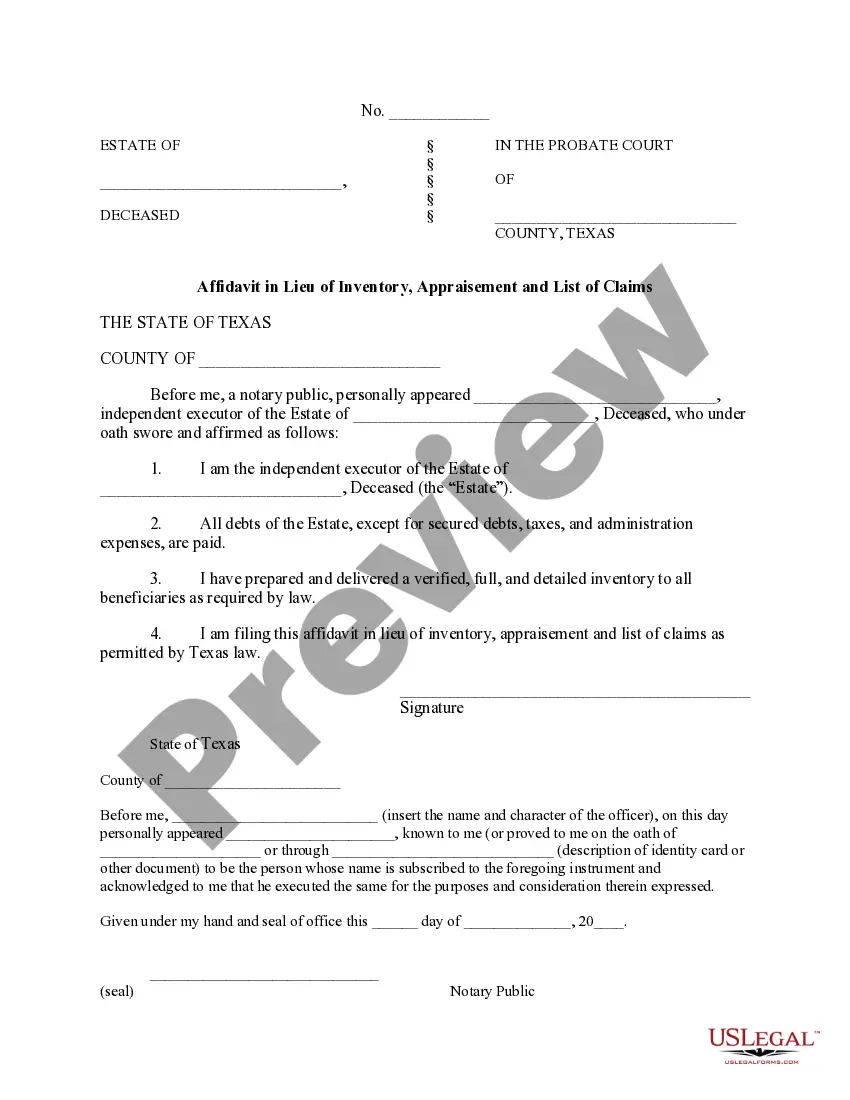

The Austin Texas Affidavit in Lieu of Inventory, Appeasement and List of Claims is a legal document used in the state of Texas to handle the administration of an estate without the need for a detailed inventory, appraisal, and list of claims. This affidavit serves as an alternative to more extensive and time-consuming probate processes. Typically, the affidavit is filed by a qualified person, such as the executor or administrator of the estate, who is responsible for managing the assets and distributing them among the beneficiaries or heirs. By submitting this affidavit, the person attests to the court that he or she has conducted a diligent search and investigation to determine if any known claims or debts exist against the estate. The affidavit contains relevant information about the estate, such as the deceased person's name, date of death, and general details about their assets and liabilities. It may also include the names and addresses of the beneficiaries or heirs. However, unlike other probate procedures, it does not require a detailed inventory of the estate's assets or an appraisal to determine their value. The purpose of the Austin Texas Affidavit in Lieu of Inventory, Appeasement and List of Claims is to provide a simplified and expedited process for small estates, minimizing the administrative burden and costs associated with traditional probate. It allows for a more streamlined transfer of assets to the rightful beneficiaries or heirs. There are no different types of Austin Texas Affidavit in Lieu of Inventory, Appeasement and List of Claims as the document serves a specific purpose in the probate process, regardless of the size or nature of the estate. However, it is important to note that the specific requirements and procedures may vary depending on the county and court jurisdiction within Austin, Texas. It is advisable to consult with an attorney or legal professional to ensure compliance with the applicable laws and regulations.

