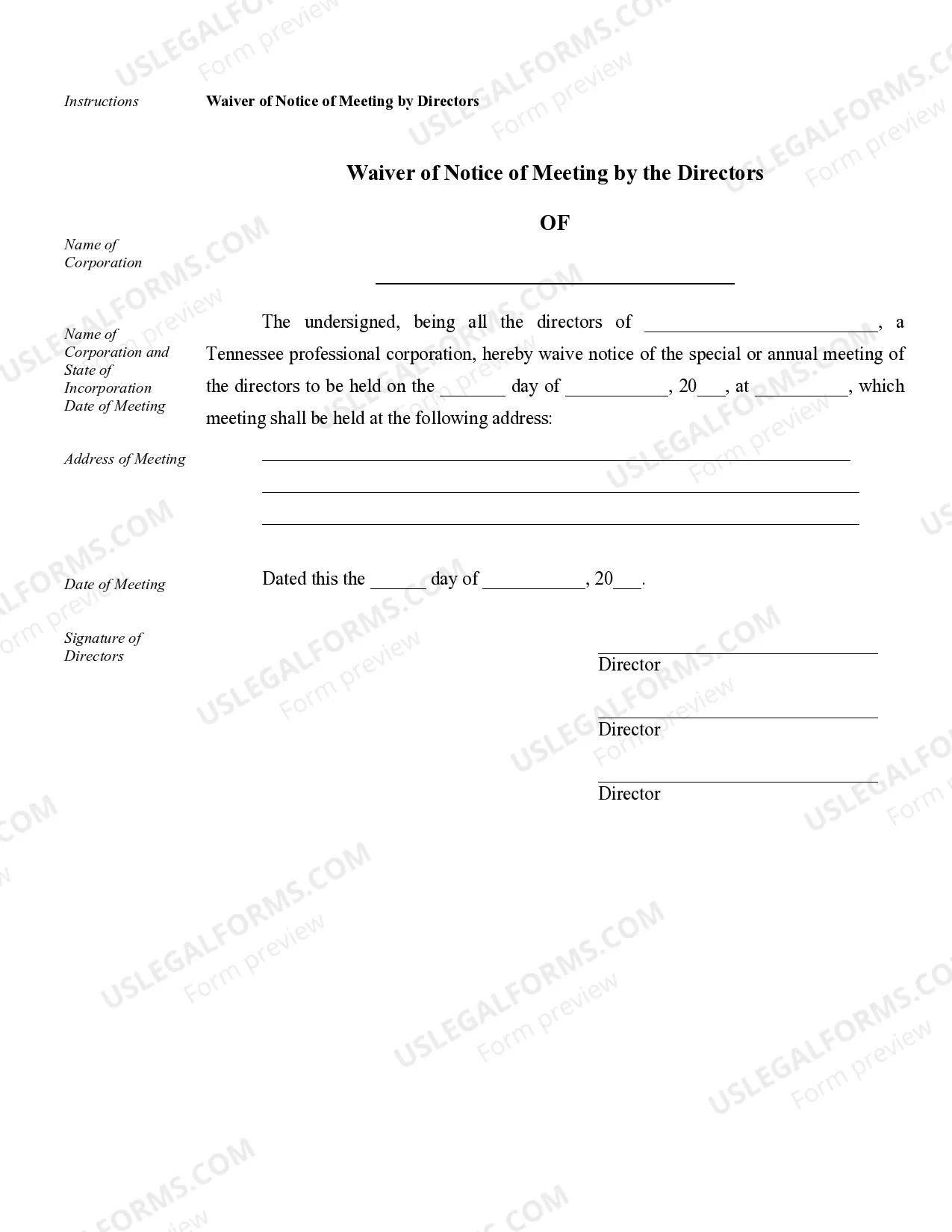

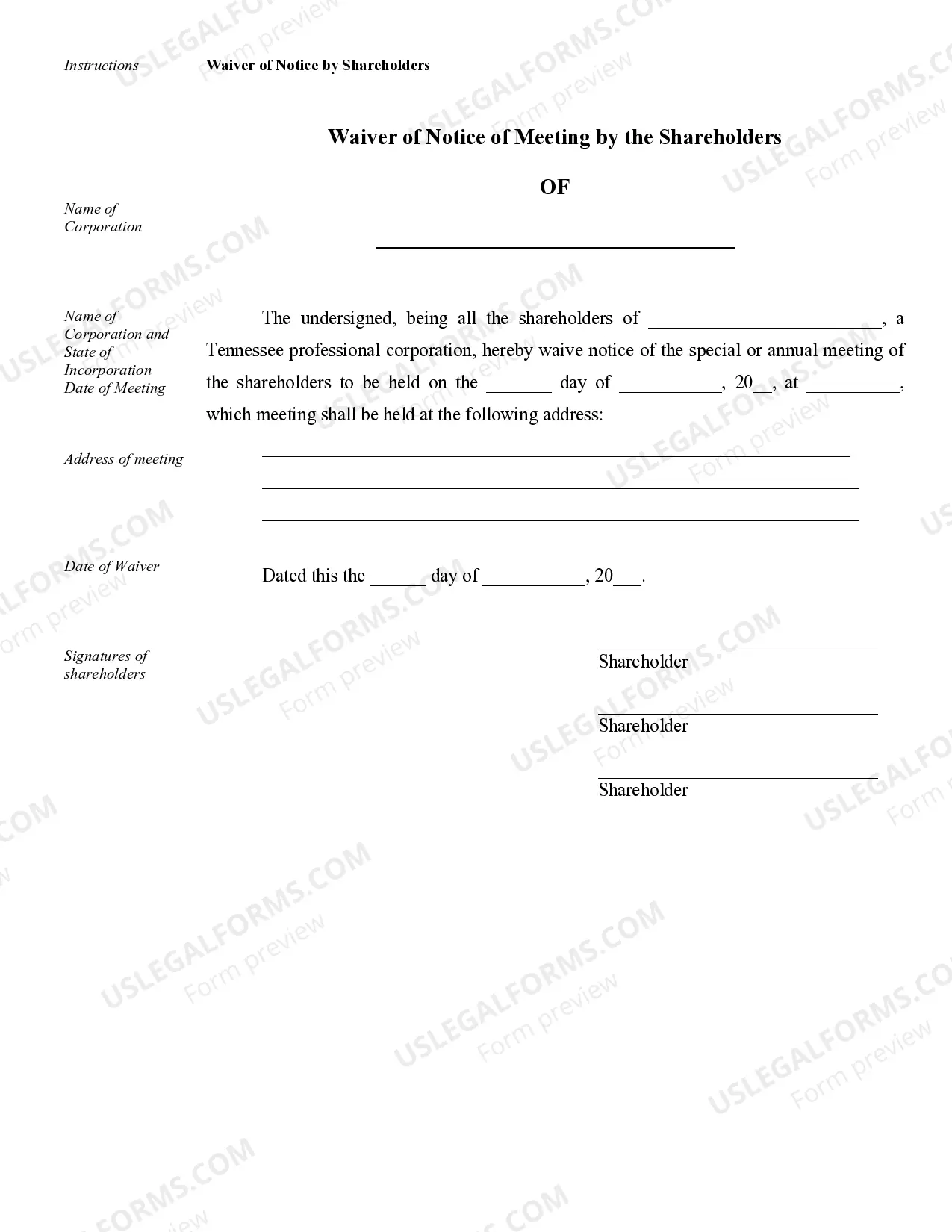

Clarksville Sample Corporate Records for a Tennessee Professional Corporation are essential documents that record and maintain vital information regarding the formation and operations of a professional corporation in Clarksville, Tennessee. These records are crucial for complying with legal requirements, maintaining corporate transparency, and ensuring proper governance. Some key types of Clarksville Sample Corporate Records for a Tennessee Professional Corporation include: 1. Articles of Incorporation: This document outlines the essential details of the corporation, such as its name, purpose, location, directors, and registered agent. It serves as the foundation of the corporation and is filed with the Tennessee Secretary of State. 2. Bylaws: The bylaws establish the internal rules and regulations that govern the corporation's operations. These include details on shareholder and director meetings, appointment of officers, voting procedures, and the distribution of dividends. 3. Shareholder Records: These records maintain information regarding the corporation's shareholders, including their names, addresses, contact details, and share ownership. Shareholder records are crucial for tracking ownership percentages, issuing dividends, and facilitating communication within the corporation. 4. Director and Officer Records: This category covers details about the corporation's directors and officers, including their names, addresses, positions, and contact information. These records help ensure transparency and accountability among the leadership team. 5. Minutes of Meetings: These records document the proceedings and decisions made during both shareholder and director meetings. They capture important discussions, resolutions, voting outcomes, and other significant corporate actions. Minutes of meetings are critical for demonstrating corporate governance and compliance. 6. Financial Records: Financial records include the corporation's balance sheets, income statements, cash flow statements, and other financial information. These records provide a clear picture of the corporation's financial health, profitability, and compliance with accounting standards. 