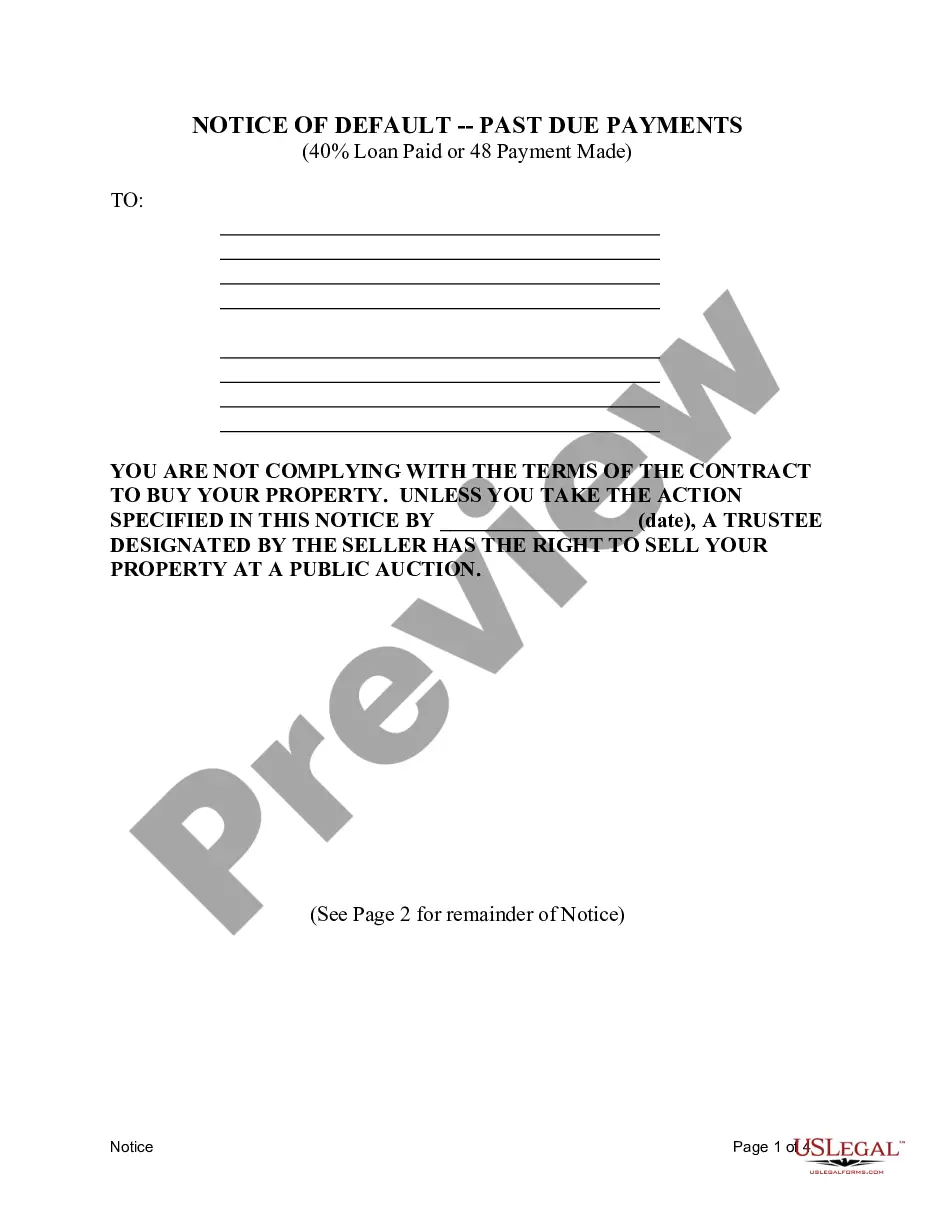

Texas Contract for Deed related forms. This is the Notice of Default form used when the Buyer has paid 40% of the principal of the contract or made a total of 48 or more payments. This form complies with the Texas law, and deal with matters related to Contract for Deed.

