Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

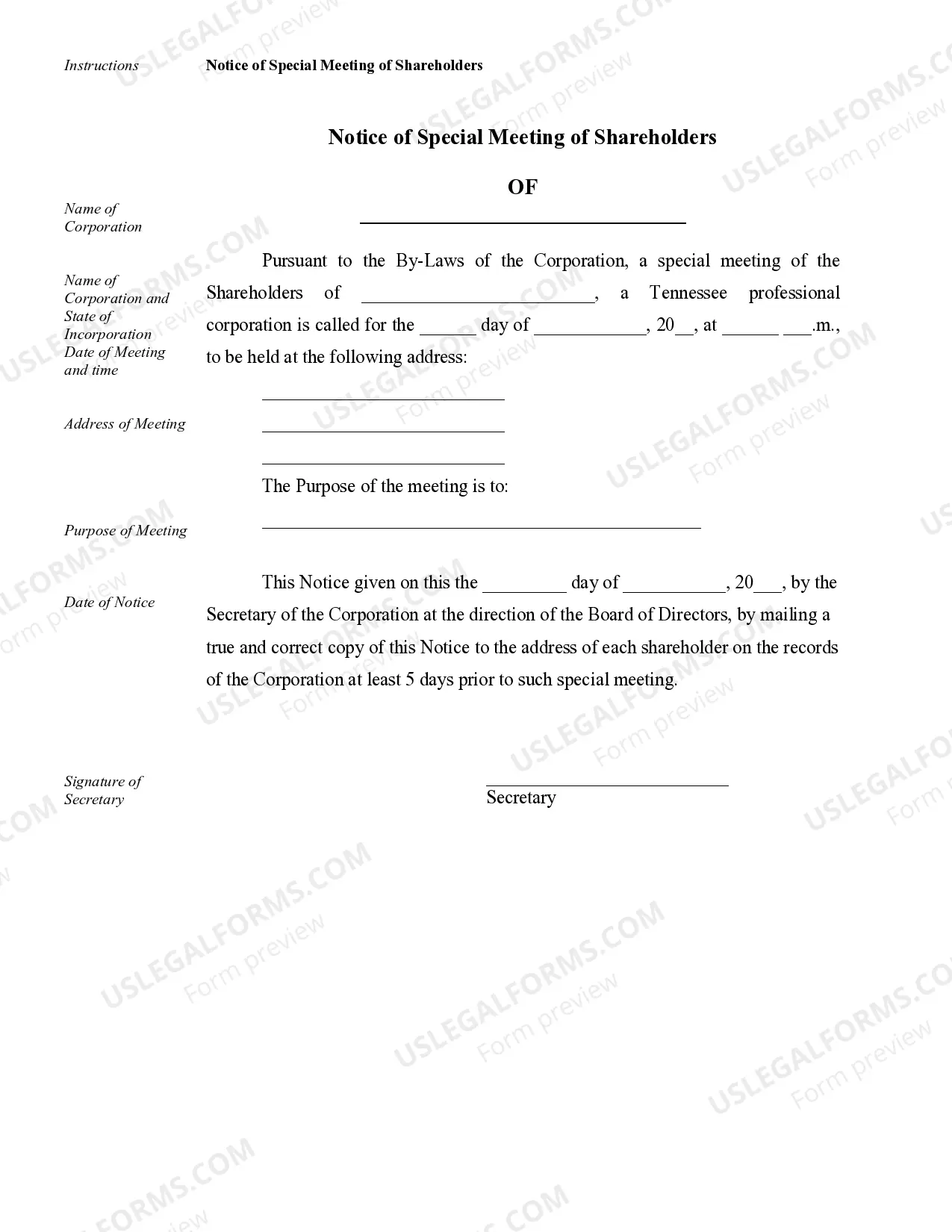

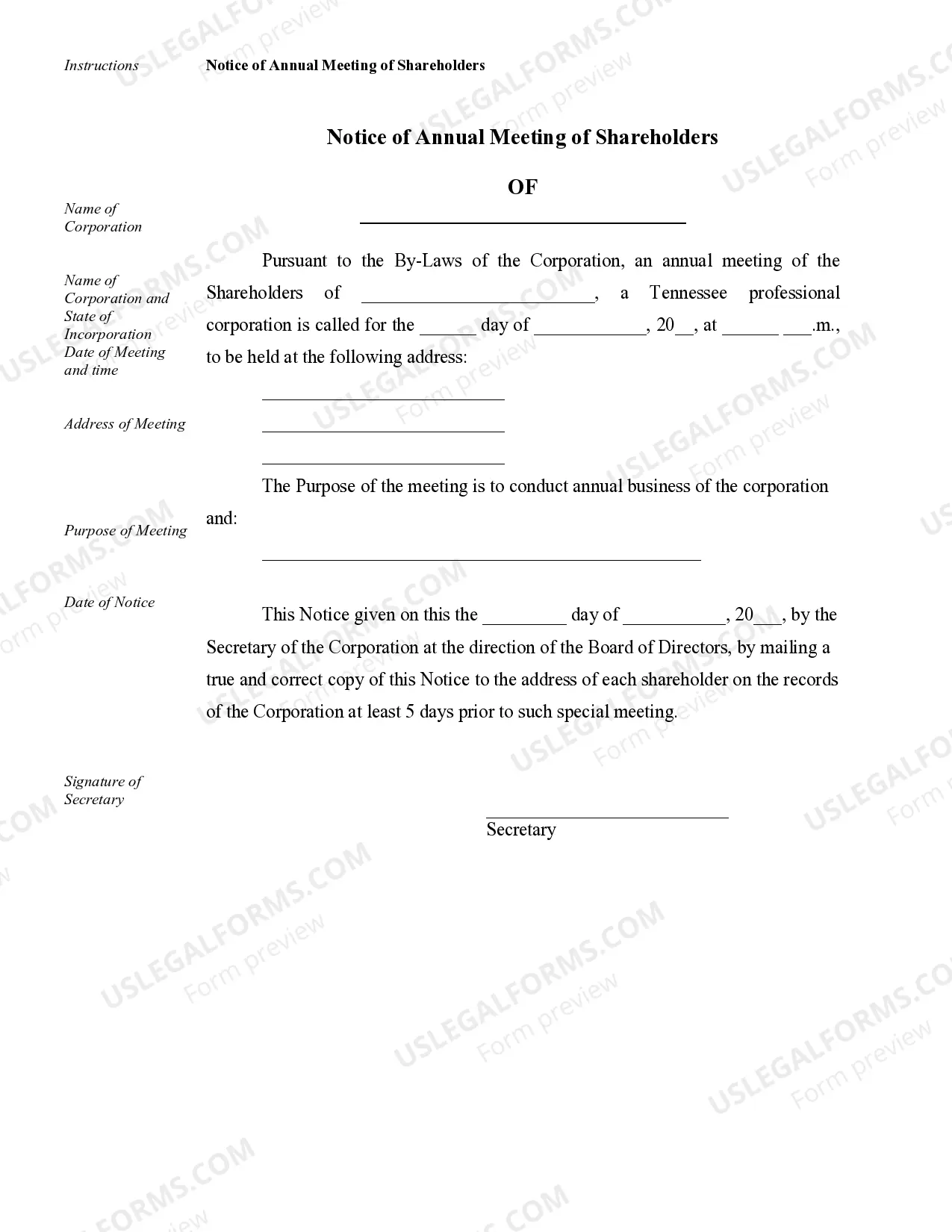

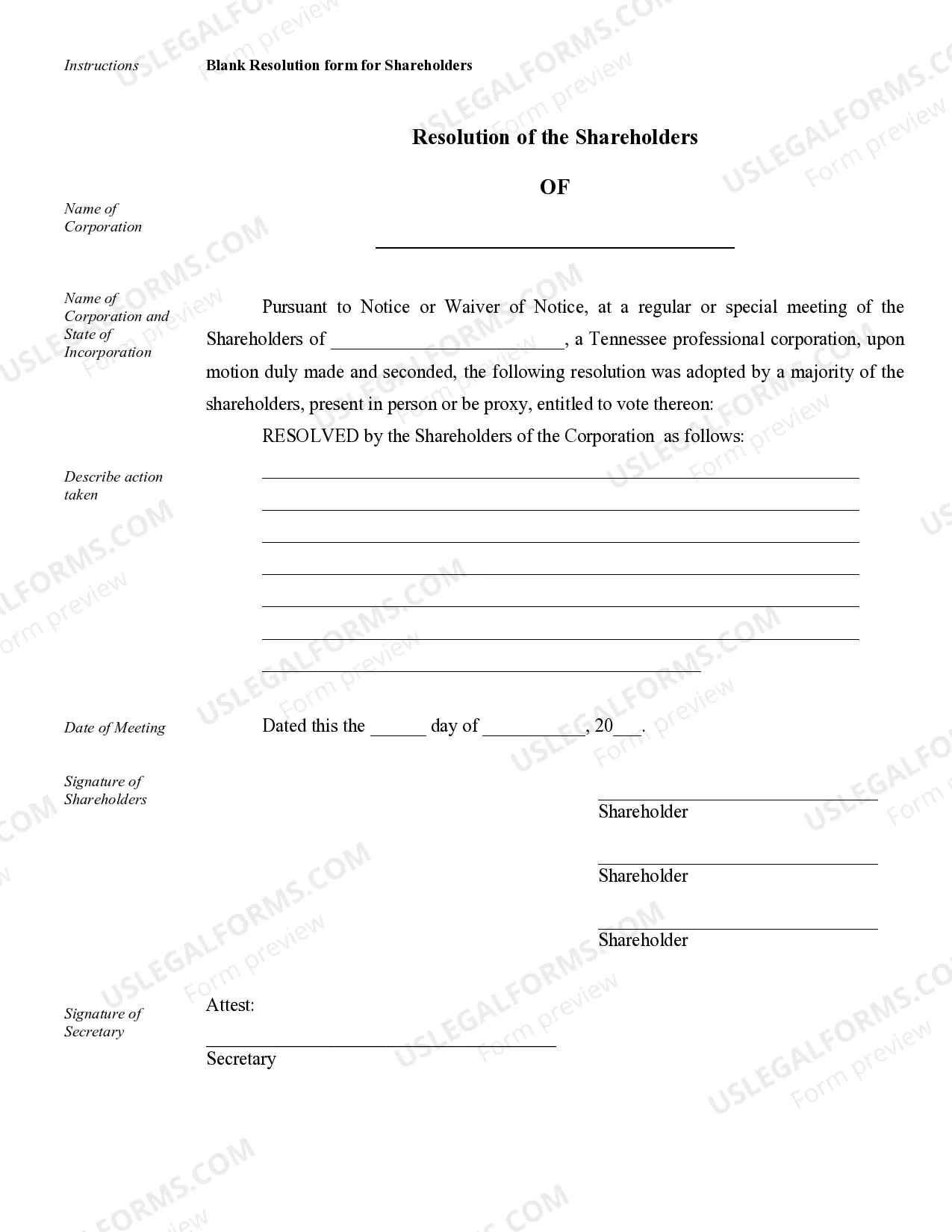

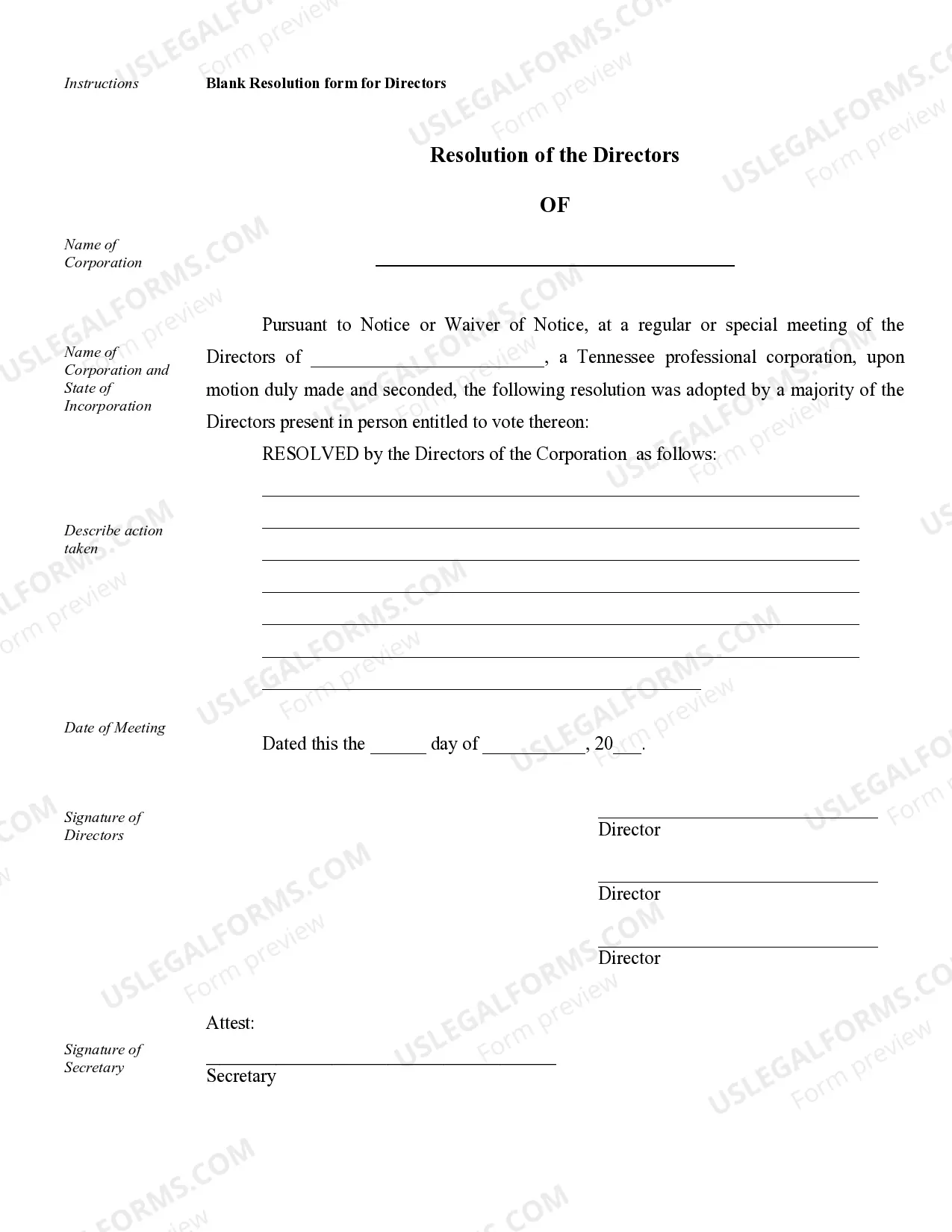

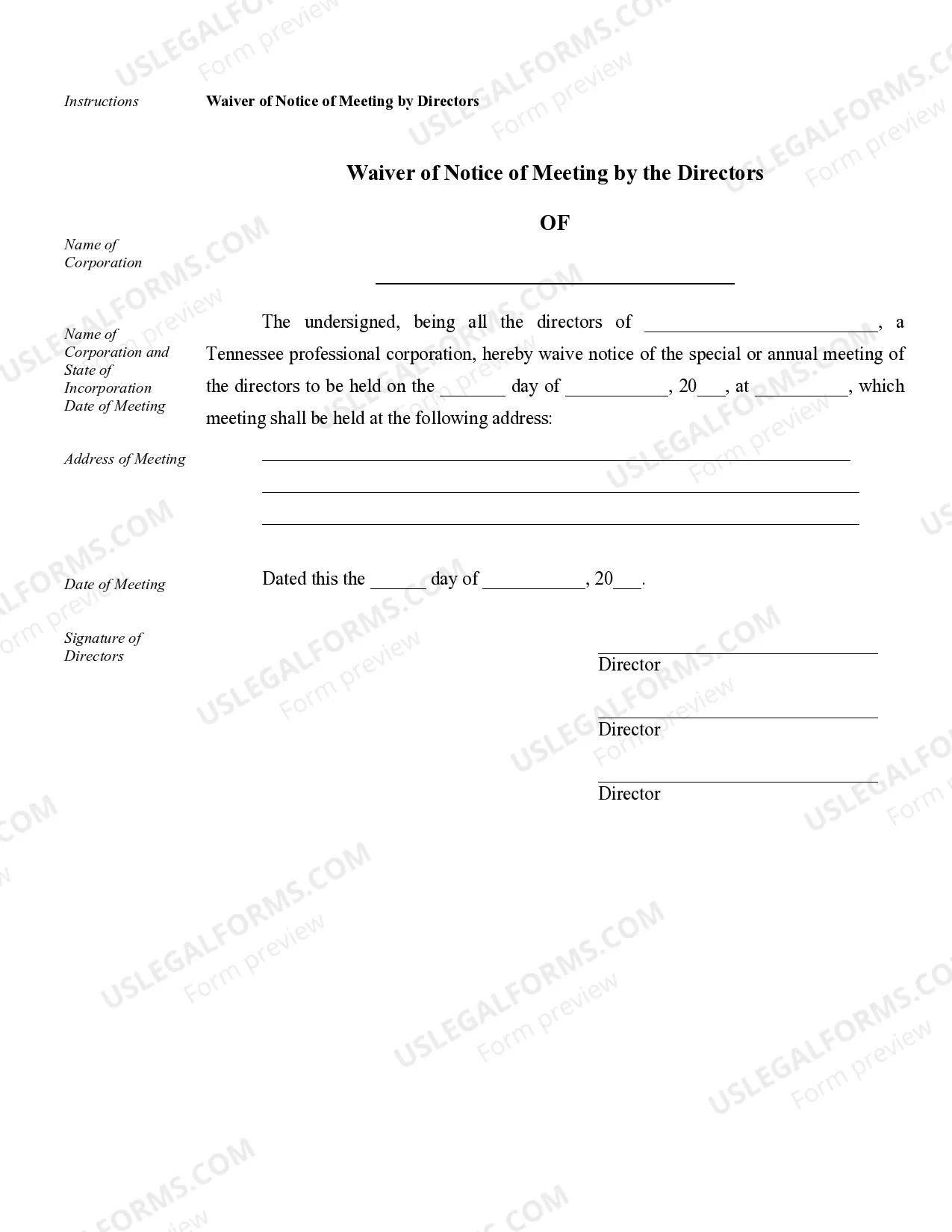

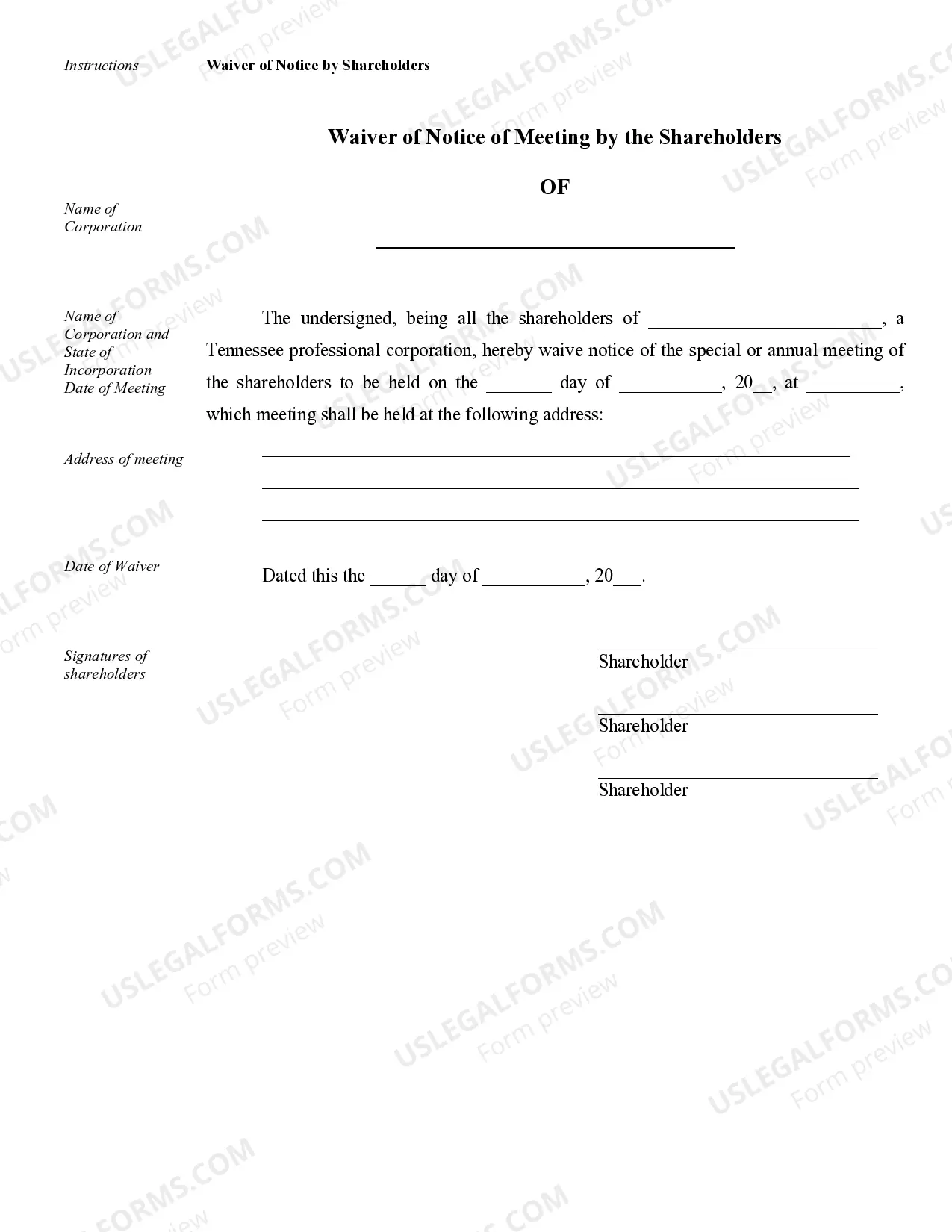

Knoxville Sample Corporate Records for a Tennessee Professional Corporation serve as essential documentation that outlines crucial information and legalities related to the operation and governance of such businesses. These records are vital for ensuring compliance with state laws and regulations, as well as for demonstrating the corporation's adherence to