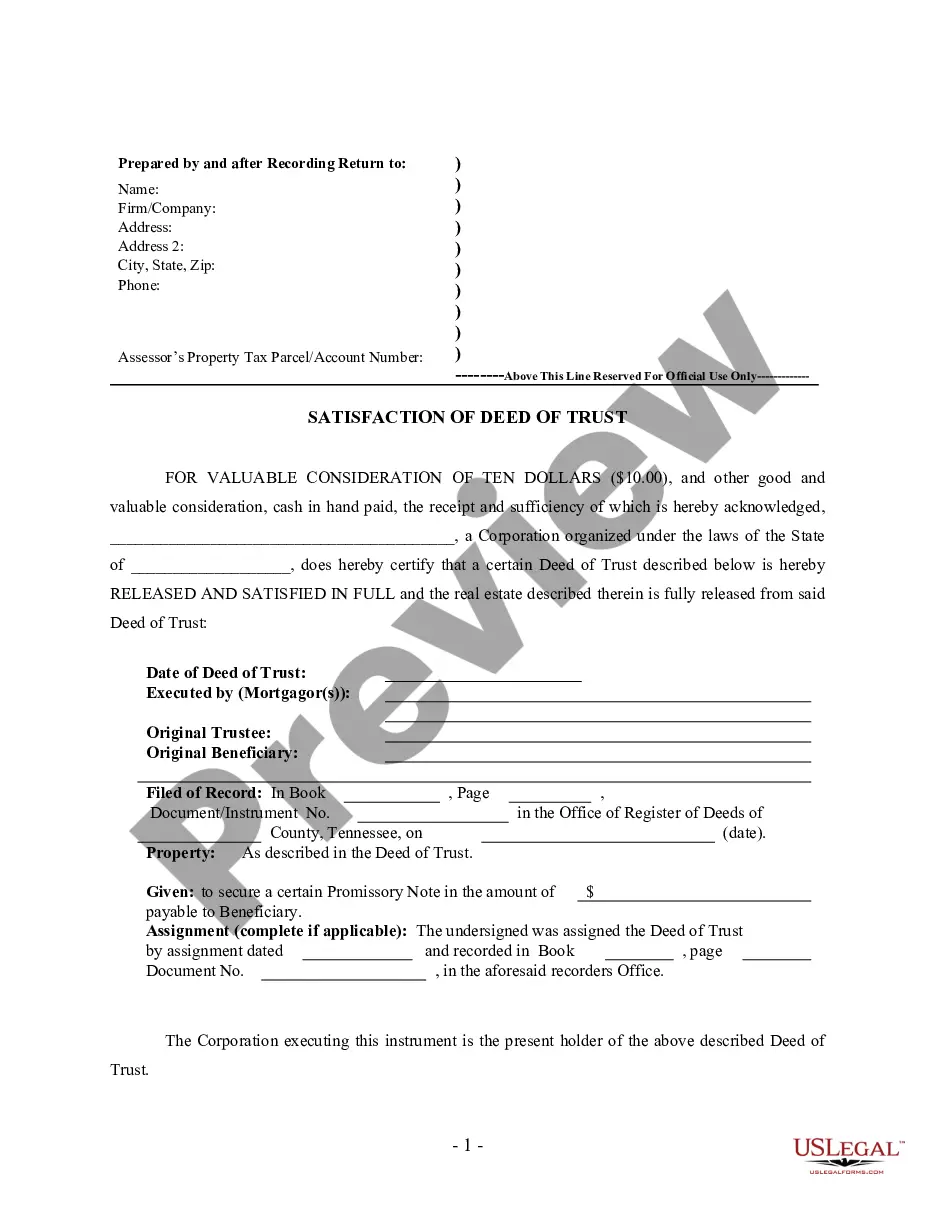

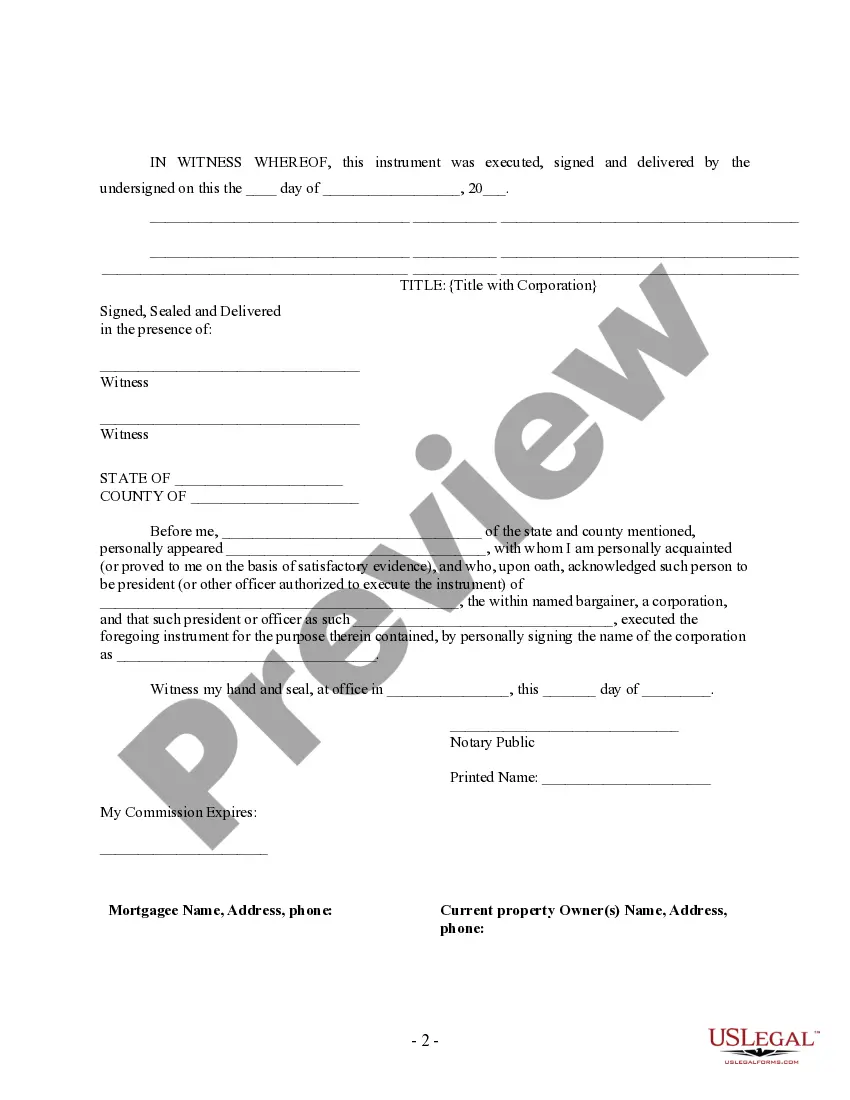

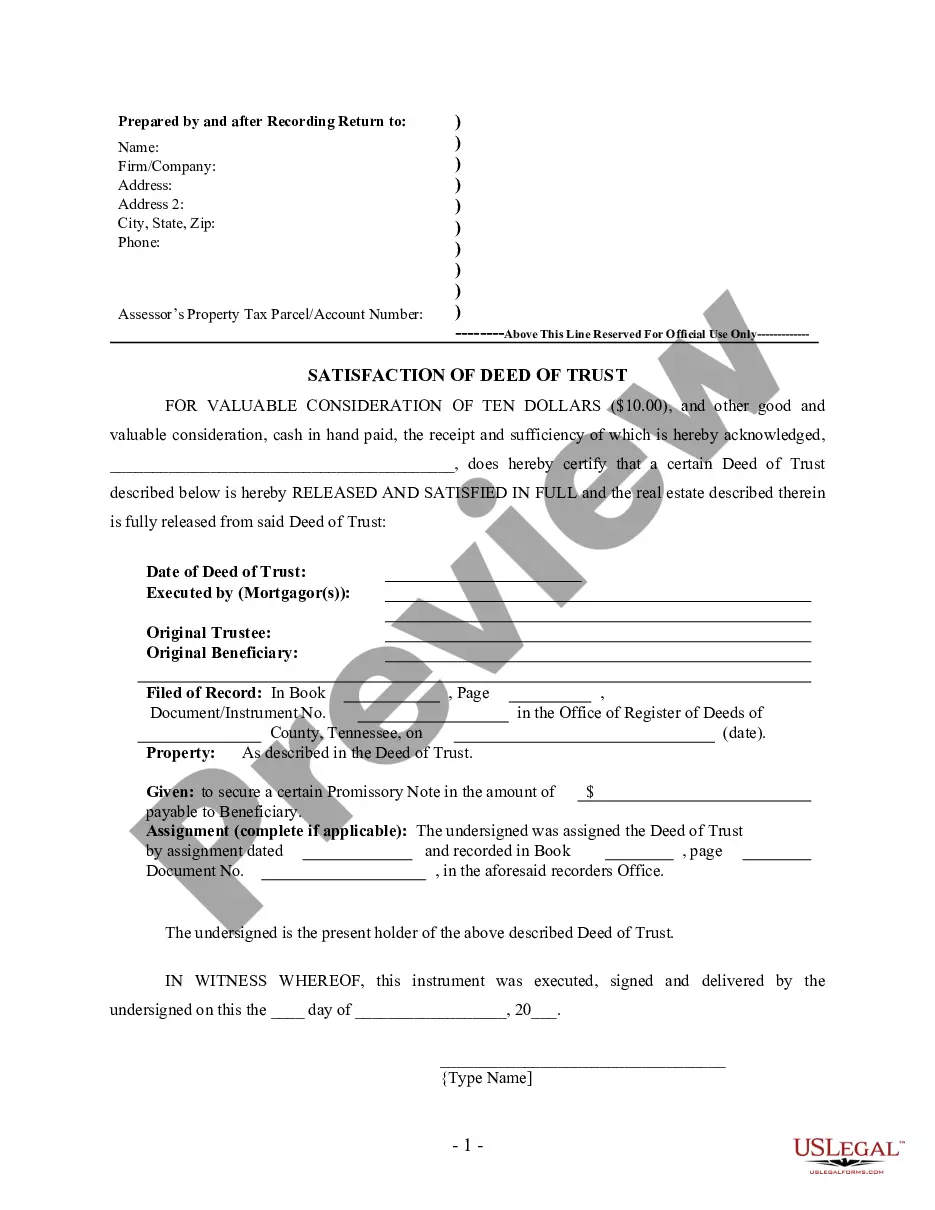

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Tennessee by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Title: Nashville Tennessee Release Satisfactionio— - Cancellation of Deed of Trust — by Corporate Lender Explained Keywords: Nashville Tennessee, Release, Satisfaction, Cancellation, Deed of Trust, Corporate Lender Introduction: In Nashville, Tennessee, the release, satisfaction, and cancellation of a deed of trust by a corporate lender are significant legal processes used to finalize a mortgage transaction. These procedures ensure that the borrower's debt is fully paid and the lender's lien on the property is removed. Let's delve into the details and various types of Nashville Tennessee Release — Satisfaction — Cancellation of Dothersusus— - by Corporate Lender. 1. Standard Release: A standard release of a deed of trust occurs when the borrower successfully fulfills their mortgage obligation, repaying the principal amount along with