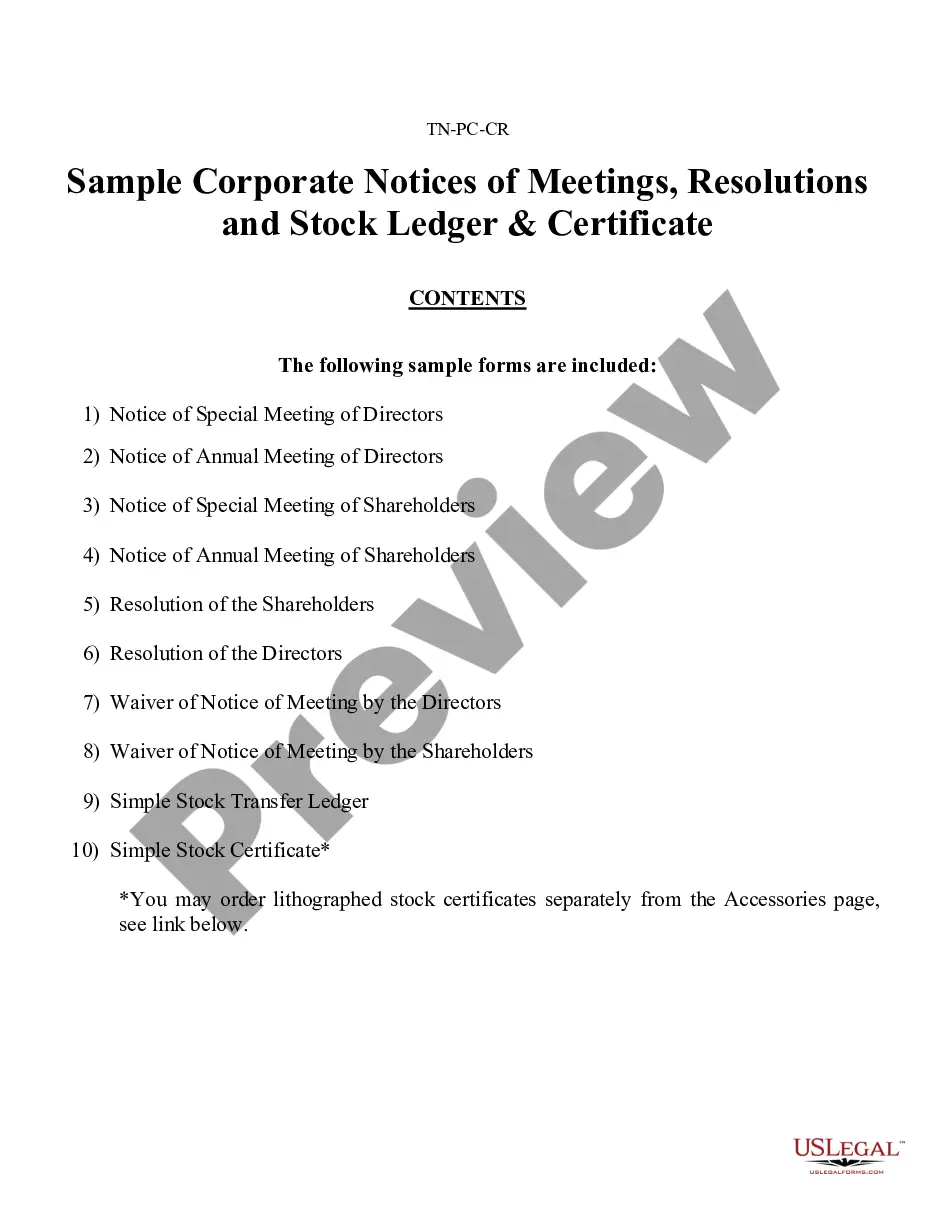

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

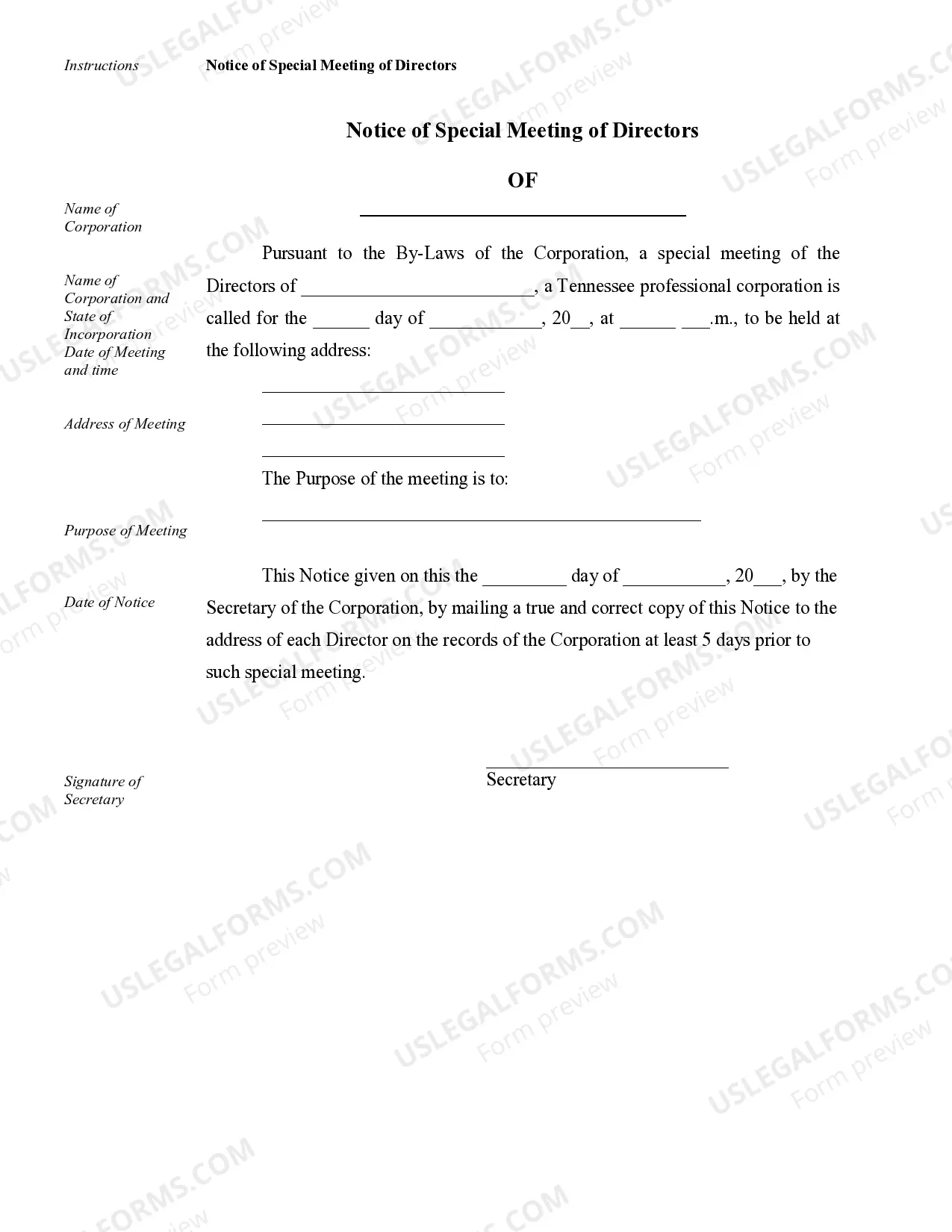

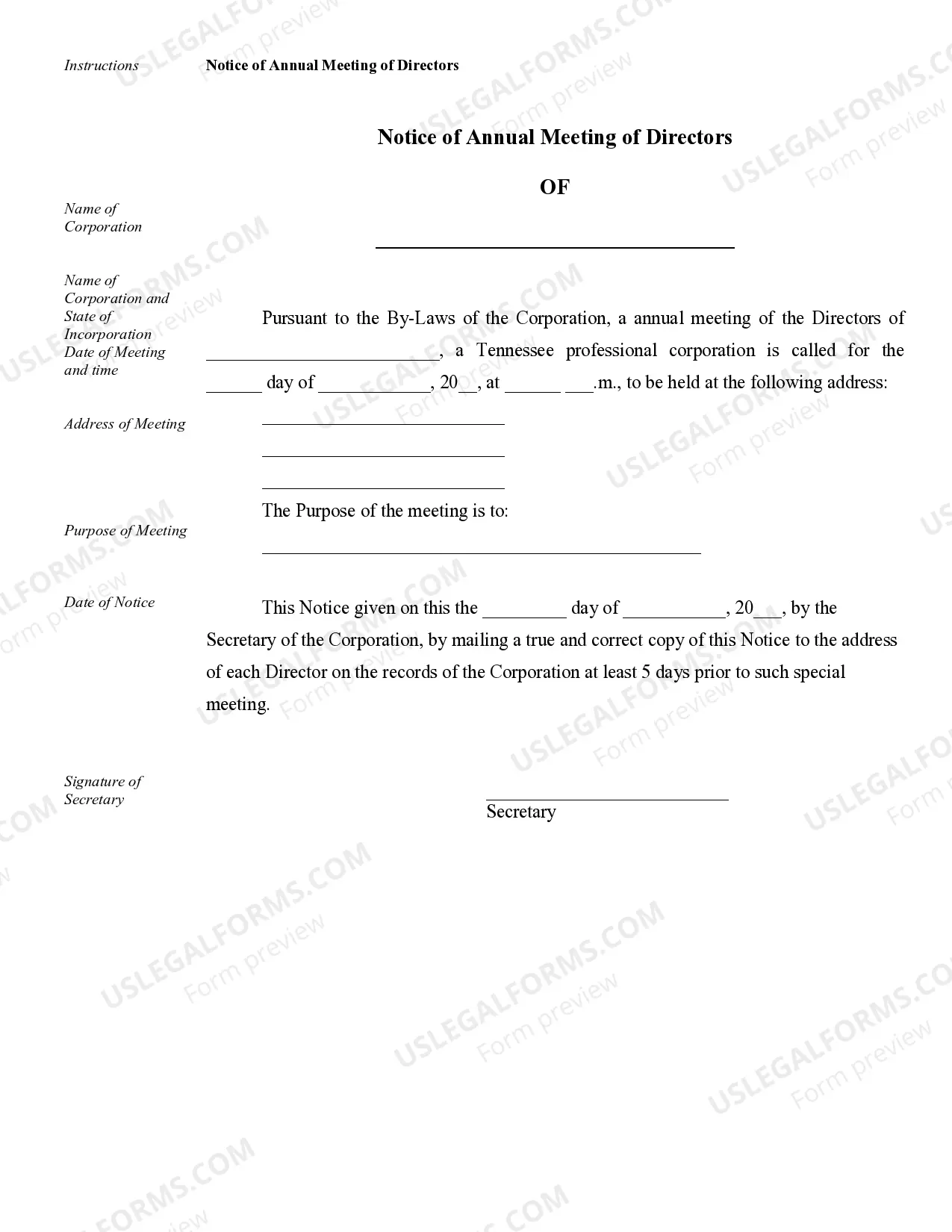

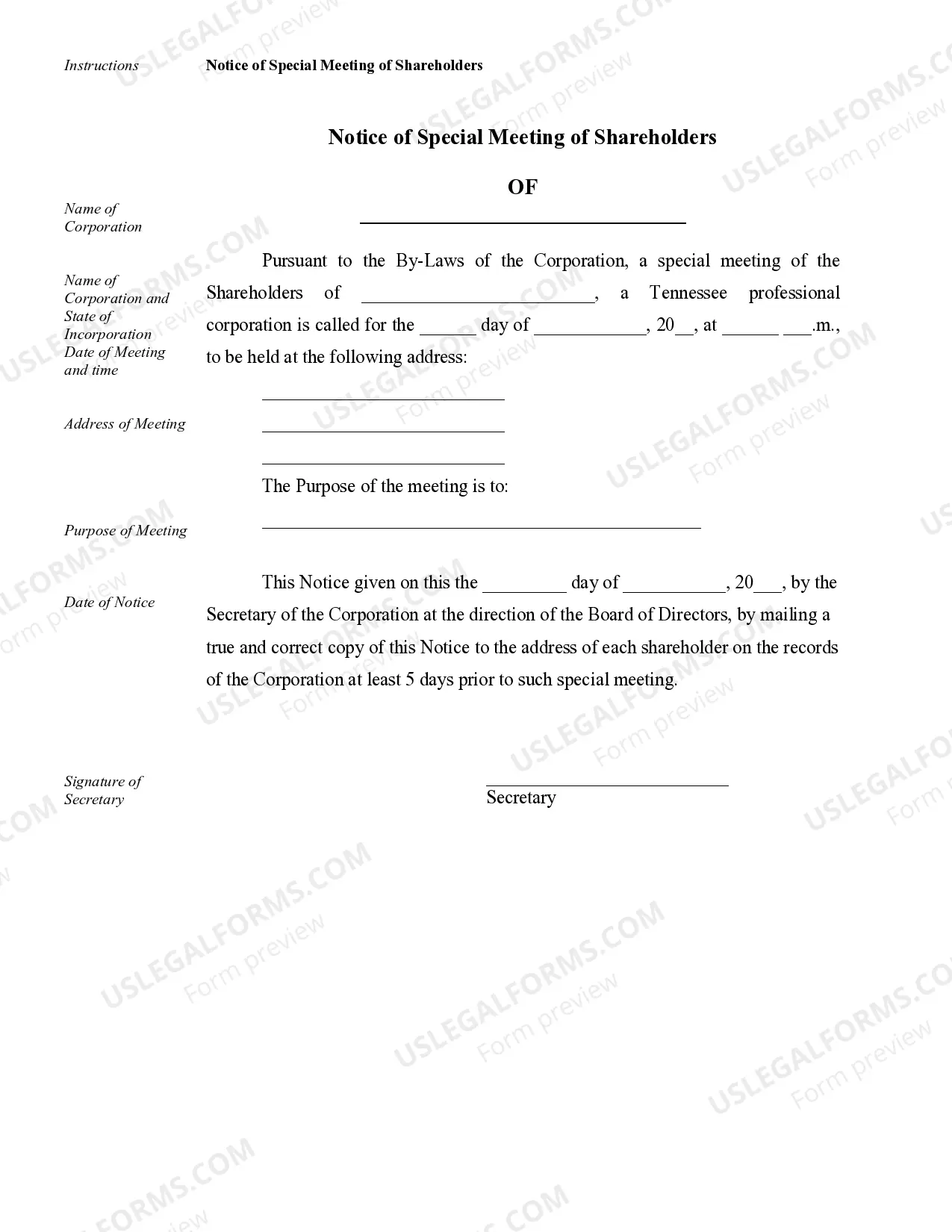

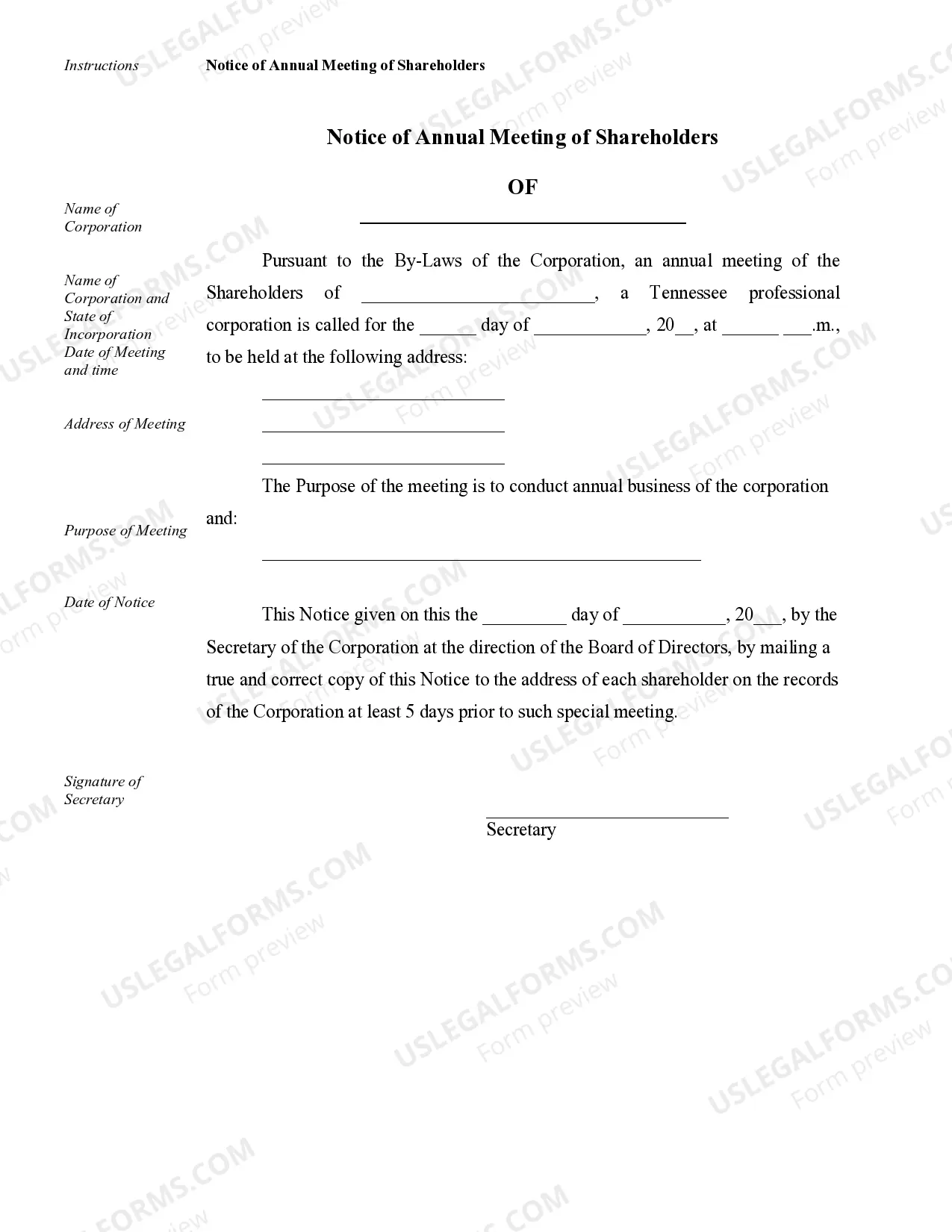

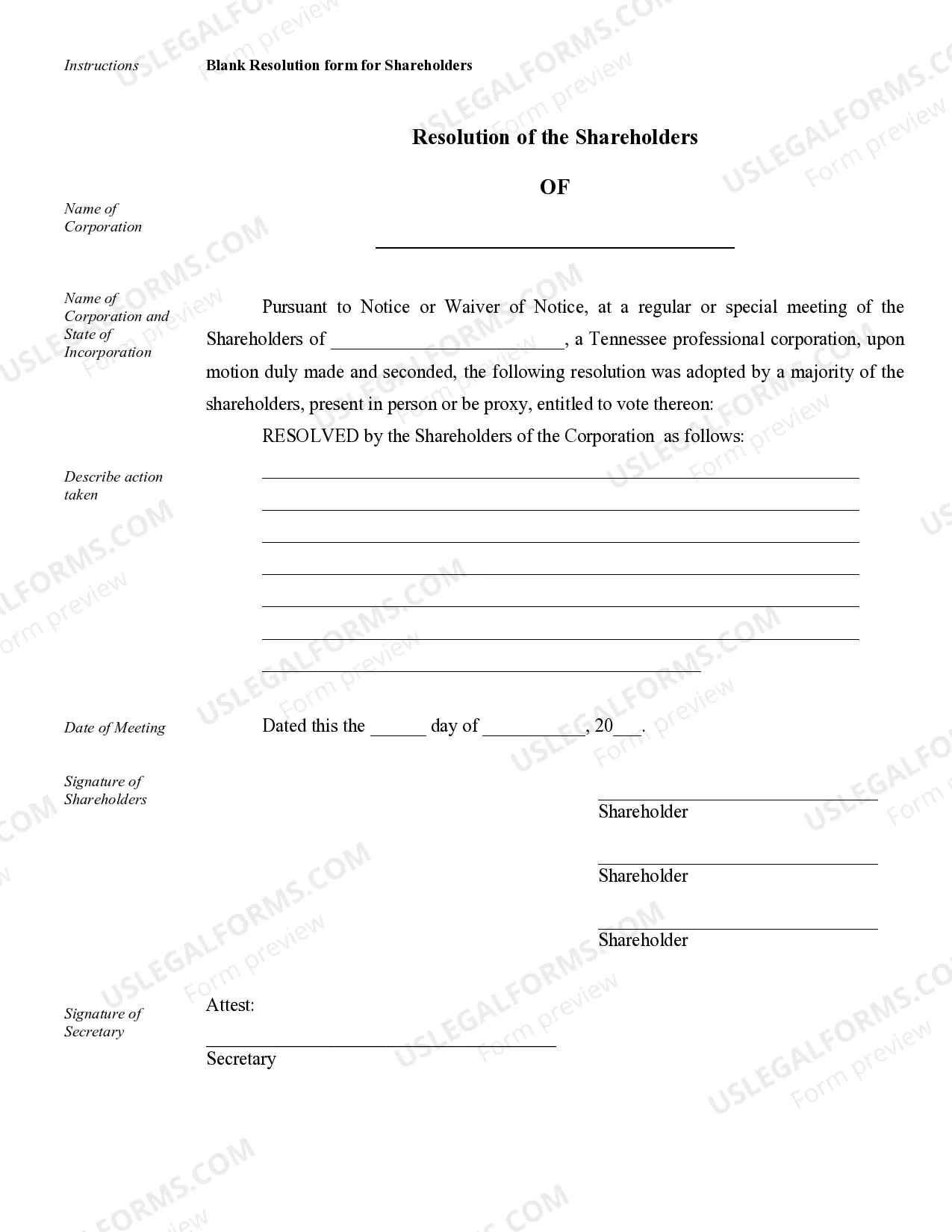

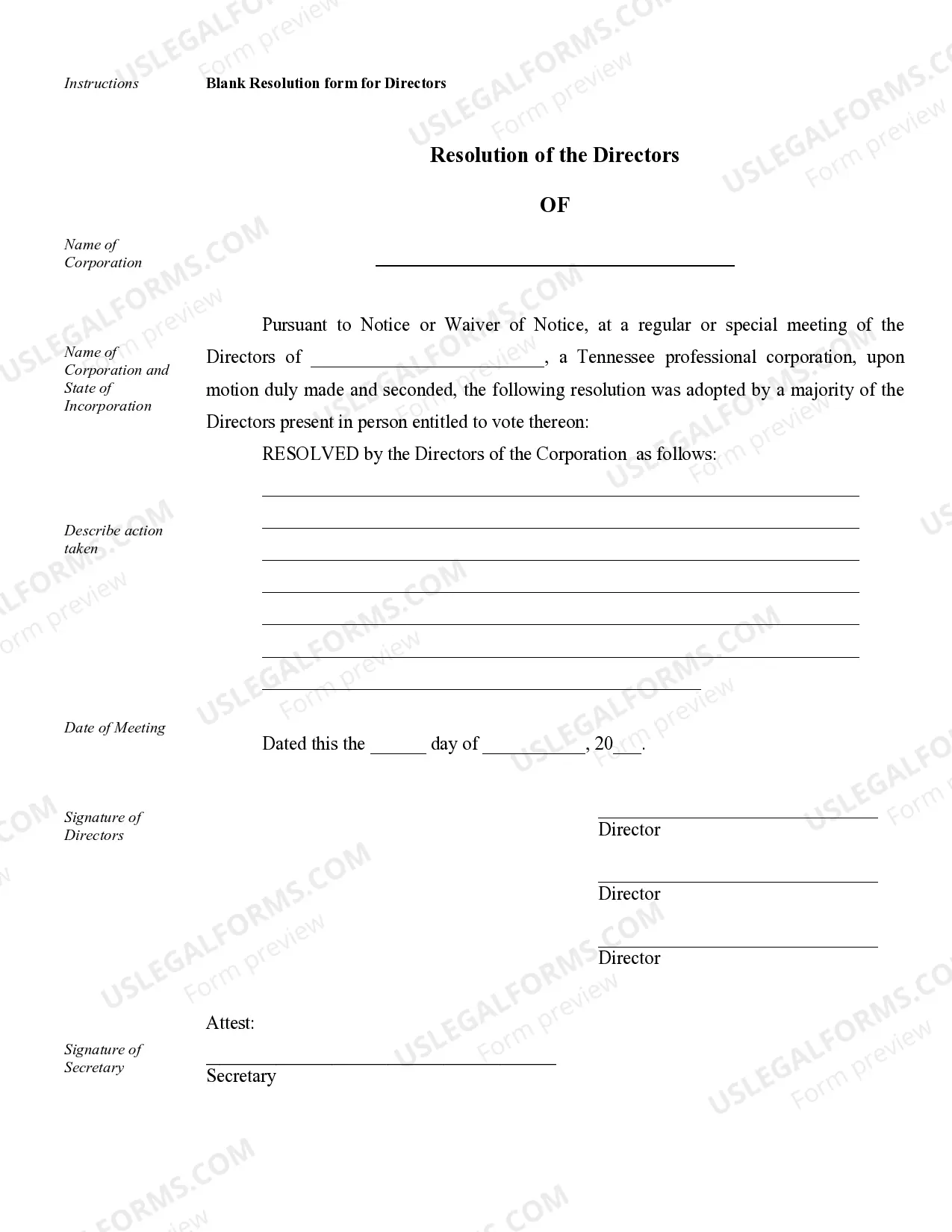

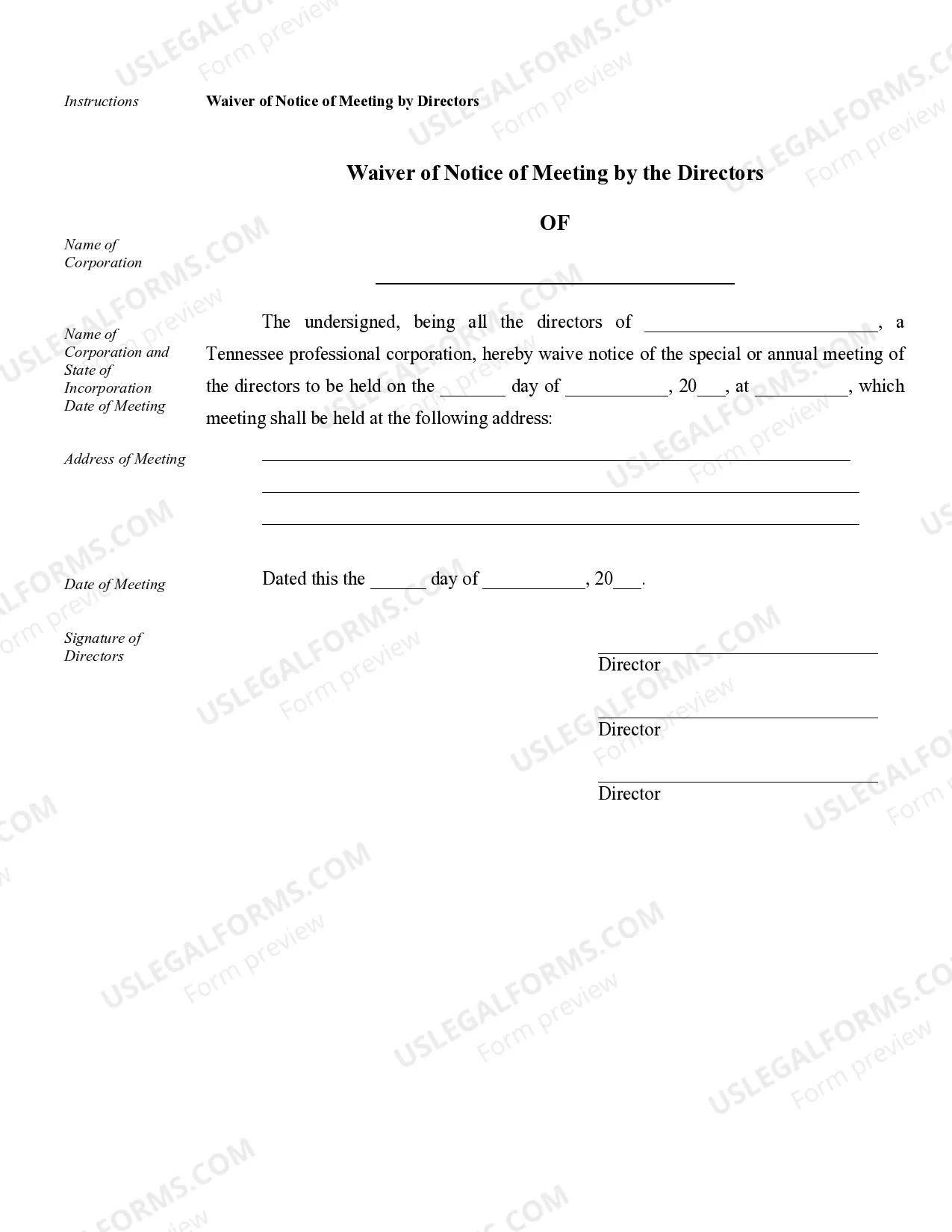

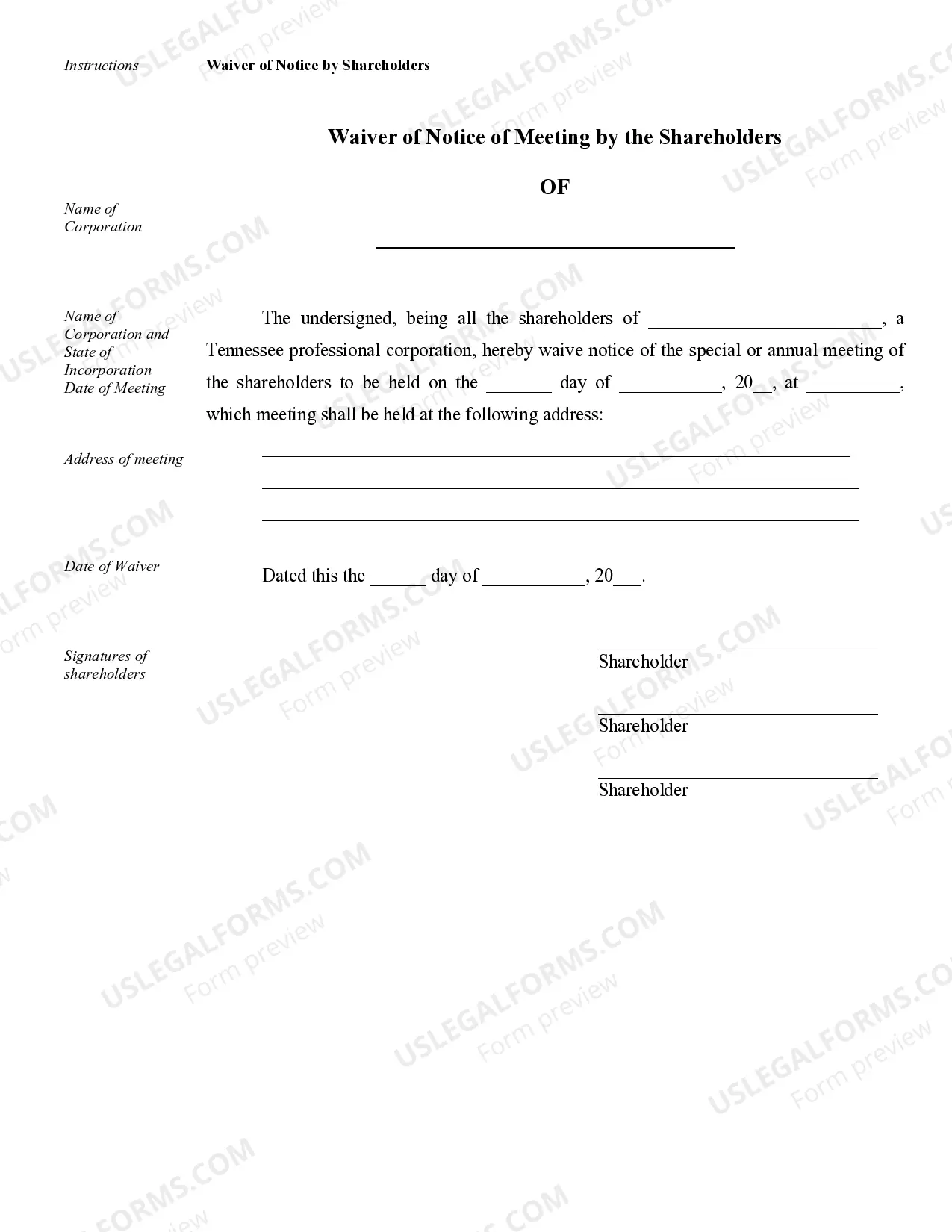

Memphis Sample Corporate Records for a Tennessee Professional Corporation refer to the official documents and records that are required to establish, maintain, and update the legal status and activities of a professional corporation in the state of Tennessee, particularly in the city of Memphis. These records play a crucial role in providing transparency, accountability, and legal compliance to the