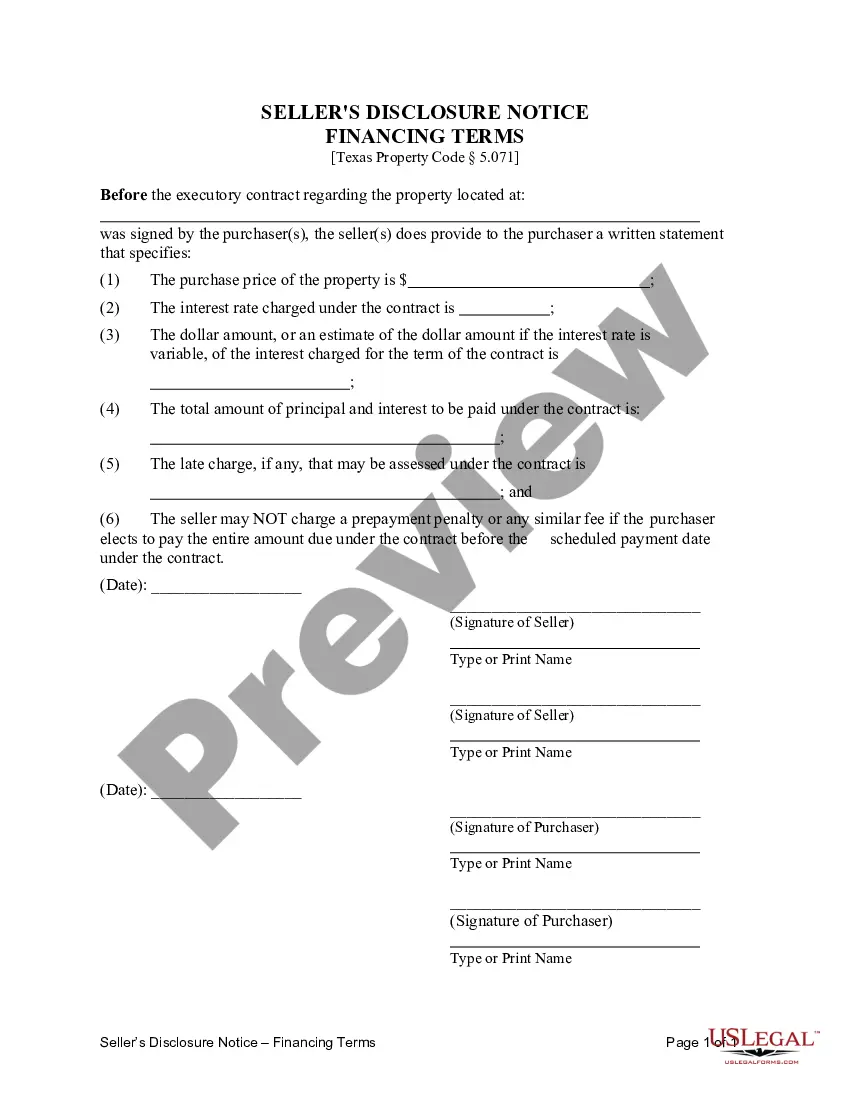

This Texas Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

Mesquite Texas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract: In Mesquite, Texas, when entering into a Contract or Agreement for Deed, also known as a Land Contract, it is important for sellers to provide a detailed disclosure of the financing terms that will be applied to the residential property transaction. This seller's disclosure aims to ensure transparency and clarity between the seller and the buyer regarding the financial aspects of the agreement. The Mesquite Texas Seller's Disclosure of Financing Terms generally includes the following information: 1. Purchase Price: The disclosure will outline the agreed-upon purchase price of the residential property. This amount represents the total cost the buyer will pay to own the property over time. 2. Down Payment: The seller's disclosure will specify the required down payment, which is the initial amount paid by the buyer to secure the agreement. This percentage or fixed amount will be subtracted from the purchase price to determine the amount financed. 3. Interest Rate: The seller will disclose the interest rate applicable to the loan or financing provided by the seller. This interest rate determines the cost the buyer will pay for borrowing the funds. 4. Financing Term: The disclosure will state the duration of the financing term, which defines the agreed-upon timeline for the buyer to repay the seller. It can vary from several months to several years, depending on the agreement. 5. Payment Schedule: This section outlines the frequency and amount of payments the buyer is obligated to make. It may indicate monthly, quarterly, or annual payment intervals and specify the due date. 6. Late Payment Penalties: The disclosure might mention any late payment penalties assessed for missed or delayed payments. These penalties commonly involve additional fees or increased interest rates. 7. Default Provisions: In case of default, the seller's disclosure may outline the rights and remedies available to the seller. This can include potential actions such as reclaiming the property, terminating the agreement, or pursuing legal recourse. It is important to note that each seller may have their specific terms and conditions outlined in the disclosure, so it is crucial for potential buyers to review the document carefully before entering into any agreement. There may be different variations or specific types of Mesquite Texas Seller's Disclosures of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, such as: 1. Fixed-Rate Land Contract Disclosure: This type of disclosure specifies a fixed interest rate for the financing, ensuring that the buyer's payments remain consistent throughout the agreed term. 2. Adjustable-Rate Land Contract Disclosure: This type of disclosure outlines an adjustable interest rate, where the rate may change at certain intervals or based on predetermined factors. This can result in varying payment amounts over time. 3. Balloon Payment Land Contract Disclosure: In a balloon payment land contract, the disclosure will state that a substantial payment is due at the end of the financing term. This payment is typically larger than the regular scheduled payments made throughout the term. By providing a comprehensive Mesquite Texas Seller's Disclosure of Financing Terms for Residential Property, sellers can establish trust, prevent misunderstandings, and ensure a smoother transaction process with buyers interested