any accrued interest. At this stage, the corporate lender, usually a bank or a financial institution, issues a formal document acknowledging the satisfaction of the debt and canceling the deed of trust. 2. Partial Release: When a borrower secures multiple properties with a single deed of trust, they may request a partial release upon meeting specific criteria. In this scenario, the corporate lender releases the lien on a specific property, allowing the borrower to transfer or sell it without affecting the remaining properties under the deed of trust. 3. Substitution of Trustee: A substitution of trustee takes place when there is a need to replace the original trustee appointed by the corporate lender. This change typically occurs due to administrative reasons or to ensure the efficient management of the deed of trust. The substitution of trustee requires proper documentation to complete the release and satisfaction process. 4. Deed of Re conveyance: After a borrower pays off their mortgage in full, the corporate lender issues a deed of reconveyance. This legal document formally cancels the deed of trust and transfers full ownership back to the borrower. The deed of reconveyance is recorded in the county register's office, signifying the release and satisfaction of the loan. 5. Release of Lien: If a borrower demonstrates exceptional financial responsibility by fulfilling their loan obligations before the agreed-upon term, they may request an early release of lien. In such cases, the corporate lender releases its lien on the property and provides a document stating the satisfaction of the debt, allowing the borrower to own the property without any encumbrances. Conclusion: The Nashville Tennessee Release — Satisfaction — Cancellation of Dothersusus— - by Corporate Lender involves multiple processes aimed at finalizing mortgage transactions. Whether it's a standard release, partial release, substitution of trustee, deed of reconveyance, or release of lien, each type has specific requirements and documentation. These procedures ensure that both borrowers and corporate lenders achieve their respective goals in Nashville's real estate market.