professional corporation. The specific types of Memphis Sample Corporate Records for a Tennessee Professional Corporation may include: 1. Articles of Incorporation: This is a legal document filed with the Tennessee Secretary of State's office, which establishes the existence of the professional corporation. It typically includes the corporation's name, purpose, duration, registered agent, and other key information. 2. Bylaws: These are the internal rules and regulations that govern the operations of the professional corporation. Bylaws outline important aspects such as shareholder rights, director responsibilities, meeting procedures, voting rules, and other governance matters. 3. Shareholder Agreements: These agreements define the rights and obligations of the shareholders in the professional corporation. It may include provisions on ownership percentages, transfer restrictions, voting rights, dividend distributions, and dispute resolution mechanisms. 4. Board of Directors Meetings Minutes: Minutes are detailed records of the discussions, decisions, and actions taken during board of directors meetings. These minutes are important for legal compliance, corporate governance, and documenting the decision-making process. 5. Shareholder Meetings Minutes: Similar to board of directors meetings minutes, these minutes record the discussions, decisions, and voting outcomes during shareholder meetings. They provide evidence of shareholder approvals, elections, amendments to bylaws, and other significant matters. 6. Stock Ledgers: These ledgers maintain a record of the ownership and transfer of shares in the professional corporation. Stock ledgers help