Texas Contract for Deed related forms. This particular form is used to notify the Buyer of the particulars regarding a lien or encumbrance on the property and it is used prior to execution of the contract. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

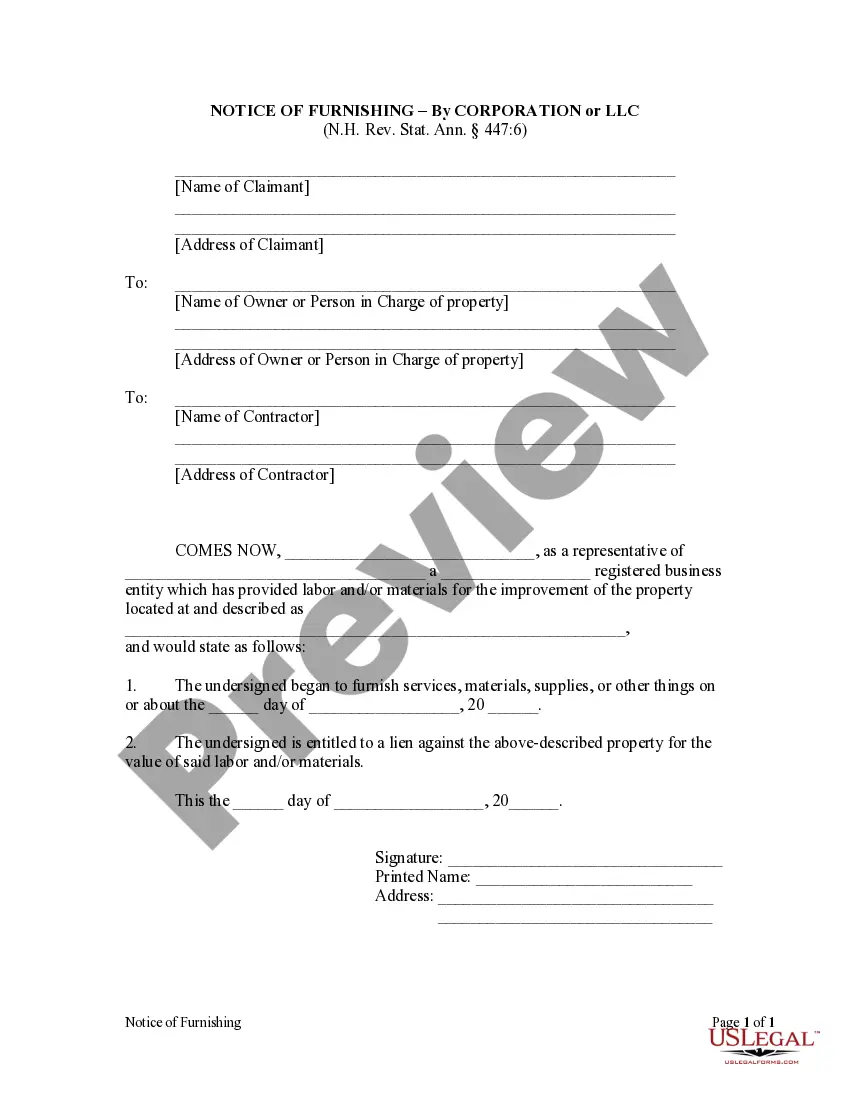

Title: Frisco Texas Notice Regarding Lien or Encumbrance: Explained in Detail Introduction: In Frisco, Texas, a Notice Regarding Lien or Encumbrance is a legal document that serves to notify prospective buyers and interested parties about the existence of a lien or encumbrance on a property. This important notice protects the rights and interests of all parties involved in real estate transactions. Let's delve deeper into the specifics and explore different types of Frisco Texas Notice Regarding Lien or Encumbrance. 1. Mechanic's Lien Notice: One type of Notice Regarding Lien or Encumbrance commonly encountered in Frisco, Texas, is the Mechanic's Lien Notice. This notice is typically filed by contractors, suppliers, or other individuals who have provided labor, materials, or services for property improvement or construction projects. The Mechanic's Lien Notice alerts interested parties that a contractor or supplier has a claim against the property until payment is received for the work completed. 2. Tax Lien Notice: When property owners fail to pay their property tax bills, the local government may place a tax lien on the property. A Tax Lien Notice is then recorded in the county records, indicating that the property has a tax debt. This type of Notice Regarding Lien or Encumbrance warns potential buyers that the property may be subject to tax foreclosure if the tax debt remains unpaid. 3. Judgment Lien Notice: In Frisco, Texas, a Judgment Lien Notice is issued if a creditor has successfully obtained a judgment against a debtor in a court of law. This notice informs interested parties that the property owner has an unpaid financial judgment and that the creditor has the right to enforce the judgment by placing a lien on the property in question. 4. Mortgage Lien Notice: A Mortgage Lien Notice is applied when a property owner obtains a mortgage loan from a lender to finance the purchase of the property. The notice is recorded with the county clerk or recorder's office, outlining the lender's right to secure the loan with the property as collateral. Prospective buyers are alerted that if the mortgage goes unpaid, the lender has the right to foreclose on the property. Conclusion: Understanding the various types of Frisco Texas Notice Regarding Lien or Encumbrance is crucial for both property owners and potential buyers. Whether it is a Mechanic's Lien Notice, Tax Lien Notice, Judgment Lien Notice, or Mortgage Lien Notice, each serves to protect the interests of parties involved in real estate