Austin Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims

Description

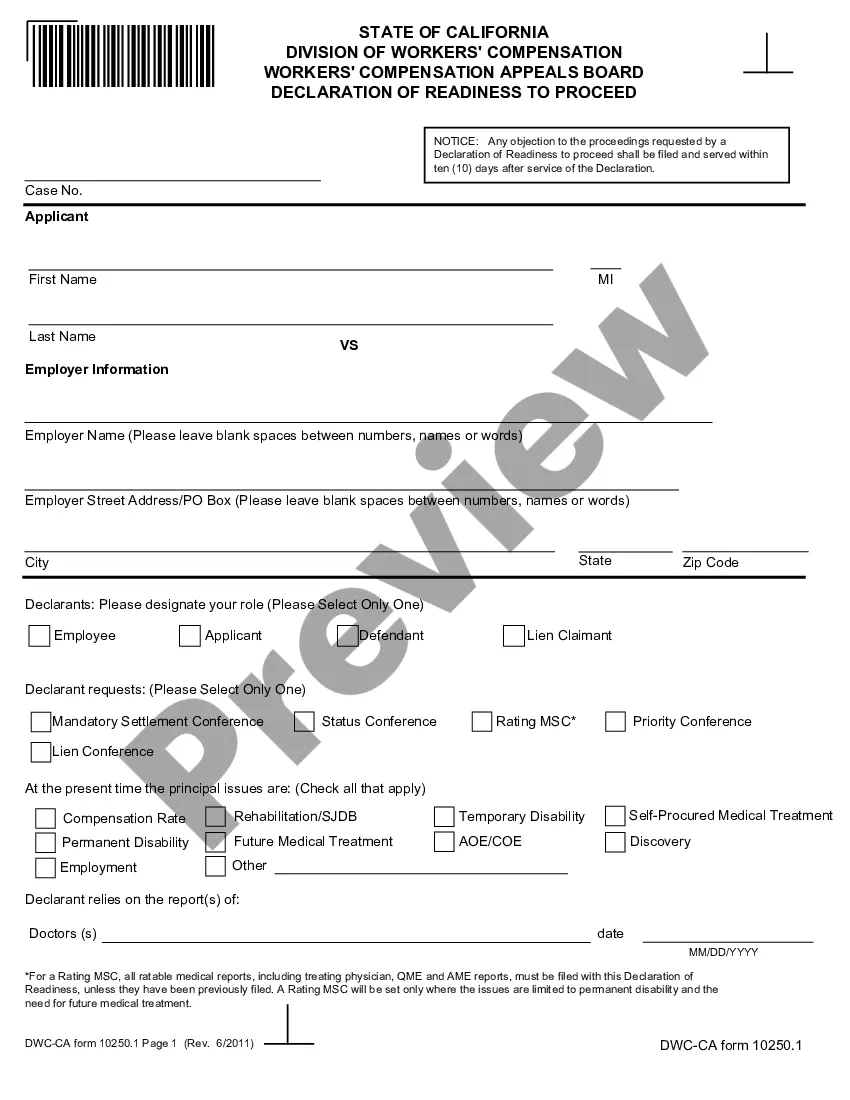

How to fill out Texas Affidavit In Lieu Of Inventory, Appraisement And List Of Claims?

Are you seeking a dependable and cost-effective supplier of legal forms to obtain the Austin Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims? US Legal Forms is your ideal option.

Whether you need a straightforward agreement to establish rules for cohabitation with your partner or a collection of documents to facilitate your divorce through the court, we have you covered. Our platform features over 85,000 current legal document templates for personal and business purposes. All templates we offer are not generic and tailored based on the specifications of particular state and county.

To retrieve the form, you must Log In to your account, locate the required template, and click the Download button adjacent to it. Please note that you can download your previously acquired document templates at any time from the My documents tab.

Are you unfamiliar with our website? No problem. You can create an account with great ease, but first, ensure you do the following.

Now you can set up your account. Then select the subscription plan and move forward with payment. Once the payment is complete, download the Austin Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims in any available file format. You can revisit the website when you wish and redownload the form without any additional charges.

Discovering current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to spending hours understanding legal paperwork online.

- Verify if the Austin Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims complies with the regulations of your state and locality.

- Review the form’s particulars (if available) to learn who and what the form is suitable for.

- Restart your search if the template does not fit your legal situation.

Form popularity

FAQ

There are certain kinds of information executors are generally required to provide to beneficiaries, including an inventory and appraisal of estate assets and an estate accounting, which should include such information as: An inventory of estate assets and their value at the time of the decedent's death.

Not all assets are subject to probate in Texas....Non-probate assets often involve the following accounts: Bank Accounts. Investment Accounts. Retirement Accounts (IRAs & Pension Plans) Life Insurance Policies. Annuity Contracts. Real Estate. Vehicles.

Within 90 days after qualification, the personal representative must file with the Court a sworn inventory, appraisement and list of claims (?Inventory?) of the estate. The Inventory must include all estate real property located in Texas and all estate personal property regardless of where the property is located.

Within 90 days of qualifying as executor or administrator, you must file an inventory with the court. If you need extra time, the court will usually let you have it. The inventory lists all the assets which pass under the decedent's will or estate.

During the divorce process, parties may have to prepare and file what is called an ?inventory and appraisement.? An inventory and appraisement (I&A) is, essentially, a list of all real and personal property as well as all debts and liabilities claimed by each spouse.

Determination of Heirship Proceeding Application of Determination of Heirship and For Letters of Administration (in Wordperfect format) Original Answer of Attorney Ad Litem (Heirship Proceeding) (in WordPerfect format) Proof of Death and Other Facts (Heirship Proceeding) (in WordPerfect format)

Residuary beneficiaries are additionally entitled to receive a copy of the estate accounts, once these have been prepared, so that they can see how their share of the inheritance has been calculated.

In Texas, while an executor of an estate does have to file an inventory, appraisement, and list of claims with the probate court, they are not necessarily required to show accountings to beneficiaries. A personal representative must file an inventory of the estate assets within 90 days of qualification.

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.