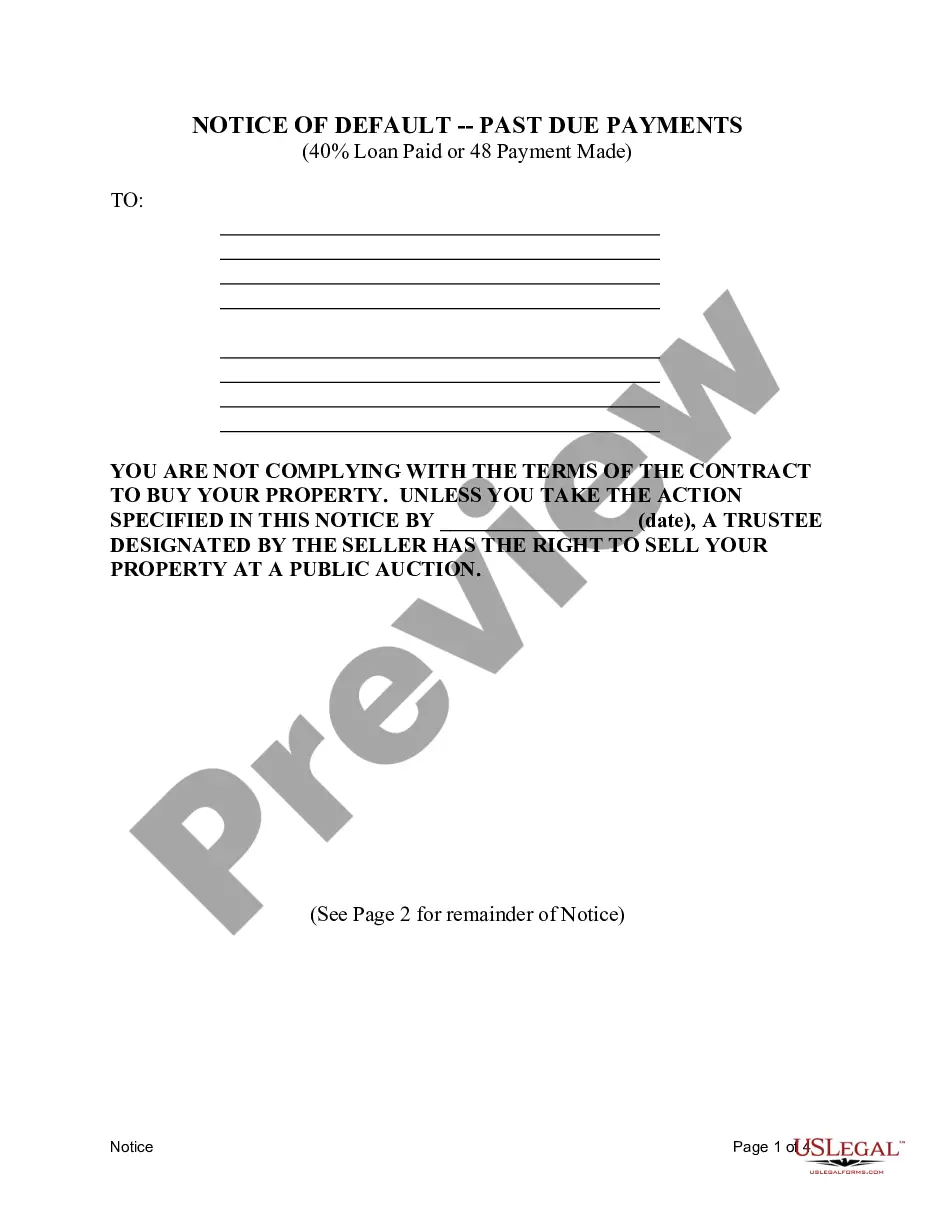

Texas Contract for Deed related forms. This is the Notice of Default form used when the Buyer has paid 40% of the principal of the contract or made a total of 48 or more payments. This form complies with the Texas law, and deal with matters related to Contract for Deed.

