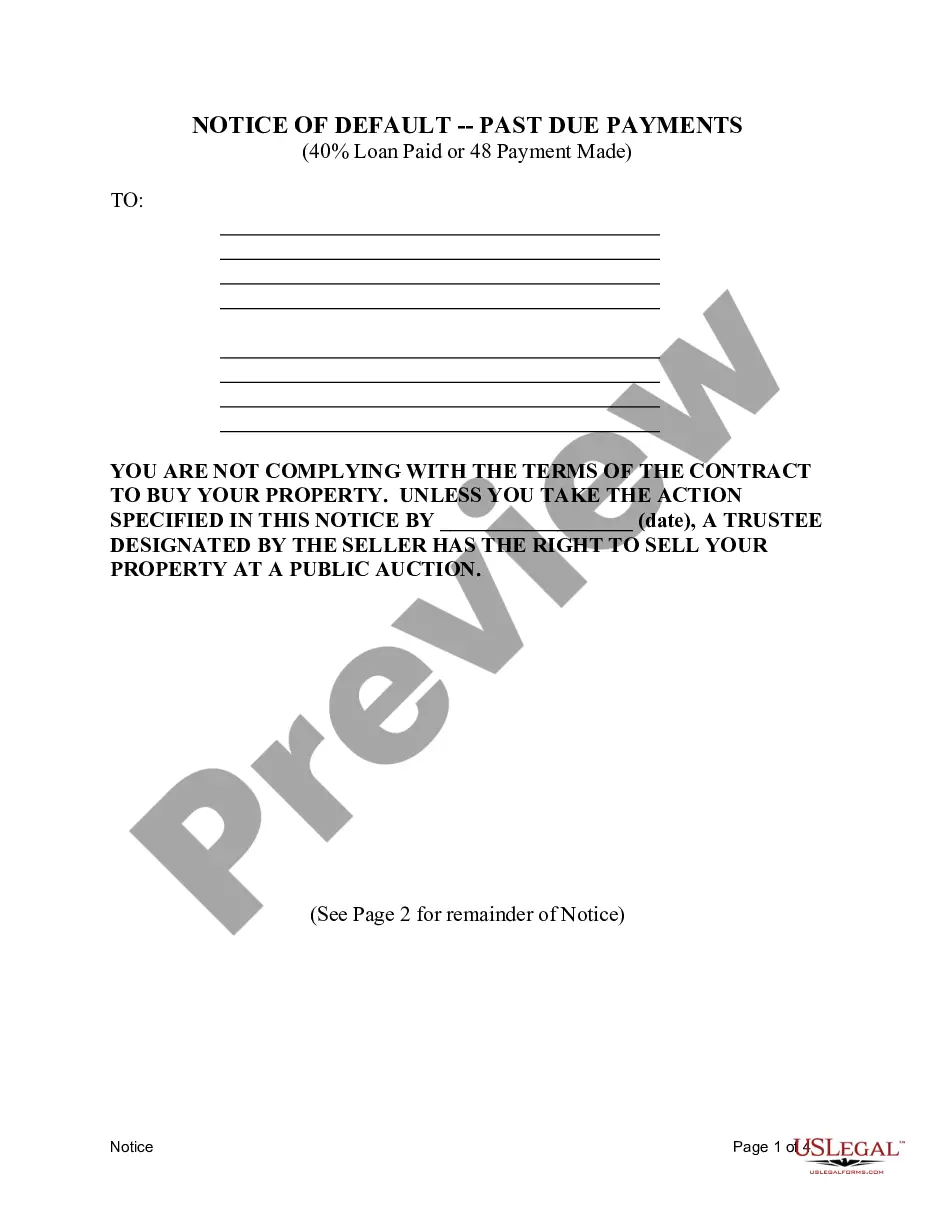

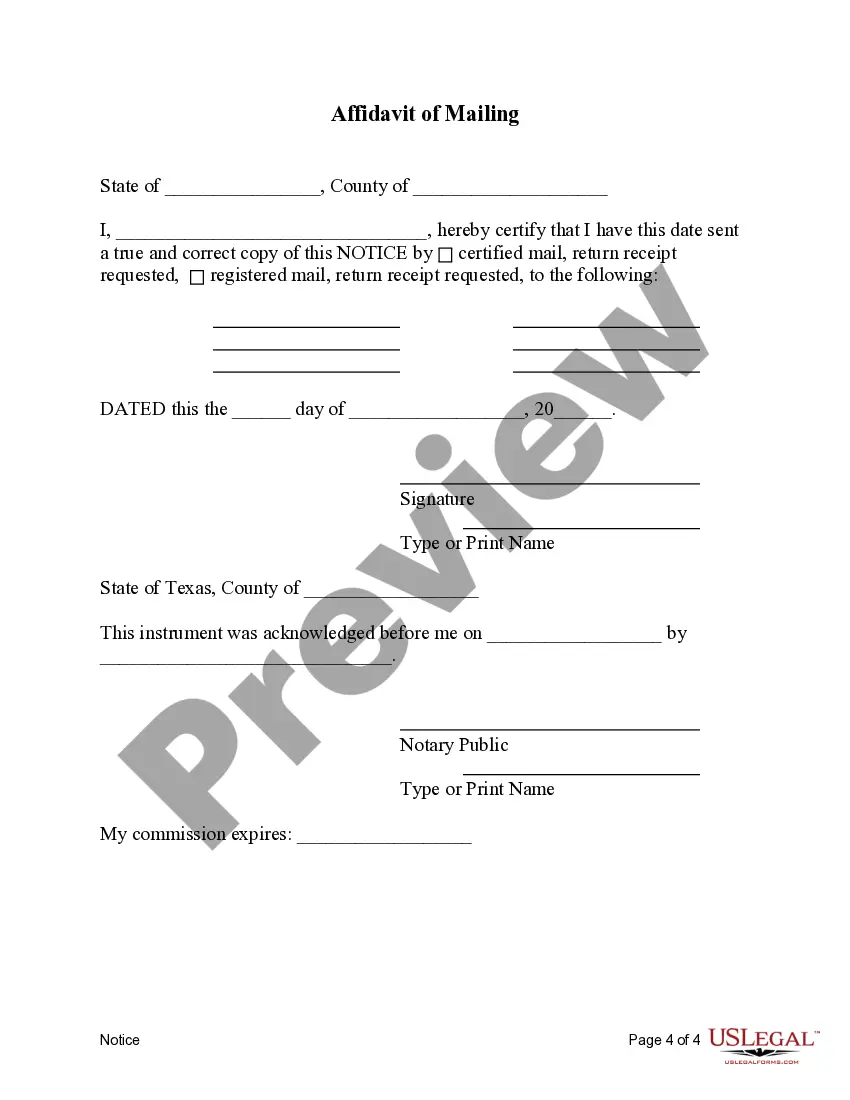

Texas Contract for Deed related forms. This is the Notice of Default form used when the Buyer has paid 40% of the principal of the contract or made a total of 48 or more payments. This form complies with the Texas law, and deal with matters related to Contract for Deed.

