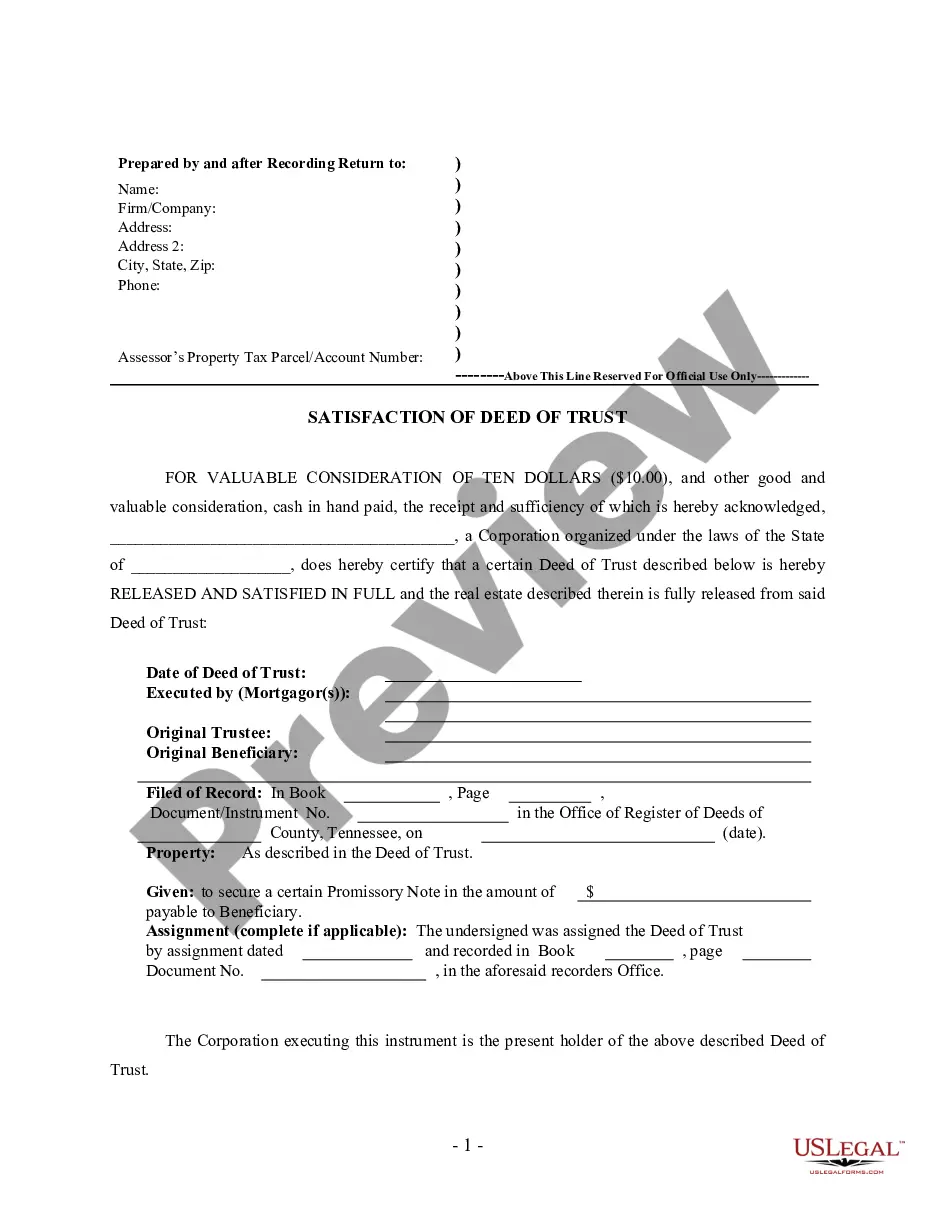

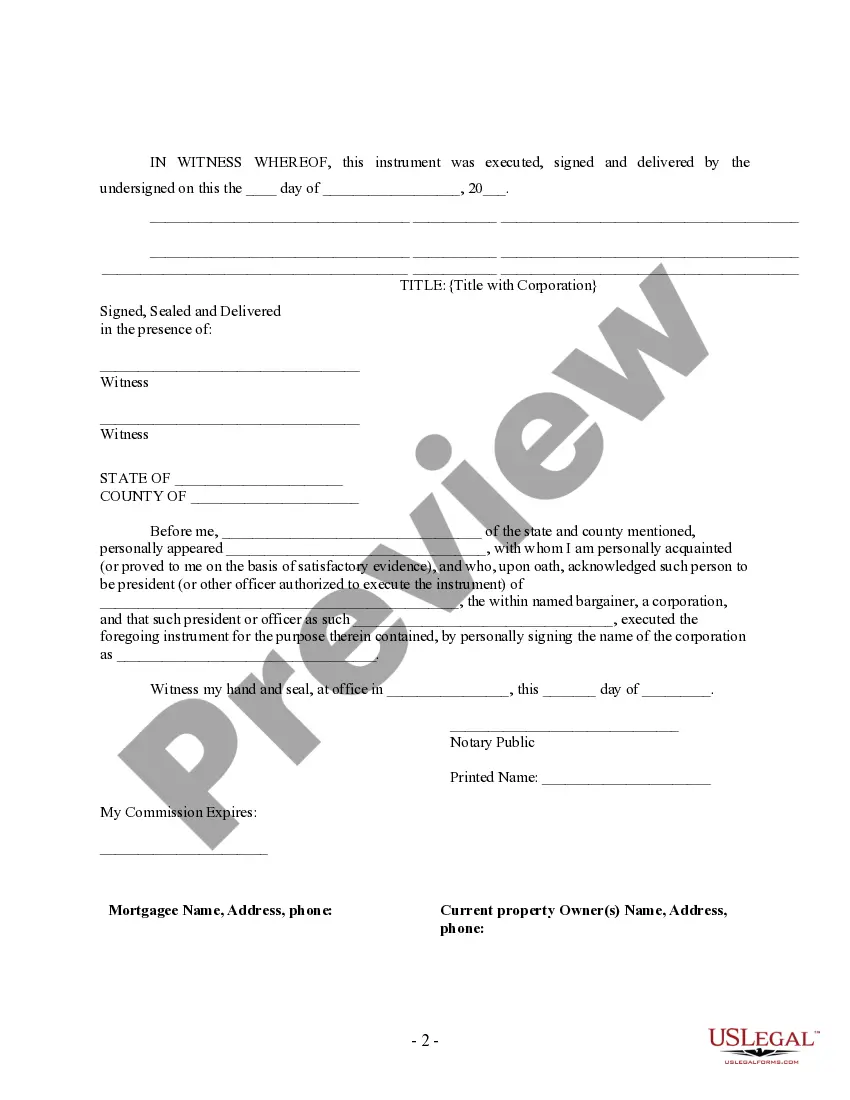

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Tennessee by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Clarksville Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender

Description

How to fill out Tennessee Release - Satisfaction - Cancellation Of Deed Of Trust - By Corporate Lender?

Utilize the US Legal Forms and gain immediate access to any form you desire.

Our user-friendly platform with countless documents streamlines the process of discovering and acquiring nearly any document sample you require.

You can save, complete, and sign the Clarksville Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender in merely a few minutes instead of spending hours online trying to find a suitable template.

Leveraging our repository is an excellent method to enhance the security of your document submissions. Our knowledgeable attorneys routinely review all records to ensure that the templates are appropriate for a specific region and adhere to current laws and regulations.

Initiate the downloading process. Click Buy Now and select the pricing option you prefer. Then, register for an account and complete your order using a credit card or PayPal.

Download the file. Specify the format to receive the Clarksville Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender and edit and fill, or sign it according to your needs. US Legal Forms is likely the largest and most reliable template database on the internet. We are always prepared to assist you with any legal matter, even if it’s just downloading the Clarksville Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender. Don’t hesitate to fully utilize our service and make your document experience as seamless as possible!

- How can you acquire the Clarksville Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender.

- If you already have an account, simply Log In to your profile. The Download button will show up on all the documents you view.

- Additionally, you can locate all previously saved documents in the My documents section.

- If you haven’t created an account yet, follow the steps below.

- Locate the template you need. Confirm that it is the template you were looking for: check its title and description, and use the Preview function when available.

Form popularity

FAQ

To obtain a deed of trust release, you usually need to confirm that your mortgage obligation has been satisfied. You can then request a deed of release from your lender or the trustee who manages your deed of trust. Utilizing resources like US Legal Forms can simplify your process when seeking a Clarksville Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender.

No, a deed of release is not the same as a regular deed. A deed of release specifically signifies the satisfaction of a debt secured by a deed of trust, effectively releasing the property from the lender's claim. If you are dealing with a Clarksville Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender, knowing how these documents differ is essential for proper documentation.