7. Stock Certificate Records: These records document the issuance and ownership of stock certificates. They include information such as the certificate number, shareholder's name, number of shares held, and the date of issuance. 8. Annual Reports: Each year, professional corporations in Tennessee are required to file an annual report with the Tennessee Secretary of State. These reports provide updates on the corporation's business activities, directors, officers, shareholders, and address changes. 9. Compliance Records: These records demonstrate the corporation's compliance with legal and regulatory requirements. They include records of business licenses, permits, tax filings, and any other documents necessary to operate legally in Clarksville, Tennessee. Properly managing and maintaining Clarksville Sample Corporate Records for a Tennessee Professional Corporation is vital for ensuring legal compliance, facilitating transparent governance, and protecting the corporation's interests. It is advisable to seek professional assistance from attorneys or corporate service providers to ensure accurate record-keeping and adherence to state-specific regulations.Clarksville Sample Corporate Records for a Tennessee Professional Corporation are essential documents that record and maintain vital information regarding the formation and operations of a professional corporation in Clarksville, Tennessee. These records are crucial for complying with legal requirements, maintaining corporate transparency, and ensuring proper governance. Some key types of Clarksville Sample Corporate Records for a Tennessee Professional Corporation include: 1. Articles of Incorporation: This document outlines the essential details of the corporation, such as its name, purpose, location, directors, and registered agent. It serves as the foundation of the corporation and is filed with the Tennessee Secretary of State. 2. Bylaws: The bylaws establish the internal rules and regulations that govern the corporation's operations. These include details on shareholder and director meetings, appointment of officers, voting procedures, and the distribution of dividends. 