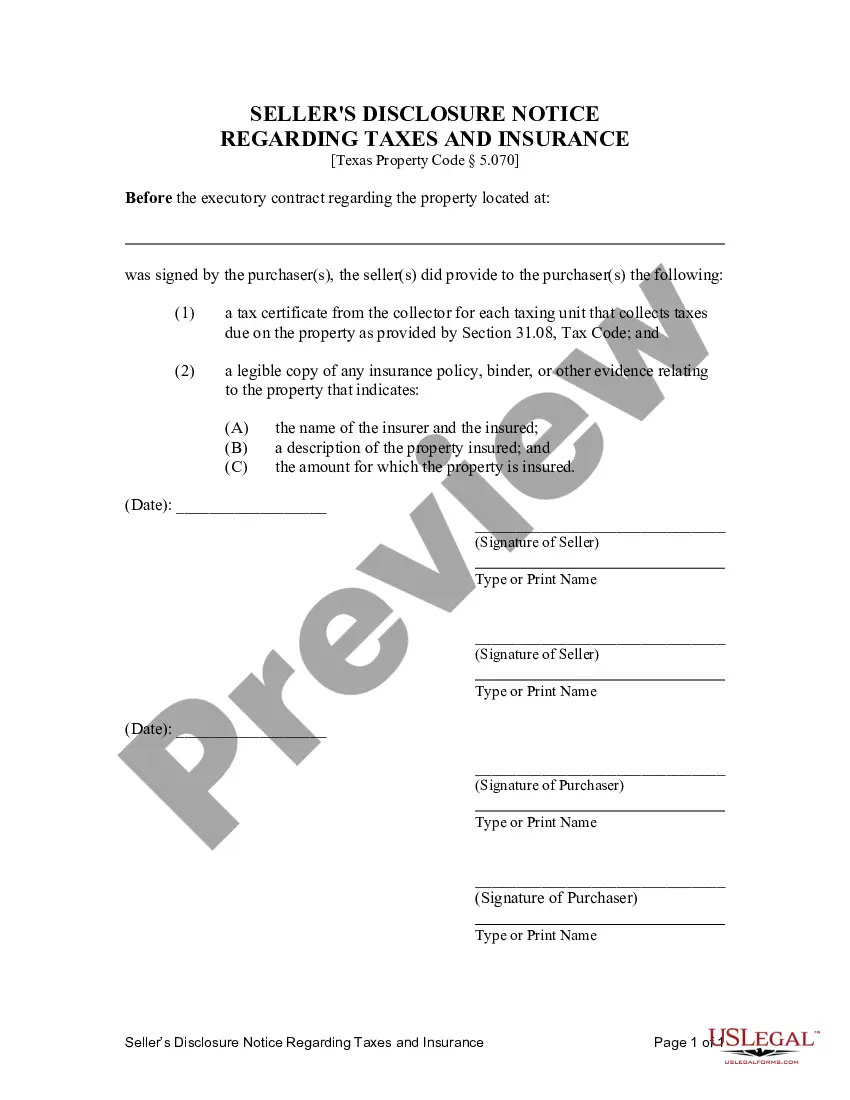

Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

The Bexar Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legally binding document that outlines the responsibilities and obligations of both the seller and the buyer in a real estate transaction. This agreement is specifically designed for properties located in Bexar County, Texas. This disclosure serves as a comprehensive record of the seller's obligations to pay property taxes and maintain insurance coverage on the property until the completion of the land contract or the agreement for deed. It protects both parties by ensuring transparency and clarity regarding these crucial financial aspects of the transaction. In Bexar County, there may be different types of contracts for deed seller's disclosures related to tax payment and insurance. These variations may include specific provisions tailored to the type of property or additional clauses to address unique circumstances. Some common variations of the Bexar Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed may include: 1. Residential Contract for Deed: This specific type of contract pertains to residential properties. It outlines the seller's disclosure regarding tax payment and insurance obligations on residential real estate, such as houses, townhouses, or condominiums. 2. Commercial Contract for Deed: For commercial properties, this type of contract is employed to detail the seller's disclosure of tax payment and insurance obligations related to commercial real estate, such as office buildings, retail spaces, or warehouses. 3. Vacant Land Contract for Deed: This type of contract is utilized for vacant land transactions. It outlines the seller's disclosure regarding tax payment and insurance obligations specifically for undeveloped land. 4. Mixed-Use Property Contract for Deed: In cases where the property serves both residential and commercial purposes, a mixed-use property contract for deed can be utilized. It covers the seller's disclosure of tax payment and insurance obligations for properties that combine residential and commercial elements. All these variations of the Bexar Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed share a common goal of ensuring transparency and protecting the rights and interests of both the seller and the buyer in a real estate transaction.The Bexar Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legally binding document that outlines the responsibilities and obligations of both the seller and the buyer in a real estate transaction. This agreement is specifically designed for properties located in Bexar County, Texas. This disclosure serves as a comprehensive record of the seller's obligations to pay property taxes and maintain insurance coverage on the property until the completion of the land contract or the agreement for deed. It protects both parties by ensuring transparency and clarity regarding these crucial financial aspects of the transaction. In Bexar County, there may be different types of contracts for deed seller's disclosures related to tax payment and insurance. These variations may include specific provisions tailored to the type of property or additional clauses to address unique circumstances. Some common variations of the Bexar Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed may include: 1. Residential Contract for Deed: This specific type of contract pertains to residential properties. It outlines the seller's disclosure regarding tax payment and insurance obligations on residential real estate, such as houses, townhouses, or condominiums. 2. Commercial Contract for Deed: For commercial properties, this type of contract is employed to detail the seller's disclosure of tax payment and insurance obligations related to commercial real estate, such as office buildings, retail spaces, or warehouses. 3. Vacant Land Contract for Deed: This type of contract is utilized for vacant land transactions. It outlines the seller's disclosure regarding tax payment and insurance obligations specifically for undeveloped land. 4. Mixed-Use Property Contract for Deed: In cases where the property serves both residential and commercial purposes, a mixed-use property contract for deed can be utilized. It covers the seller's disclosure of tax payment and insurance obligations for properties that combine residential and commercial elements. All these variations of the Bexar Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed share a common goal of ensuring transparency and protecting the rights and interests of both the seller and the buyer in a real estate transaction.