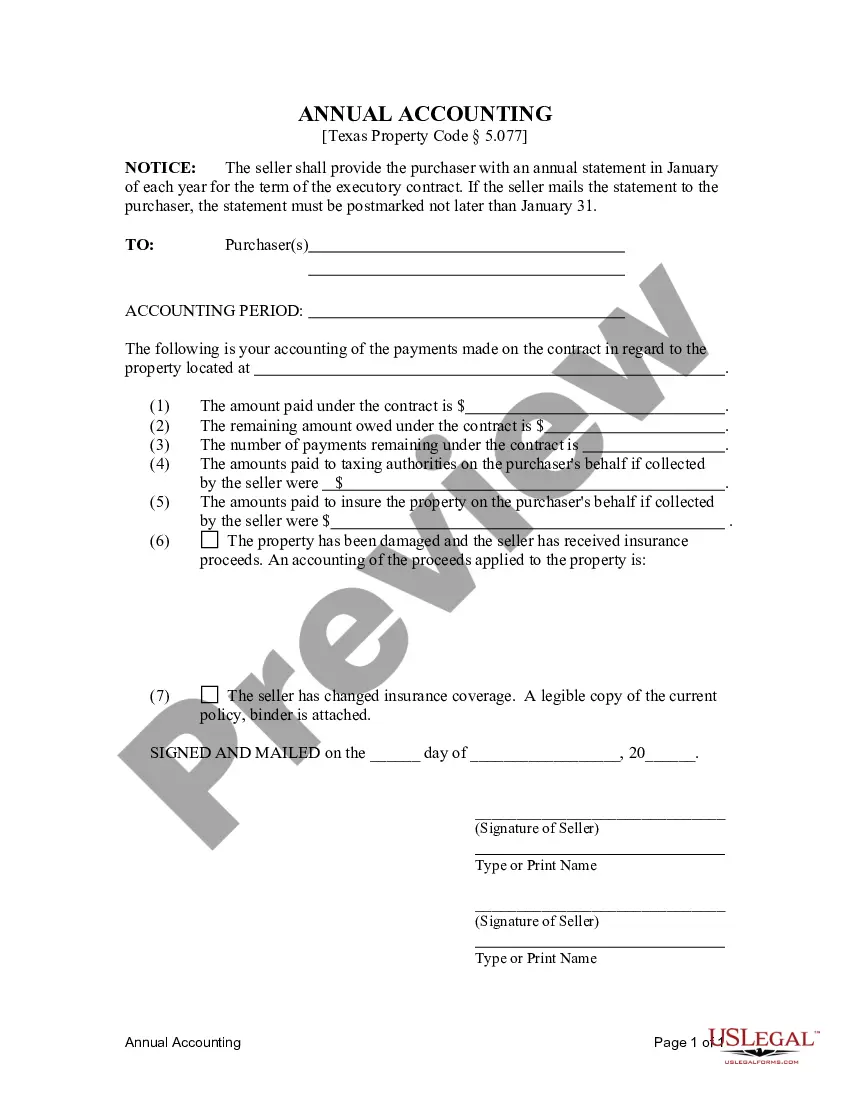

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

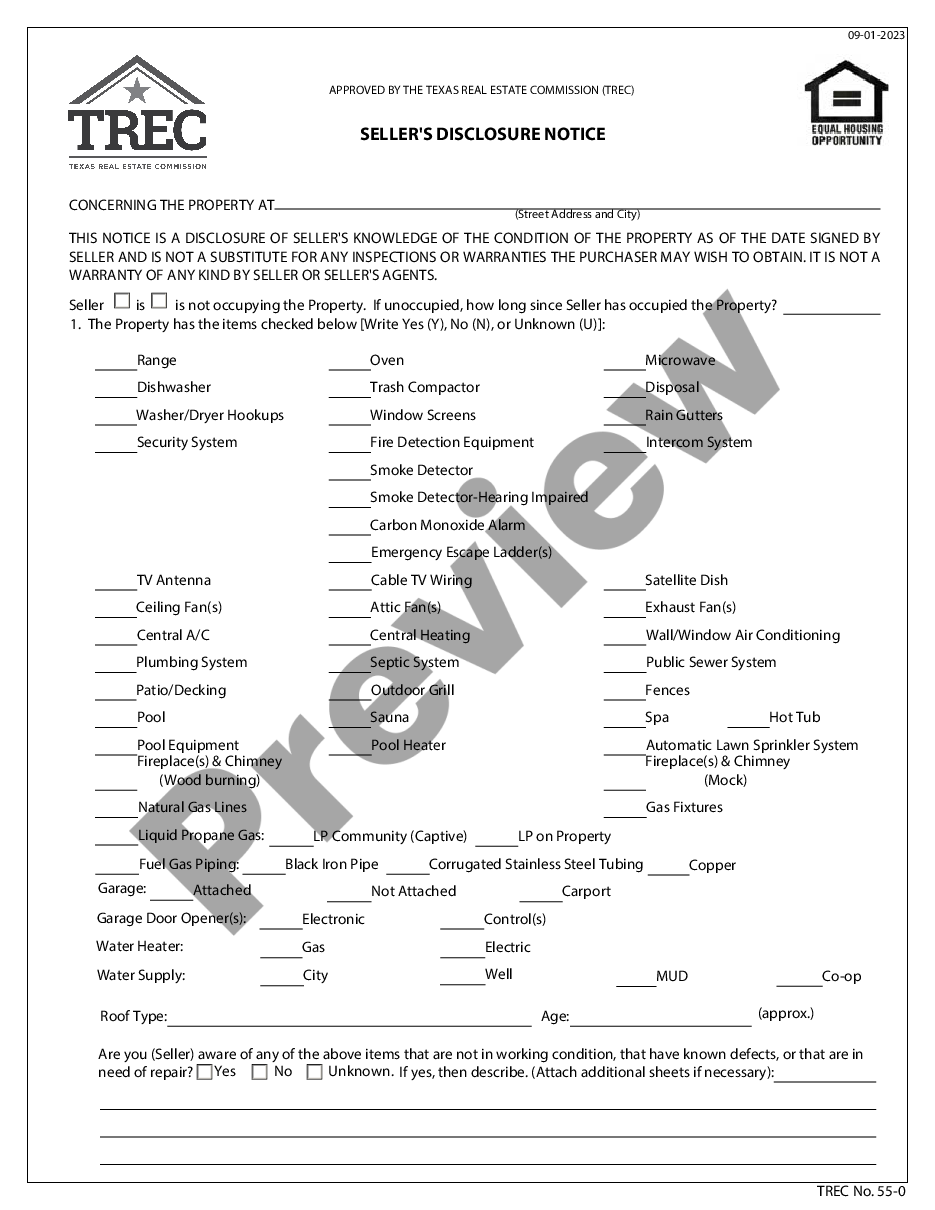

The Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a crucial document that outlines the financial obligations and responsibilities between the seller and purchaser in a residential land contract or executory contract. As per this contract, the seller is obligated to provide the purchaser with an annual accounting statement, which serves as a detailed record of all financial transactions and activities related to the property. Key elements included in the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may include: 1. Property information: This section provides details about the residential property involved in the contract, such as the address, legal description, and parcel number. 2. Purchase price and payments: The accounting statement will outline the original purchase price agreed upon by the parties and any subsequent payments made by the purchaser, including the principal amount, interest, and any additional fees. 3. Payment history: This section provides a comprehensive breakdown of all payments made by the purchaser to the seller, including the dates, amounts, and how they were applied (e.g., towards principal, interest, taxes, insurance, etc.). 4. Escrow account: If an escrow account was established, the statement will include a detailed summary of any funds deposited and disbursed from the account, including property taxes, insurance premiums, and any other authorized expenses. 5. Charges and fees: Any charges or fees imposed by the seller should be clearly outlined in the accounting statement, such as late payment fees, transaction fees, or administrative fees. 6. Maintenance and repair expenses: If the contract stipulates that the purchaser is responsible for maintaining or repairing the property, this section will detail any related expenses incurred, such as repairs, landscaping, or utilities. 7. Insurance and taxes: The accounting statement will provide information regarding property insurance payments made by the purchaser, as well as any property tax obligations and payments. It is important to note that variations of the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may exist, depending on the specific terms and conditions mutually agreed upon by both parties. These variations may address additional elements or emphasize certain aspects of the agreement. Potential variations of the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract may include: 1. Commercial properties: If the contract pertains to a commercial property, the accounting statement may include additional sections addressing revenue from tenants, expenses related to common areas, or the allocation of maintenance costs. 2. Agricultural land: In cases where the land contract involves agricultural land, the accounting statement may incorporate information on crop yields, irrigation expenses, or any income generated from farming activities. 3. Installment sales: If the contract is structured as an installment sale, wherein the purchaser pays off the purchase price in periodic installments, the accounting statement may focus on the outstanding balance, interest paid, and the remaining payment schedule. It is essential for both parties to review the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser thoroughly and ensure its compliance with state and local regulations. Seek legal advice and clarification, if necessary, to maintain a transparent and fair financial relationship