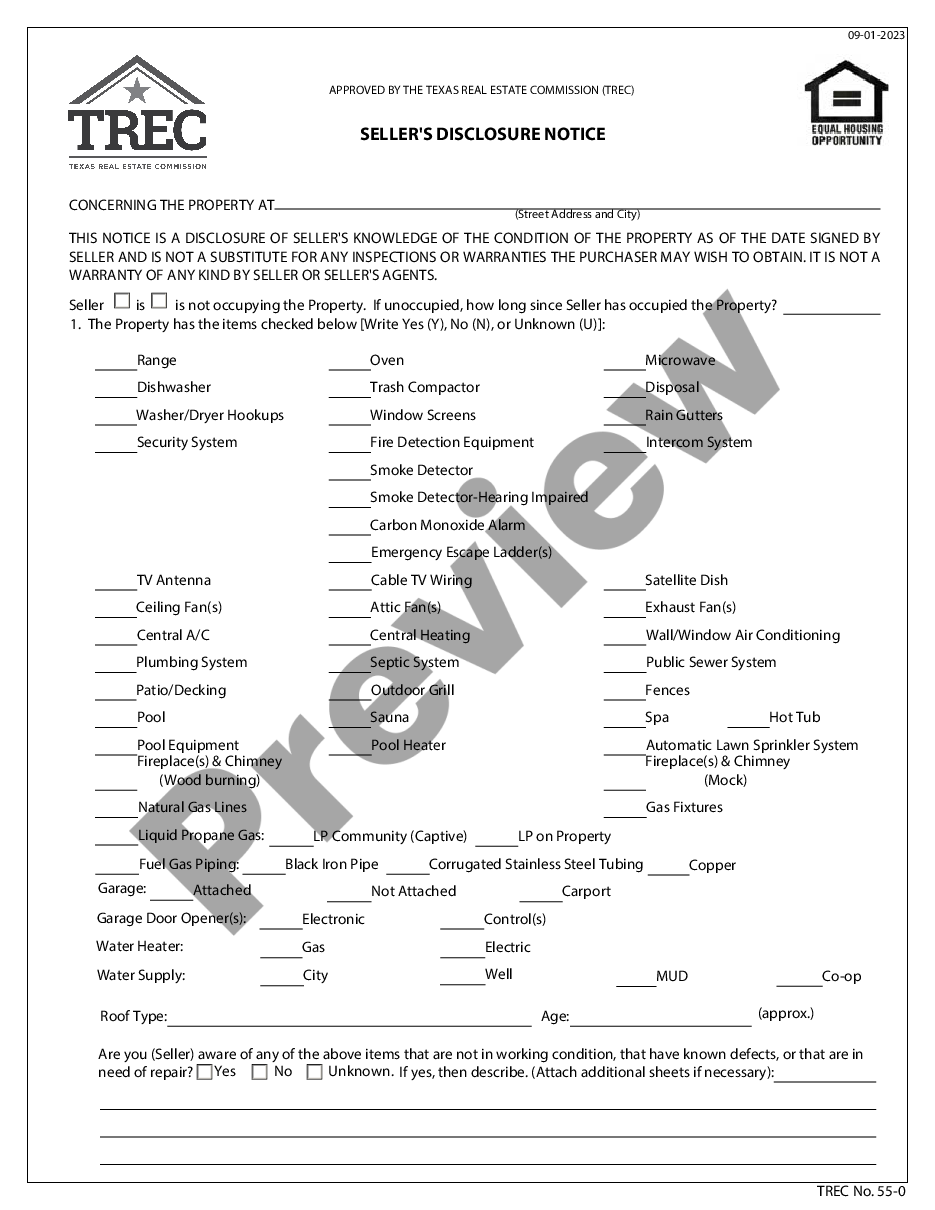

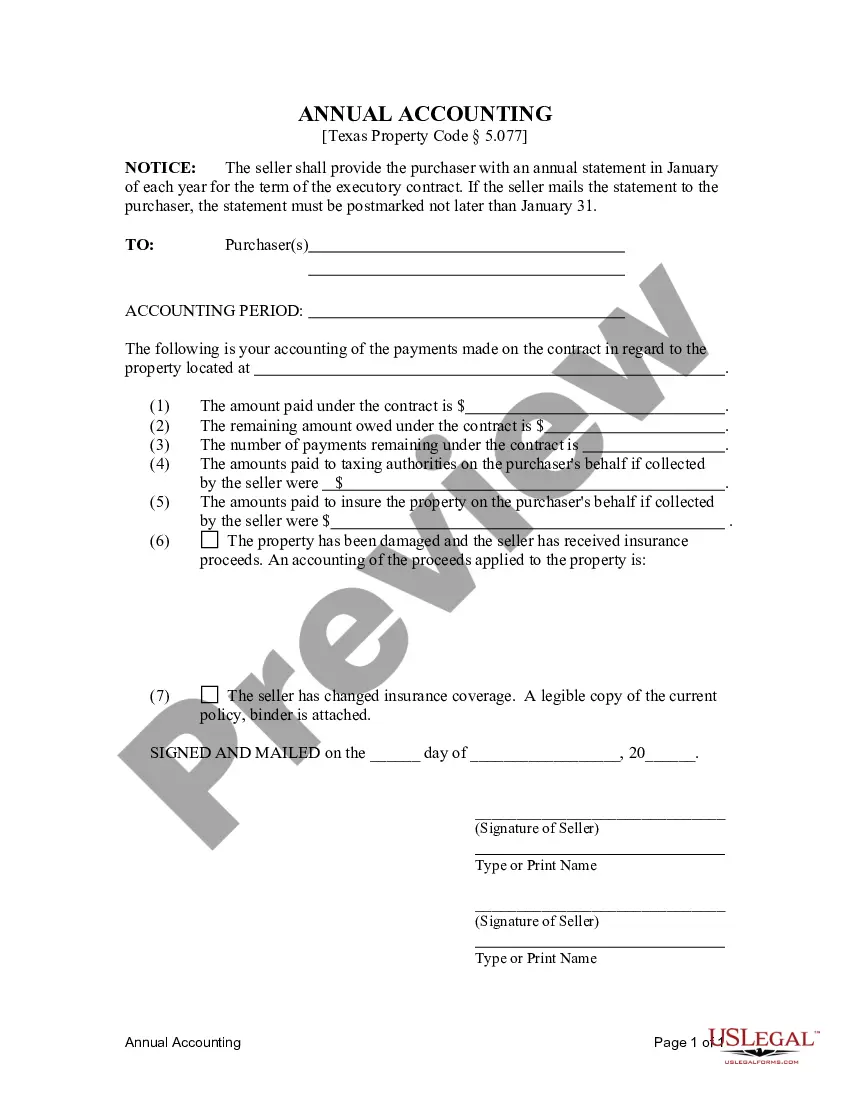

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

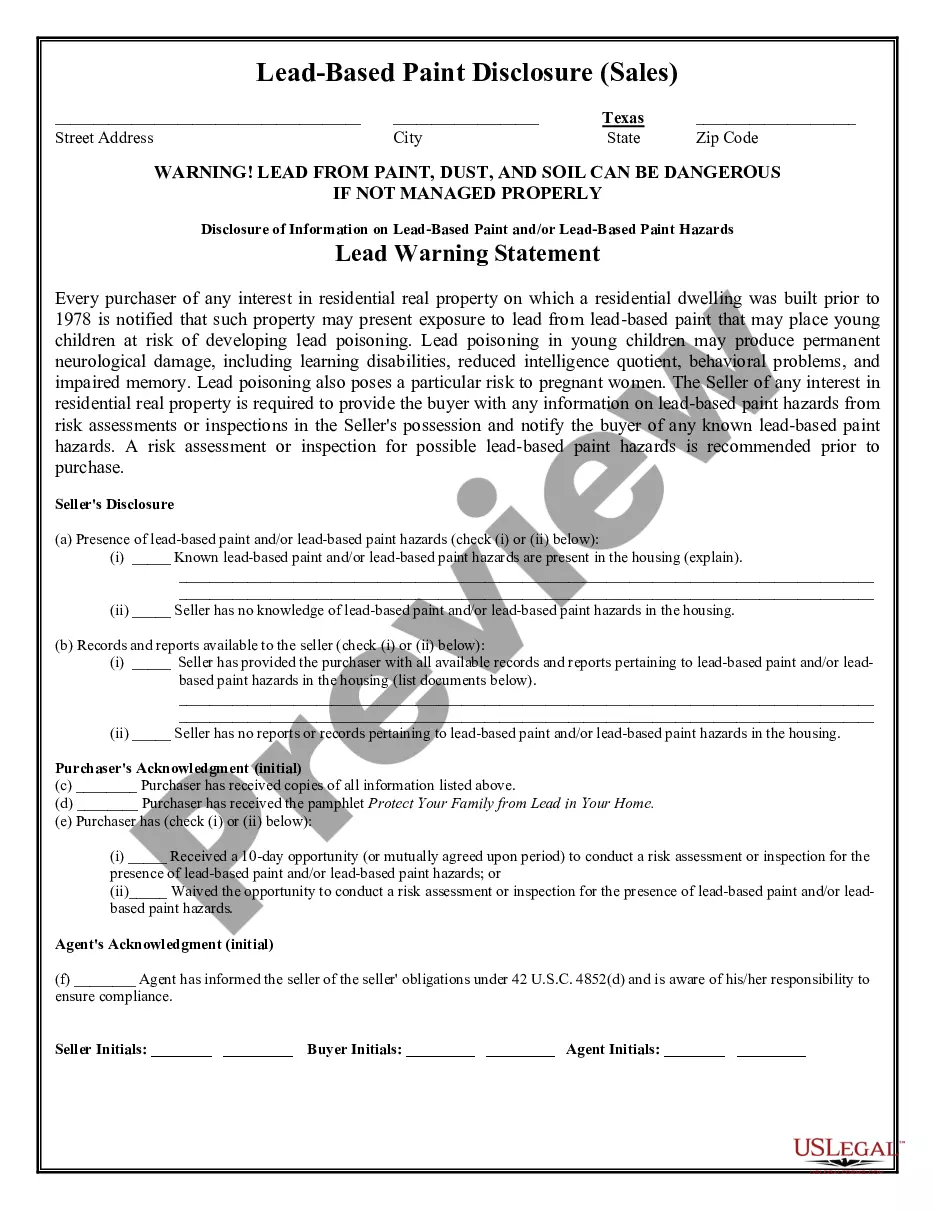

The San Antonio Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a critical document that facilitates communication between the seller (also known as the vendor) and the purchaser (also referred to as the Vendée) in a residential land contract. This agreement, also recognized as an executory contract, outlines the financial details of the transaction and provides transparency regarding the payments made by the purchaser towards the purchase of the property. The purpose of the Contract for Deed Seller's Annual Accounting Statement is to ensure that both parties are aware of the current financial status of the contract, including the outstanding balance, total payments made, and any interest charges. It provides important information regarding the progress of the contract and serves as a record of the financial transactions between the seller and purchaser. Key elements of the Contract for Deed Seller's Annual Accounting Statement include: 1. Identification of the parties involved: The document clearly specifies the names and addresses of both the seller and the purchaser, ensuring that there is no confusion regarding their identities. 2. Description of the property: The Contract for Deed Seller's Annual Accounting Statement includes a detailed description of the residential property that is subject to the land contract. This description typically includes the legal description of the property, its physical address, and any other relevant details. 3. Contract terms and conditions: The statement outlines the specific terms and conditions of the land contract, such as the purchase price, the duration of the contract, and the interest rate (if applicable). It may also include provisions regarding late payment penalties or other financial penalties. 