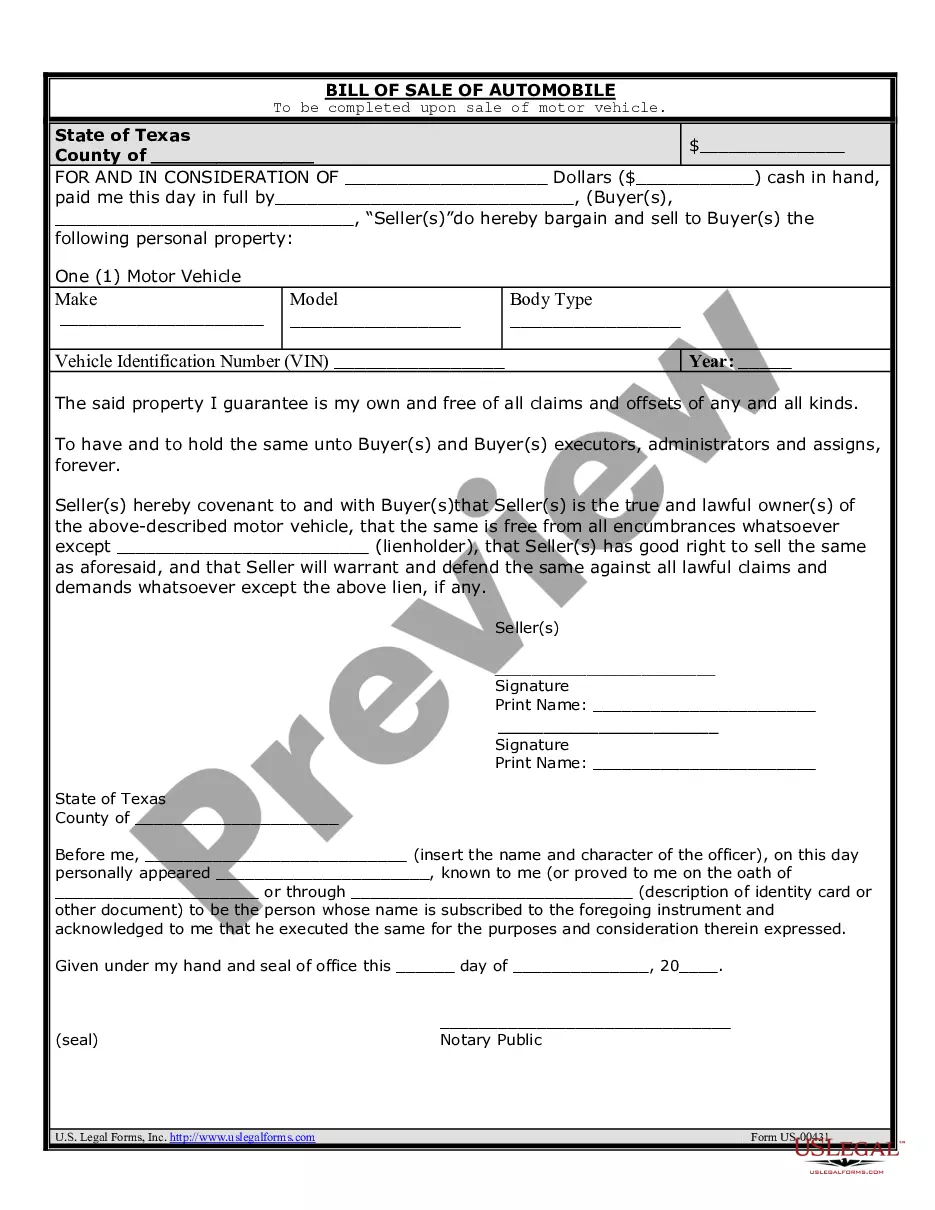

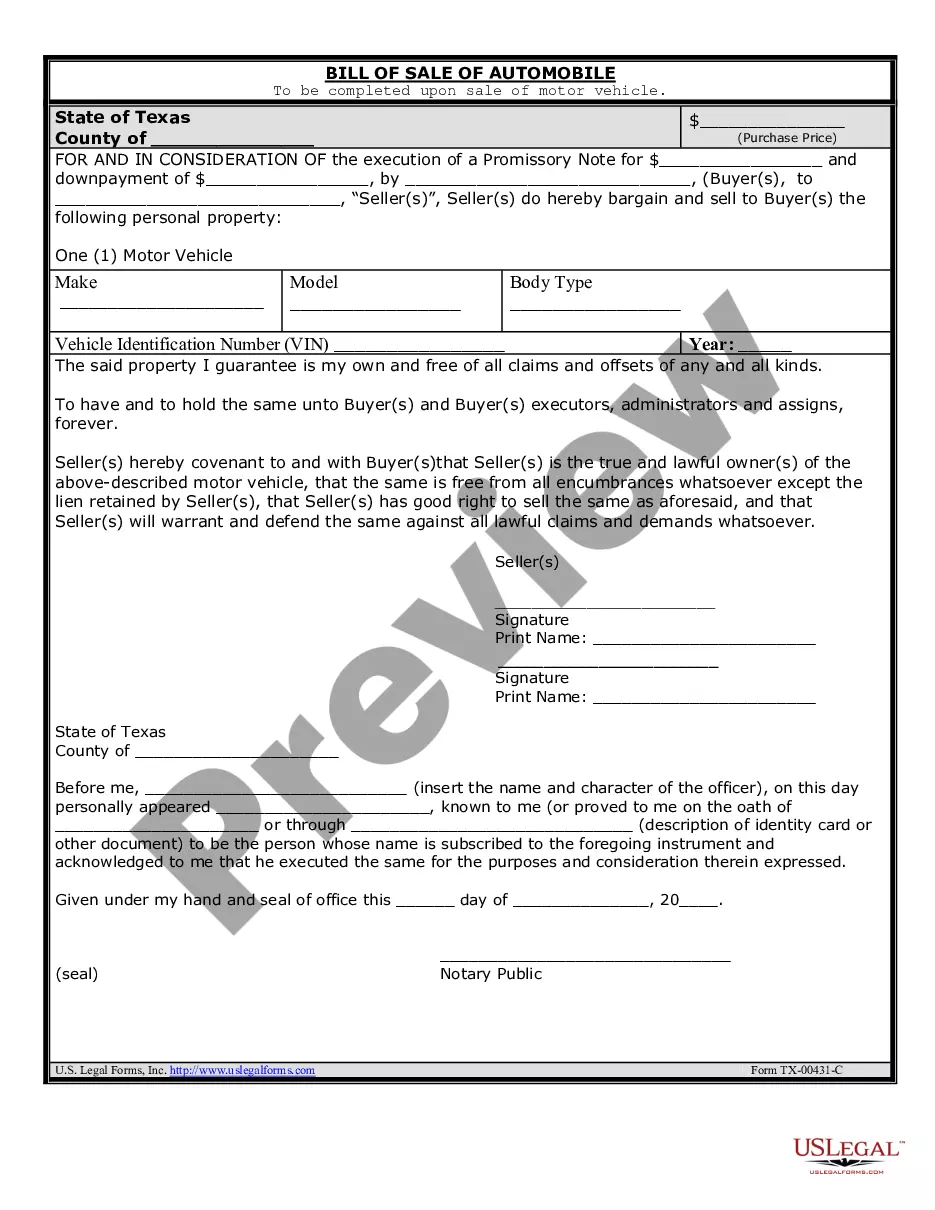

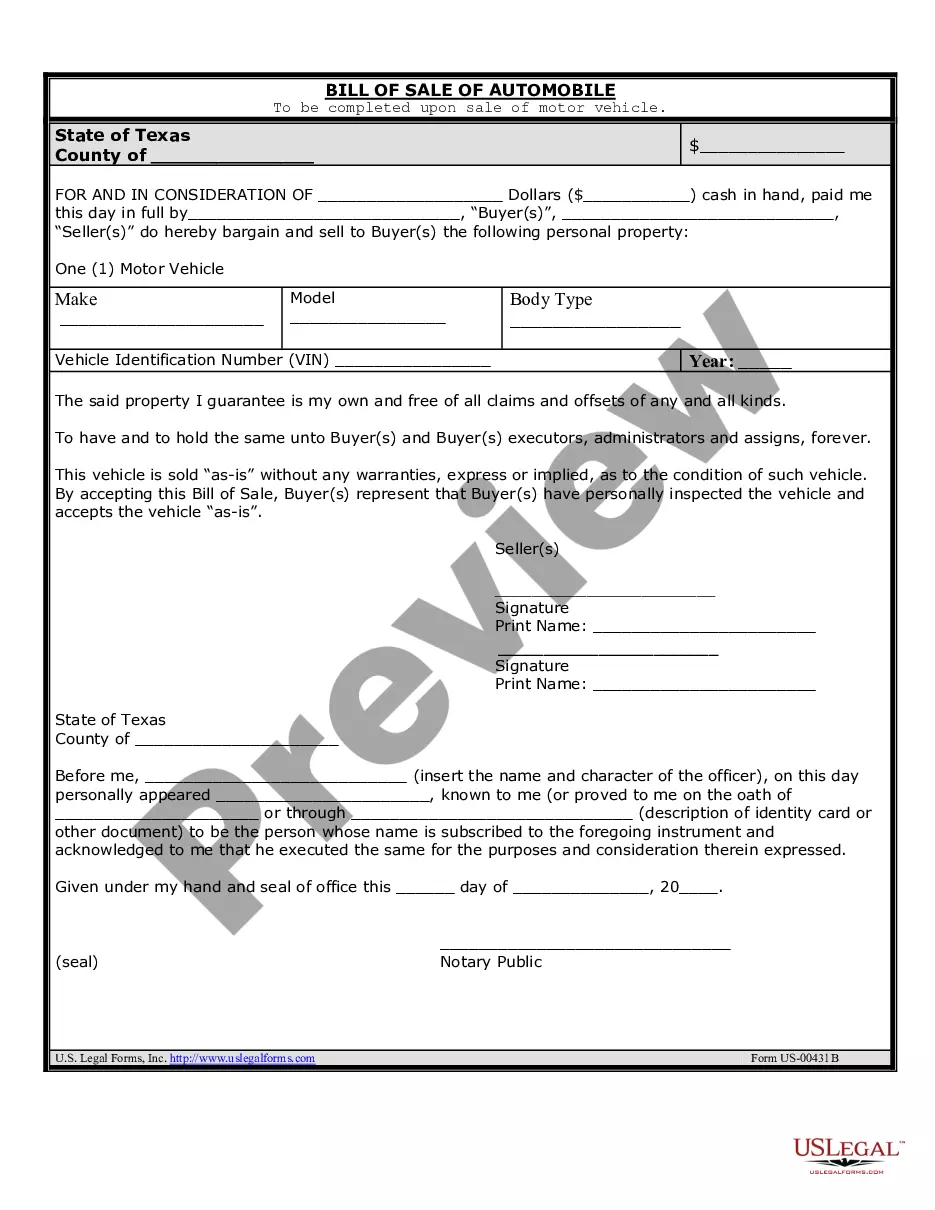

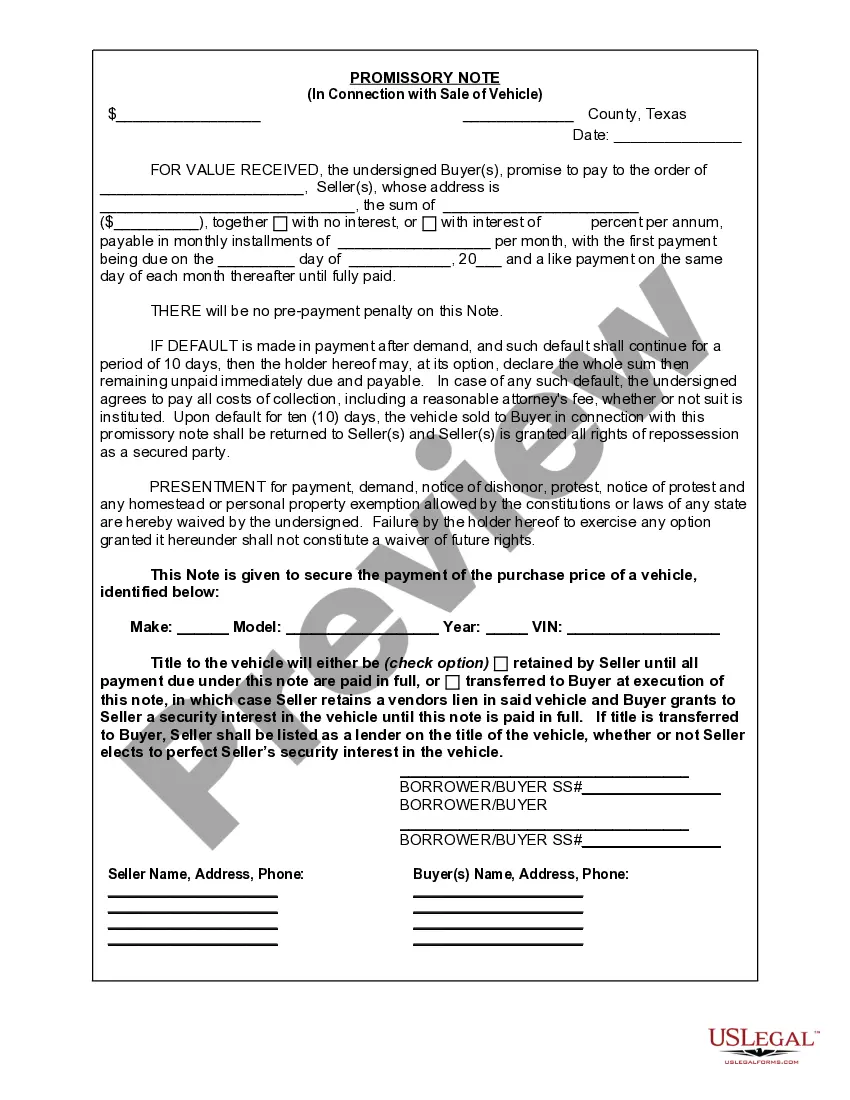

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Travis Texas Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle in Travis County, Texas. This promissory note serves as evidence of the loan, ensuring that both parties understand their rights and responsibilities. The Travis Texas Promissory Note typically includes details such as: 1. Parties Involved: The note identifies the buyer and seller, stating their full legal names, addresses, and contact information. 2. Vehicle Description: The promissory note includes detailed information about the vehicle being sold, including the make, model, year, VIN, and any other relevant identification details to ensure clarity. 3. Purchase Price: This section specifies the agreed-upon purchase price for the vehicle. It may also include information about any down payment, trade-in value, or additional costs included in the transaction. 4. Terms of the Loan: The promissory note outlines the terms of the loan, including the loan amount, interest rate, and repayment schedule. Additionally, it may specify any late payment penalties or fees that apply if the buyer fails to make timely payments. 