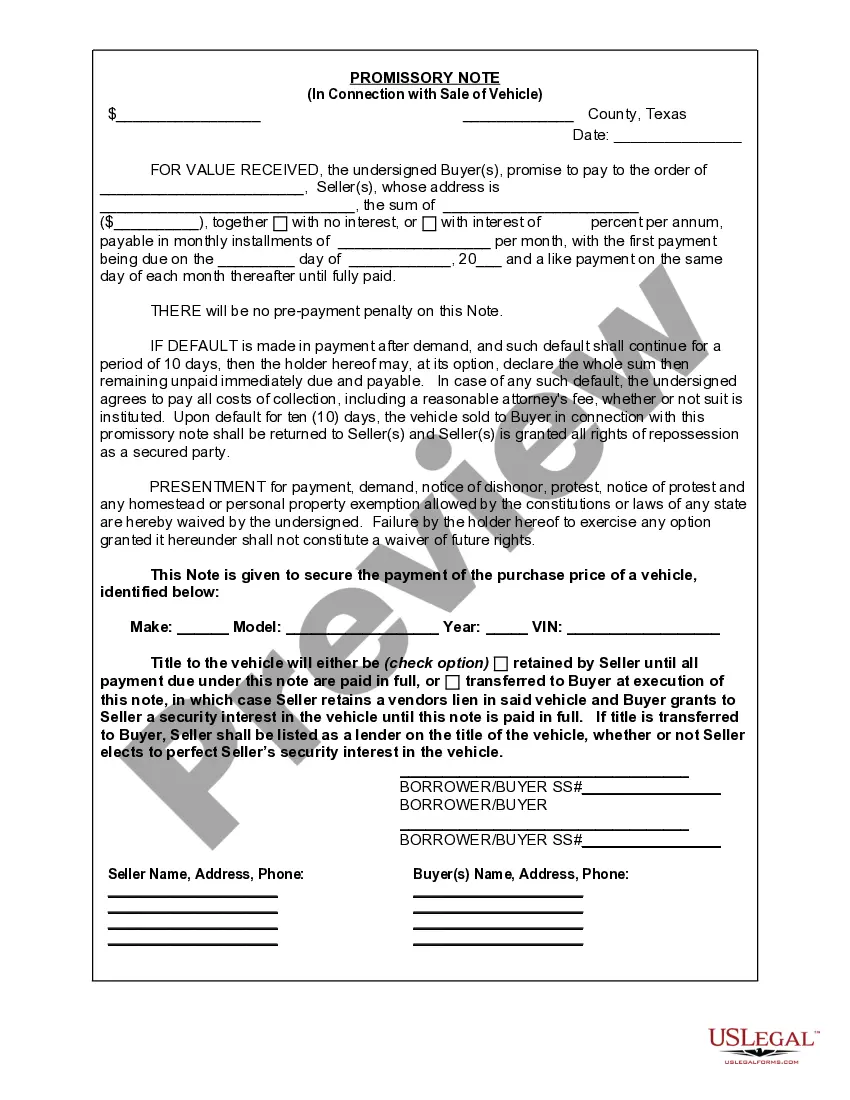

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Arlington Texas Promissory Note in Connection with Sale of Vehicle or Automobile In Arlington, Texas, a promissory note is a legal document that establishes a binding agreement between the seller and buyer of a vehicle or automobile. This note contains the detailed terms and conditions agreed upon by both parties, outlining the payment schedule, interest rate, and other relevant provisions. A promissory note is an essential document in ensuring a secure transaction and protecting the rights of both the buyer and seller. There are several types of promissory notes that can be used in Arlington, Texas, in connection with the sale of a vehicle or automobile: 1. Fixed-Term Promissory Note: This type of note specifies a fixed duration for the agreement, typically set by the parties involved. It includes details such as the payment amount, interest rate, and the number of installments over the agreed-upon period. Upon the completion of the payments, the buyer becomes the rightful owner of the vehicle. 2. Balloon Payment Promissory Note: A balloon payment note features fixed monthly payments for a certain term, followed by a larger final payment called the balloon payment. This option may be chosen when the buyer prefers smaller monthly payments initially, but can afford a larger payment at the end of the term. Upon making the balloon payment, ownership of the vehicle is transferred to the buyer. 3. Secured Promissory Note: Sometimes, a seller may request collateral to secure the payment of the promissory note. In this case, the vehicle being sold is used as security. If the buyer fails to make payments as agreed, the seller reserves the right to repossess the vehicle and sell it to recover the outstanding amount. 4. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require collateral. It solely relies on the buyer's promise to repay the amount borrowed. This type may be chosen when the parties involved have a high level of trust or when the vehicle being sold has minimal value. Regardless of the type of promissory note used in Arlington, Texas, it is crucial to ensure that all essential details are included in the agreement. These details may include the make, model, and year of the vehicle, its identification number, the purchase price, down payment (if any), interest rate, late payment penalties, and any other mutually agreed-upon terms. To protect the interests of both parties, it is recommended that individuals seek legal advice before entering into a promissory note agreement. Consulting an attorney in Arlington, Texas, who specializes in contract law, can help ensure that the document complies with all applicable laws and regulations while considering the unique circumstances of the sale. In conclusion, an Arlington Texas Promissory Note in Connection with Sale of Vehicle or Automobile is a crucial document that outlines the terms and conditions of a vehicle sale transaction. By utilizing different types of promissory notes, buyers and sellers can customize the agreement based on their specific circumstances and preferences, while ensuring a secure and