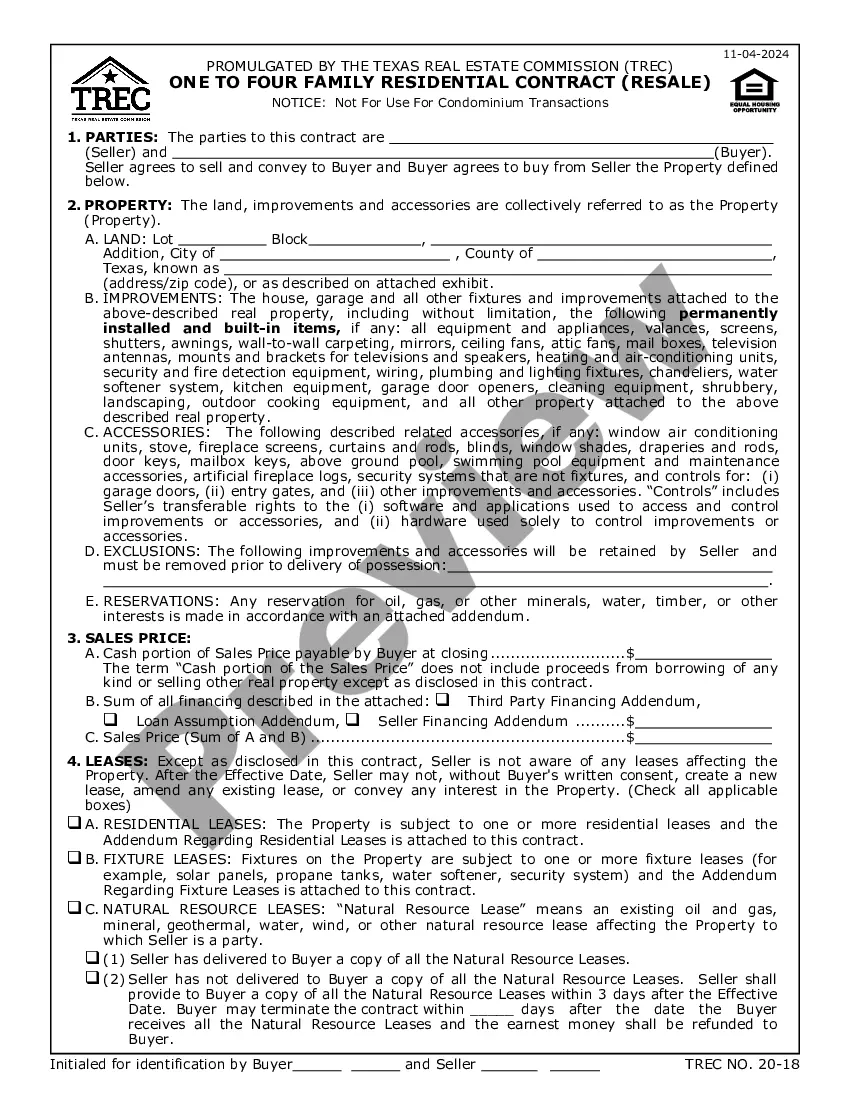

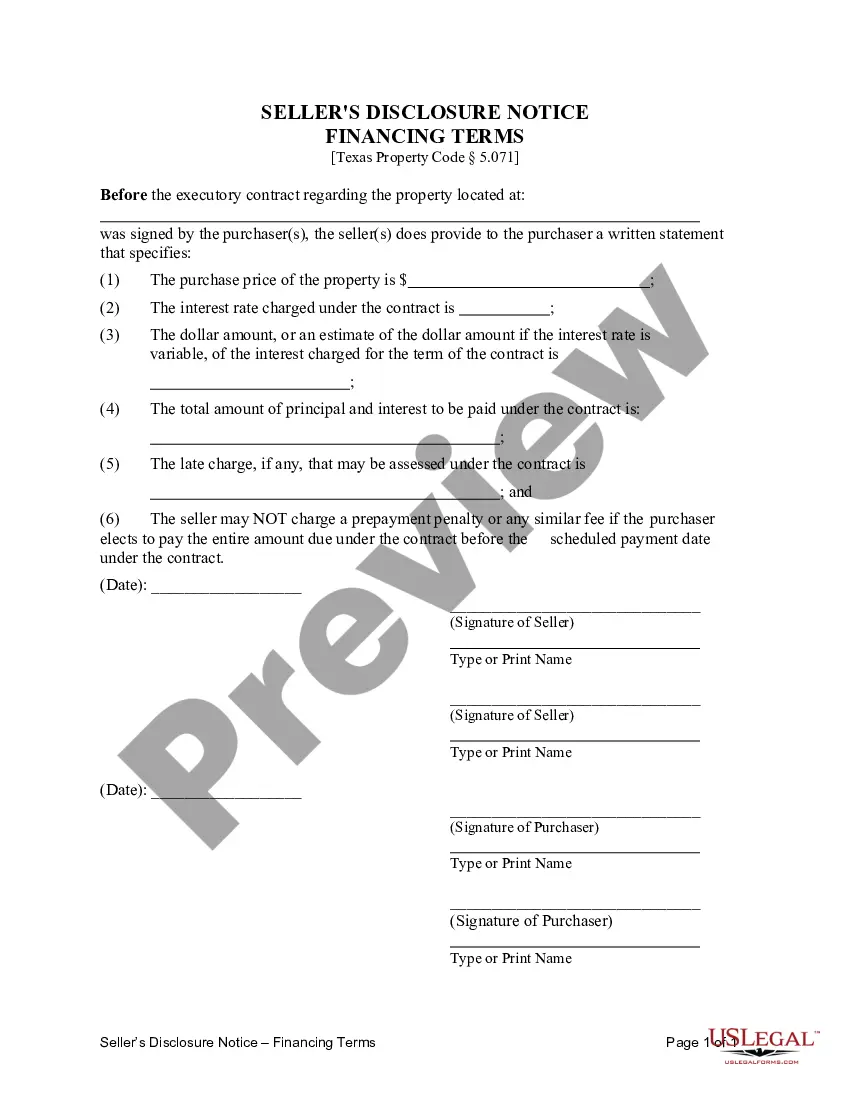

This Texas Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

A Dallas Texas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an essential document that outlines the specific terms and conditions of the financing arrangement between a seller and a buyer in a real estate transaction. This disclosure plays a crucial role in informing the buyer about the financing details and protecting their interests. The Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed offers transparency and clarity regarding the financing terms negotiated between the parties involved. It ensures that both the buyer and seller are aware of the financial obligations and responsibilities associated with the property purchase. Typically, this disclosure includes various key elements that must be clearly defined, such as: 1. Purchase price: The document should specify the agreed-upon purchase price for the property. This is the total amount that the buyer is obligated to pay to acquire ownership rights. 2. Down payment: The disclosure should outline the amount of the down payment required by the seller. This is the initial sum the buyer must provide when entering into the contract or agreement. 3. Installment payments: If the financing arrangement involves installment payments, the disclosure should detail the amount, frequency, and due dates of these payments. It may specify whether these payments cover both the principal amount and any interest charges. 4. Interest rate: If the seller charges interest on the outstanding balance, the document should clearly state the agreed-upon interest rate. It helps the buyer understand the additional cost associated with the land contract financing. 5. Duration of the contract: The disclosure should specify the duration of the land contract, including the start and end dates. Additionally, it may outline any provisions for early termination or extension options. 6. Title and ownership: The document should clarify the transfer of ownership rights, ensuring that the property title is transferred to the buyer once the contractual obligations have been met. It is important to note that sellers may offer different types of financing terms for residential properties in connection with a contract or agreement for deed. Some variations include: 1. Fixed-rate land contract: This type of financing term involves a fixed interest rate throughout the contract's duration. It offers stability to both parties, as the interest rate remains constant regardless of market fluctuations. 2. Adjustable-rate land contract: Unlike a fixed-rate contract, an adjustable-rate contract involves an interest rate that can fluctuate over time. The rate may change periodically based on predetermined factors, such as an index or market conditions. 3. Balloon payment land contract: In some cases, sellers may structure the financing terms with lower monthly payments but include a large final payment, known as a balloon payment, at the end of the contract term. This type of arrangement allows buyers to manage smaller monthly payments but requires careful budgeting for the final lump-sum payment. In conclusion, a Dallas Texas Seller's Disclosure of Financing Terms for Residential Property serves as a vital tool in ensuring transparency and clarity between buyers and sellers entering into a land contract or agreement for deed. By including essential details such as purchase price, down payment, installment payments, interest rate, contract duration, and title transfer, this disclosure protects the interests of both parties involved and helps facilitate a smooth and well-informed real estate transaction.