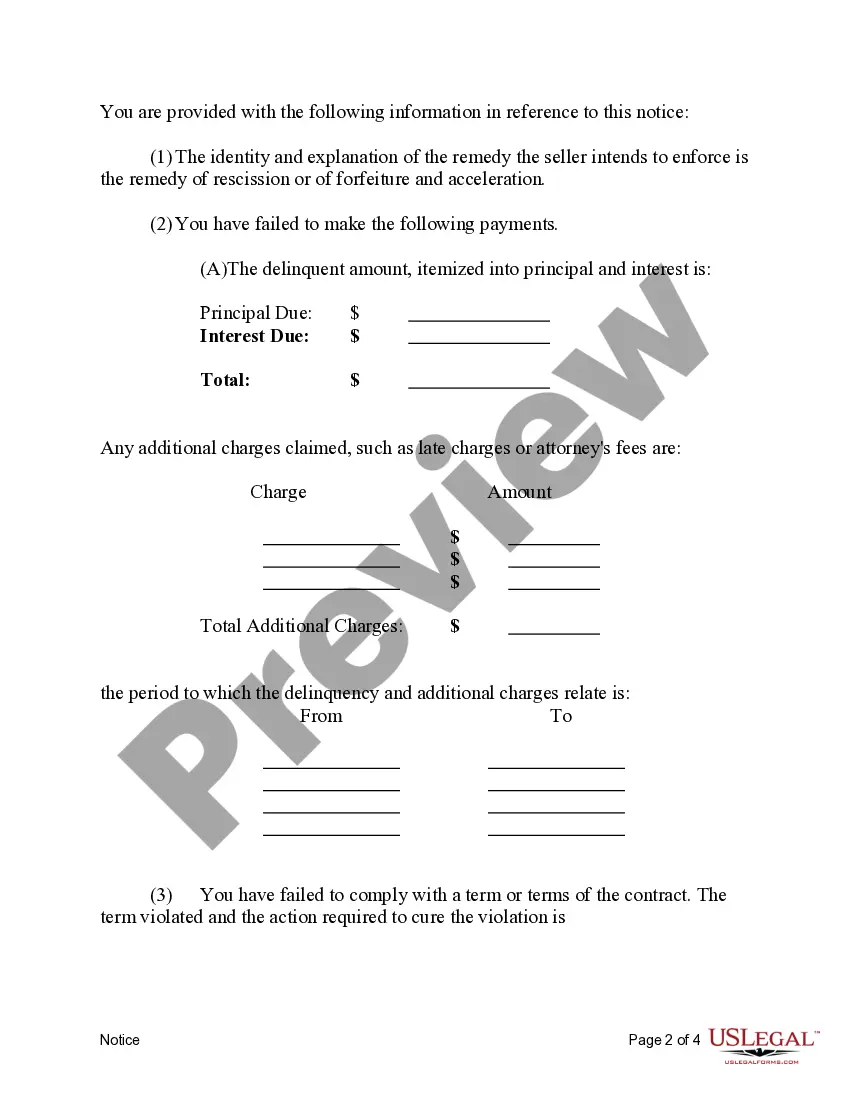

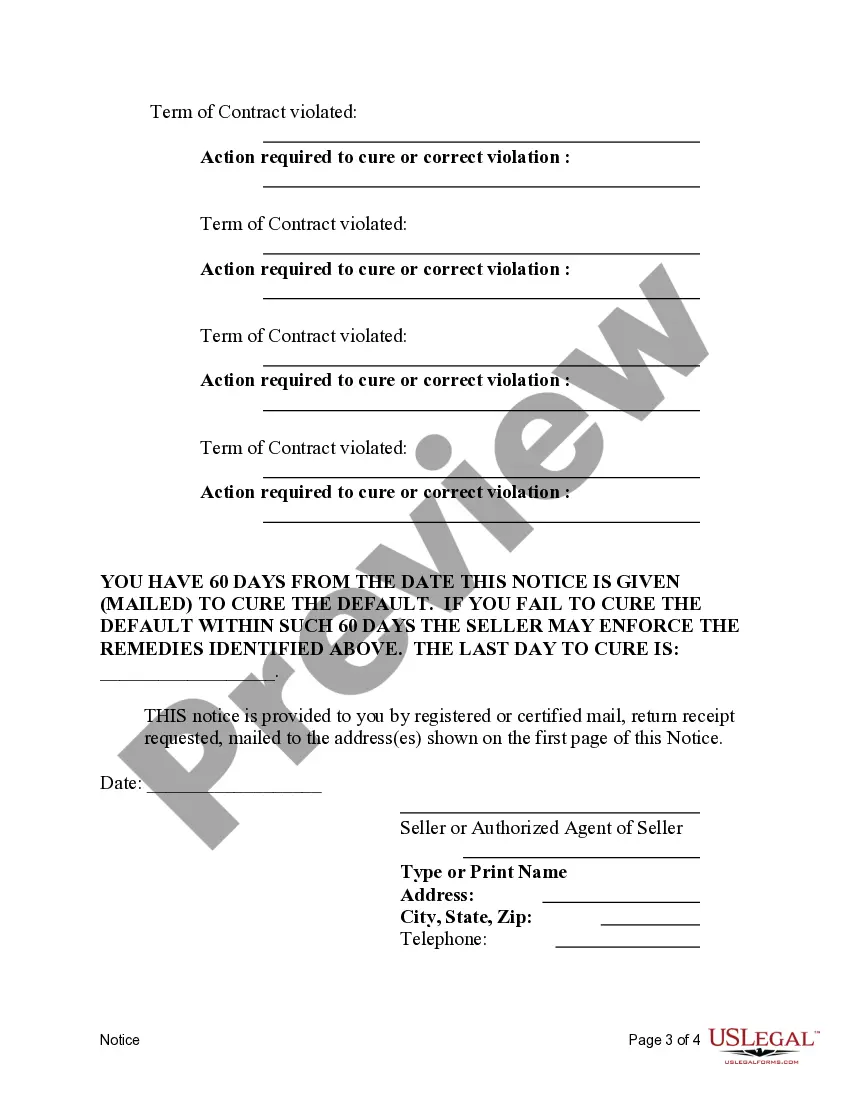

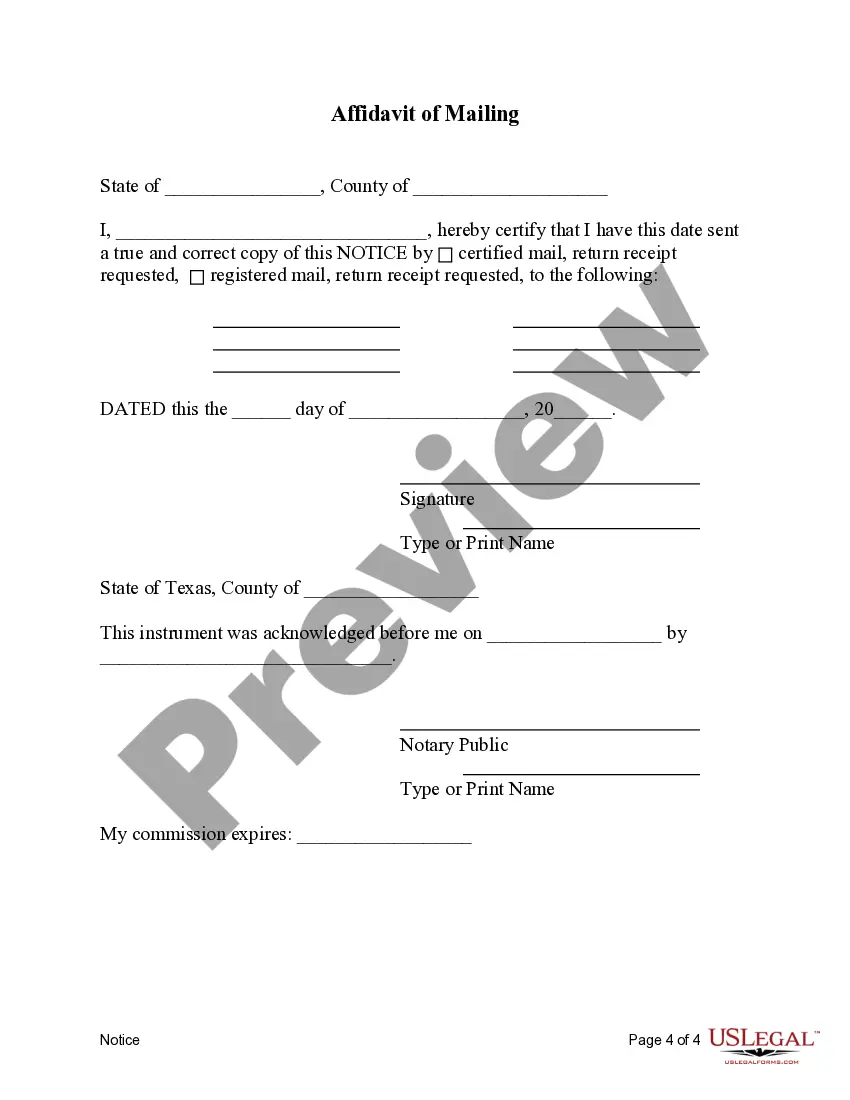

Title: Understanding Beaumont Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made Introduction: In Beaumont, Texas, the Contract for Deed Notice of Default serves as an important legal document that outlines the conditions under which a default occurs when 40% of the loan has been repaid or after 48 scheduled payments have been made. This detail-oriented article will dive deep into the intricacies of this notice, shedding light on various types, implications, and steps involved. Key Keywords: Beaumont Texas, Contract for Deed, Notice of Default, 40% of Loan Paid, 48 Payments Made 1. Types of Beaumont Texas Contract for Deed Notice of Default: a) "40% of Loan Paid" Default Notice: This variant of the notice comes into play when 40% of the loan, stipulated in the Contract for Deed, has been paid by the buyer. It triggers specific actions and legal steps by the seller to address the default situation. b) "48 Payments Made" Default Notice: This type of notice is activated when the buyer has successfully completed 48 scheduled payments as specified in the Contract for Deed. Non-compliance at this stage can lead to significant consequences. 2. Implied Consequences of Default: a) Loss of Property Ownership: Depending on the terms of the Contract for Deed, a default can result in the forfeiture of the buyer's ownership rights. The property may revert to the seller, giving them the authority to reclaim ownership. b) Financial Implications: Defaulting on a Beaumont Texas Contract for Deed can have severe financial consequences for the buyer, including the loss of invested funds, accumulated equity, and future accrued benefits. 