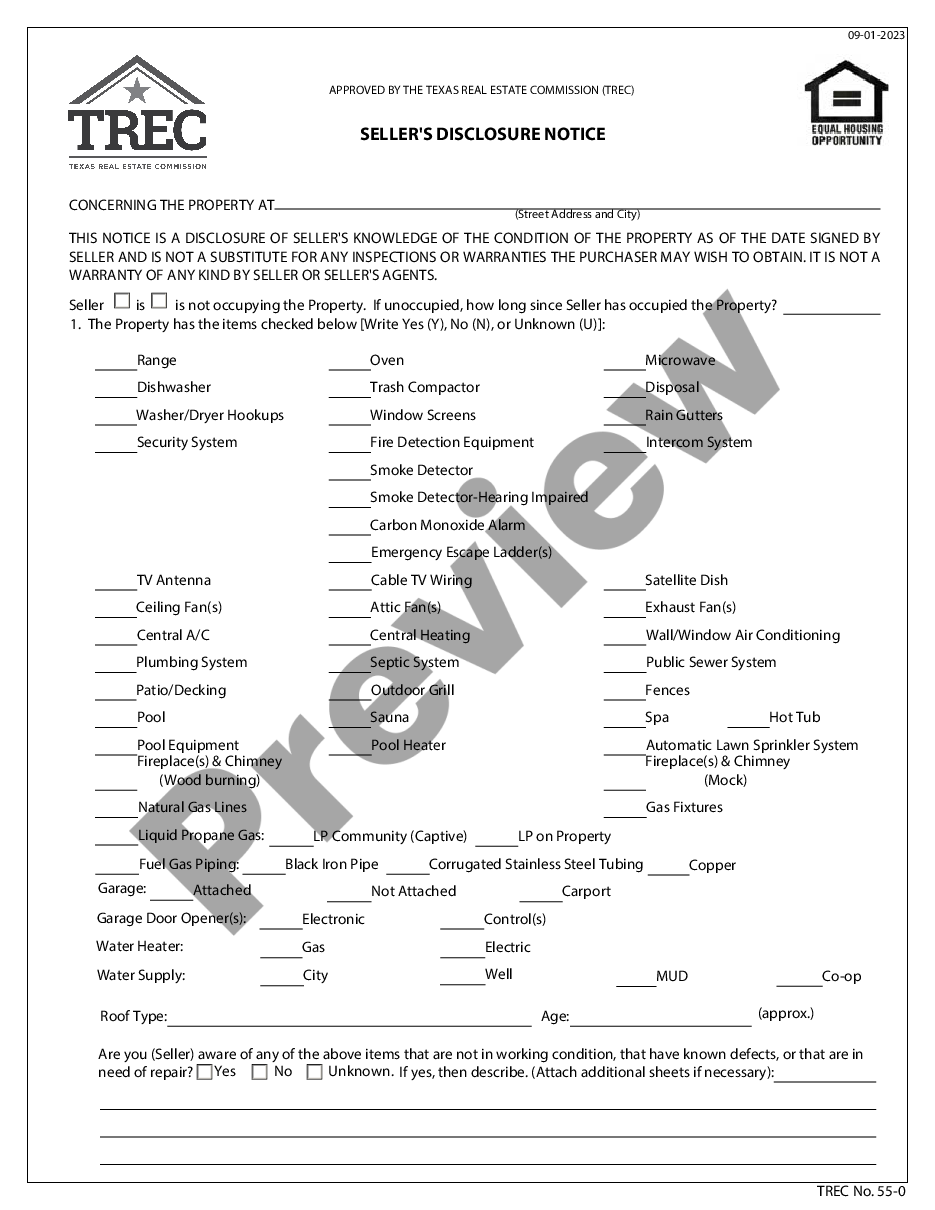

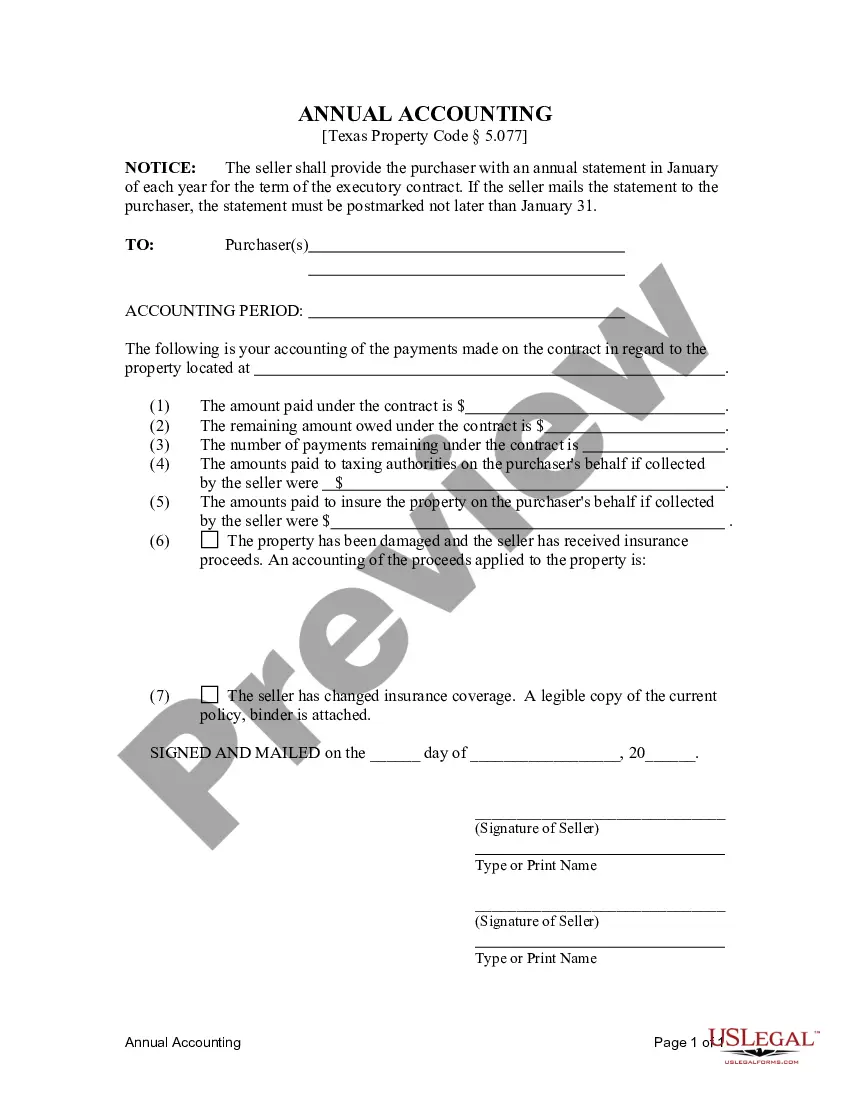

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

Title: Understanding Frisco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract Introduction: In Frisco, Texas, the Contract for Deed Seller's Annual Accounting Statement to Purchaser plays a crucial role in documenting and maintaining financial transparency between the buyer and seller in a residential land contract. This statement ensures both parties stay informed about financial matters related to the property. This article delves into the important aspects of this statement, including its purpose, components, and variations. 1. Purpose of Frisco Texas Contract for Deed Seller's Annual Accounting Statement: The primary purpose of this statement is to provide the purchaser with an annual financial summary of their contractual agreement with the seller. It helps track payments made, outstanding amounts, maintenance expenses, and other financial aspects. 2. Components of the Annual Accounting Statement: a. Transaction Summary: This section provides an overview of all financial transactions made during the year, including payment details, late fees, interest accrued, or any other relevant financial information. b. Payment Schedule: The statement includes a detailed payment schedule outlining the principal amount, interest, and any applicable fees. c. Balance Due: It presents the current outstanding balance, incorporating any adjustments or credits. d. Maintenance and Repairs: If the contract assigns maintenance and repair responsibilities to the purchaser, this section outlines the costs incurred and any reimbursements implemented. e. Property Taxes and Insurance: Detailed information about property taxes paid by the seller and any adjustments made to the purchase price due to tax changes is included. Additionally, the statement may reflect information about insurance payments and relevant adjustments. 3. Different Types of Frisco Texas Contract for Deed Seller's Annual Accounting Statement: a. Residential Land Contract: This annual accounting statement applies to residential properties sold under a contract for deed and emphasizes the financial aspects specific to the residential contract. b. Executory Contract: This variation of the statement is tailored to address the complexities and unique financial factors associated with an executory contract, which is a legal arrangement that outlines the transfer of property rights in the future, subject to specified conditions. Conclusion: Frisco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a vital document that ensures financial transparency and accountability between the buyer and seller in a residential land contract or an executory contract. It helps the purchaser understand their financial standing, track payments made, and provides necessary updates regarding property maintenance, taxes, and insurance. By adhering to the requirements of this statement, both parties