In Tennessee, the trustee on a deed of trust is typically a third party, often a title company or an attorney, who holds legal title to the property. This individual acts on behalf of the lender to ensure that the terms of the deed are fulfilled. If you're navigating a Clarksville Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender, understanding the role of the trustee can help streamline the process.

To fill out a quit claim deed in Tennessee, start by entering the names of the current property owners and those receiving the property. Then include the legal description of the property, ensuring all information is accurate. This document must be signed in front of a notary, and filing it with the county clerk’s office will complete the transfer, providing a clear path for a Clarksville, Tennessee release of interest.

Releasing a trust typically involves creating a trust termination document that complies with Tennessee laws. This document should clearly state the terms and conditions under which the trust is released and should be signed by the trustee and beneficiaries. In Clarksville, considering assistance from a legal professional or uslegalforms can streamline this process and help ensure accuracy.

Removing someone from a deed of trust in Clarksville, Tennessee, typically involves executing a release or amendment to the existing deed. The person being removed must consent, and all necessary legal forms must be completed and notarized. Once properly executed, you will need to file the amended documents with the appropriate county office to finalize the change.

To remove someone from a deed of trust, you typically need their consent or a legal action such as a court order. This process involves drafting a release document that both parties must sign. In Clarksville, Tennessee, utilizing the release - satisfaction - cancellation of deed of trust - by corporate lender can simplify this task. This ensures you're following the correct legal steps to protect your property interests.

The termination of a deed of trust occurs when the borrower pays off the secured debt in full. This process legally frees the property from the lender's claim, marking the end of the agreement. In Clarksville, Tennessee, the release - satisfaction - cancellation of deed of trust - by corporate lender is essential for ensuring the rightful ownership of the property. Understanding this process helps property owners maintain clear titles.

Tennessee is classified as a deed of trust state. This is significant for anyone involved in real estate transactions within the state. Understanding this distinction helps in managing your property title and securing your financial interests effectively. For clarity and comprehensive support with the Release, Satisfaction, and Cancellation of Deed of Trust by Corporate Lender, visit US Legal Forms for expertly crafted resources.

Tennessee is classified as a deed of trust state. This means that lenders often use deeds of trust to secure loans for real estate transactions. Borrowers should be aware of this distinction, as it affects how property titles are managed upon debt satisfaction. For assistance with completing or understanding the Release, Satisfaction, and Cancellation of Deed of Trust by Corporate Lender in Clarksville, Tennessee, refer to US Legal Forms for expert guidance.