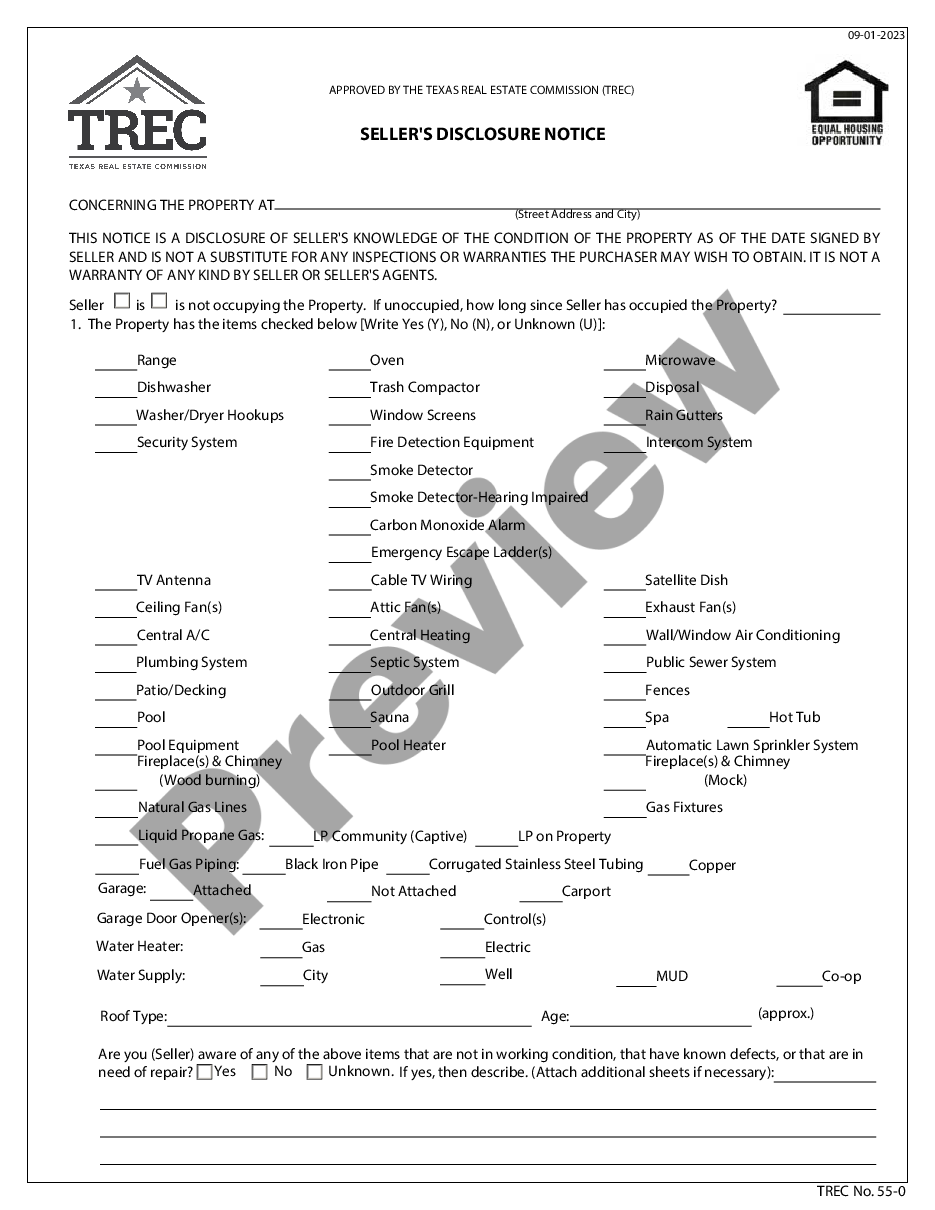

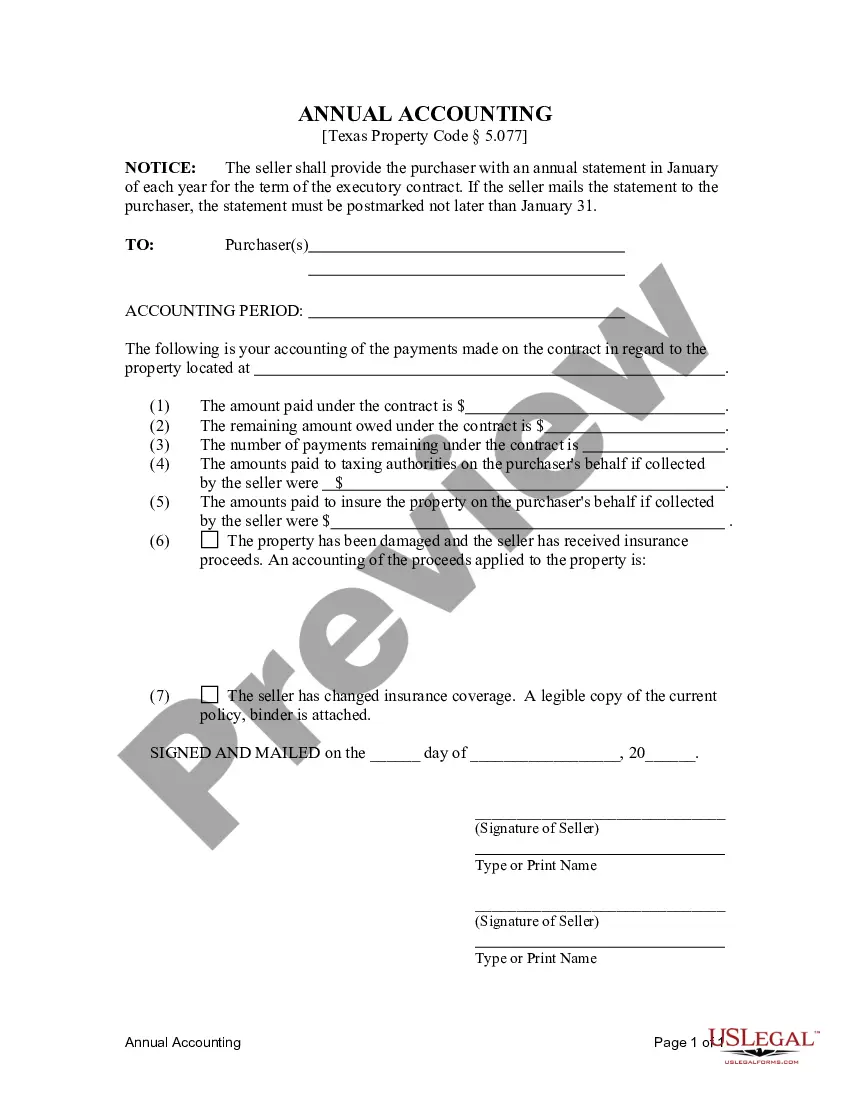

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

In Odessa, Texas, a Contract for Deed Seller's Annual Accounting Statement to Purchaser is a crucial document that outlines the financial details and transactions between the seller and purchaser in a residential land contract or executory contract. This statement provides a comprehensive overview of the financial activities related to the contract and ensures transparency and accountability between the parties involved. The Contract for Deed Seller's Annual Accounting Statement is designed to establish a clear understanding of the financial obligations, rights, and responsibilities for both the seller and purchaser. It serves as a statement of income and expenses related to the property and helps maintain a harmonious and trustworthy relationship by promoting open communication and financial transparency. Key elements covered in the Odessa, Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser include: 1. Income Declaration: This section of the statement lists all sources of income received by the seller relating to the property, including rent, lease payments, or any other revenue generated from the property during the specified accounting period. It highlights the amount received, the date of receipt, and a detailed breakdown of income sources. 2. Expense Declaration: This part of the statement includes all the expenses incurred by the seller in relation to the property. It includes items such as property tax payments, insurance costs, maintenance expenses, repairs, and any miscellaneous expenses relevant to the property's upkeep. A clear breakdown of these expenses, along with supporting documentation, is presented in this section. 3. Principal and Interest Calculation: If the contract includes loan or financing arrangements, the statement will provide a breakdown of the principal and interest portions of the payments made during the accounting period. This section elucidates the amount dedicated to the reduction of the principal balance and the interest accrued on the outstanding balance. 4. Escrow Account Details: In some circumstances, the seller may be responsible for maintaining an escrow account to cover certain expenses, such as property taxes or insurance premiums. This statement will outline any funds deposited or disbursed from the escrow account and any interest earned during the specified accounting period. Different variations or types of the Odessa, Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may include: 1. Residential Land Contract: This type of contract typically involves the sale of a residential property under a long-term installment payment plan. The statement will reflect the financial activities related to this specific type of land contract. 