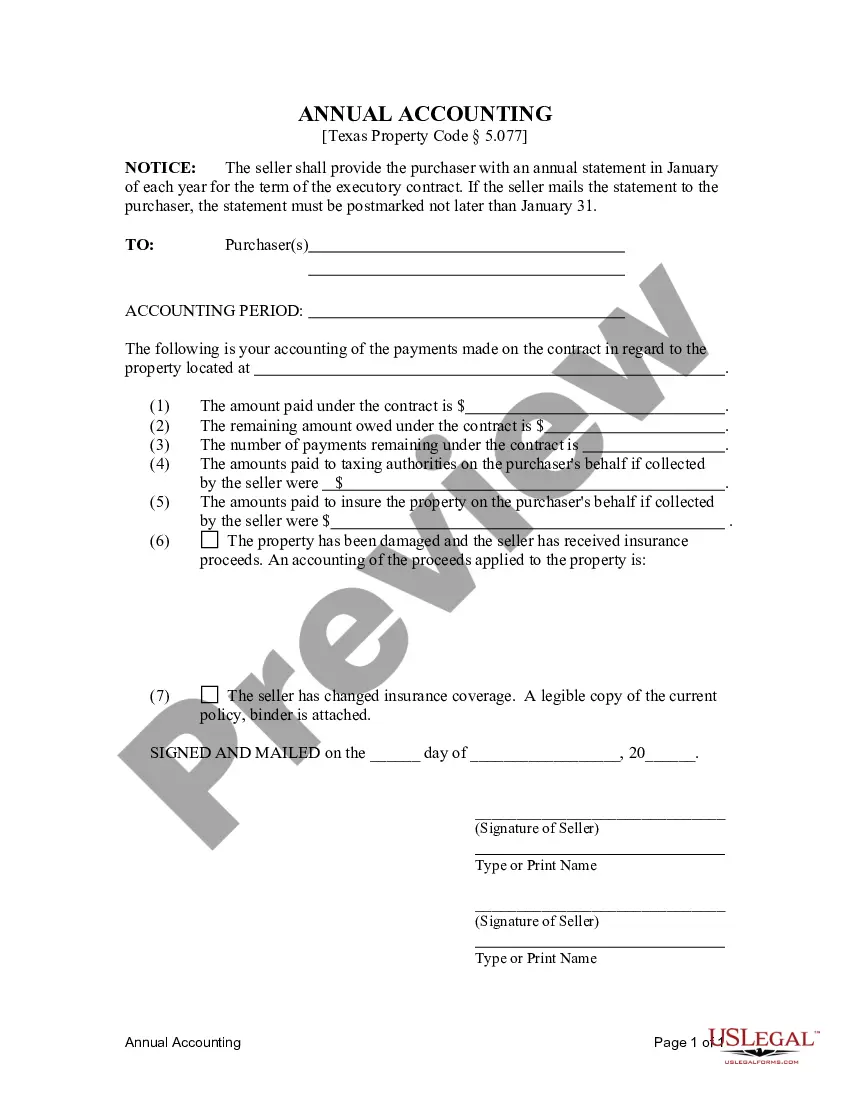

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

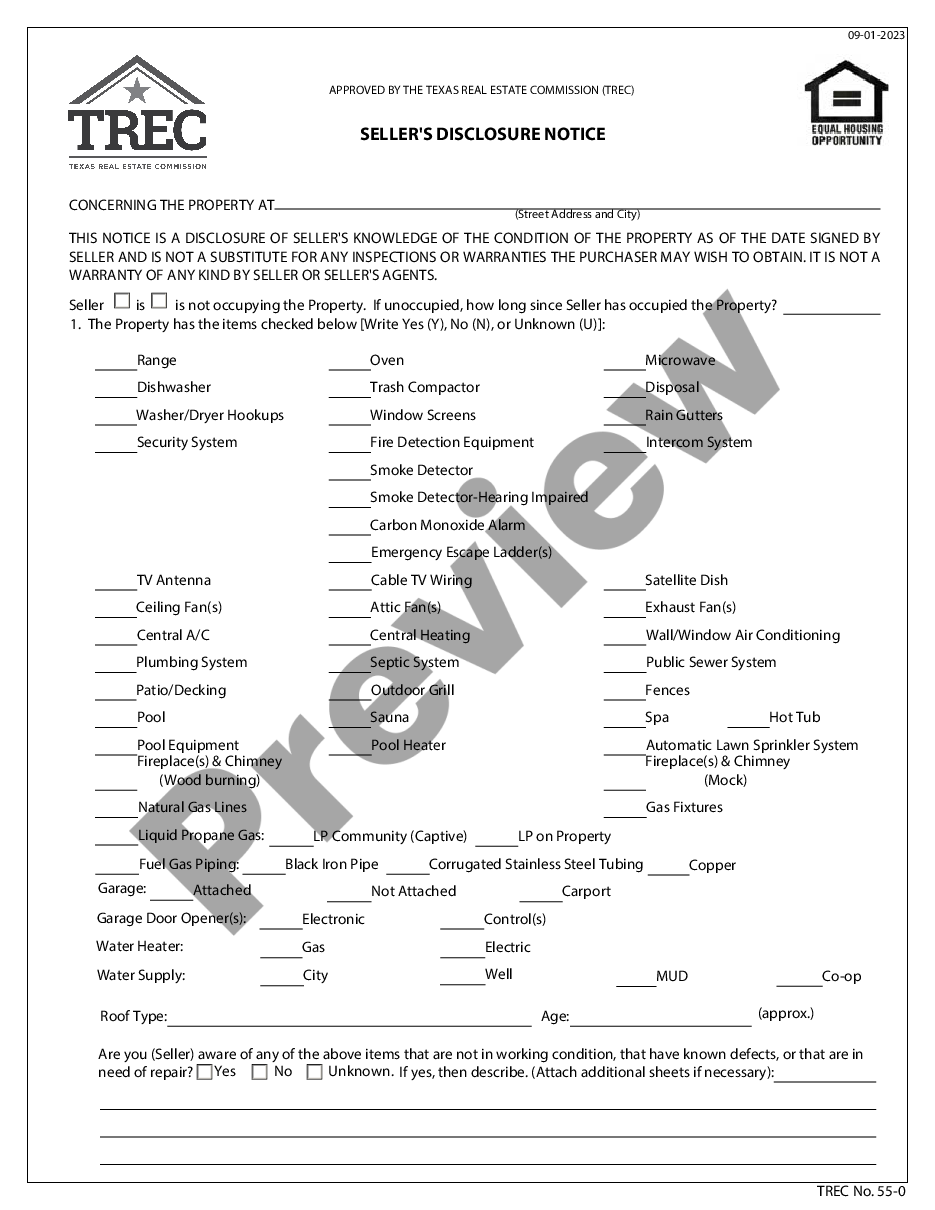

The McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a crucial document designed to provide a comprehensive overview of financial transactions between the seller and purchaser in a residential land contract or executory contract. This annual accounting statement serves as a formal record of payments made, outstanding balances, and other financial details pertaining to the contract for deed agreement. In a McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, several key elements are usually included: 1. Parties involved: Clearly state the names and contact information of both the seller and purchaser, ensuring accurate identification. 2. Property details: Provide a thorough description of the property subject to the contract, including its address, legal description, and any relevant parcel numbers or surveys. 3. Payment summary: Present a detailed breakdown of all payments made by the purchaser during the preceding year, specifying the date, amount, and purpose of each payment. This information helps track the progress of the contract and assess the outstanding balance. 4. Outstanding balance: Clearly state the remaining balance owed by the purchaser to the seller, along with any applicable interest, penalties, or fees. 5. Escrow account information: If the contract stipulates the use of an escrow account for property taxes, insurance premiums, or other expenses, include a summary of the amounts held in the account, as well as any disbursements made. 6. Taxes and insurance: Detail any property taxes or insurance premiums paid by the seller on behalf of the purchaser. This information ensures transparency and facilitates financial planning for both parties. 7. Interest and penalties: If the contract includes provisions for interest or penalties on overdue payments, provide a clear breakdown of these charges, if applicable. 8. Other financial obligations: Specify any additional financial obligations, such as maintenance or repair costs, which the purchaser may be responsible for under the terms of the contract. Different types of McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may include variations based on the specific terms of the land contract or executory contract. Some examples include: — McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract - Fixed Interest Rate: This statement would include a fixed interest rate on the outstanding balance, ensuring consistent payments throughout the contract term. — McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract - Balloon Payment: In this case, the accounting statement might outline a large final payment, or balloon payment, due at the end of the contract term. — McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract - Variable Interest Rate: This statement would reflect changes in interest rates, as agreed upon in the contract, resulting in fluctuating payments throughout the contract duration. By diligently creating and providing the McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser, both the seller and purchaser can maintain transparency, stay updated on financial