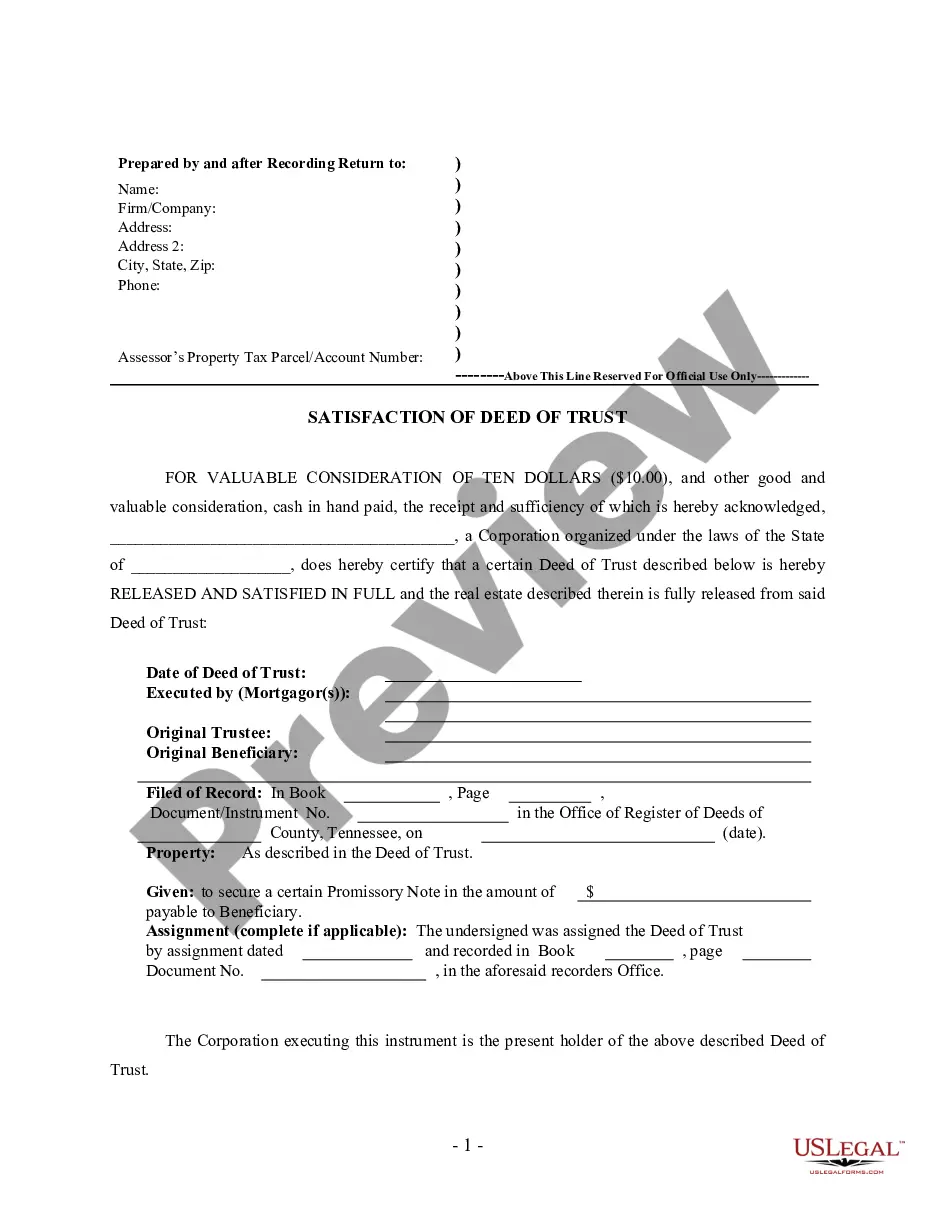

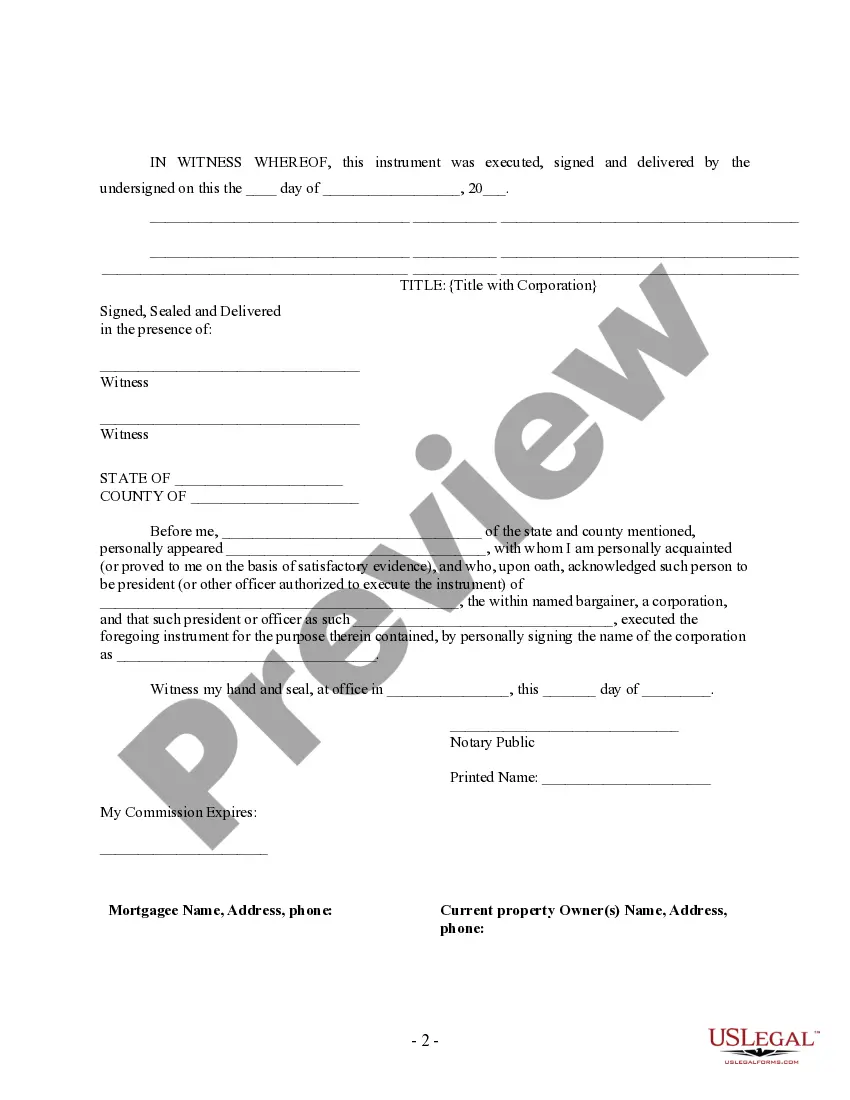

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Tennessee by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Murfreesboro Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender

Description

How to fill out Tennessee Release - Satisfaction - Cancellation Of Deed Of Trust - By Corporate Lender?

We consistently seek to reduce or avert legal repercussions when navigating intricate legal or financial issues.

To achieve this, we seek the services of lawyers that tend to be quite expensive.

Nevertheless, not all legal challenges are equally intricate; most can be handled independently.

US Legal Forms is a web-based repository of current self-service legal documents spanning from wills and powers of attorney to incorporation articles and dissolution petitions. Our collection empowers you to manage your legal affairs on your own without resorting to legal advice. We offer access to legal form templates that aren’t always readily available. Our templates are tailored to specific states and regions, greatly simplifying the search process.

Ensure that the Murfreesboro Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender abides by the laws and regulations of your state and region. Additionally, it is imperative to review the form’s description (if provided), and should you find any inconsistencies with your initial requirements, look for another template. Once you confirm that the Murfreesboro Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender is suitable for your needs, you can select a subscription plan and proceed to payment. Following that, you can download the form in any preferred file format. With over 24 years in the industry, we have assisted millions by supplying customizable and up-to-date legal documents. Take full advantage of US Legal Forms now to conserve time and resources!

- Capitalize on US Legal Forms whenever you need to acquire and download the Murfreesboro Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender or any other form swiftly and securely.

- Simply Log In to your account and click the Get button alongside it.

- If you happen to lose the document, you can always re-download it in the My documents section.

- The procedure is equally straightforward for those unfamiliar with the site! You can create your account in just a few minutes.

Form popularity

FAQ

Filling out a quit claim deed is straightforward. First, ensure the document includes your name, the name of the grantor, and the legal description of the property. You also need to specify the purpose of the transfer clearly. For expert assistance, consider using the Murfreesboro Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender services available through US Legal Forms for a seamless experience.