transactions. Being aware of these notices helps ensure informed decision-making and safeguards against potential legal complications in Frisco, Texas.Title: Frisco Texas Notice Regarding Lien or Encumbrance: Explained in Detail Introduction: In Frisco, Texas, a Notice Regarding Lien or Encumbrance is a legal document that serves to notify prospective buyers and interested parties about the existence of a lien or encumbrance on a property. This important notice protects the rights and interests of all parties involved in real estate transactions. Let's delve deeper into the specifics and explore different types of Frisco Texas Notice Regarding Lien or Encumbrance. 1. Mechanic's Lien Notice: One type of Notice Regarding Lien or Encumbrance commonly encountered in Frisco, Texas, is the Mechanic's Lien Notice. This notice is typically filed by contractors, suppliers, or other individuals who have provided labor, materials, or services for property improvement or construction projects. The Mechanic's Lien Notice alerts interested parties that a contractor or supplier has a claim against the property until payment is received for the work completed. 2. Tax Lien Notice: When property owners fail to pay their property tax bills, the local government may place a tax lien on the property. A Tax Lien Notice is then recorded in the county records, indicating that the property has a tax debt. This type of Notice Regarding Lien or Encumbrance warns potential buyers that the property may be subject to tax foreclosure if the tax debt remains unpaid. 3. Judgment Lien Notice: In Frisco, Texas, a Judgment Lien Notice is issued if a creditor has successfully obtained a judgment against a debtor in a court of law. This notice informs interested parties that the property owner has an unpaid financial judgment and that the creditor has the right to enforce the judgment by placing a lien on the property in question. 4. Mortgage Lien Notice: A Mortgage Lien Notice is applied when a property owner obtains a mortgage loan from a lender to finance the purchase of the property. The notice is recorded with the county clerk or recorder's office, outlining the lender's right to secure the loan with the property as collateral. Prospective buyers are alerted that if the mortgage goes unpaid, the lender has the right to foreclose on the property. Conclusion: Understanding the various types of Frisco Texas Notice Regarding Lien or Encumbrance is crucial for both property owners and potential buyers. Whether it is a Mechanic's Lien Notice, Tax Lien Notice, Judgment Lien Notice, or Mortgage Lien Notice, each serves to protect the interests of parties involved in real estate transactions. Being aware of these notices helps ensure informed decision-making and safeguards against potential legal complications in Frisco, Texas.