Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

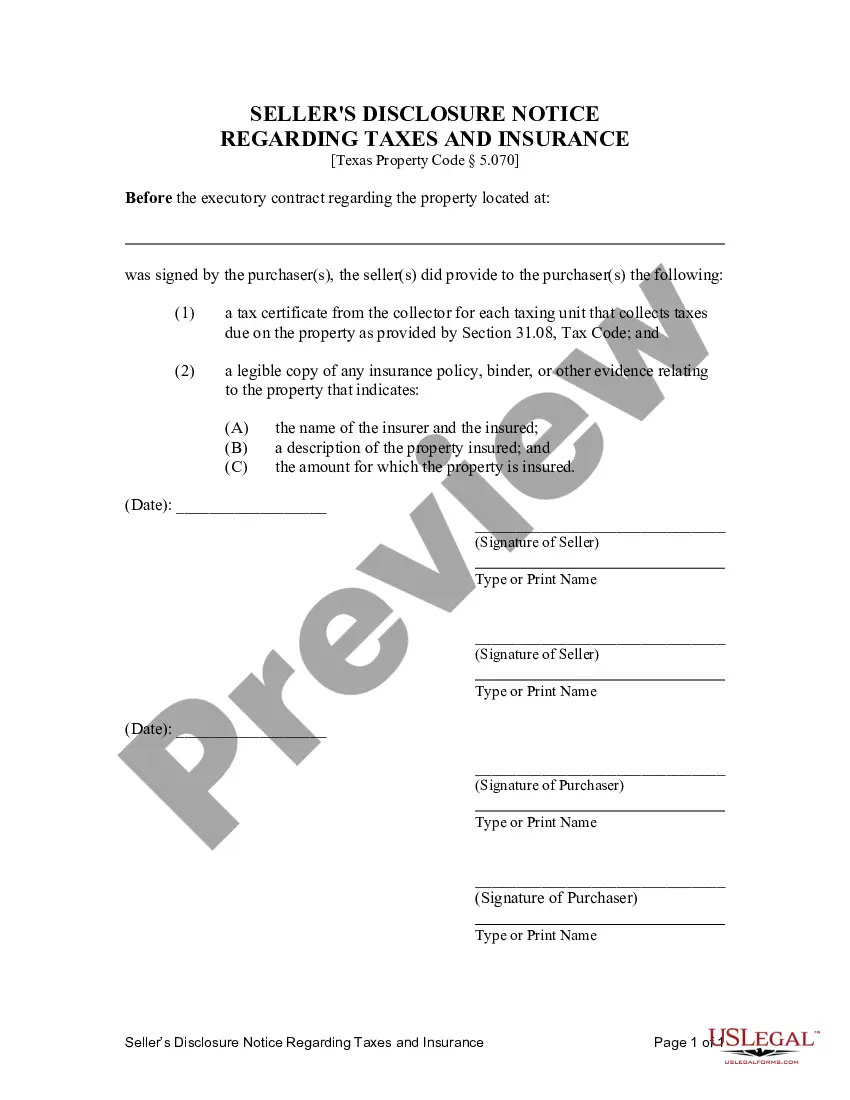

Arlington, Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed In Arlington, Texas, the Contract for Deed Seller's Disclosure of Tax Payment and Insurance plays a crucial role when entering into a residential land contract or agreement for deed. This comprehensive document ensures transparency between the seller and buyer, outlining important details regarding tax payments and insurance associated with the property. Different types of Arlington, Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed may include: 1. Residential Contract for Deed Seller's Disclosure: This type of disclosure specifically caters to residential properties where the seller provides detailed information on tax payment history and insurance coverage linked to the property. It aims to protect the buyer from any potential liabilities or undisclosed taxes. 2. Commercial Contract for Deed Seller's Disclosure: When it comes to commercial properties, Arlington, Texas offers a specific Contract for Deed Seller's Disclosure for commercial transactions. This document contains tailored information about tax payment status and insurance details related to the commercial property being sold. 3. Land Contract Seller's Disclosure: Land contracts involve the sale of undeveloped or vacant land. In this case, the Land Contract Seller's Disclosure focuses on tax obligations, delinquent tax status, and insurance coverage associated with the land being transferred. This disclosure ensures the buyer is aware of any existing tax liabilities or potential issues related to insurance. 4. Agreement for Deed Seller's Disclosure: The Agreement for Deed Seller's Disclosure is a comprehensive document that encompasses tax payment details and insurance requirements for residential or commercial properties being sold through an agreement for deed. It highlights the seller's responsibility to disclose accurate and up-to-date information related to taxes and insurance coverage. Regardless of the specific type, Arlington, Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is vital for both buyers and sellers involved in real estate transactions. It aims to protect the buyer from any unforeseen liabilities and ensures transparency between the parties. By thoroughly examining this disclosure, buyers can make informed decisions and sellers can fulfill their legal obligations, ultimately facilitating a smooth and secure property transfer process.Arlington, Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed In Arlington, Texas, the Contract for Deed Seller's Disclosure of Tax Payment and Insurance plays a crucial role when entering into a residential land contract or agreement for deed. This comprehensive document ensures transparency between the seller and buyer, outlining important details regarding tax payments and insurance associated with the property. Different types of Arlington, Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed may include: 1. Residential Contract for Deed Seller's Disclosure: This type of disclosure specifically caters to residential properties where the seller provides detailed information on tax payment history and insurance coverage linked to the property. It aims to protect the buyer from any potential liabilities or undisclosed taxes. 2. Commercial Contract for Deed Seller's Disclosure: When it comes to commercial properties, Arlington, Texas offers a specific Contract for Deed Seller's Disclosure for commercial transactions. This document contains tailored information about tax payment status and insurance details related to the commercial property being sold. 3. Land Contract Seller's Disclosure: Land contracts involve the sale of undeveloped or vacant land. In this case, the Land Contract Seller's Disclosure focuses on tax obligations, delinquent tax status, and insurance coverage associated with the land being transferred. This disclosure ensures the buyer is aware of any existing tax liabilities or potential issues related to insurance. 4. Agreement for Deed Seller's Disclosure: The Agreement for Deed Seller's Disclosure is a comprehensive document that encompasses tax payment details and insurance requirements for residential or commercial properties being sold through an agreement for deed. It highlights the seller's responsibility to disclose accurate and up-to-date information related to taxes and insurance coverage. Regardless of the specific type, Arlington, Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is vital for both buyers and sellers involved in real estate transactions. It aims to protect the buyer from any unforeseen liabilities and ensures transparency between the parties. By thoroughly examining this disclosure, buyers can make informed decisions and sellers can fulfill their legal obligations, ultimately facilitating a smooth and secure property transfer process.