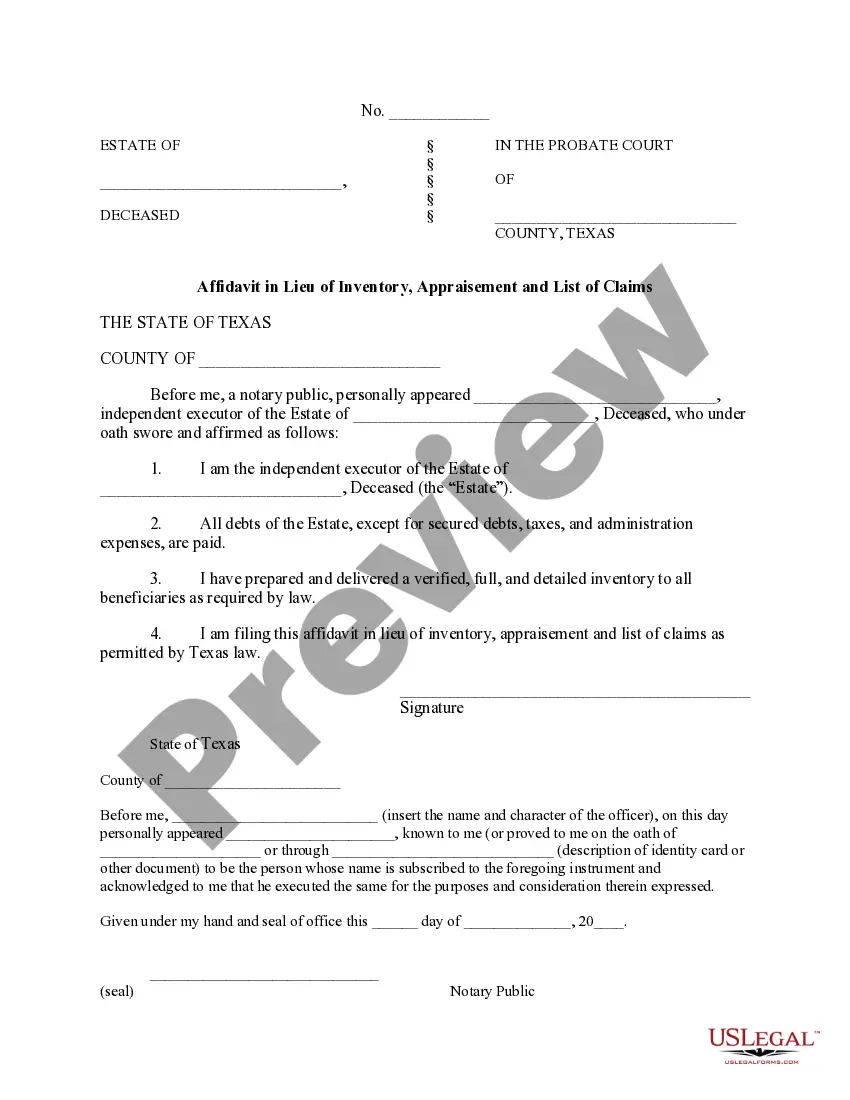

The Pasadena Texas Affidavit in Lieu of Inventory, Appeasement, and List of Claims is a legal document that is used in the state of Texas in certain probate cases. This affidavit allows the executor or administrator of an estate to forgo the requirement of submitting an inventory, appeasement, and list of claims to the court. The purpose of this affidavit is to simplify the probate process by eliminating the need for an extensive inventory and appraisal of all the assets and debts of the deceased individual's estate. By filing this affidavit, the executor or administrator is able to streamline the process and reduce time and administrative burden. The Pasadena Texas Affidavit in Lieu of Inventory, Appeasement, and List of Claims is typically used when the value of the estate is below a certain threshold, as determined by the Texas probate code. This threshold may vary depending on the year in which the decedent passed away and should be confirmed with a legal professional. By filing this affidavit, the executor or administrator is, in essence, attesting under oath that they have made a diligent effort to locate all the assets and debts of the estate and that they have disclosed any known claims against the estate. This affidavit must be signed and notarized, and it becomes a part of the official probate record. It is important to note that there may be other types of affidavits in lieu of inventory, appeasement, and list of claims used in different counties or jurisdictions within Pasadena, Texas. These variations might have slightly different requirements or may be applicable to specific scenarios, such as small estates or uncontested probate cases. It is advisable to consult with a knowledgeable attorney or seek guidance from the probate court to ensure compliance with the appropriate affidavit for a specific situation. In summary, the Pasadena Texas Affidavit in Lieu of Inventory, Appeasement, and List of Claims is a valuable legal tool that can simplify the probate process in certain cases. By eliminating the need for an extensive inventory and appraisal of assets, it allows the executor or administrator to navigate through the probate process more efficiently, saving time and reducing administrative burden.

