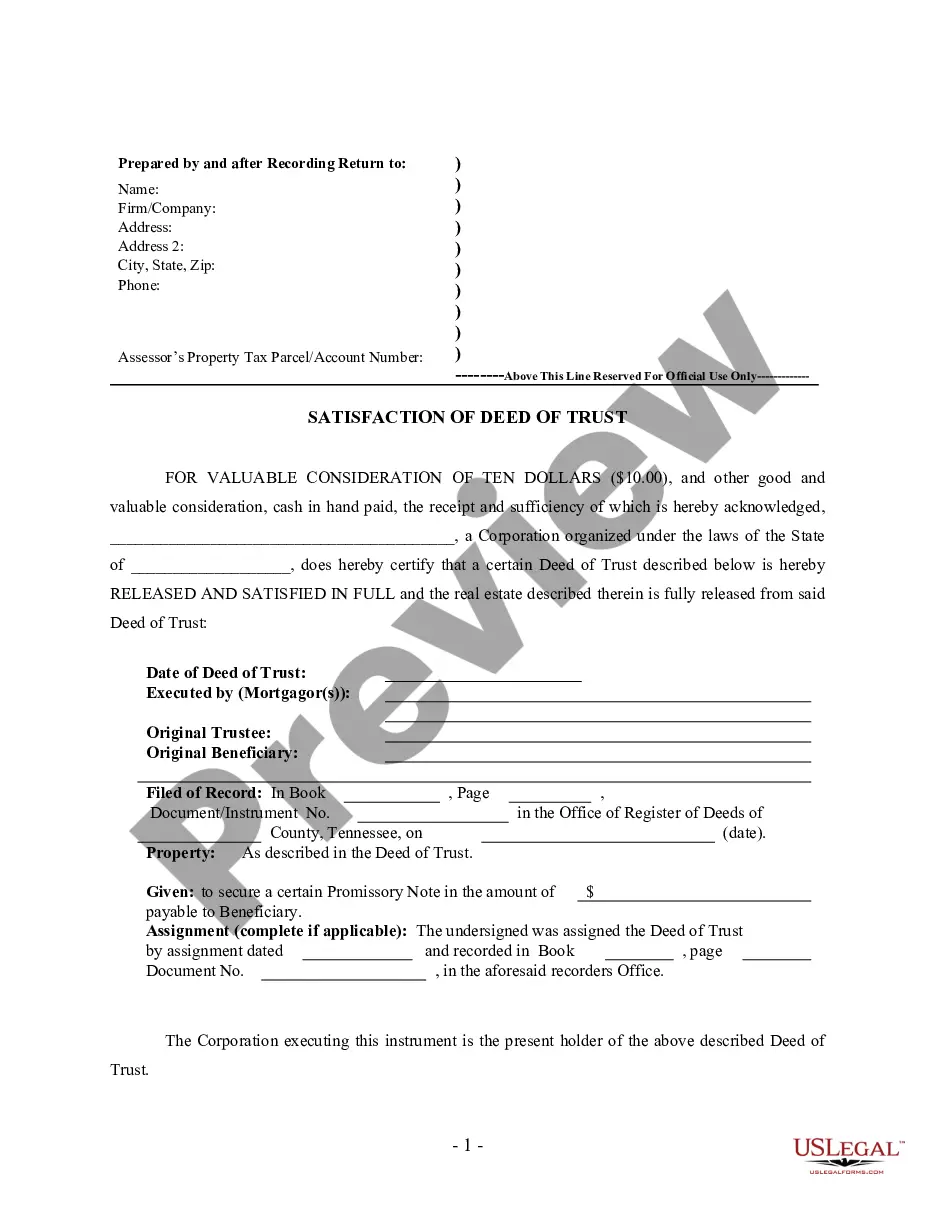

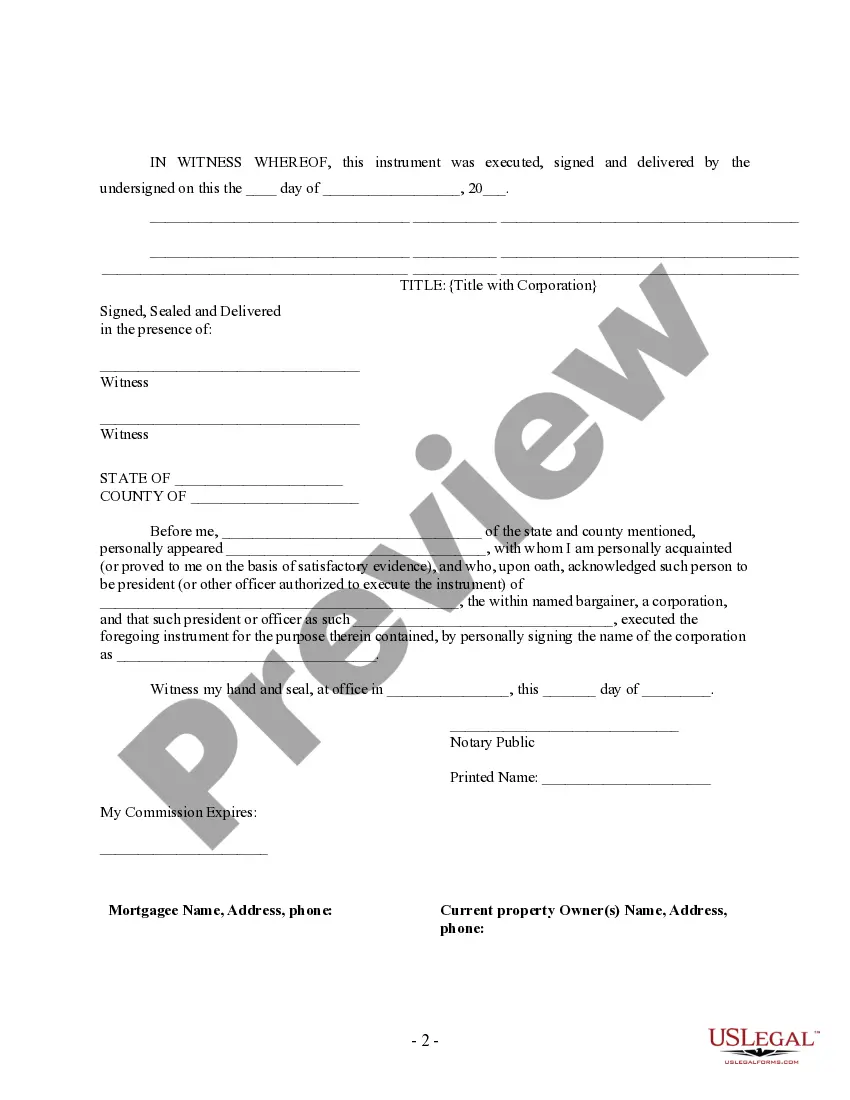

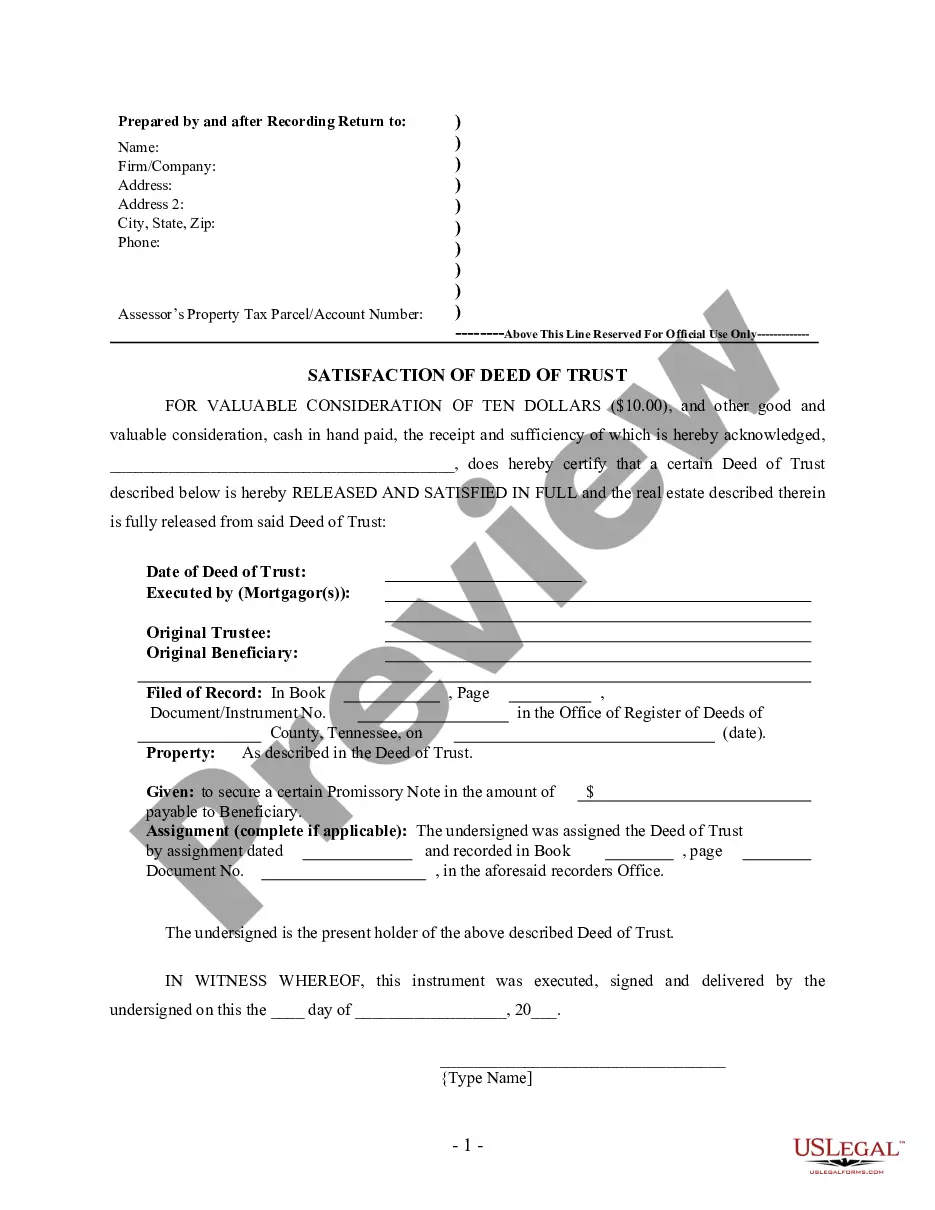

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Tennessee by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Chattanooga Tennessee Release Satisfactionio— - Cancellation of Deed of Trust — by Corporate Lender is a legal document that signifies the completion of a loan repayment and the release of a lien on a property. This document outlines the process by which a corporate lender officially acknowledges that the borrower has fulfilled their financial obligation and cancels the deed of trust. Keywords: Chattanooga Tennessee, Release, Satisfaction, Cancellation, Deed of Trust, Corporate Lender. In Chattanooga, Tennessee, when a borrower obtains a loan from a corporate lender for the purchase of a property, a deed of trust is usually created to secure the lender's interest in the property. Once the borrower repays the loan in full, it is necessary to file a release, satisfaction, and cancellation of the deed of trust to remove any encumbrances on the property title. The Chattanooga Tennessee Release Satisfactionio— - Cancellation of Deed of Trust — by Corporate Lender has different types depending on the circumstances of the loan repayment. Some of these variations include: 1. Full Loan Repayment Release: This type occurs when the borrower repays the entire loan principal, including any accrued interest and fees. The corporate lender acknowledges the borrower's fulfillment of their financial obligation and cancels the deed of trust, releasing any claim on the property. 2. Refinancing Release: In cases where a borrower refinances their loan with a new corporate lender, the original lender must release their deed of trust. This release signifies that the original loan has been fully satisfied and that the new lender will hold the lien on the property. 