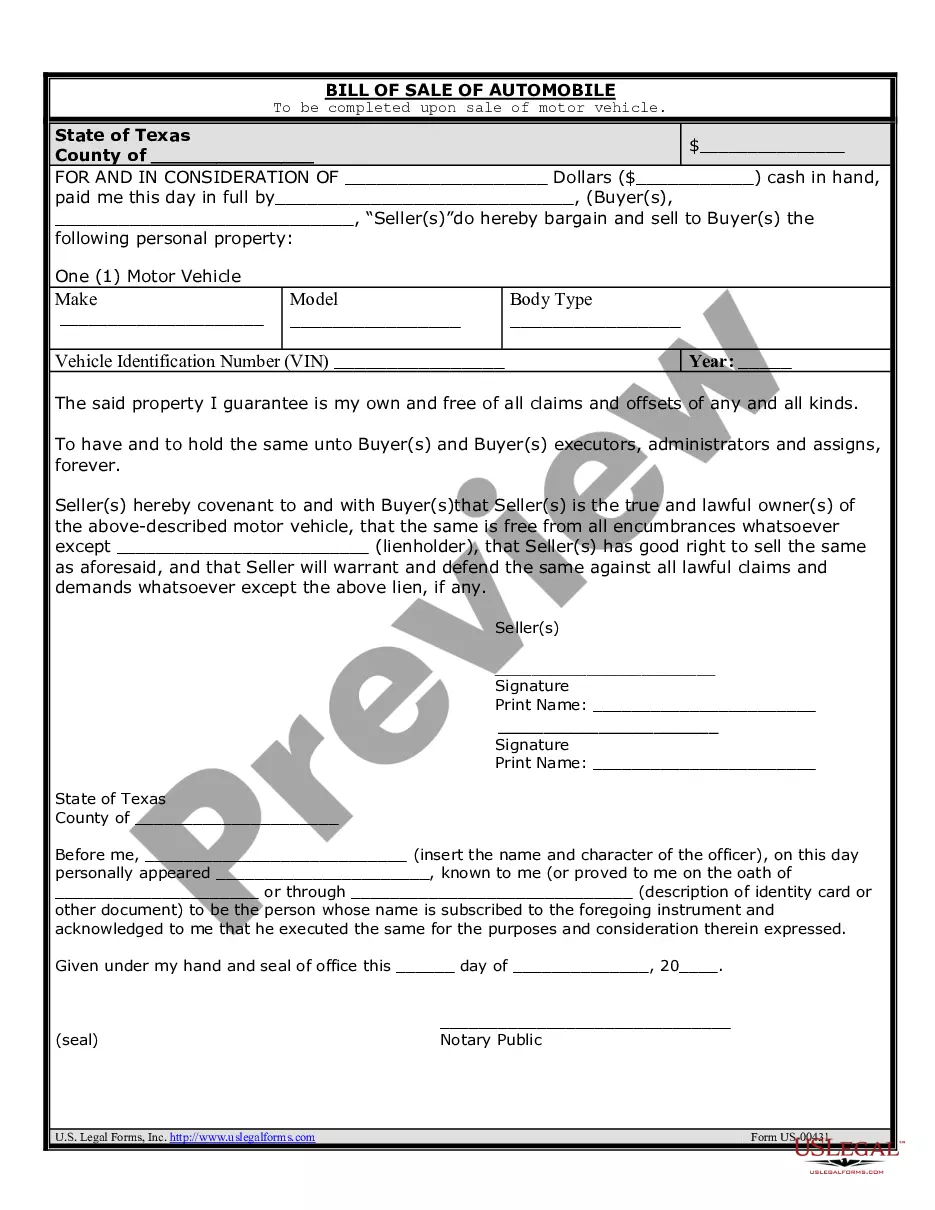

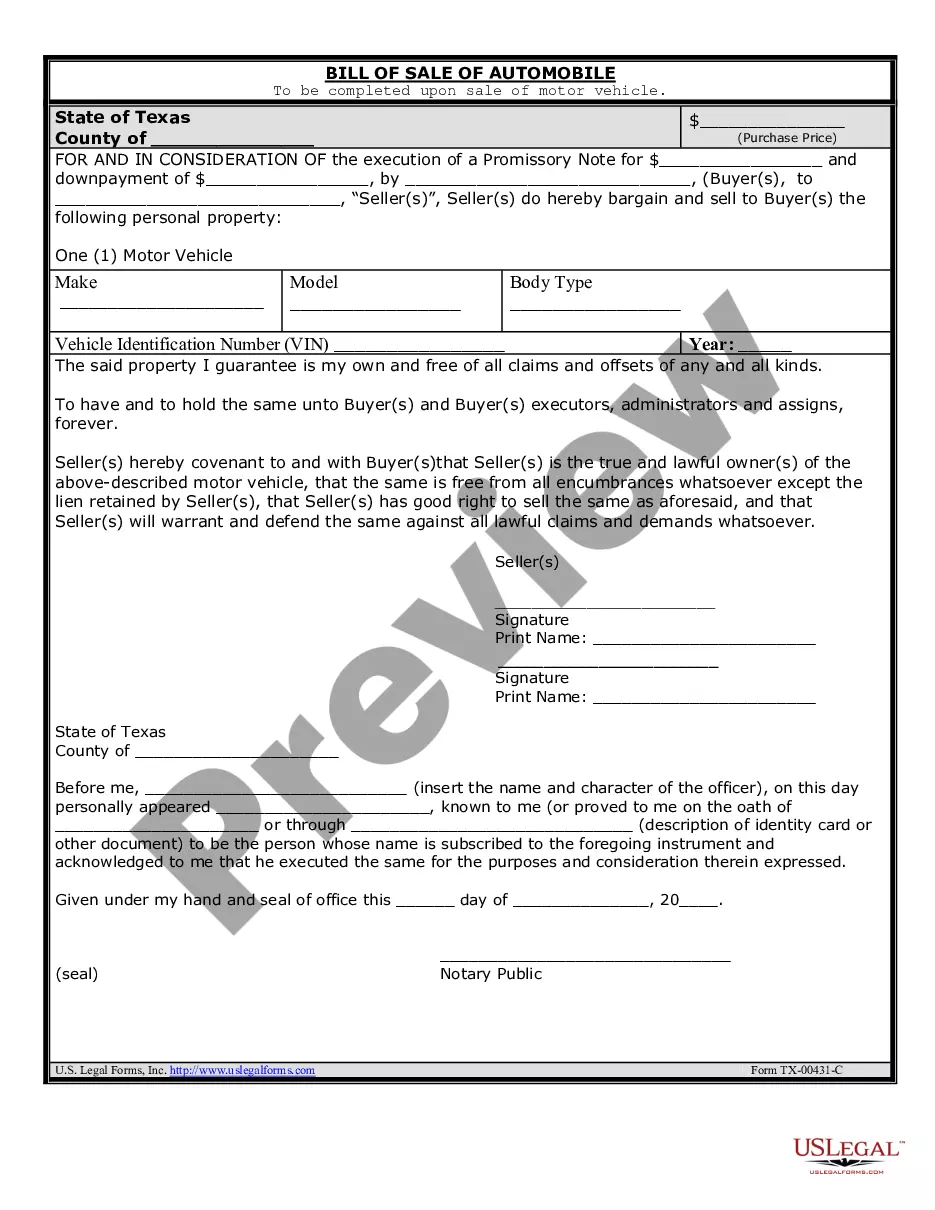

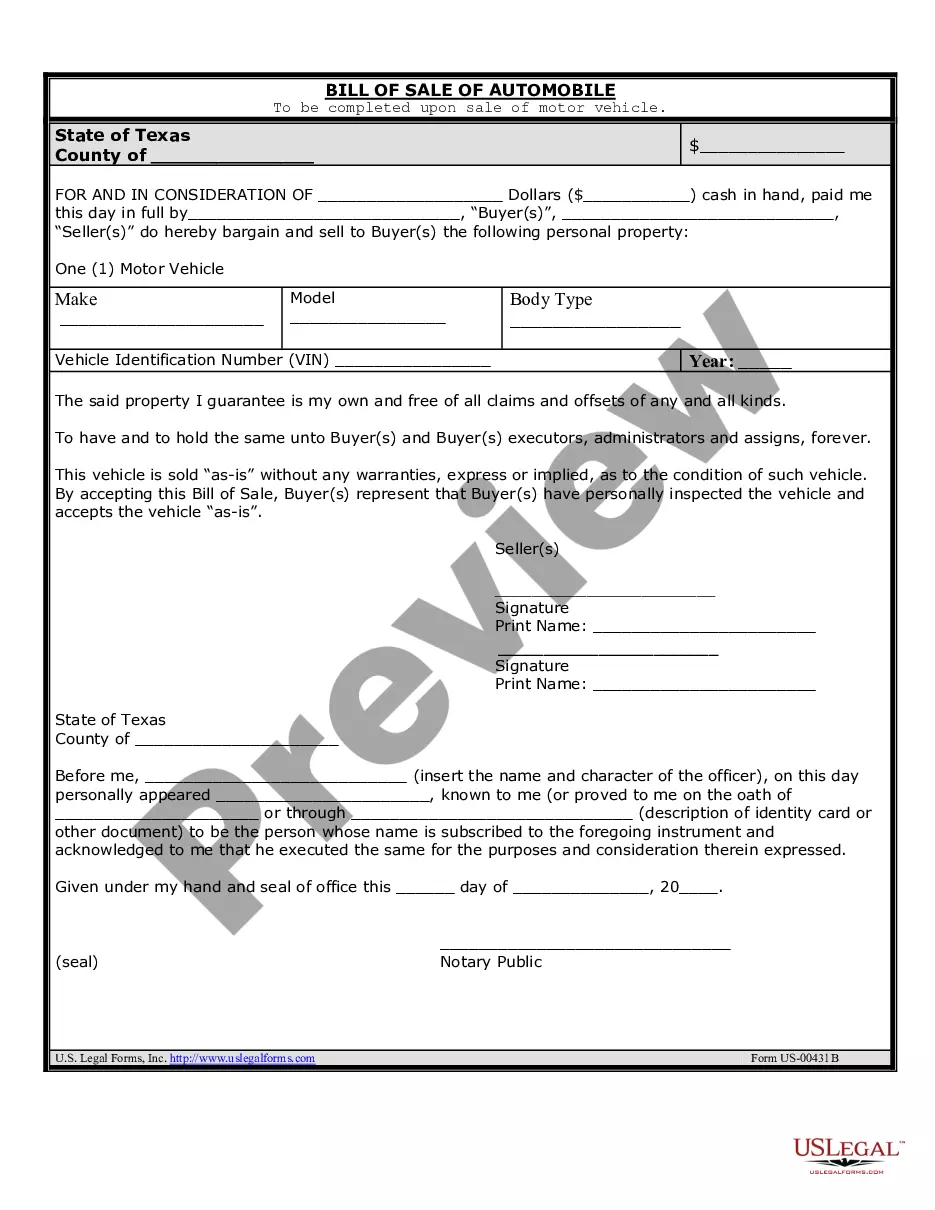

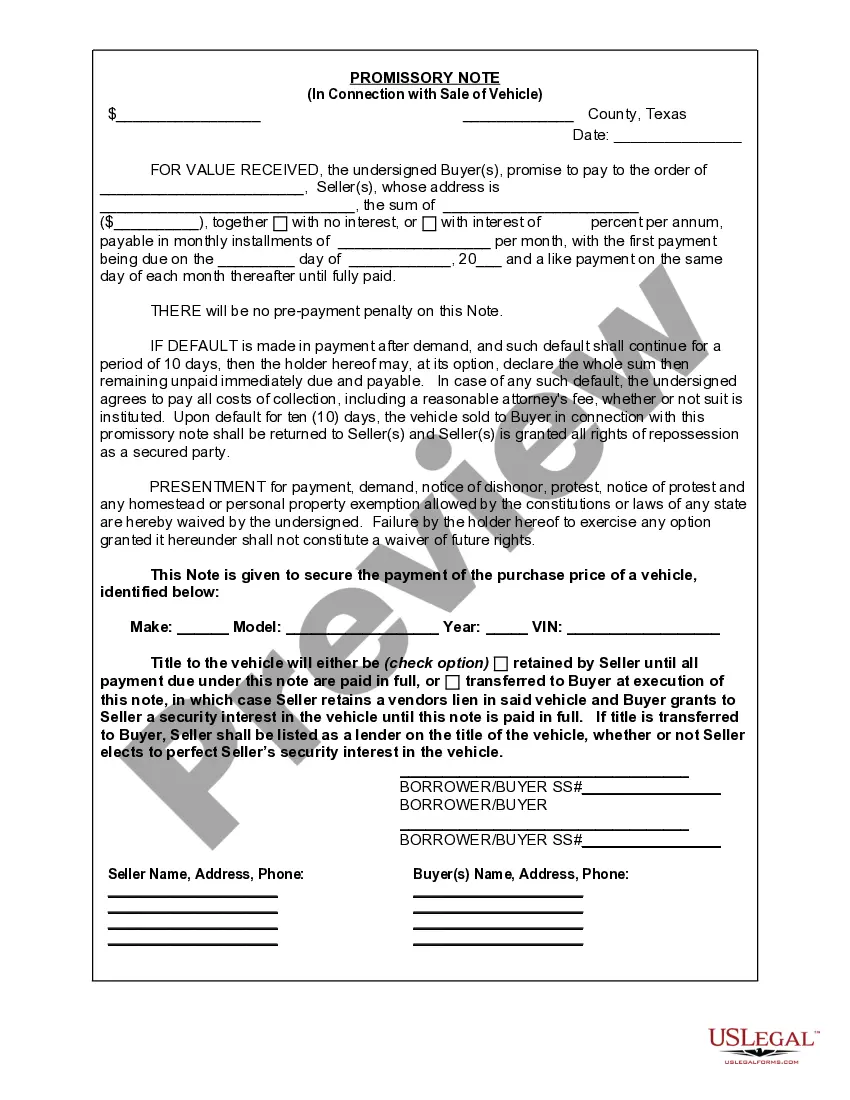

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Fort Worth Texas Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and seller. It is created when the buyer of a vehicle agrees to make payments to the seller over a specified period of time instead of paying the full purchase price upfront. This promissory note serves as evidence of the loan agreement and provides clarity on the repayment terms, interest rate, consequences of default, and any other relevant details. It helps protect both the buyer and seller by ensuring clear communication and understanding of their obligations and rights. Some of the key components that are typically included in a Fort Worth Texas Promissory Note in connection with the sale of a vehicle or automobile are: 1. Parties: Identification of both the buyer and seller, including their legal names and addresses. 2. Vehicle Details: A detailed description of the vehicle being sold, including its make, model, year, color, and VIN (Vehicle Identification Number). 