3. Shareholder Records: These records maintain information regarding the corporation's shareholders, including their names, addresses, contact details, and share ownership. Shareholder records are crucial for tracking ownership percentages, issuing dividends, and facilitating communication within the corporation. 4. Director and Officer Records: This category covers details about the corporation's directors and officers, including their names, addresses, positions, and contact information. These records help ensure transparency and accountability among the leadership team. 5. Minutes of Meetings: These records document the proceedings and decisions made during both shareholder and director meetings. They capture important discussions, resolutions, voting outcomes, and other significant corporate actions. Minutes of meetings are critical for demonstrating corporate governance and compliance. 6. Financial Records: Financial records include the corporation's balance sheets, income statements, cash flow statements, and other financial information. These records provide a clear picture of the corporation's financial health, profitability, and compliance with accounting standards. 7. Stock Certificate Records: These records document the issuance and ownership of stock certificates. They include information such as the certificate number, shareholder's name, number of shares held, and the date of issuance. 8. Annual Reports: Each year, professional corporations in Tennessee are required to file an annual report with the Tennessee Secretary of State. These reports provide updates on the corporation's business activities, directors, officers, shareholders, and address changes. 9. Compliance Records: These records demonstrate the corporation's compliance with legal and regulatory requirements. They include records of business licenses, permits, tax filings, and any other documents necessary to operate legally in Clarksville, Tennessee. Properly managing and maintaining Clarksville Sample Corporate Records for a Tennessee Professional Corporation is vital for ensuring legal compliance, facilitating transparent governance, and protecting the corporation's interests. It is advisable to seek professional assistance from attorneys or corporate service providers to ensure accurate record-keeping and adherence to state-specific regulations.