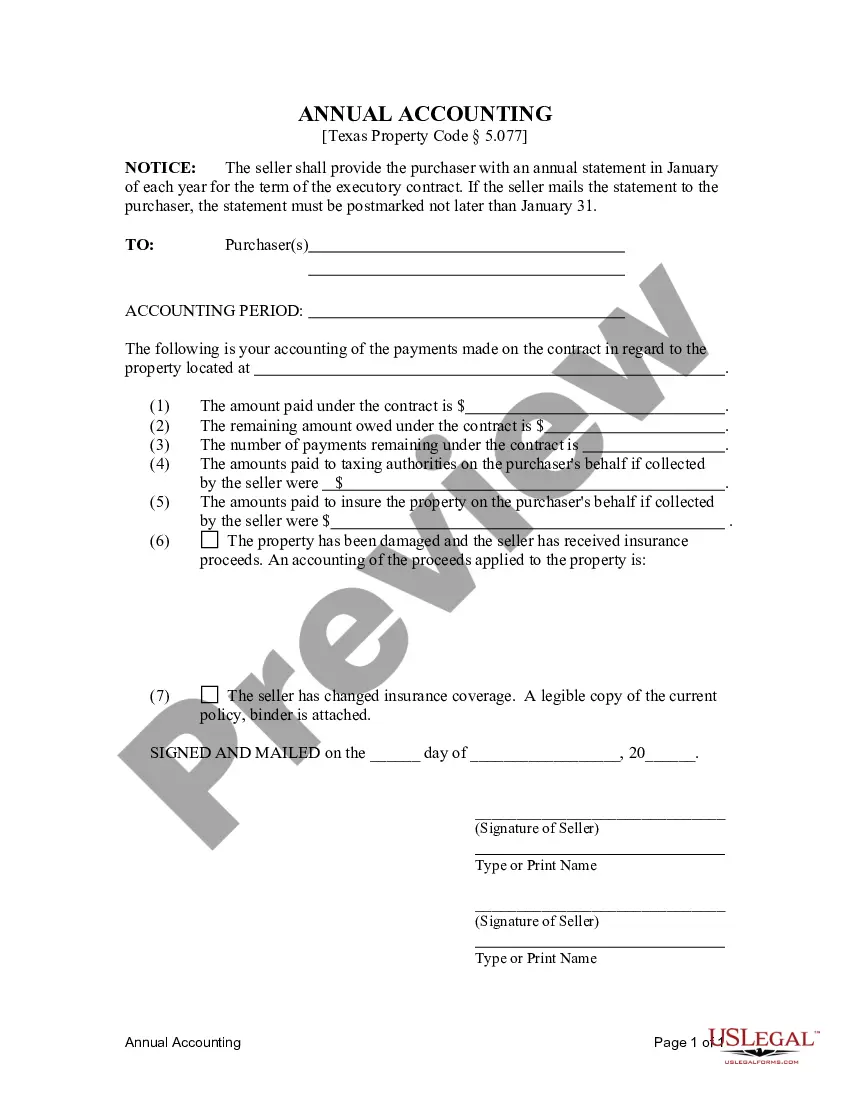

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Title: Beaumont Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract Introduction: In Beaumont, Texas, the Contract for Deed Seller's Annual Accounting Statement plays a crucial role in the smooth execution of a Residential Land Contract or Executory Contract. This statement serves as a detailed financial report provided annually by the seller to the purchaser. It outlines the financial transactions and obligations related to the property under contract. Understanding the various types of Beaumont Texas Contract for Deed Seller's Annual Accounting Statements is vital for both sellers and purchasers involved in land contracts or executory contracts. 1. Residential Land Contract: The Residential Land Contract refers to an agreement between the seller and purchaser related to the transfer of ownership rights gradually, rather than through conventional mortgage financing. It typically involves a predetermined purchase price, a down payment, and equal installment payments over a specified period. The Contract for Deed Seller's Annual Accounting Statement serves as a reliable tool for monitoring financial transactions and keeping track of the property's ongoing obligations. 2. Executory Contract: An Executory Contract is a unique arrangement wherein the buyer gains equitable title and the right to possess the property while making installment payments to the seller. This contract details the terms of the agreement, such as the purchase price, interest rate, and payment schedule. The annual accounting statement allows both parties to review the financial standing of the agreement, ensuring transparency, and providing necessary documentation during the contract term. Key Contents of the Contract for Deed Seller's Annual Accounting Statement: 1. Opening Balance: The statement should begin with the opening balance reflecting the outstanding amount owed by the purchaser from the previous accounting period. 2. Payments Made: This section outlines all payments made by the purchaser during the specific annual period. It includes installment payments, property taxes, insurance premiums, and any other relevant expenses associated with the property. 3. Interest Calculations: If applicable, the statement incorporates interest calculations on the outstanding balance to determine the finance charges accumulated during the accounting period. 4. Principal Reductions: This part discloses the portion of the payment applied towards the principal balance, demonstrating the progress of the purchaser in reducing the overall debt. 5. Escrow Account: If an escrow account exists, details about the funds held in the account, including property taxes and insurance premiums, should be included. 6. Property Maintenance Costs: Any expenses incurred by the seller related to property maintenance should be itemized in this section. 7. Late Fees or Penalties: If there were any late payments or penalties assessed during the accounting period, they should be recorded, along with explanations for transparency purposes. 8. Final Balance: The statement concludes with the remaining principal balance owed by the purchaser after accounting for all the payments, credits, and charges. By comprehensively understanding the Beaumont Texas Contract for Deed Seller's Annual Accounting Statement's purpose and its significance within Residential Land Contracts and Executory Contracts, both sellers and purchasers can ensure a fair and transparent relationship throughout the contract tenure. Regularly reviewing and providing this statement contributes to a clear financial understanding, promoting trust