4. Payment summary: The statement provides a comprehensive summary of all the payments made by the purchaser since the beginning of the contract. This includes the amount paid towards the principal, the interest charges (if any), and any other fees or charges stipulated in the agreement. 5. Calculation of outstanding balance: The Contract for Deed Seller's Annual Accounting Statement calculates the remaining balance that the purchaser owes to the seller. This includes subtracting the total payments made from the original purchase price, along with any applicable interest charges. 6. Itemization of taxes and insurance: If the land contract includes provisions for the seller to handle taxes and insurance, the statement itemizes these costs. It includes information on the amount paid for property taxes, homeowners' insurance, and any escrow payments made by the seller on behalf of the purchaser. It is important to note that variations of the San Antonio Texas Contract for Deed Seller's Annual Accounting Statement may exist to accommodate specific contractual arrangements or state-mandated requirements. However, the core purpose and content of the document typically remain consistent across different versions.The San Antonio Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a critical document that facilitates communication between the seller (also known as the vendor) and the purchaser (also referred to as the Vendée) in a residential land contract. This agreement, also recognized as an executory contract, outlines the financial details of the transaction and provides transparency regarding the payments made by the purchaser towards the purchase of the property. The purpose of the Contract for Deed Seller's Annual Accounting Statement is to ensure that both parties are aware of the current financial status of the contract, including the outstanding balance, total payments made, and any interest charges. It provides important information regarding the progress of the contract and serves as a record of the financial transactions between the seller and purchaser. Key elements of the Contract for Deed Seller's Annual Accounting Statement include: 1. Identification of the parties involved: The document clearly specifies the names and addresses of both the seller and the purchaser, ensuring that there is no confusion regarding their identities. 