A deed to secure debt and a deed of trust serve similar purposes but are not identical. Both create a security interest in property, but a deed of trust involves a third party, known as a trustee, who facilitates the transaction. Understanding these nuances is important for property owners in Murfreesboro Tennessee, especially when considering a release, satisfaction, or cancellation of a deed of trust by a corporate lender. Clear knowledge can save you time and stress in legal processes.

Tennessee is primarily a deed of trust state, which means that most real estate transactions are secured using deeds of trust rather than traditional mortgages. This method tends to streamline the process of foreclosure, making it important for borrowers to comprehend their rights and obligations. If you need assistance with a Murfreesboro Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender, understanding this distinction can help in making informed decisions about your property.

To remove someone from a deed of trust, the parties must agree to modify the deed, typically through a refinancing process. This involves discussions with the lender and possibly executing a new deed of trust. Utilizing platforms like uslegalforms can help you navigate the Murfreesboro Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender effectively.

Releasing a trust generally involves the trustee executing a document called a release or termination of trust. This document outlines the intent to dissolve the trust, ensuring that all assets are distributed per the trust's terms. If you are in Murfreesboro, Tennessee, consider utilizing legal services that facilitate the Murfreesboro Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender to streamline this process.

Filling out a quit claim deed in Tennessee requires you to include specific information such as the names of the parties involved, the legal description of the property, and your intentions regarding the transfer. You can find templates on uslegalforms designed for Tennessee, which simplify the Murfreesboro Tennessee Release - Satisfaction - Cancellation of Deed of Trust - by Corporate Lender process. Ensure you sign the deed and have it notarized before filing.

Once the loan amount has been paid in full, California requires lenders to execute a deed of reconveyance within seventy-five days after the debt has been paid.

Deeds of trust and mortgages are a means of securing the payment of a debt or performance of an obligation. The debt may be established by promissory note, bond or other instrument. In North Carolina, a deed of trust or mortgage acts as a conveyance of the real estate.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.

In Texas, when the borrower's obligations under the deed of trust are fully satisfied, the lien of the deed of trust is discharged by recording a release of lien (release). A release must be recorded with the county recorder for the deed of trust to be discharged from the public records.