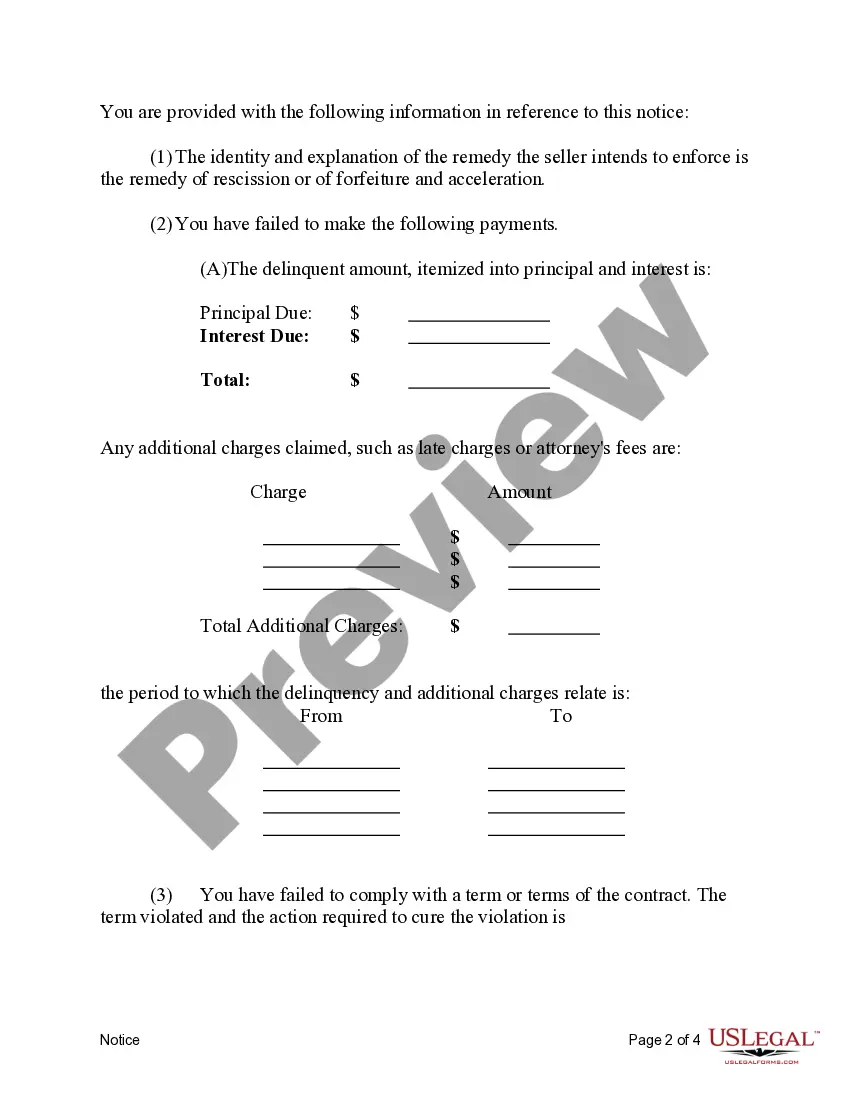

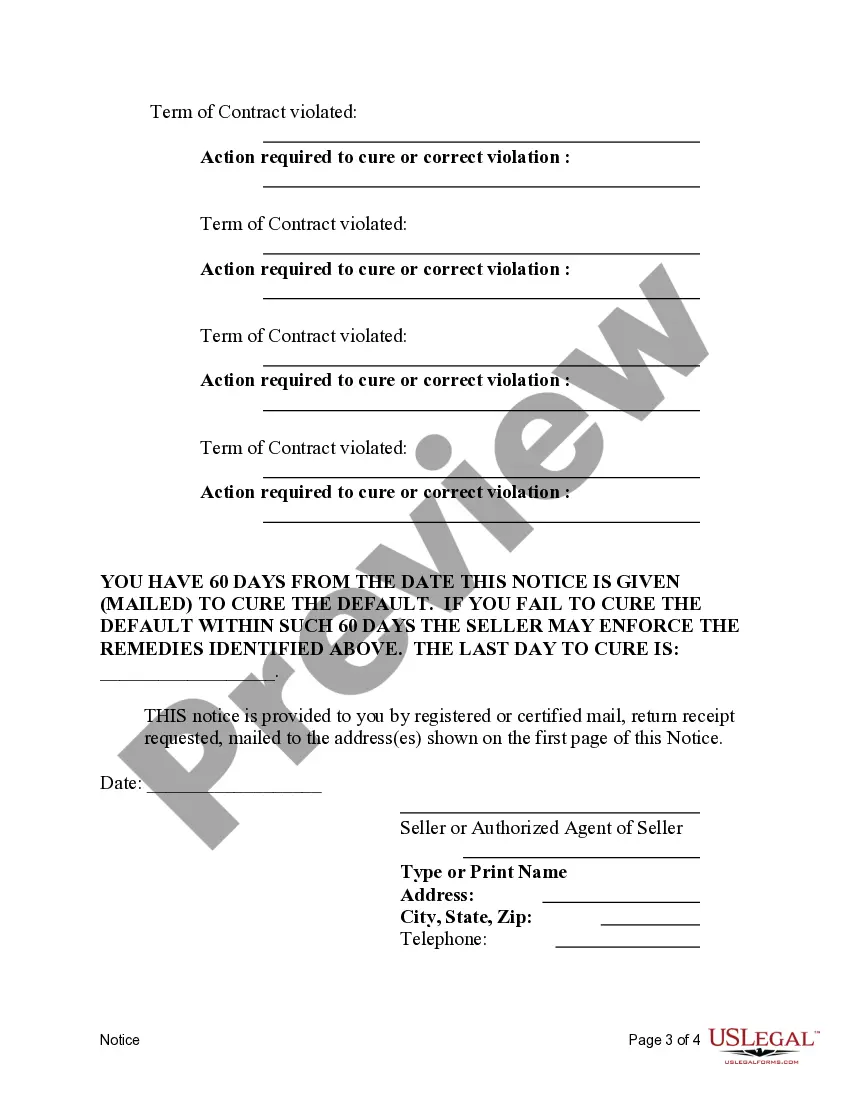

McKinney Texas Contract for Deed Notice of Default occurs when a buyer fails to meet specific terms outlined in the contract. This legal notice is issued when the buyer either fails to pay at least 40% of the loan amount or misses a total of 48 payments. A Contract for Deed, also known as a Land Contract or Installment Agreement, is a type of seller financing where the seller holds the title to the property until the buyer fulfills the agreed-upon payment terms. If the buyer in McKinney, Texas fails to pay at least 40% of the loan amount or misses a total of 48 payments, the seller can initiate the Notice of Default process. This critical event triggers various consequences and potential remedies available to the seller. The specifics of the default notice may vary depending on the terms outlined in the individual Contract for Deed. The Notice of Default typically notifies the buyer that their failure to meet the contractual obligations has resulted in default. It may outline the specific payment terms violated, including the amount owed or the number of missed payments. Additionally, it often informs the buyer of the potential consequences, such as the possibility of losing their equity in the property. McKinney Texas Contract for Deed Notice of Default may have different variations based on the specific conditions stated in the contract. These variations could include clauses regarding the payment timeline, interest rate, penalties for missed payments, and the rights of the buyers and sellers involved. It is crucial for both parties to carefully review and understand the terms outlined in the contract to avoid any misunderstandings or disputes. In summary, the McKinney Texas Contract for Deed Notice of Default is triggered when a buyer fails to meet the contractual obligations of paying at least 40% of the loan amount or missing a total of 48 payments. Each Contract for Deed may have different terms and conditions, so it's essential to review the specific contract