and accountability between the involved parties.Title: Beaumont Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract Introduction: In Beaumont, Texas, the Contract for Deed Seller's Annual Accounting Statement plays a crucial role in the smooth execution of a Residential Land Contract or Executory Contract. This statement serves as a detailed financial report provided annually by the seller to the purchaser. It outlines the financial transactions and obligations related to the property under contract. Understanding the various types of Beaumont Texas Contract for Deed Seller's Annual Accounting Statements is vital for both sellers and purchasers involved in land contracts or executory contracts. 1. Residential Land Contract: The Residential Land Contract refers to an agreement between the seller and purchaser related to the transfer of ownership rights gradually, rather than through conventional mortgage financing. It typically involves a predetermined purchase price, a down payment, and equal installment payments over a specified period. The Contract for Deed Seller's Annual Accounting Statement serves as a reliable tool for monitoring financial transactions and keeping track of the property's ongoing obligations. 2. Executory Contract: An Executory Contract is a unique arrangement wherein the buyer gains equitable title and the right to possess the property while making installment payments to the seller. This contract details the terms of the agreement, such as the purchase price, interest rate, and payment schedule. The annual accounting statement allows both parties to review the financial standing of the agreement, ensuring transparency, and providing necessary documentation during the contract term. Key Contents of the Contract for Deed Seller's Annual Accounting Statement: 1. Opening Balance: The statement should begin with the opening balance reflecting the outstanding amount owed by the purchaser from the previous accounting period. 2. Payments Made: This section outlines all payments made by the purchaser during the specific annual period. It includes installment payments, property taxes, insurance premiums, and any other relevant expenses associated with the property. 3. Interest Calculations: If applicable, the statement incorporates interest calculations on the outstanding balance to determine the finance charges accumulated during the accounting period. 4. Principal Reductions: This part discloses the portion of the payment applied towards the principal balance, demonstrating the progress of the purchaser in reducing the overall debt. 5. Escrow Account: If an escrow account exists, details about the funds held in the account, including property taxes and insurance premiums, should be included. 6. Property Maintenance Costs: Any expenses incurred by the seller related to property maintenance should be itemized in this section. 7. Late Fees or Penalties: If there were any late payments or penalties assessed during the accounting period, they should be recorded, along with explanations for transparency purposes. 8. Final Balance: The statement concludes with the remaining principal balance owed by the purchaser after accounting for all the payments, credits, and charges. By comprehensively understanding the Beaumont Texas Contract for Deed Seller's Annual Accounting Statement's purpose and its significance within Residential Land Contracts and Executory Contracts, both sellers and purchasers can ensure a fair and transparent relationship throughout the contract tenure. Regularly reviewing and providing this statement contributes to a clear financial understanding, promoting trust and accountability between the involved parties.