throughout the duration of the land contract or executory contract.The Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a crucial document that outlines the financial obligations and responsibilities between the seller and purchaser in a residential land contract or executory contract. As per this contract, the seller is obligated to provide the purchaser with an annual accounting statement, which serves as a detailed record of all financial transactions and activities related to the property. Key elements included in the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may include: 1. Property information: This section provides details about the residential property involved in the contract, such as the address, legal description, and parcel number. 2. Purchase price and payments: The accounting statement will outline the original purchase price agreed upon by the parties and any subsequent payments made by the purchaser, including the principal amount, interest, and any additional fees. 3. Payment history: This section provides a comprehensive breakdown of all payments made by the purchaser to the seller, including the dates, amounts, and how they were applied (e.g., towards principal, interest, taxes, insurance, etc.). 4. Escrow account: If an escrow account was established, the statement will include a detailed summary of any funds deposited and disbursed from the account, including property taxes, insurance premiums, and any other authorized expenses. 5. Charges and fees: Any charges or fees imposed by the seller should be clearly outlined in the accounting statement, such as late payment fees, transaction fees, or administrative fees. 6. Maintenance and repair expenses: If the contract stipulates that the purchaser is responsible for maintaining or repairing the property, this section will detail any related expenses incurred, such as repairs, landscaping, or utilities. 7. Insurance and taxes: The accounting statement will provide information regarding property insurance payments made by the purchaser, as well as any property tax obligations and payments. It is important to note that variations of the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may exist, depending on the specific terms and conditions mutually agreed upon by both parties. These variations may address additional elements or emphasize certain aspects of the agreement. Potential variations of the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract may include: 1. Commercial properties: If the contract pertains to a commercial property, the accounting statement may include additional sections addressing revenue from tenants, expenses related to common areas, or the allocation of maintenance costs. 2. Agricultural land: In cases where the land contract involves agricultural land, the accounting statement may incorporate information on crop yields, irrigation expenses, or any income generated from farming activities. 3. Installment sales: If the contract is structured as an installment sale, wherein the purchaser pays off the purchase price in periodic installments, the accounting statement may focus on the outstanding balance, interest paid, and the remaining payment schedule. It is essential for both parties to review the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser thoroughly and ensure its compliance with state and local regulations. Seek legal advice and clarification, if necessary, to maintain a transparent and fair financial relationship throughout the duration of the land contract or executory contract.