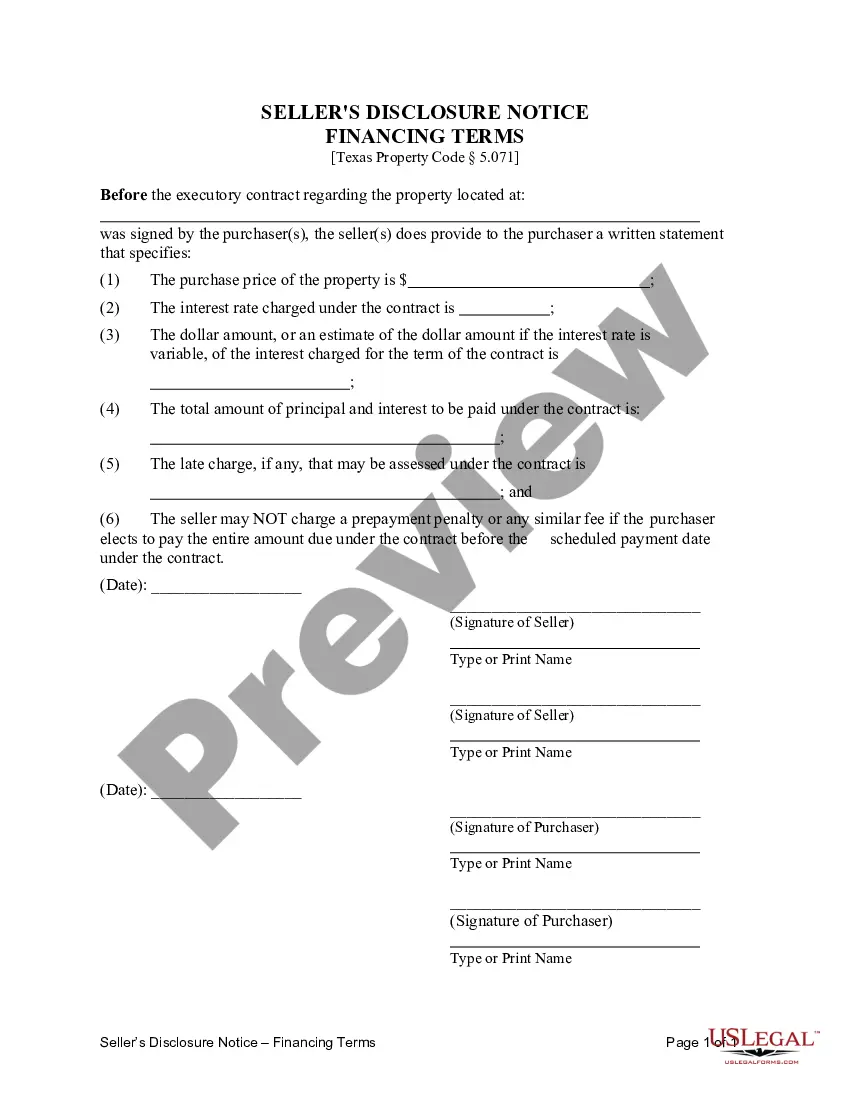

This Texas Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Brownsville Texas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed (commonly referred to as Land Contract) is a crucial document that outlines the specific financing terms and conditions associated with the purchase of a residential property in Brownsville, Texas. This comprehensive disclosure serves to protect both the seller and buyer by ensuring transparency and clarity regarding the terms of the financing agreement. Keyword: Brownsville Texas Seller's Disclosure, Financing Terms, Residential Property, Contract or Agreement for Deed, Land Contract. The Brownsville Texas Seller's Disclosure of Financing Terms for Residential Property focuses on the following key aspects: 1. Purchase Price: The disclosure outlines the agreed-upon purchase price of the property, which is the total amount the buyer is required to pay over the specified period. 2. Down Payment: This section details the required down payment amount or percentage, which is typically a portion of the total purchase price paid upfront by the buyer. The disclosure specifies whether this amount is refundable or non-refundable. 3. Interest Rate: The disclosure highlights the interest rate applicable to the financing agreement. This rate represents the amount the buyer will pay in addition to the principal amount borrowed, expressed as an annual percentage. 4. Principal Balance: This section outlines the remaining balance of the purchase price after deducting the down payment. It indicates the total amount the buyer will need to repay over the duration of the agreement. 5. Monthly Payments: The disclosure specifies the amount due by the buyer each month. It breaks down the payment into principal and interest portions, allowing the buyer to understand the allocation of their monthly installment. 6. Late Payment Policy: This section explains the consequences and penalties associated with late payments. It may include information on late fees, potential legal actions, or renegotiation options. 7. Length of Agreement: The disclosure specifies the duration of the financing agreement, meaning the length of time the buyer has to fully repay the outstanding balance. The agreement should clearly state the start and end dates of the contract. 8. Ownership Transfer: This section outlines the conditions under which the legal ownership of the property transfers from the seller to the buyer. It may include provisions for a clear title, potential liens, or encumbrances affecting the property. It is important to note that while the above sections are typically included in the Brownsville Texas Seller's Disclosure of Financing Terms for Residential Property, additional sections or specific terms may vary, depending on factors such as the property's characteristics, the nature of the agreement, and any additional negotiated terms. Furthermore, it is essential for both the seller and the buyer to carefully review and understand all aspects of this disclosure before signing the Contract or Agreement for Deed, also known as a Land Contract, to