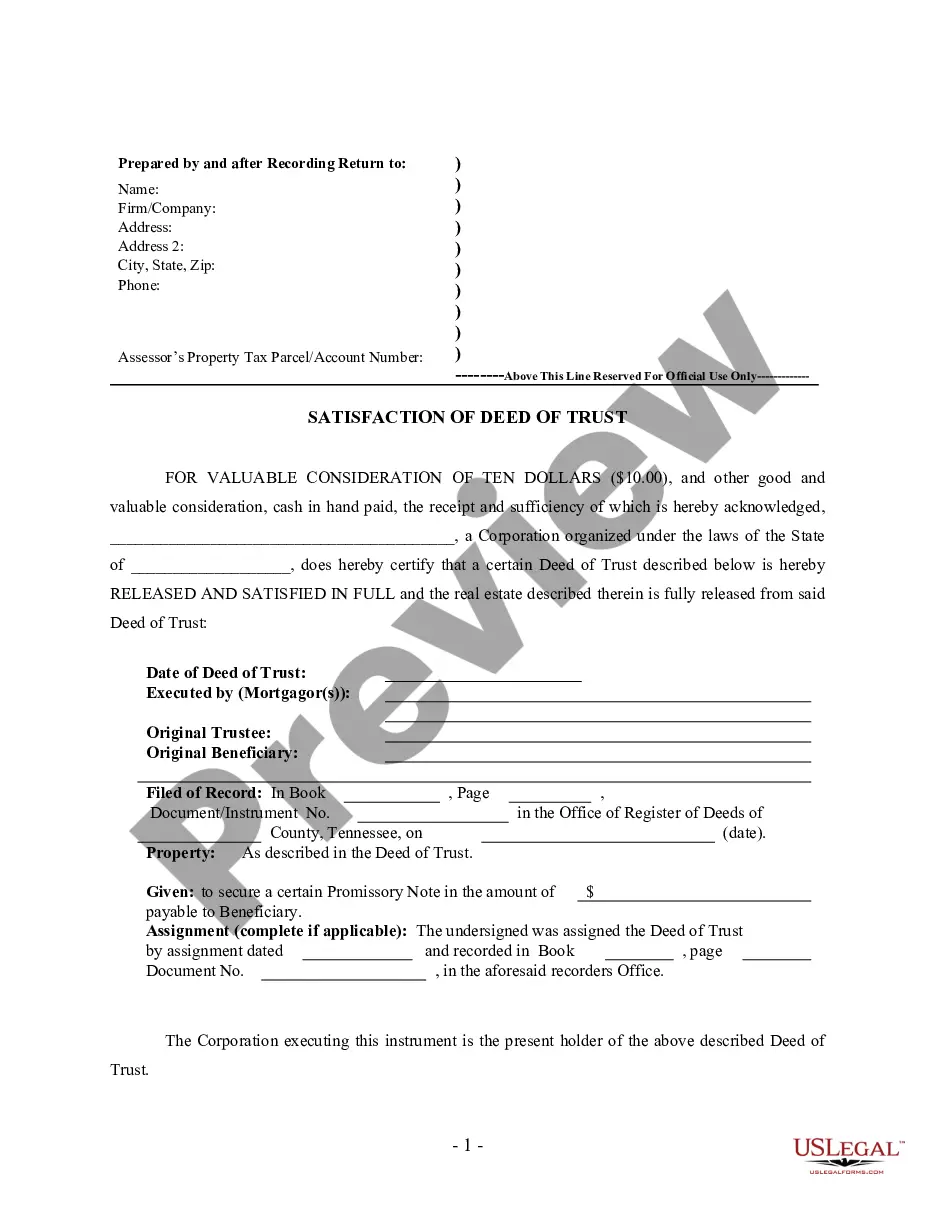

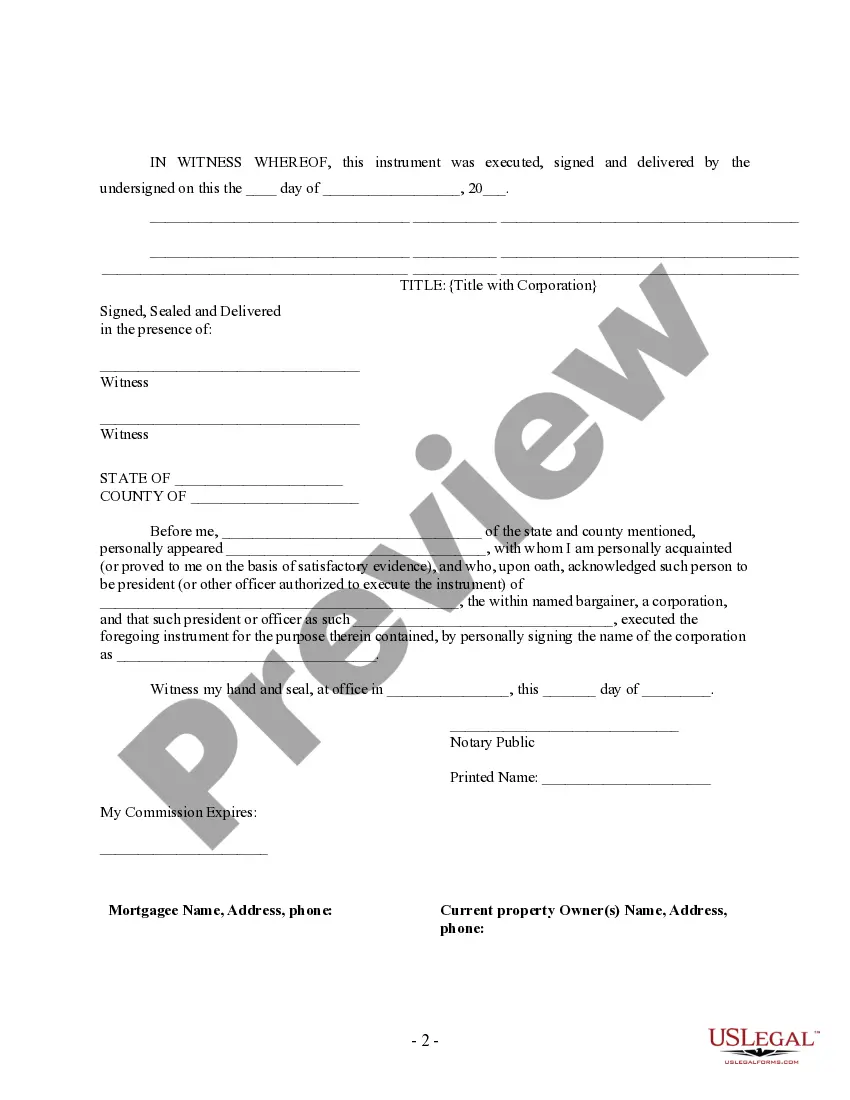

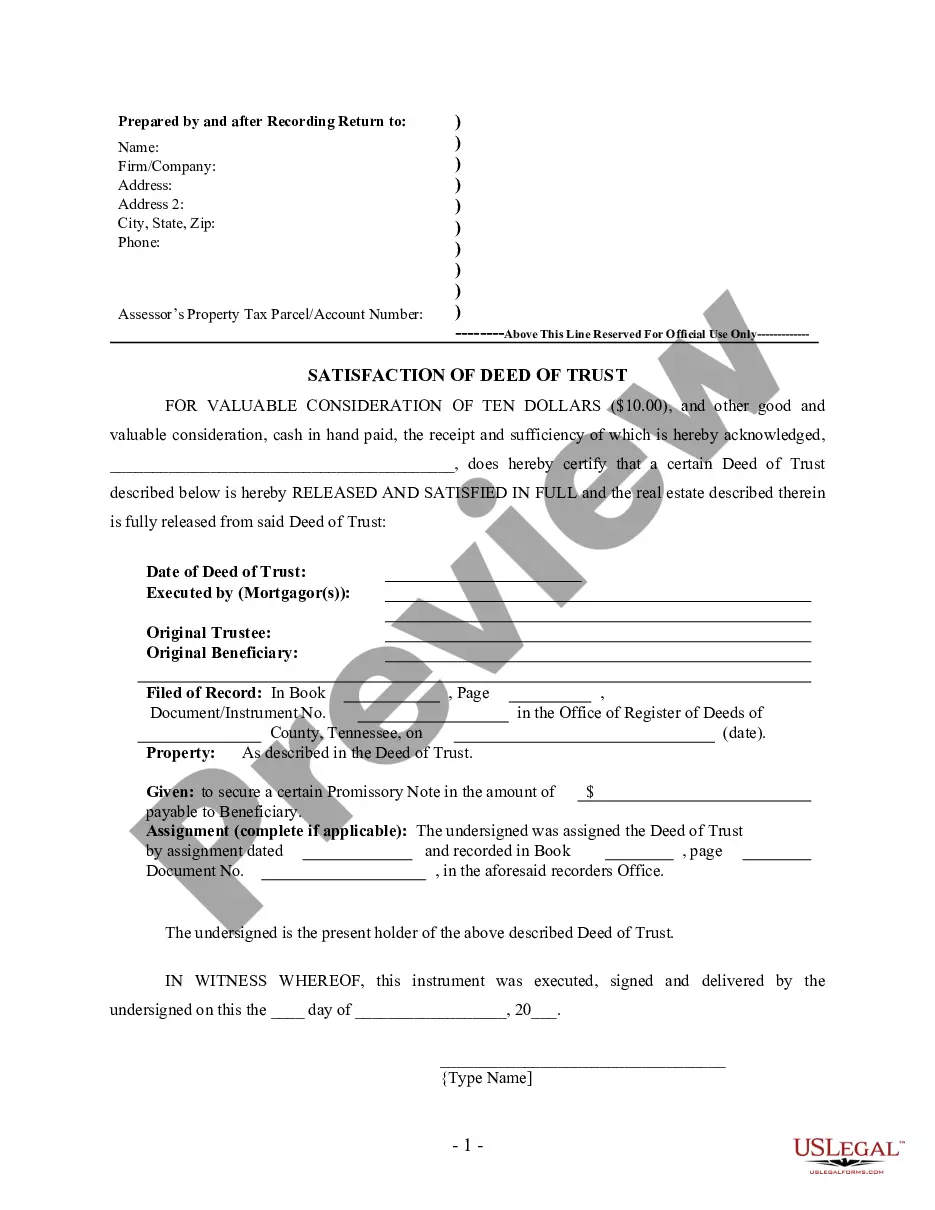

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Tennessee by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Knoxville Tennessee Release Satisfactionio— - Cancellation of Deed of Trust — by Corporate Lender: Explained Introduction: In Knoxville, Tennessee, the process of releasing, satisfying, or canceling a Deed of Trust by a corporate lender is a crucial legal procedure. This article aims to provide a detailed understanding of the concept, the parties involved, and the various types of releases related to Deeds of Trust in Knoxville, Tennessee. Keywords: Knoxville Tennessee Release, Satisfaction, Cancellation, Deed of Trust, Corporate Lender. 1. Definition and Purpose: A release, satisfaction, or cancellation of a Deed of Trust refers to the legal action taken by a corporate lender to officially release or cancel the lien held against a property after the underlying debt has been paid in full. This action provides the property owner with clear title to the property. 2. Parties Involved: The typical parties involved in a Knoxville Tennessee Release Satisfactionio— - Cancellation of Deed of Trust are: — Corporate Lender: The lending institution or entity that provided the loan using the property as collateral. — Borrower: The individual or entity that received the loan and granted the Deed of Trust. — Trustee: A neutral third party appointed to administer and oversee the terms of the Deed of Trust. — Property Owner: The individual or entity that holds legal ownership of the property subject to the Deed of Trust. 