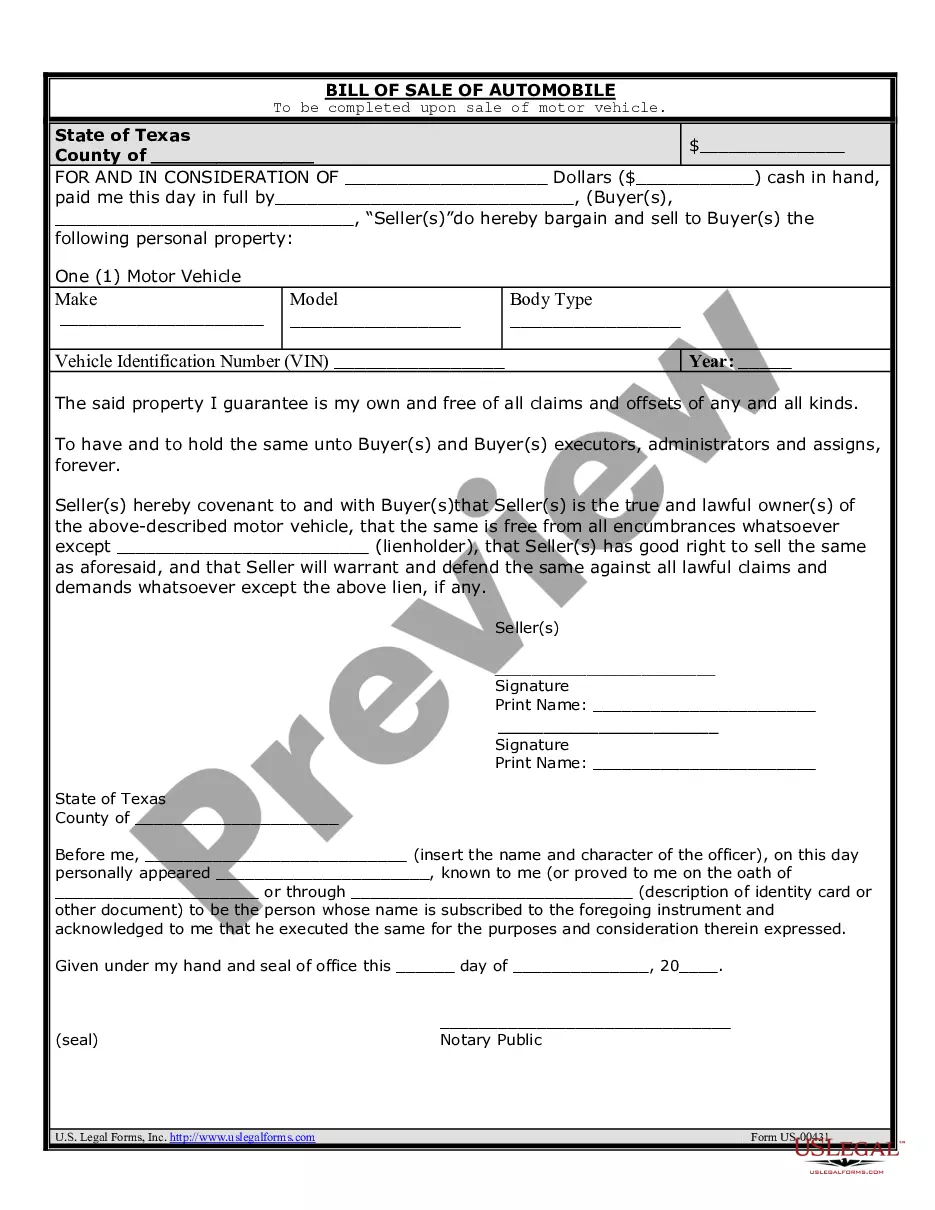

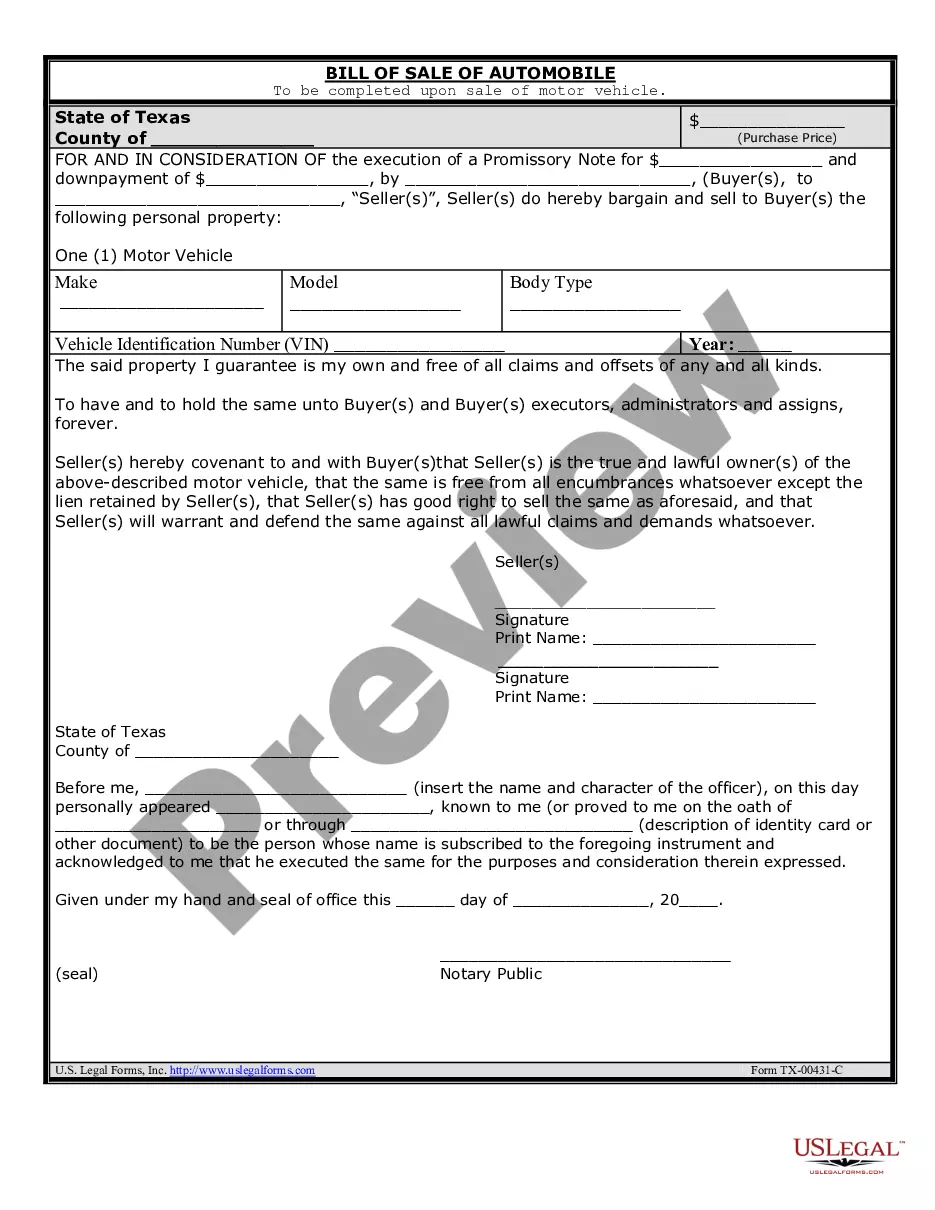

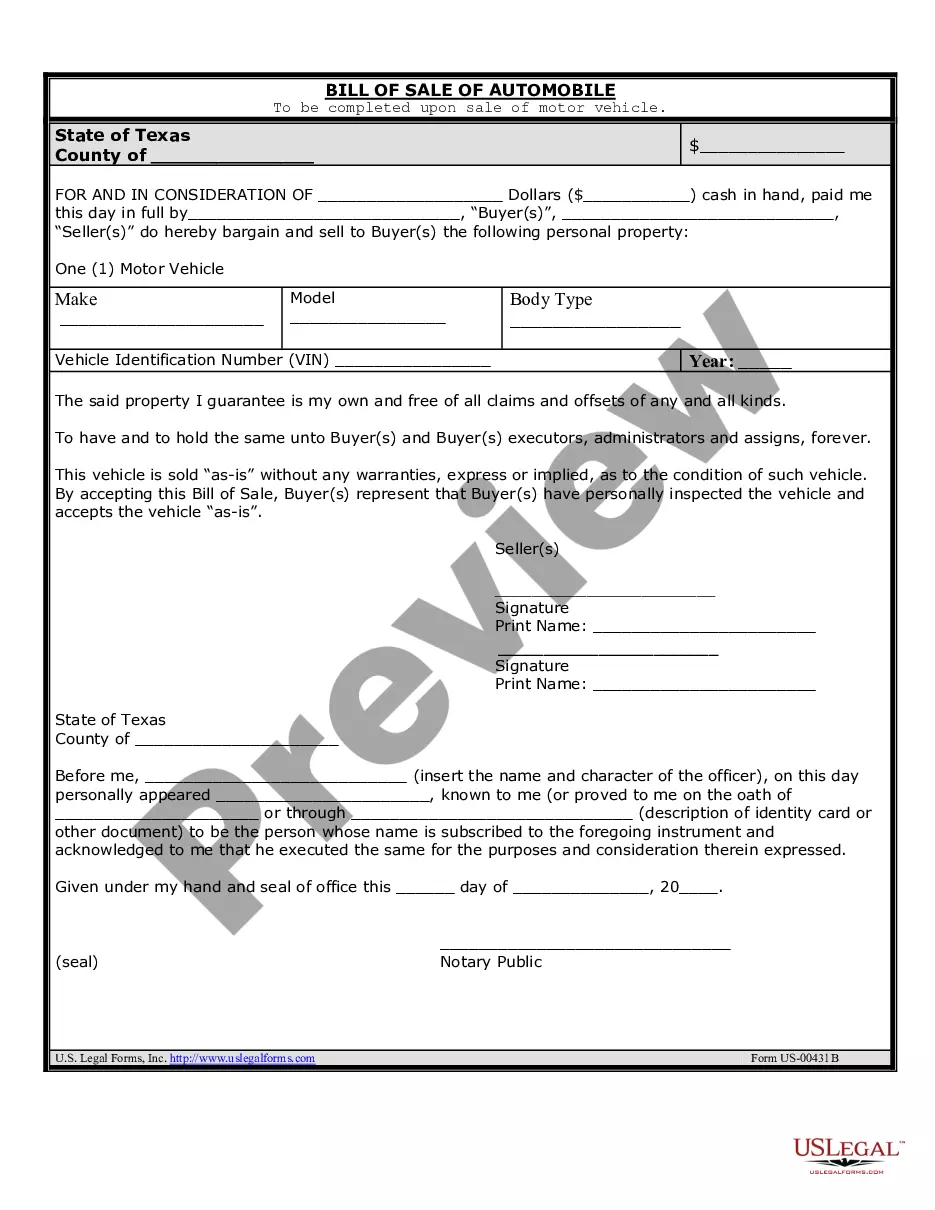

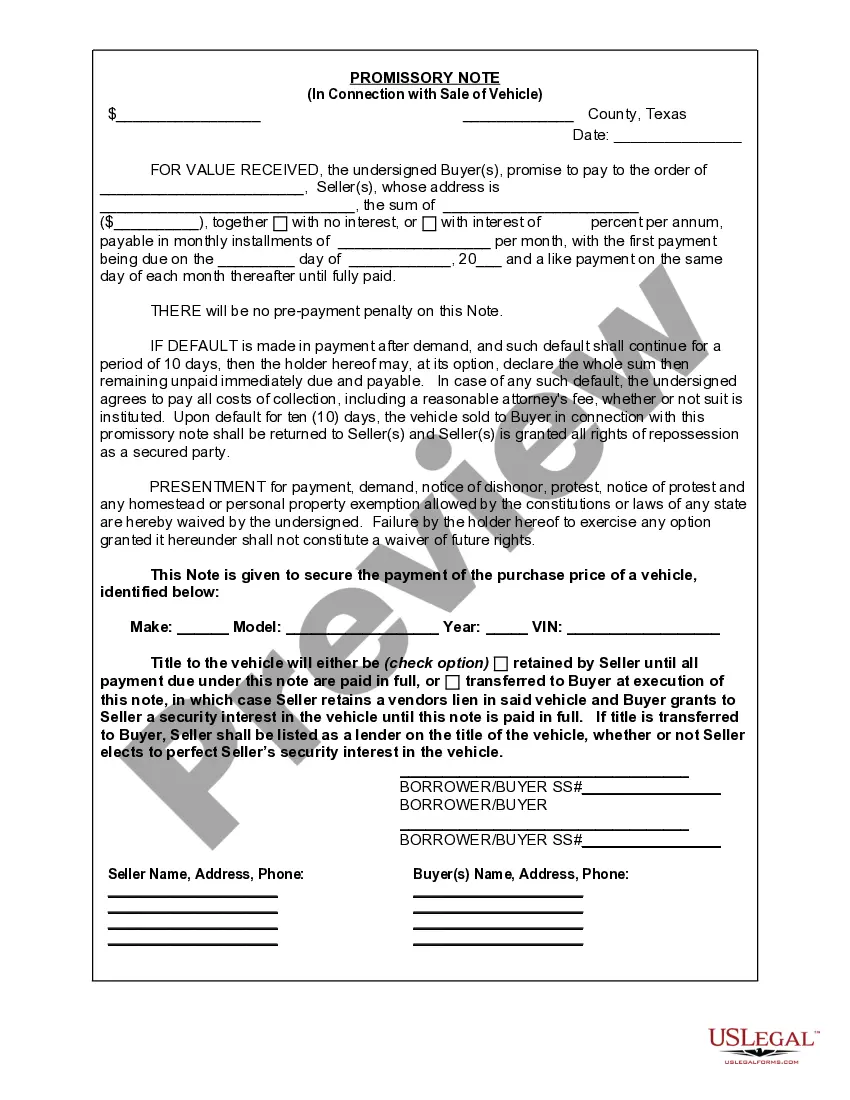

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A McAllen Texas Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that establishes a written agreement between the buyer and the seller regarding the purchase of a vehicle. It outlines the terms and conditions of the sale, including payment details and any additional agreements made between both parties. Promissory notes are commonly used when the buyer is unable to pay the full purchase price upfront or when the seller agrees to finance the sale. There are a few different types of McAllen Texas Promissory Notes in Connection with Sale of Vehicle or Automobile that may be used, depending on the specific circumstances: 1. Installment Promissory Note: This type of promissory note is used when the buyer agrees to make payments in fixed installments over an agreed-upon period of time until the full purchase price is paid. The note specifies the amount and frequency of each installment, along with any interest charges or additional fees. 2. Balloon Payment Promissory Note: A balloon payment promissory note is utilized when the buyer agrees to make smaller regular payments, with a larger final payment or "balloon