to understand the implications of default.McKinney Texas Contract for Deed Notice of Default occurs when a buyer fails to meet specific terms outlined in the contract. This legal notice is issued when the buyer either fails to pay at least 40% of the loan amount or misses a total of 48 payments. A Contract for Deed, also known as a Land Contract or Installment Agreement, is a type of seller financing where the seller holds the title to the property until the buyer fulfills the agreed-upon payment terms. If the buyer in McKinney, Texas fails to pay at least 40% of the loan amount or misses a total of 48 payments, the seller can initiate the Notice of Default process. This critical event triggers various consequences and potential remedies available to the seller. The specifics of the default notice may vary depending on the terms outlined in the individual Contract for Deed. The Notice of Default typically notifies the buyer that their failure to meet the contractual obligations has resulted in default. It may outline the specific payment terms violated, including the amount owed or the number of missed payments. Additionally, it often informs the buyer of the potential consequences, such as the possibility of losing their equity in the property. McKinney Texas Contract for Deed Notice of Default may have different variations based on the specific conditions stated in the contract. These variations could include clauses regarding the payment timeline, interest rate, penalties for missed payments, and the rights of the buyers and sellers involved. It is crucial for both parties to carefully review and understand the terms outlined in the contract to avoid any misunderstandings or disputes. In summary, the McKinney Texas Contract for Deed Notice of Default is triggered when a buyer fails to meet the contractual obligations of paying at least 40% of the loan amount or missing a total of 48 payments. Each Contract for Deed may have different terms and conditions, so it's essential to review the specific contract to understand the implications of default.