obligations, and ensure a smooth and successful contract term.The McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a crucial document designed to provide a comprehensive overview of financial transactions between the seller and purchaser in a residential land contract or executory contract. This annual accounting statement serves as a formal record of payments made, outstanding balances, and other financial details pertaining to the contract for deed agreement. In a McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, several key elements are usually included: 1. Parties involved: Clearly state the names and contact information of both the seller and purchaser, ensuring accurate identification. 2. Property details: Provide a thorough description of the property subject to the contract, including its address, legal description, and any relevant parcel numbers or surveys. 3. Payment summary: Present a detailed breakdown of all payments made by the purchaser during the preceding year, specifying the date, amount, and purpose of each payment. This information helps track the progress of the contract and assess the outstanding balance. 4. Outstanding balance: Clearly state the remaining balance owed by the purchaser to the seller, along with any applicable interest, penalties, or fees. 5. Escrow account information: If the contract stipulates the use of an escrow account for property taxes, insurance premiums, or other expenses, include a summary of the amounts held in the account, as well as any disbursements made. 6. Taxes and insurance: Detail any property taxes or insurance premiums paid by the seller on behalf of the purchaser. This information ensures transparency and facilitates financial planning for both parties. 7. Interest and penalties: If the contract includes provisions for interest or penalties on overdue payments, provide a clear breakdown of these charges, if applicable. 8. Other financial obligations: Specify any additional financial obligations, such as maintenance or repair costs, which the purchaser may be responsible for under the terms of the contract. Different types of McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may include variations based on the specific terms of the land contract or executory contract. Some examples include: — McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract - Fixed Interest Rate: This statement would include a fixed interest rate on the outstanding balance, ensuring consistent payments throughout the contract term. — McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract - Balloon Payment: In this case, the accounting statement might outline a large final payment, or balloon payment, due at the end of the contract term. — McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract - Variable Interest Rate: This statement would reflect changes in interest rates, as agreed upon in the contract, resulting in fluctuating payments throughout the contract duration. By diligently creating and providing the McKinney Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser, both the seller and purchaser can maintain transparency, stay updated on financial obligations, and ensure a smooth and successful contract term.