3. Purchase Price and Payment Terms: The total purchase price of the vehicle and the agreed-upon down payment, if any. The note specifies the number and frequency of installment payments, the due dates, and the amount to be paid in each installment. 4. Interest Rate: The interest rate charged on the outstanding balance owed by the buyer. It is crucial to note that certain regulations govern the maximum interest rate that can be charged in relation to vehicle sales in Fort Worth, Texas. 5. Late Fees and Default: The consequences and penalties incurred by the buyer in case of late or missed payments. It may include the imposition of late fees, repossession rights, or legal actions to recover the amount owed. 6. Security Agreement: If the seller wishes to secure the note with the vehicle itself, a separate security agreement can be included. This allows the seller to repossess the vehicle in case of default. 7. Governing Law: Specifying that the promissory note is subject to the laws of Fort Worth, Texas. Additionally, any disputes or claims arising from the agreement are to be resolved through arbitration or litigation in Fort Worth, Texas. While there may not be different types of Fort Worth Texas Promissory Notes specific to the sale of vehicles or automobiles, the terms and conditions can vary depending on the negotiation between the buyer and seller. However, it is essential to accurately document these terms to ensure legal compliance and protect the interests of both parties involved.A Fort Worth Texas Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and seller. It is created when the buyer of a vehicle agrees to make payments to the seller over a specified period of time instead of paying the full purchase price upfront. This promissory note serves as evidence of the loan agreement and provides clarity on the repayment terms, interest rate, consequences of default, and any other relevant details. It helps protect both the buyer and seller by ensuring clear communication and understanding of their obligations and rights. Some of the key components that are typically included in a Fort Worth Texas Promissory Note in connection with the sale of a vehicle or automobile are: 1. Parties: Identification of both the buyer and seller, including their legal names and addresses. 2. Vehicle Details: A detailed description of the vehicle being sold, including its make, model, year, color, and VIN (Vehicle Identification Number). 3. Purchase Price and Payment Terms: The total purchase price of the vehicle and the agreed-upon down payment, if any. The note specifies the number and frequency of installment payments, the due dates, and the amount to be paid in each installment. 4. Interest Rate: The interest rate charged on the outstanding balance owed by the buyer. It is crucial to note that certain regulations govern the maximum interest rate that can be charged in relation to vehicle sales in Fort Worth, Texas. 5. Late Fees and Default: The consequences and penalties incurred by the buyer in case of late or missed payments. It may include the imposition of late fees, repossession rights, or legal actions to recover the amount owed. 6. Security Agreement: If the seller wishes to secure the note with the vehicle itself, a separate security agreement can be included. This allows the seller to repossess the vehicle in case of default. 7. Governing Law: Specifying that the promissory note is subject to the laws of Fort Worth, Texas. Additionally, any disputes or claims arising from the agreement are to be resolved through arbitration or litigation in Fort Worth, Texas. While there may not be different types of Fort Worth Texas Promissory Notes specific to the sale of vehicles or automobiles, the terms and conditions can vary depending on the negotiation between the buyer and seller. However, it is essential to accurately document these terms to ensure legal compliance and protect the interests of both parties involved.