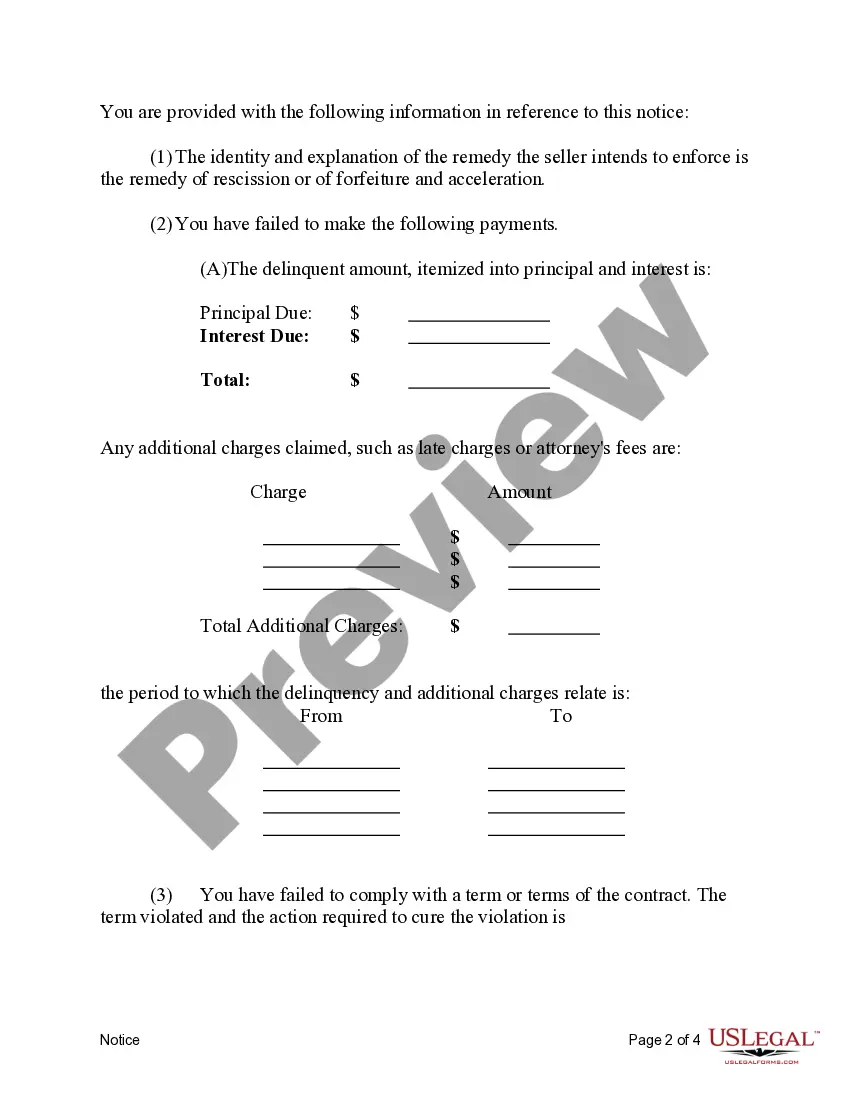

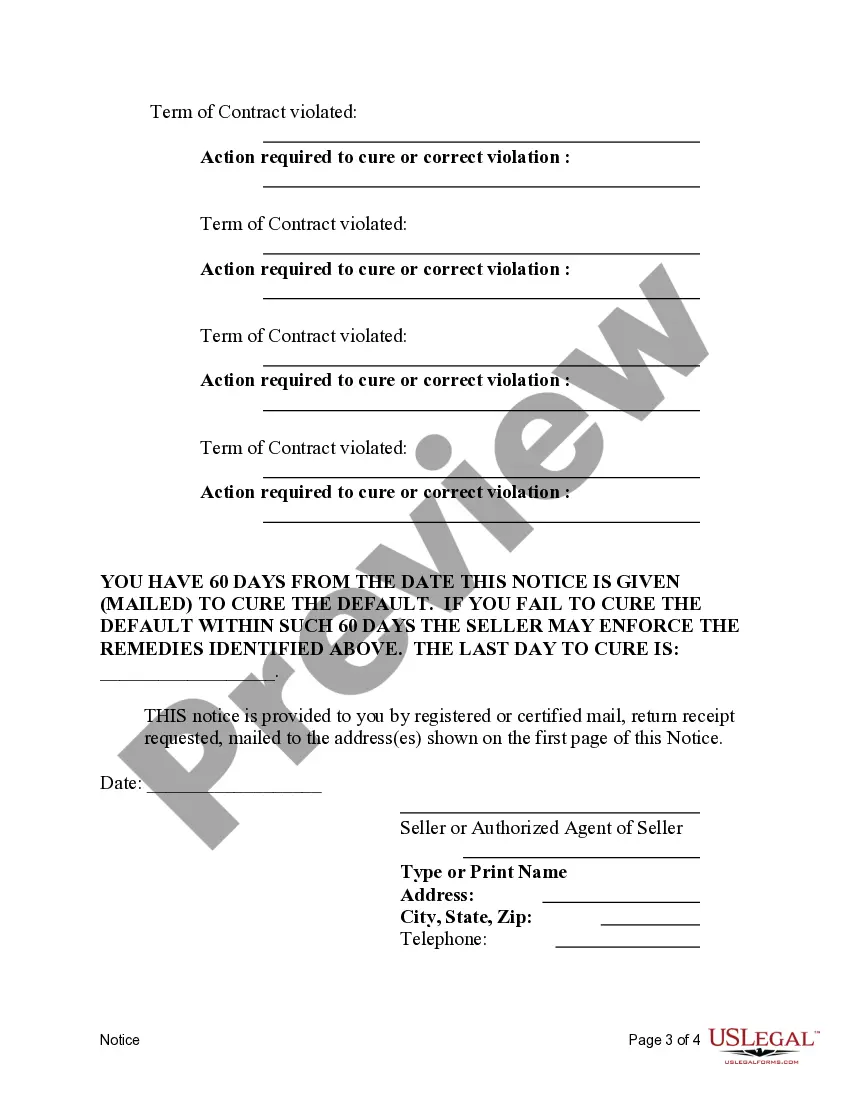

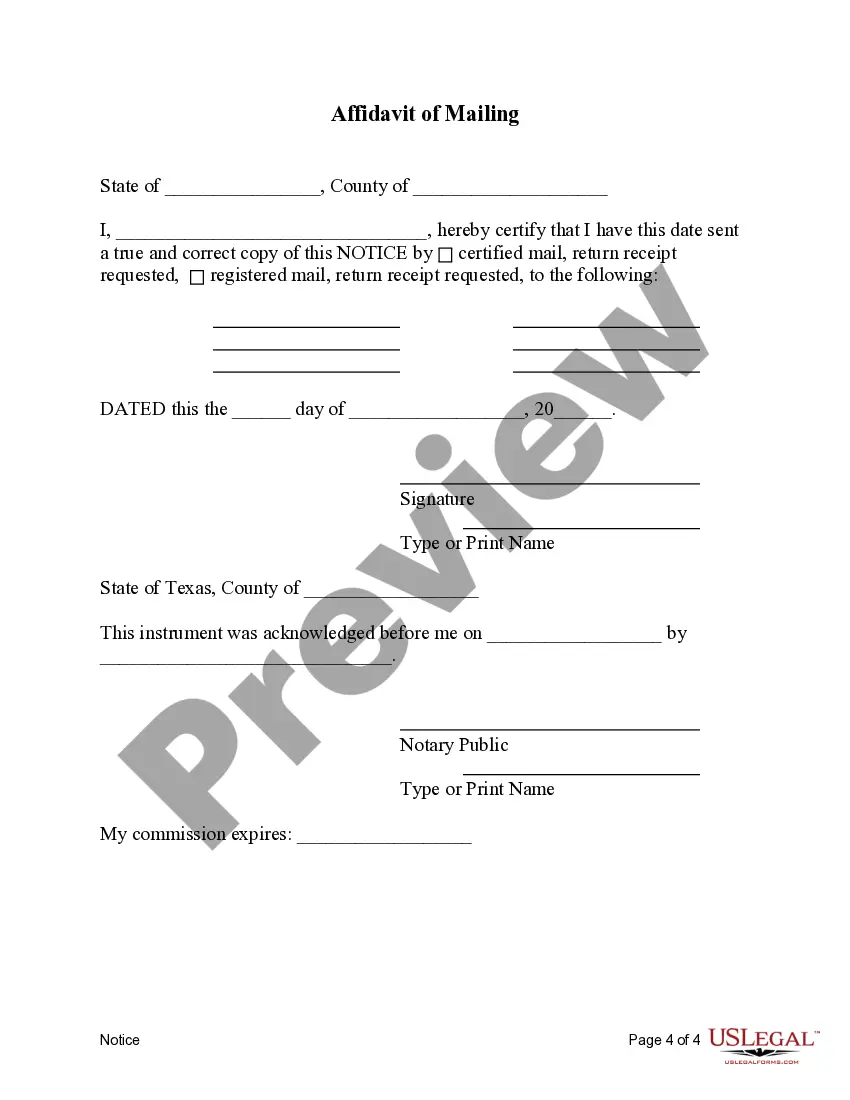

A Grand Prairie Texas Contract for Deed is a legally binding agreement between a buyer and seller in real estate transactions. It allows the buyer to occupy and make payments on a property while the seller retains the deed until certain conditions are met. This type of arrangement provides an alternative option for those who may struggle to qualify for traditional mortgage loans. The Notice of Default is a crucial aspect of the Contract for Deed in Grand Prairie, Texas. It outlines specific conditions under which the buyer is at risk of defaulting on their contractual obligations. One such condition is when the buyer has paid off 40% of the loan or has made a total of 48 payments. When either of these conditions is met, the seller has the right to issue a Notice of Default to the buyer. This notice serves as a formal communication informing the buyer of their state of default and outlining the consequences that may follow if the default is not remedied within a specified timeframe. Upon receiving a Notice of Default, the buyer must take immediate action to rectify the situation. This generally involves either bringing the outstanding payments up to date or negotiating an alternative arrangement with the seller, such as a payment plan or loan modification. If the buyer fails to cure the default within the specified timeframe, the seller may initiate further legal actions, which could include foreclosure proceedings and the termination of the Contract for Deed. It's important to note that there might be