identify the shareholders, their respective shareholdings, and any changes in ownership over time. 7. Annual Reports: Tennessee law requires professional corporations to file an annual report with the Secretary of State's office. This report typically updates the state on the corporation's contact information, registered agent, officers, directors, and other pertinent details. 8. Financial Records: Professional corporations must maintain accurate financial records, including income statements, balance sheets, cash flow statements, and retained earnings statements. These records are essential for tax compliance, auditing, and tracking the financial health of the corporation. It is important to note that these Memphis Sample Corporate Records for a Tennessee Professional Corporation may vary depending on the specific nature of the professional corporation, its industry, and its specific legal and regulatory requirements. Professional advice from legal and accounting professionals can ensure compliance with all relevant rules and regulations.Memphis Sample Corporate Records for a Tennessee Professional Corporation refer to the official documents and records that are required to establish, maintain, and update the legal status and activities of a professional corporation in the state of Tennessee, particularly in the city of Memphis. These records play a crucial role in providing transparency, accountability, and legal compliance to the professional corporation. The specific types of Memphis Sample Corporate Records for a Tennessee Professional Corporation may include: 1. Articles of Incorporation: This is a legal document filed with the Tennessee Secretary of State's office, which establishes the existence of the professional corporation. It typically includes the corporation's name, purpose, duration, registered agent, and other key information. 2. Bylaws: These are the internal rules and regulations that govern the operations of the professional corporation. Bylaws outline important aspects such as shareholder rights, director responsibilities, meeting procedures, voting rules, and other governance matters. 3. Shareholder Agreements: These agreements define the rights and obligations of the shareholders in the professional corporation. It may include provisions on ownership percentages, transfer restrictions, voting rights, dividend distributions, and dispute resolution mechanisms. 