payment" due at the end of an agreed term. This allows the buyer flexibility in meeting regular payments while providing an opportunity for the seller to receive the full purchase price at the end. 3. Secured Promissory Note: In a secured promissory note, the buyer pledges collateral (such as the purchased vehicle) to secure the debt. This type of note provides the seller with added protection in case of default, as they can repossess the vehicle to recover the outstanding amount. 4. Unsecured Promissory Note: An unsecured promissory note does not require any collateral. It relies solely on the buyer's promise to repay the debt. Due to the increased risk for the seller, an unsecured note often includes higher interest rates or additional terms to protect their interests. 5. Assignment of Promissory Note: In certain instances, the seller may choose to transfer the promissory note to another party, known as the assignee. This assignment allows the seller to receive immediate payment by selling the note, often at a discounted price, rather than waiting for the buyer to make payments over time. When drafting or entering into a McAllen Texas Promissory Note in Connection with Sale of Vehicle or Automobile, it is crucial to consult with a legal professional to ensure that the note complies with all local, state, and federal laws, and that it includes all necessary provisions to protect the rights and interests of both the buyer and the seller.A McAllen Texas Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that establishes a written agreement between the buyer and the seller regarding the purchase of a vehicle. It outlines the terms and conditions of the sale, including payment details and any additional agreements made between both parties. Promissory notes are commonly used when the buyer is unable to pay the full purchase price upfront or when the seller agrees to finance the sale. There are a few different types of McAllen Texas Promissory Notes in Connection with Sale of Vehicle or Automobile that may be used, depending on the specific circumstances: 1. Installment Promissory Note: This type of promissory note is used when the buyer agrees to make payments in fixed installments over an agreed-upon period of time until the full purchase price is paid. The note specifies the amount and frequency of each installment, along with any interest charges or additional fees. 2. Balloon Payment Promissory Note: A balloon payment promissory note is utilized when the buyer agrees to make smaller regular payments, with a larger final payment or "balloon payment" due at the end of an agreed term. This allows the buyer flexibility in meeting regular payments while providing an opportunity for the seller to receive the full purchase price at the end. 3. Secured Promissory Note: In a secured promissory note, the buyer pledges collateral (such as the purchased vehicle) to secure the debt. This type of note provides the seller with added protection in case of default, as they can repossess the vehicle to recover the outstanding amount. 4. Unsecured Promissory Note: An unsecured promissory note does not require any collateral. It relies solely on the buyer's promise to repay the debt. Due to the increased risk for the seller, an unsecured note often includes higher interest rates or additional terms to protect their interests. 5. Assignment of Promissory Note: In certain instances, the seller may choose to transfer the promissory note to another party, known as the assignee. This assignment allows the seller to receive immediate payment by selling the note, often at a discounted price, rather than waiting for the buyer to make payments over time. When drafting or entering into a McAllen Texas Promissory Note in Connection with Sale of Vehicle or Automobile, it is crucial to consult with a legal professional to ensure that the note complies with all local, state, and federal laws, and that it includes all necessary provisions to protect the rights and interests of both the buyer and the seller.