corporate formalities. The following are different types of Knoxville Sample Corporate Records that are commonly maintained for a Tennessee Professional Corporation: 1. Articles of Incorporation: This document signifies the corporation's creation and includes details like the corporation's name, purpose, registered agent, and initial board of directors. 2. Bylaws: The corporate bylaws outline the internal structure and governance procedures of the corporation. They typically include information about shareholder rights, board meetings, officer roles, voting procedures, and more. 3. Meeting Minutes: These records document the proceedings of corporate meetings, such as shareholder meetings and board of directors meetings. Meeting minutes provide a comprehensive account of discussions, decisions, and actions taken during these meetings. 4. Shareholder Agreements: Shareholder agreements are contractual agreements between the corporation and its shareholders. They define the rights and responsibilities of shareholders, including issues related to stock ownership, dividend distribution, voting rights, and transfer restrictions. 5. Stock Certificates and Ledgers: Stock certificates represent ownership in the corporation and are issued to shareholders. Alongside, stock ledgers are maintained to record the issuance, transfer, and cancellation of stock certificates, thus ensuring an accurate record of all stock-related transactions. 6. Financial Statements: These records present the financial performance and position of the corporation. They typically include balance sheets, income statements, cash flow statements, and statements of retained earnings. Financial statements are crucial for tax reporting, investor communication, and decision-making purposes. 7. Annual Reports: In Tennessee, professional corporations are required to file annual reports with the Secretary of State's office. These reports provide updates on the corporation's current information, such as address changes, officer and director information, and any other pertinent updates. 8. Stockholder Voting Agreements: In some cases, stockholders may enter into agreements that outline how they will vote on corporate matters, such as electing directors or approving significant transactions. These voting agreements ensure transparency and clarity regarding shareholder decisions. 9. Board Resolutions: Board resolutions are formal records that document decisions made by the board of directors. They are typically required for significant company actions, such as approving contracts, mergers, acquisitions, or major investments. Resolutions are vital for demonstrating corporate authority and decision-making processes. 10. Stock Option Plans: If the corporation has established an employee stock option plan (ESOP), records related to these plans need to be created and maintained. These records typically include the ESOP agreement, option grants, exercise notices, and any relevant communications. In summary, Knoxville Sample Corporate Records for a Tennessee Professional Corporation encompass a range of documents that help establish and maintain the legal and operational framework of the corporation. By diligently maintaining these records, a professional corporation demonstrates its commitment to compliance, transparency, and good governance practices.