can establish a mutually beneficial and financially secure agreement.Title: Understanding Frisco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract Introduction: In Frisco, Texas, the Contract for Deed Seller's Annual Accounting Statement to Purchaser plays a crucial role in documenting and maintaining financial transparency between the buyer and seller in a residential land contract. This statement ensures both parties stay informed about financial matters related to the property. This article delves into the important aspects of this statement, including its purpose, components, and variations. 1. Purpose of Frisco Texas Contract for Deed Seller's Annual Accounting Statement: The primary purpose of this statement is to provide the purchaser with an annual financial summary of their contractual agreement with the seller. It helps track payments made, outstanding amounts, maintenance expenses, and other financial aspects. 2. Components of the Annual Accounting Statement: a. Transaction Summary: This section provides an overview of all financial transactions made during the year, including payment details, late fees, interest accrued, or any other relevant financial information. b. Payment Schedule: The statement includes a detailed payment schedule outlining the principal amount, interest, and any applicable fees. c. Balance Due: It presents the current outstanding balance, incorporating any adjustments or credits. d. Maintenance and Repairs: If the contract assigns maintenance and repair responsibilities to the purchaser, this section outlines the costs incurred and any reimbursements implemented. e. Property Taxes and Insurance: Detailed information about property taxes paid by the seller and any adjustments made to the purchase price due to tax changes is included. Additionally, the statement may reflect information about insurance payments and relevant adjustments. 3. Different Types of Frisco Texas Contract for Deed Seller's Annual Accounting Statement: a. Residential Land Contract: This annual accounting statement applies to residential properties sold under a contract for deed and emphasizes the financial aspects specific to the residential contract. b. Executory Contract: This variation of the statement is tailored to address the complexities and unique financial factors associated with an executory contract, which is a legal arrangement that outlines the transfer of property rights in the future, subject to specified conditions. Conclusion: Frisco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a vital document that ensures financial transparency and accountability between the buyer and seller in a residential land contract or an executory contract. It helps the purchaser understand their financial standing, track payments made, and provides necessary updates regarding property maintenance, taxes, and insurance. By adhering to the requirements of this statement, both parties can establish a mutually beneficial and financially secure agreement.