Pasadena Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims

Description

How to fill out Pasadena Texas Affidavit In Lieu Of Inventory, Appraisement And List Of Claims?

Utilize US Legal Forms and gain immediate access to any document you need.

Our user-friendly website, featuring a vast array of templates, enables you to locate and acquire nearly any document sample you require.

You can save, fill out, and sign the Pasadena Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims in just a few minutes instead of spending hours searching the internet for a suitable template.

Employing our library is an excellent way to enhance the security of your document submissions. Our skilled legal experts routinely assess all documents to ensure that the forms are applicable for a specific region and adhere to updated laws and regulations.

If you haven't created an account yet, follow the steps outlined below.

Access the page with the template you need. Ensure that it is the form you intended to find: verify its title and description, and utilize the Preview option when available. Otherwise, use the Search function to locate the correct one.

- How do you obtain the Pasadena Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims.

- If you have an account, simply Log In to your profile. The Download button will be activated for all the documents you view.

- Additionally, you can find all previously saved documents in the My documents section.

Form popularity

FAQ

An affidavit in lieu of inventory is a legal instrument that allows individuals to avoid the lengthy process of creating a full inventory of their assets. Instead of listing each item, this affidavit summarizes the key information required by law. In Pasadena, utilizing the Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims can greatly simplify the management of your estate during legal proceedings.

An affidavit in lieu is a legal document that serves as a substitute for a more formal requirement, typically involving financial disclosures. This affidavit provides a streamlined approach by confirming relevant facts of property ownership or debts. For those in Pasadena, the Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims offers a convenient way to manage these disclosures.

An inventory appraisal is an assessment of the value of assets owned by individuals or entities. This process involves evaluating each item listed to establish its current market value. Using the Pasadena Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims allows you to document valuations without extensive paperwork, making the process smoother.

An inventory and appraisement of property in a divorce form is a detailed list of all assets that spouses share. This document helps clarify what each person owns, leading to fair distribution during the divorce process. In Pasadena, the Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims simplifies this process, saving you time and potential disputes.

In Texas probate cases, an inventory is generally required unless you file an affidavit in lieu of inventory. An inventory outlines all the decedent's assets and their values. However, for smaller estates, using the Pasadena Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims can waive the need for a formal inventory, simplifying the process significantly.

You can file an affidavit in lieu of inventory in Texas when the estate qualifies as a small estate. This option is available for estates worth less than a specific threshold, allowing you to bypass traditional inventory requirements. This is where the Pasadena Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims becomes pivotal, making the process simpler and more manageable.

In Texas, you typically need to list all assets solely owned by the deceased, including real property, bank accounts, and personal belongings, for probate. This provides a clear picture of the estate's value and aids in the administration process. The Pasadena Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims can help streamline the listing process and avoid the need for a detailed inventory.

Assets that do not go through probate include those with a payable-on-death designation, jointly held properties, and assets placed in a trust. These assets can transfer directly to their beneficiaries, minimizing delays. Utilizing the Pasadena Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims can provide clarity on which assets require probate and which do not.

Certain types of property are exempt from probate in Texas, including life insurance policies with named beneficiaries, assets held in a trust, and retirement accounts with designated recipients. Additionally, property owned jointly with rights of survivorship can pass directly to the co-owner without probate. Knowing these exemptions can help you make the best use of the Pasadena Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims to expedite the distribution process.

While you do not technically need a lawyer to file a small estate affidavit in Texas, having legal guidance can be beneficial. A legal expert can help ensure that all required documentation is correctly prepared and filed, potentially saving you time and effort. If you use the Pasadena Texas Affidavit in Lieu of Inventory, Appraisement and List of Claims, you may navigate the process more smoothly with professional help.