in a Contract or Agreement for Deed.Mesquite Texas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract: In Mesquite, Texas, when entering into a Contract or Agreement for Deed, also known as a Land Contract, it is important for sellers to provide a detailed disclosure of the financing terms that will be applied to the residential property transaction. This seller's disclosure aims to ensure transparency and clarity between the seller and the buyer regarding the financial aspects of the agreement. The Mesquite Texas Seller's Disclosure of Financing Terms generally includes the following information: 1. Purchase Price: The disclosure will outline the agreed-upon purchase price of the residential property. This amount represents the total cost the buyer will pay to own the property over time. 2. Down Payment: The seller's disclosure will specify the required down payment, which is the initial amount paid by the buyer to secure the agreement. This percentage or fixed amount will be subtracted from the purchase price to determine the amount financed. 3. Interest Rate: The seller will disclose the interest rate applicable to the loan or financing provided by the seller. This interest rate determines the cost the buyer will pay for borrowing the funds. 4. Financing Term: The disclosure will state the duration of the financing term, which defines the agreed-upon timeline for the buyer to repay the seller. It can vary from several months to several years, depending on the agreement. 5. Payment Schedule: This section outlines the frequency and amount of payments the buyer is obligated to make. It may indicate monthly, quarterly, or annual payment intervals and specify the due date. 6. Late Payment Penalties: The disclosure might mention any late payment penalties assessed for missed or delayed payments. These penalties commonly involve additional fees or increased interest rates. 7. Default Provisions: In case of default, the seller's disclosure may outline the rights and remedies available to the seller. This can include potential actions such as reclaiming the property, terminating the agreement, or pursuing legal recourse. It is important to note that each seller may have their specific terms and conditions outlined in the disclosure, so it is crucial for potential buyers to review the document carefully before entering into any agreement. There may be different variations or specific types of Mesquite Texas Seller's Disclosures of Financing Terms for Residential Property in connection with Contract or Agreement for Deed, such as: 1. Fixed-Rate Land Contract Disclosure: This type of disclosure specifies a fixed interest rate for the financing, ensuring that the buyer's payments remain consistent throughout the agreed term. 2. Adjustable-Rate Land Contract Disclosure: This type of disclosure outlines an adjustable interest rate, where the rate may change at certain intervals or based on predetermined factors. This can result in varying payment amounts over time. 3. Balloon Payment Land Contract Disclosure: In a balloon payment land contract, the disclosure will state that a substantial payment is due at the end of the financing term. This payment is typically larger than the regular scheduled payments made throughout the term. By providing a comprehensive Mesquite Texas Seller's Disclosure of Financing Terms for Residential Property, sellers can establish trust, prevent misunderstandings, and ensure a smoother transaction process with buyers interested in a Contract or Agreement for Deed.