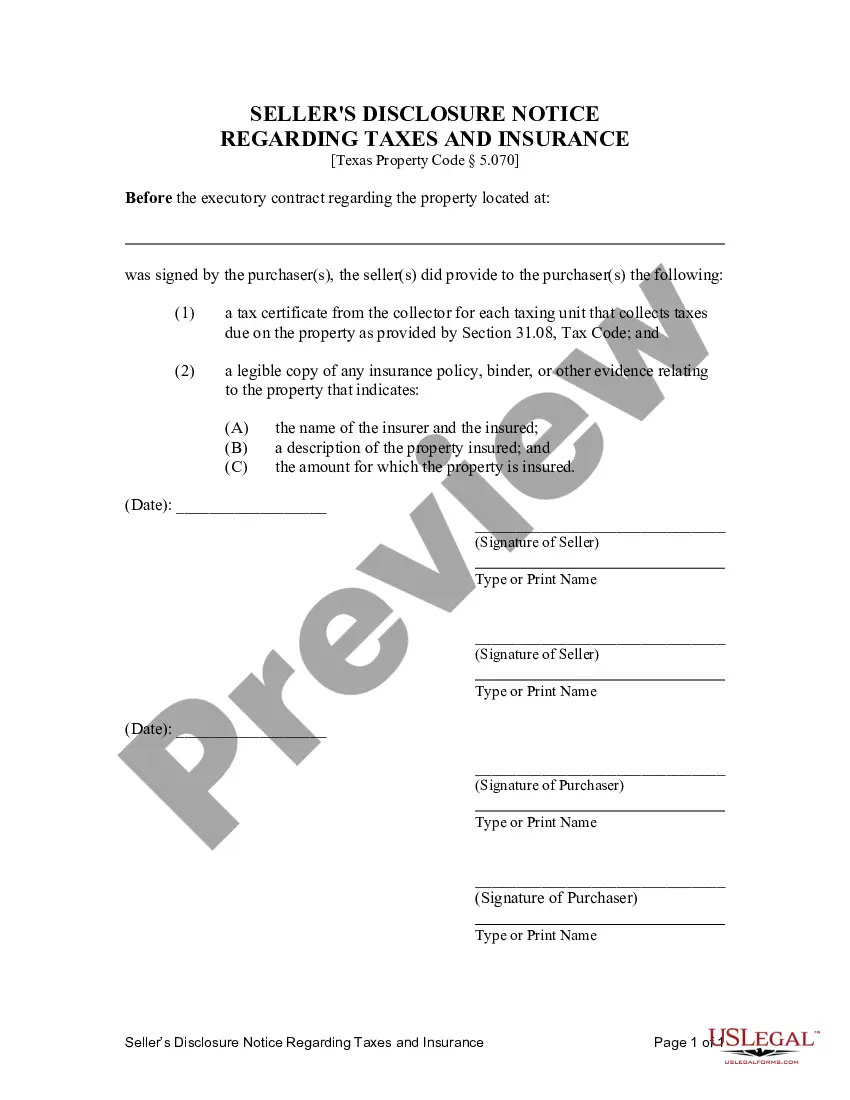

Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

The Houston Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is a legally binding document that is utilized in real estate transactions involving residential properties. This disclosure is specifically designed for agreements such as Land Contracts, Agreement for Deed, and other similar arrangements. This contract serves as a comprehensive and detailed disclosure statement, focusing on crucial aspects like tax payments and insurance. It is required by the state of Texas to ensure transparency and protection of both the buyer and seller in such transactions. The Houston Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance contains relevant keywords that help in categorizing and identifying different variations or types of contracts within this particular genre. Some of the different types that can be named are: 1. Residential Contract for Deed: — This type specifically pertains to the purchase or sale of residential properties, providing disclosures related to tax payments and insurance obligations. 2. Commercial Contract for Deed: — This variant is intended for commercial real estate transactions, where tax payment and insurance obligations might differ from residential properties. The disclosure outlined in this agreement would address these specific considerations. 3. Vacant Land Contract for Deed: — This type of agreement focuses on the purchase or sale of vacant land parcels. The disclosure included in this contract would be tailored to the unique tax payment and insurance requirements associated with undeveloped land. Each of these variations of the Houston Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance ensures that all parties involved in the transaction are aware of their responsibilities and obligations concerning tax payments and insurance coverage. By explicitly addressing these matters, it provides clarity, minimizes potential disputes, and protects the interests of both the buyer and seller.The Houston Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is a legally binding document that is utilized in real estate transactions involving residential properties. This disclosure is specifically designed for agreements such as Land Contracts, Agreement for Deed, and other similar arrangements. This contract serves as a comprehensive and detailed disclosure statement, focusing on crucial aspects like tax payments and insurance. It is required by the state of Texas to ensure transparency and protection of both the buyer and seller in such transactions. The Houston Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance contains relevant keywords that help in categorizing and identifying different variations or types of contracts within this particular genre. Some of the different types that can be named are: 1. Residential Contract for Deed: — This type specifically pertains to the purchase or sale of residential properties, providing disclosures related to tax payments and insurance obligations. 2. Commercial Contract for Deed: — This variant is intended for commercial real estate transactions, where tax payment and insurance obligations might differ from residential properties. The disclosure outlined in this agreement would address these specific considerations. 3. Vacant Land Contract for Deed: — This type of agreement focuses on the purchase or sale of vacant land parcels. The disclosure included in this contract would be tailored to the unique tax payment and insurance requirements associated with undeveloped land. Each of these variations of the Houston Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance ensures that all parties involved in the transaction are aware of their responsibilities and obligations concerning tax payments and insurance coverage. By explicitly addressing these matters, it provides clarity, minimizes potential disputes, and protects the interests of both the buyer and seller.