3. The Notice of Default Process: a) Notification: Once the default conditions are met, the seller must issue a Notice of Default to the buyer, informing them about the breach of the contract. b) Grace Period: In some cases, a grace period may be granted to the buyer, allowing them to rectify the default within a specified timeframe. c) Legal Procedures: If the default remains unresolved, the seller may initiate legal proceedings, including foreclosure, to protect their interests. The buyer may be required to vacate the property, facing potential litigation and damage to their credit score. d) Negotiation and Settlement: In some instances, the seller and buyer may engage in negotiations to find an alternative solution, such as payment plan restructuring or refinancing, to avoid the foreclosure process. Conclusion: Understanding the intricacies of the Beaumont Texas Contract for Deed Notice of Default when 40% of the loan has been paid or 48 payments have been made is crucial for both buyers and sellers. Vigilance in adhering to the contractual terms, along with open communication and proactive resolution of disputes, can help mitigate any potential default risks.Title: Understanding Beaumont Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made Introduction: In Beaumont, Texas, the Contract for Deed Notice of Default serves as an important legal document that outlines the conditions under which a default occurs when 40% of the loan has been repaid or after 48 scheduled payments have been made. This detail-oriented article will dive deep into the intricacies of this notice, shedding light on various types, implications, and steps involved. Key Keywords: Beaumont Texas, Contract for Deed, Notice of Default, 40% of Loan Paid, 48 Payments Made 1. Types of Beaumont Texas Contract for Deed Notice of Default: a) "40% of Loan Paid" Default Notice: This variant of the notice comes into play when 40% of the loan, stipulated in the Contract for Deed, has been paid by the buyer. It triggers specific actions and legal steps by the seller to address the default situation. b) "48 Payments Made" Default Notice: This type of notice is activated when the buyer has successfully completed 48 scheduled payments as specified in the Contract for Deed. Non-compliance at this stage can lead to significant consequences. 