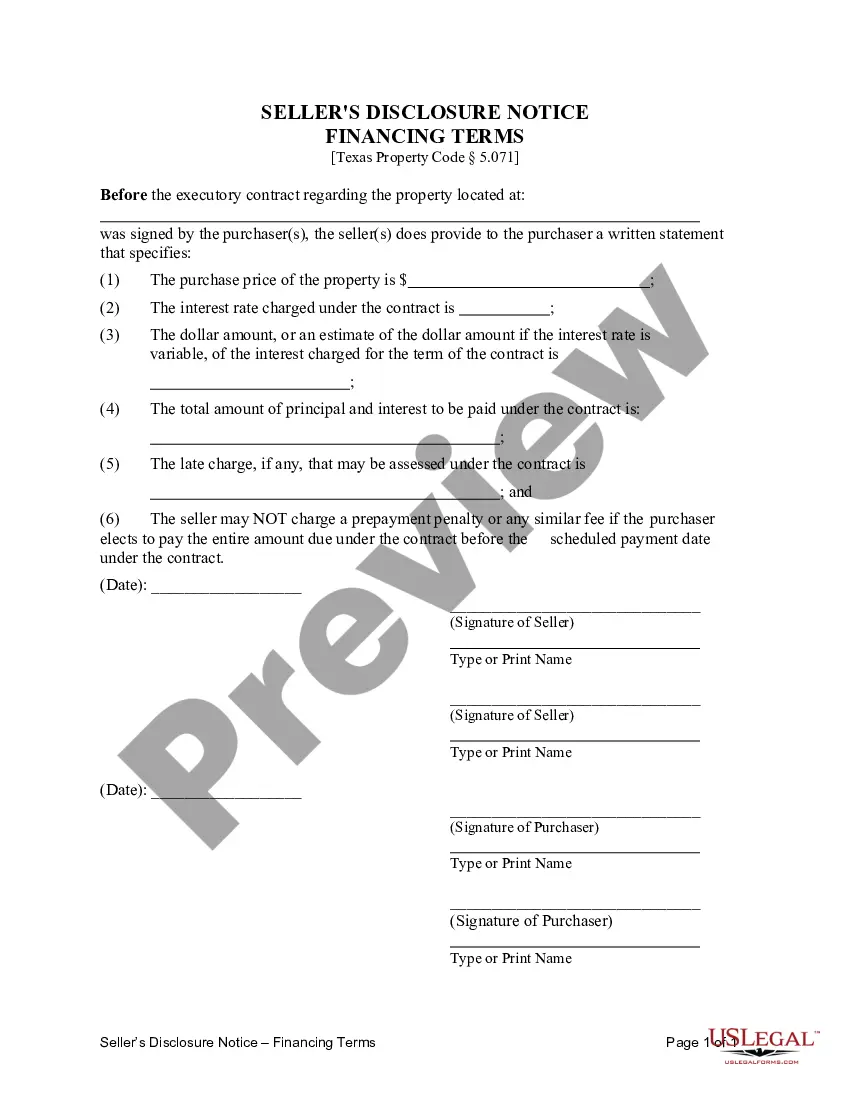

This Texas Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Pearland Texas Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the specific details and terms related to the financing arrangement between the seller and the buyer. This disclosure is typically provided by the seller to the buyer before the signing of the contract, ensuring transparency and a fair understanding of the financing terms involved. The purpose of this disclosure is to inform the buyer about the financing arrangements and to ensure that both parties are on the same page regarding the payment terms, interest rates, and any other financial obligations. It is crucial for buyers to carefully review this disclosure and seek legal advice if necessary, as it can significantly impact their financial commitment and contractual obligations. The following are some key areas that are typically covered in Pearland Texas Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed: 1. Purchase Price: This section will outline the agreed-upon purchase price of the property. It is essential for both the buyer and seller to agree upon this amount and ensure that it is clearly stated in the disclosure. 2. Down Payment: The down payment is the initial amount paid by the buyer to secure the property and express their commitment to the transaction. The seller's disclosure should specify the agreed-upon down payment amount and whether there are any additional requirements. 3. Interest Rates: This section will detail the interest rates that will be applied to the financing arrangement. It may state whether the interest rates are fixed or adjustable, along with any specific terms regarding rate changes. 4. Payment Terms: The disclosure will outline the expected payment schedule, including the due dates, frequency (monthly, quarterly, etc.), and the preferred method of payment (check, electronic transfer, etc.). 5. Term of Contract: The term of the contract defines the length of the financing arrangement. The disclosure should clearly state the agreed-upon duration of the contract, whether it is a specific number of years or months. 6. Late Payment Penalties: In the case of late payments, this section should address any penalties or fees that may be incurred by the buyer. It is crucial for the buyer to understand the consequences of late or missed payments. 7. Prepayment Penalties: Some financing arrangements may impose prepayment penalties if the buyer decides to pay off the loan early. The seller's disclosure should clearly state whether there are any prepayment penalties involved. 8. Default and Remedies: This section will outline the actions that can be taken by the seller in the event of a default, including potential remedies such as repossession of the property, termination of the contract, or legal action. It is important to note that while this general outline covers the main components, the specific content and terminology used in the Pearland Texas Seller's Disclosure of Financing Terms for Residential Property may vary. It is recommended for buyers to carefully read and understand the language used in the disclosure and consult with professionals such as real estate attorneys or experts in land contracts for any clarification required. Different types of Pearland Texas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may include variations in interest rates, payment terms, prepayment penalties, or default and remedies clauses. It is essential for buyers to review each specific disclosure document in detail to ensure a complete understanding of the financing terms and their