A Dallas Texas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, also known as a Land Contract, is an essential document that outlines the specific terms and conditions of the financing arrangement between a seller and a buyer in a real estate transaction. This disclosure plays a crucial role in informing the buyer about the financing details and protecting their interests. The Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed offers transparency and clarity regarding the financing terms negotiated between the parties involved. It ensures that both the buyer and seller are aware of the financial obligations and responsibilities associated with the property purchase. Typically, this disclosure includes various key elements that must be clearly defined, such as: 1. Purchase price: The document should specify the agreed-upon purchase price for the property. This is the total amount that the buyer is obligated to pay to acquire ownership rights. 2. Down payment: The disclosure should outline the amount of the down payment required by the seller. This is the initial sum the buyer must provide when entering into the contract or agreement. 3. Installment payments: If the financing arrangement involves installment payments, the disclosure should detail the amount, frequency, and due dates of these payments. It may specify whether these payments cover both the principal amount and any interest charges. 4. Interest rate: If the seller charges interest on the outstanding balance, the document should clearly state the agreed-upon interest rate. It helps the buyer understand the additional cost associated with the land contract financing. 5. Duration of the contract: The disclosure should specify the duration of the land contract, including the start and end dates. Additionally, it may outline any provisions for early termination or extension options. 6. Title and ownership: The document should clarify the transfer of ownership rights, ensuring that the property title is transferred to the buyer once the contractual obligations have been met. It is important to note that sellers may offer different types of financing terms for residential properties in connection with a contract or agreement for deed. Some variations include: 1. Fixed-rate land contract: This type of financing term involves a fixed interest rate throughout the contract's duration. It offers stability to both parties, as the interest rate remains constant regardless of market fluctuations. 2. Adjustable-rate land contract: Unlike a fixed-rate contract, an adjustable-rate contract involves an interest rate that can fluctuate over time. The rate may change periodically based on predetermined factors, such as an index or market conditions. 3. Balloon payment land contract: In some cases, sellers may structure the financing terms with lower monthly payments but include a large final payment, known as a balloon payment, at the end of the contract term. This type of arrangement allows buyers to manage smaller monthly payments but requires careful budgeting for the final lump-sum payment. In conclusion, a Dallas Texas Seller's Disclosure of Financing Terms for Residential Property serves as a vital tool in ensuring transparency and clarity between buyers and sellers entering into a land contract or agreement for deed. By including essential details such as purchase price, down payment, installment payments, interest rate, contract duration, and title transfer, this disclosure protects the interests of both parties involved and helps facilitate a smooth and well-informed real estate transaction.