2. Description of the property: The Contract for Deed Seller's Annual Accounting Statement includes a detailed description of the residential property that is subject to the land contract. This description typically includes the legal description of the property, its physical address, and any other relevant details. 3. Contract terms and conditions: The statement outlines the specific terms and conditions of the land contract, such as the purchase price, the duration of the contract, and the interest rate (if applicable). It may also include provisions regarding late payment penalties or other financial penalties. 4. Payment summary: The statement provides a comprehensive summary of all the payments made by the purchaser since the beginning of the contract. This includes the amount paid towards the principal, the interest charges (if any), and any other fees or charges stipulated in the agreement. 5. Calculation of outstanding balance: The Contract for Deed Seller's Annual Accounting Statement calculates the remaining balance that the purchaser owes to the seller. This includes subtracting the total payments made from the original purchase price, along with any applicable interest charges. 6. Itemization of taxes and insurance: If the land contract includes provisions for the seller to handle taxes and insurance, the statement itemizes these costs. It includes information on the amount paid for property taxes, homeowners' insurance, and any escrow payments made by the seller on behalf of the purchaser. It is important to note that variations of the San Antonio Texas Contract for Deed Seller's Annual Accounting Statement may exist to accommodate specific contractual arrangements or state-mandated requirements. However, the core purpose and content of the document typically remain consistent across different versions.