3. Types of Releases: A. Full Release: A Full Release indicates that the debt secured by the Deed of Trust has been satisfied in full, and the corporate lender releases all claims on the property. The released Deed of Trust will be marked as satisfied or canceled, and the property owner receives clear title. B. Partial Release: In cases where multiple properties are secured by a single Deed of Trust, a Partial Release may be requested to remove specific properties from the collateral after a portion of the debt is paid. The released properties will be marked as satisfied or canceled. C. Release by Substitution: In some instances, a corporate lender may agree to release a property from the Deed of Trust in exchange for the substitution of another property as collateral. This allows the property owner to sell or refinance the released property while maintaining the loan against the substituted property. D. Release of Lien: When a Deed of Trust becomes invalid due to procedural errors or certain circumstances, the corporate lender may release the lien voluntarily or as mandated by a court order. Conclusion: Understanding the Knoxville Tennessee Release Satisfactionio— - Cancellation of Deed of Trust is essential for both corporate lenders and property owners. It enables corporate lenders to protect their interests while giving property owners the confidence and freedom to exercise their property rights without any encumbrances. Whether it's a full release, partial release, release by substitution, or release of lien, following the proper procedures and engaging legal professionals is vital to ensure a successful release of the Deed of Trust.Title: Knoxville Tennessee Release Satisfactionio— - Cancellation of Deed of Trust — by Corporate Lender: Explained Introduction: In Knoxville, Tennessee, the process of releasing, satisfying, or canceling a Deed of Trust by a corporate lender is a crucial legal procedure. This article aims to provide a detailed understanding of the concept, the parties involved, and the various types of releases related to Deeds of Trust in Knoxville, Tennessee. Keywords: Knoxville Tennessee Release, Satisfaction, Cancellation, Deed of Trust, Corporate Lender. 1. Definition and Purpose: A release, satisfaction, or cancellation of a Deed of Trust refers to the legal action taken by a corporate lender to officially release or cancel the lien held against a property after the underlying debt has been paid in full. This action provides the property owner with clear title to the property. 2. Parties Involved: The typical parties involved in a Knoxville Tennessee Release Satisfactionio— - Cancellation of Deed of Trust are: — Corporate Lender: The lending institution or entity that provided the loan using the property as collateral. — Borrower: The individual or entity that received the loan and granted the Deed of Trust. — Trustee: A neutral third party appointed to administer and oversee the terms of the Deed of Trust. — Property Owner: The individual or entity that holds legal ownership of the property subject to the Deed of Trust. 3. Types of Releases: A. Full Release: A Full Release indicates that the debt secured by the Deed of Trust has been satisfied in full, and the corporate lender releases all claims on the property. The released Deed of Trust will be marked as satisfied or canceled, and the property owner receives clear title. B. Partial Release: In cases where multiple properties are secured by a single Deed of Trust, a Partial Release may be requested to remove specific properties from the collateral after a portion of the debt is paid. The released properties will be marked as satisfied or canceled. C. Release by Substitution: In some instances, a corporate lender may agree to release a property from the Deed of Trust in exchange for the substitution of another property as collateral. This allows the property owner to sell or refinance the released property while maintaining the loan against the substituted property. D. Release of Lien: When a Deed of Trust becomes invalid due to procedural errors or certain circumstances, the corporate lender may release the lien voluntarily or as mandated by a court order. Conclusion: Understanding the Knoxville Tennessee Release Satisfactionio— - Cancellation of Deed of Trust is essential for both corporate lenders and property owners. It enables corporate lenders to protect their interests while giving property owners the confidence and freedom to exercise their property rights without any encumbrances. Whether it's a full release, partial release, release by substitution, or release of lien, following the proper procedures and engaging legal professionals is vital to ensure a successful release of the Deed of Trust.