legally binding transaction.Arlington Texas Promissory Note in Connection with Sale of Vehicle or Automobile In Arlington, Texas, a promissory note is a legal document that establishes a binding agreement between the seller and buyer of a vehicle or automobile. This note contains the detailed terms and conditions agreed upon by both parties, outlining the payment schedule, interest rate, and other relevant provisions. A promissory note is an essential document in ensuring a secure transaction and protecting the rights of both the buyer and seller. There are several types of promissory notes that can be used in Arlington, Texas, in connection with the sale of a vehicle or automobile: 1. Fixed-Term Promissory Note: This type of note specifies a fixed duration for the agreement, typically set by the parties involved. It includes details such as the payment amount, interest rate, and the number of installments over the agreed-upon period. Upon the completion of the payments, the buyer becomes the rightful owner of the vehicle. 2. Balloon Payment Promissory Note: A balloon payment note features fixed monthly payments for a certain term, followed by a larger final payment called the balloon payment. This option may be chosen when the buyer prefers smaller monthly payments initially, but can afford a larger payment at the end of the term. Upon making the balloon payment, ownership of the vehicle is transferred to the buyer. 3. Secured Promissory Note: Sometimes, a seller may request collateral to secure the payment of the promissory note. In this case, the vehicle being sold is used as security. If the buyer fails to make payments as agreed, the seller reserves the right to repossess the vehicle and sell it to recover the outstanding amount. 4. Unsecured Promissory Note: Unlike a secured note, an unsecured promissory note does not require collateral. It solely relies on the buyer's promise to repay the amount borrowed. This type may be chosen when the parties involved have a high level of trust or when the vehicle being sold has minimal value. Regardless of the type of promissory note used in Arlington, Texas, it is crucial to ensure that all essential details are included in the agreement. These details may include the make, model, and year of the vehicle, its identification number, the purchase price, down payment (if any), interest rate, late payment penalties, and any other mutually agreed-upon terms. To protect the interests of both parties, it is recommended that individuals seek legal advice before entering into a promissory note agreement. Consulting an attorney in Arlington, Texas, who specializes in contract law, can help ensure that the document complies with all applicable laws and regulations while considering the unique circumstances of the sale. In conclusion, an Arlington Texas Promissory Note in Connection with Sale of Vehicle or Automobile is a crucial document that outlines the terms and conditions of a vehicle sale transaction. By utilizing different types of promissory notes, buyers and sellers can customize the agreement based on their specific circumstances and preferences, while ensuring a secure and legally binding transaction.