4. Board of Directors Meetings Minutes: Minutes are detailed records of the discussions, decisions, and actions taken during board of directors meetings. These minutes are important for legal compliance, corporate governance, and documenting the decision-making process. 5. Shareholder Meetings Minutes: Similar to board of directors meetings minutes, these minutes record the discussions, decisions, and voting outcomes during shareholder meetings. They provide evidence of shareholder approvals, elections, amendments to bylaws, and other significant matters. 6. Stock Ledgers: These ledgers maintain a record of the ownership and transfer of shares in the professional corporation. Stock ledgers help identify the shareholders, their respective shareholdings, and any changes in ownership over time. 7. Annual Reports: Tennessee law requires professional corporations to file an annual report with the Secretary of State's office. This report typically updates the state on the corporation's contact information, registered agent, officers, directors, and other pertinent details. 8. Financial Records: Professional corporations must maintain accurate financial records, including income statements, balance sheets, cash flow statements, and retained earnings statements. These records are essential for tax compliance, auditing, and tracking the financial health of the corporation. It is important to note that these Memphis Sample Corporate Records for a Tennessee Professional Corporation may vary depending on the specific nature of the professional corporation, its industry, and its specific legal and regulatory requirements. Professional advice from legal and accounting professionals can ensure compliance with all relevant rules and regulations.