3. Partial Loan Repayment Release: Occasionally, a borrower may make a partial repayment of the loan principal before the agreed-upon maturity date. In such cases, the corporate lender may choose to release a portion of the deed of trust while maintaining a lien on the remaining outstanding balance. 4. Loan Modification Release: If the borrower and the corporate lender agree to modify the terms of the loan, such as adjusting the interest rate or extending the loan duration, a release may be required. This type of release updates the terms of the deed of trust to reflect the modified loan agreement. It is important to note that the Chattanooga Tennessee Release Satisfactionio— - Cancellation of Deed of Trust — by Corporate Lender is a legal document that must be accurately prepared and filed with the appropriate authorities. This process ensures that the property is free from any encumbrances, allowing the borrower to fully enjoy their ownership rights. It is recommended to consult with a qualified attorney or legal professional to oversee the preparation and filing of this important document.Chattanooga Tennessee Release Satisfactionio— - Cancellation of Deed of Trust — by Corporate Lender is a legal document that signifies the completion of a loan repayment and the release of a lien on a property. This document outlines the process by which a corporate lender officially acknowledges that the borrower has fulfilled their financial obligation and cancels the deed of trust. Keywords: Chattanooga Tennessee, Release, Satisfaction, Cancellation, Deed of Trust, Corporate Lender. In Chattanooga, Tennessee, when a borrower obtains a loan from a corporate lender for the purchase of a property, a deed of trust is usually created to secure the lender's interest in the property. Once the borrower repays the loan in full, it is necessary to file a release, satisfaction, and cancellation of the deed of trust to remove any encumbrances