ensure a fair and transparent financing arrangement.The Brownsville Texas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed (commonly referred to as Land Contract) is a crucial document that outlines the specific financing terms and conditions associated with the purchase of a residential property in Brownsville, Texas. This comprehensive disclosure serves to protect both the seller and buyer by ensuring transparency and clarity regarding the terms of the financing agreement. Keyword: Brownsville Texas Seller's Disclosure, Financing Terms, Residential Property, Contract or Agreement for Deed, Land Contract. The Brownsville Texas Seller's Disclosure of Financing Terms for Residential Property focuses on the following key aspects: 1. Purchase Price: The disclosure outlines the agreed-upon purchase price of the property, which is the total amount the buyer is required to pay over the specified period. 2. Down Payment: This section details the required down payment amount or percentage, which is typically a portion of the total purchase price paid upfront by the buyer. The disclosure specifies whether this amount is refundable or non-refundable. 3. Interest Rate: The disclosure highlights the interest rate applicable to the financing agreement. This rate represents the amount the buyer will pay in addition to the principal amount borrowed, expressed as an annual percentage. 4. Principal Balance: This section outlines the remaining balance of the purchase price after deducting the down payment. It indicates the total amount the buyer will need to repay over the duration of the agreement. 5. Monthly Payments: The disclosure specifies the amount due by the buyer each month. It breaks down the payment into principal and interest portions, allowing the buyer to understand the allocation of their monthly installment. 6. Late Payment Policy: This section explains the consequences and penalties associated with late payments. It may include information on late fees, potential legal actions, or renegotiation options. 7. Length of Agreement: The disclosure specifies the duration of the financing agreement, meaning the length of time the buyer has to fully repay the outstanding balance. The agreement should clearly state the start and end dates of the contract. 8. Ownership Transfer: This section outlines the conditions under which the legal ownership of the property transfers from the seller to the buyer. It may include provisions for a clear title, potential liens, or encumbrances affecting the property. It is important to note that while the above sections are typically included in the Brownsville Texas Seller's Disclosure of Financing Terms for Residential Property, additional sections or specific terms may vary, depending on factors such as the property's characteristics, the nature of the agreement, and any additional negotiated terms. Furthermore, it is essential for both the seller and the buyer to carefully review and understand all aspects of this disclosure before signing the Contract or Agreement for Deed, also known as a Land Contract, to ensure a fair and transparent financing arrangement.