2. Implied Consequences of Default: a) Loss of Property Ownership: Depending on the terms of the Contract for Deed, a default can result in the forfeiture of the buyer's ownership rights. The property may revert to the seller, giving them the authority to reclaim ownership. b) Financial Implications: Defaulting on a Beaumont Texas Contract for Deed can have severe financial consequences for the buyer, including the loss of invested funds, accumulated equity, and future accrued benefits. 3. The Notice of Default Process: a) Notification: Once the default conditions are met, the seller must issue a Notice of Default to the buyer, informing them about the breach of the contract. b) Grace Period: In some cases, a grace period may be granted to the buyer, allowing them to rectify the default within a specified timeframe. c) Legal Procedures: If the default remains unresolved, the seller may initiate legal proceedings, including foreclosure, to protect their interests. The buyer may be required to vacate the property, facing potential litigation and damage to their credit score. d) Negotiation and Settlement: In some instances, the seller and buyer may engage in negotiations to find an alternative solution, such as payment plan restructuring or refinancing, to avoid the foreclosure process. Conclusion: Understanding the intricacies of the Beaumont Texas Contract for Deed Notice of Default when 40% of the loan has been paid or 48 payments have been made is crucial for both buyers and sellers. Vigilance in adhering to the contractual terms, along with open communication and proactive resolution of disputes, can help mitigate any potential default risks.