2. Executory Contract: An executory contract is a flexible option that allows a purchaser to take possession of a property without immediately obtaining legal ownership. The statement under this contract will detail the financial transactions and obligations arising from this arrangement. Regardless of the specific type, the Odessa, Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract serves as a crucial financial document to maintain transparency, record keeping, and promote a mutually beneficial relationship between the seller and purchaser.In Odessa, Texas, a Contract for Deed Seller's Annual Accounting Statement to Purchaser is a crucial document that outlines the financial details and transactions between the seller and purchaser in a residential land contract or executory contract. This statement provides a comprehensive overview of the financial activities related to the contract and ensures transparency and accountability between the parties involved. The Contract for Deed Seller's Annual Accounting Statement is designed to establish a clear understanding of the financial obligations, rights, and responsibilities for both the seller and purchaser. It serves as a statement of income and expenses related to the property and helps maintain a harmonious and trustworthy relationship by promoting open communication and financial transparency. Key elements covered in the Odessa, Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser include: 1. Income Declaration: This section of the statement lists all sources of income received by the seller relating to the property, including rent, lease payments, or any other revenue generated from the property during the specified accounting period. It highlights the amount received, the date of receipt, and a detailed breakdown of income sources. 2. Expense Declaration: This part of the statement includes all the expenses incurred by the seller in relation to the property. It includes items such as property tax payments, insurance costs, maintenance expenses, repairs, and any miscellaneous expenses relevant to the property's upkeep. A clear breakdown of these expenses, along with supporting documentation, is presented in this section. 3. Principal and Interest Calculation: If the contract includes loan or financing arrangements, the statement will provide a breakdown of the principal and interest portions of the payments made during the accounting period. This section elucidates the amount dedicated to the reduction of the principal balance and the interest accrued on the outstanding balance. 4. Escrow Account Details: In some circumstances, the seller may be responsible for maintaining an escrow account to cover certain expenses, such as property taxes or insurance premiums. This statement will outline any funds deposited or disbursed from the escrow account and any interest earned during the specified accounting period. Different variations or types of the Odessa, Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may include: 1. Residential Land Contract: This type of contract typically involves the sale of a residential property under a long-term installment payment plan. The statement will reflect the financial activities related to this specific type of land contract. 2. Executory Contract: An executory contract is a flexible option that allows a purchaser to take possession of a property without immediately obtaining legal ownership. The statement under this contract will detail the financial transactions and obligations arising from this arrangement. Regardless of the specific type, the Odessa, Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract serves as a crucial financial document to maintain transparency, record keeping, and promote a mutually beneficial relationship between the seller and purchaser.