on the property title. The Chattanooga Tennessee Release Satisfactionio— - Cancellation of Deed of Trust — by Corporate Lender has different types depending on the circumstances of the loan repayment. Some of these variations include: 1. Full Loan Repayment Release: This type occurs when the borrower repays the entire loan principal, including any accrued interest and fees. The corporate lender acknowledges the borrower's fulfillment of their financial obligation and cancels the deed of trust, releasing any claim on the property. 2. Refinancing Release: In cases where a borrower refinances their loan with a new corporate lender, the original lender must release their deed of trust. This release signifies that the original loan has been fully satisfied and that the new lender will hold the lien on the property. 3. Partial Loan Repayment Release: Occasionally, a borrower may make a partial repayment of the loan principal before the agreed-upon maturity date. In such cases, the corporate lender may choose to release a portion of the deed of trust while maintaining a lien on the remaining outstanding balance. 4. Loan Modification Release: If the borrower and the corporate lender agree to modify the terms of the loan, such as adjusting the interest rate or extending the loan duration, a release may be required. This type of release updates the terms of the deed of trust to reflect the modified loan agreement. It is important to note that the Chattanooga Tennessee Release Satisfactionio— - Cancellation of Deed of Trust — by Corporate Lender is a legal document that must be accurately prepared and filed with the appropriate authorities. This process ensures that the property is free from any encumbrances, allowing the borrower to fully enjoy their ownership rights. It is recommended to consult with a qualified attorney or legal professional to oversee the preparation and filing of this important document.