implications.The Pearland Texas Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed, also known as a Land Contract, is an important document that outlines the specific details and terms related to the financing arrangement between the seller and the buyer. This disclosure is typically provided by the seller to the buyer before the signing of the contract, ensuring transparency and a fair understanding of the financing terms involved. The purpose of this disclosure is to inform the buyer about the financing arrangements and to ensure that both parties are on the same page regarding the payment terms, interest rates, and any other financial obligations. It is crucial for buyers to carefully review this disclosure and seek legal advice if necessary, as it can significantly impact their financial commitment and contractual obligations. The following are some key areas that are typically covered in Pearland Texas Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed: 1. Purchase Price: This section will outline the agreed-upon purchase price of the property. It is essential for both the buyer and seller to agree upon this amount and ensure that it is clearly stated in the disclosure. 2. Down Payment: The down payment is the initial amount paid by the buyer to secure the property and express their commitment to the transaction. The seller's disclosure should specify the agreed-upon down payment amount and whether there are any additional requirements. 3. Interest Rates: This section will detail the interest rates that will be applied to the financing arrangement. It may state whether the interest rates are fixed or adjustable, along with any specific terms regarding rate changes. 4. Payment Terms: The disclosure will outline the expected payment schedule, including the due dates, frequency (monthly, quarterly, etc.), and the preferred method of payment (check, electronic transfer, etc.). 5. Term of Contract: The term of the contract defines the length of the financing arrangement. The disclosure should clearly state the agreed-upon duration of the contract, whether it is a specific number of years or months. 6. Late Payment Penalties: In the case of late payments, this section should address any penalties or fees that may be incurred by the buyer. It is crucial for the buyer to understand the consequences of late or missed payments. 7. Prepayment Penalties: Some financing arrangements may impose prepayment penalties if the buyer decides to pay off the loan early. The seller's disclosure should clearly state whether there are any prepayment penalties involved. 8. Default and Remedies: This section will outline the actions that can be taken by the seller in the event of a default, including potential remedies such as repossession of the property, termination of the contract, or legal action. It is important to note that while this general outline covers the main components, the specific content and terminology used in the Pearland Texas Seller's Disclosure of Financing Terms for Residential Property may vary. It is recommended for buyers to carefully read and understand the language used in the disclosure and consult with professionals such as real estate attorneys or experts in land contracts for any clarification required. Different types of Pearland Texas Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed may include variations in interest rates, payment terms, prepayment penalties, or default and remedies clauses. It is essential for buyers to review each specific disclosure document in detail to ensure a complete understanding of the financing terms and their implications.