5. Security Agreement: In some cases, the promissory note may also serve as a security agreement, indicating that the vehicle being sold will serve as collateral for the loan. This ensures that the seller has recourse in the event of default. It is important to note that while the basic structure of a Travis Texas Promissory Note remains relatively consistent, there may be slight variations depending on the specific circumstances of the sale. These variations may include: 1. Installment Sales Agreement: In an installment sales agreement, the buyer agrees to make set payments over a predetermined period to the seller, typically with interest. This type of promissory note provides a clear timeline for repayment and specifies consequences for default. 2. Balloon Payment Agreement: A balloon payment agreement allows the buyer to make smaller periodic payments but includes a larger final payment (the "balloon payment") due at the end of the loan term. This type of promissory note provides flexibility in monthly payments but requires the buyer to plan for a larger payment at the loan's conclusion. 3. Personal Loan Agreement: Sometimes, the seller may agree to provide a personal loan to the buyer, rather than involving a financial institution. In such cases, the promissory note will reflect the terms of the personal loan, including the interest rate, repayment schedule, and any necessary security agreements. To ensure the validity and enforceability of the Travis Texas Promissory Note in Connection with Sale of Vehicle or Automobile, it is advisable to consult with legal professionals who can provide expert guidance and ensure compliance with all relevant laws and regulations.A Travis Texas Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and seller of a vehicle in Travis County, Texas. This promissory note serves as evidence of the loan, ensuring that both parties understand their rights and responsibilities. The Travis Texas Promissory Note typically includes details such as: 1. Parties Involved: The note identifies the buyer and seller, stating their full legal names, addresses, and contact information. 2. Vehicle Description: The promissory note includes detailed information about the vehicle being sold, including the make, model, year, VIN, and any other relevant identification details to ensure clarity. 3. Purchase Price: This section specifies the agreed-upon purchase price for the vehicle. It may also include information about any down payment, trade-in value, or additional costs included in the transaction. 4. Terms of the Loan: The promissory note outlines the terms of the loan, including the loan amount, interest rate, and repayment schedule. Additionally, it may specify any late payment penalties or fees that apply if the buyer fails to make timely payments. 5. Security Agreement: In some cases, the promissory note may also serve as a security agreement, indicating that the vehicle being sold will serve as collateral for the loan. This ensures that the seller has recourse in the event of default. It is important to note that while the basic structure of a Travis Texas Promissory Note remains relatively consistent, there may be slight variations depending on the specific circumstances of the sale. These variations may include: 1. Installment Sales Agreement: In an installment sales agreement, the buyer agrees to make set payments over a predetermined period to the seller, typically with interest. This type of promissory note provides a clear timeline for repayment and specifies consequences for default. 2. Balloon Payment Agreement: A balloon payment agreement allows the buyer to make smaller periodic payments but includes a larger final payment (the "balloon payment") due at the end of the loan term. This type of promissory note provides flexibility in monthly payments but requires the buyer to plan for a larger payment at the loan's conclusion. 3. Personal Loan Agreement: Sometimes, the seller may agree to provide a personal loan to the buyer, rather than involving a financial institution. In such cases, the promissory note will reflect the terms of the personal loan, including the interest rate, repayment schedule, and any necessary security agreements. To ensure the validity and enforceability of the Travis Texas Promissory Note in Connection with Sale of Vehicle or Automobile, it is advisable to consult with legal professionals who can provide expert guidance and ensure compliance with all relevant laws and regulations.