variations or additional clauses within Grand Prairie Texas Contract for Deed agreements. These variations could include different conditions for default, such as a different percentage of loan paid or a different number of payments made. It is essential for both buyers and sellers to carefully review the terms of their Contract for Deed to understand the specific conditions and consequences outlined within it. In summary, a Grand Prairie Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made is a crucial component of a real estate agreement. It protects the interests of both the buyer and seller, ensuring that the buyer fulfills their payment obligations and preventing the seller from being left in a precarious position. However, it is crucial for all parties involved to thoroughly understand the terms of the contract to avoid any potential complications or default situations.A Grand Prairie Texas Contract for Deed is a legally binding agreement between a buyer and seller in real estate transactions. It allows the buyer to occupy and make payments on a property while the seller retains the deed until certain conditions are met. This type of arrangement provides an alternative option for those who may struggle to qualify for traditional mortgage loans. The Notice of Default is a crucial aspect of the Contract for Deed in Grand Prairie, Texas. It outlines specific conditions under which the buyer is at risk of defaulting on their contractual obligations. One such condition is when the buyer has paid off 40% of the loan or has made a total of 48 payments. When either of these conditions is met, the seller has the right to issue a Notice of Default to the buyer. This notice serves as a formal communication informing the buyer of their state of default and outlining the consequences that may follow if the default is not remedied within a specified timeframe. Upon receiving a Notice of Default, the buyer must take immediate action to rectify the situation. This generally involves either bringing the outstanding payments up to date or negotiating an alternative arrangement with the seller, such as a payment plan or loan modification. If the buyer fails to cure the default within the specified timeframe, the seller may initiate further legal actions, which could include foreclosure proceedings and the termination of the Contract for Deed. It's important to note that there might be variations or additional clauses within Grand Prairie Texas Contract for Deed agreements. These variations could include different conditions for default, such as a different percentage of loan paid or a different number of payments made. It is essential for both buyers and sellers to carefully review the terms of their Contract for Deed to understand the specific conditions and consequences outlined within it. In summary, a Grand Prairie Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made is a crucial component of a real estate agreement. It protects the interests of both the buyer and seller, ensuring that the buyer fulfills their payment obligations and preventing the seller from being left in a precarious position. However, it is crucial for all parties involved to thoroughly understand the terms of the contract to avoid any potential complications or default situations.