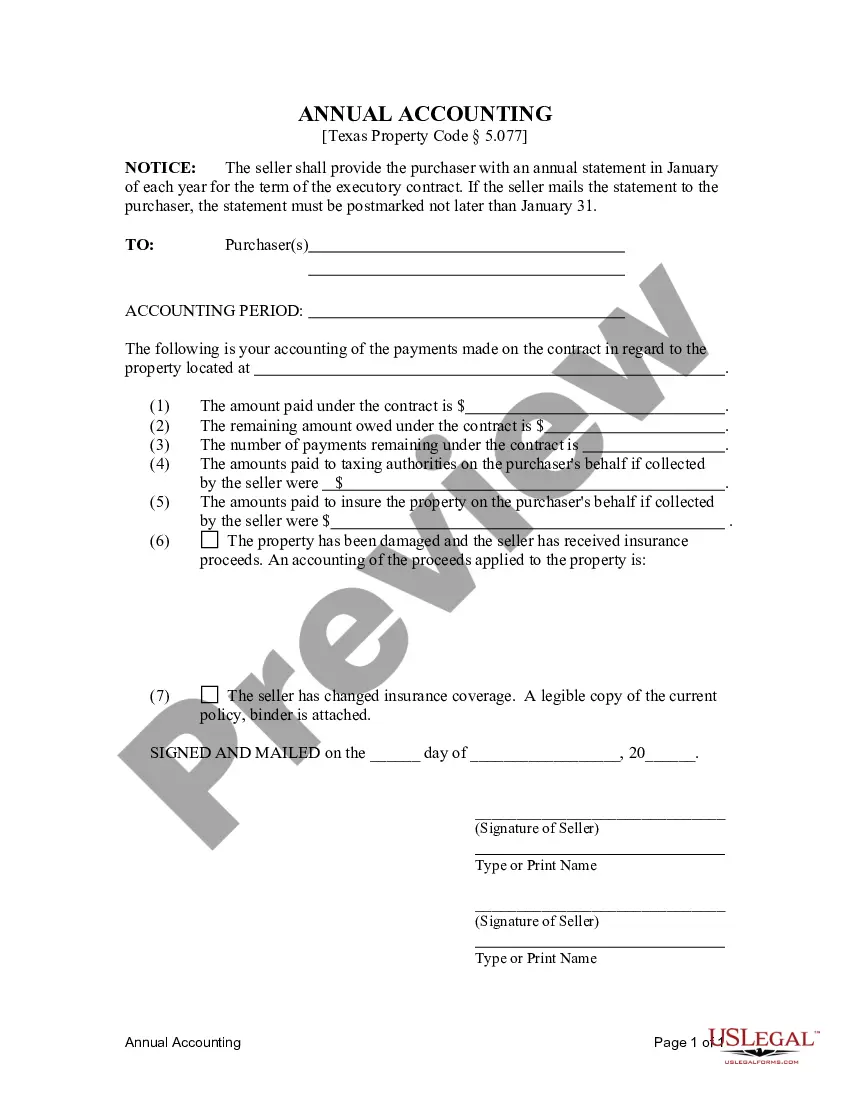

This is a Seller's Annual Accounting Statement notifying the Purchaser of the number and amount of payments received toward contract for deed's purchase price and interest. This document is provided annually by Seller to Purchaser.

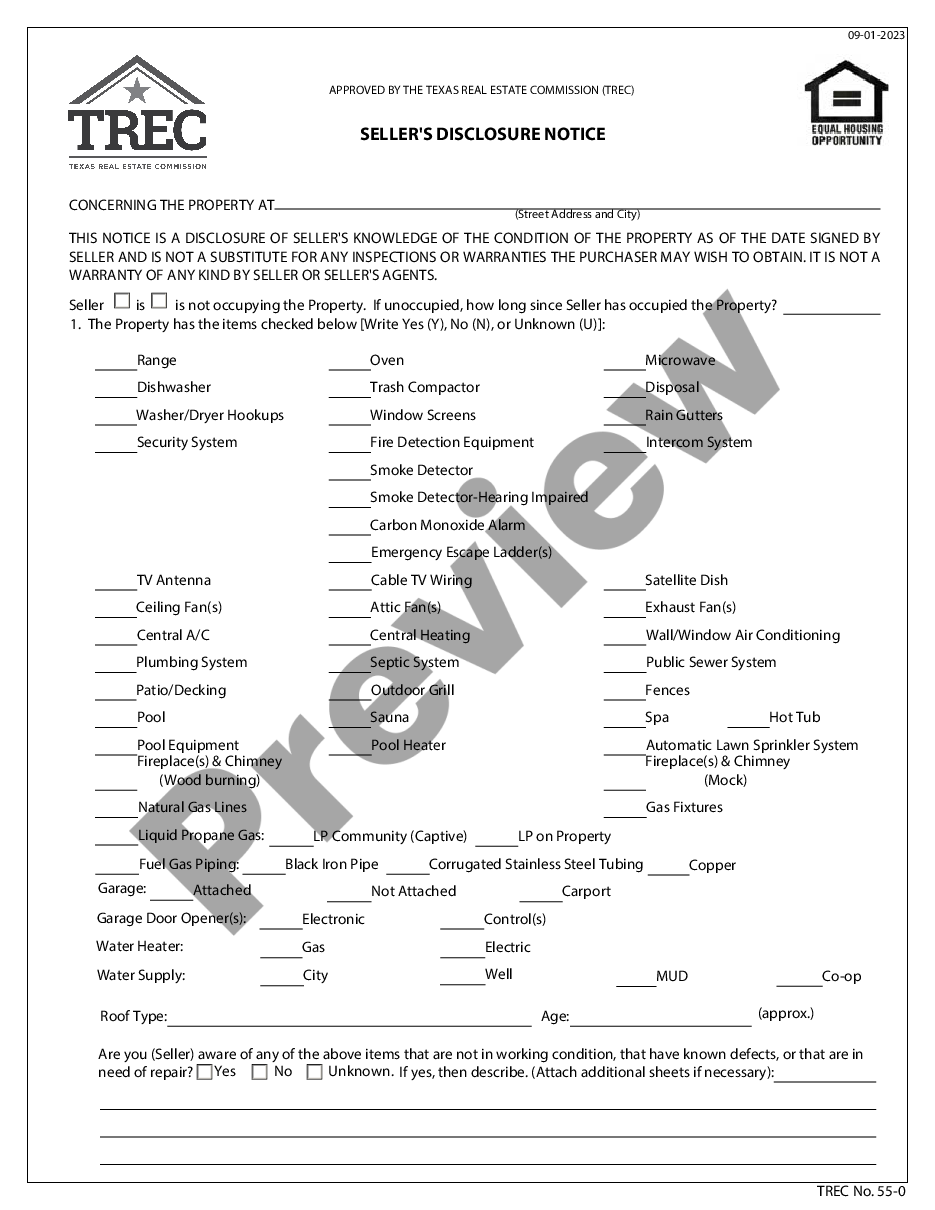

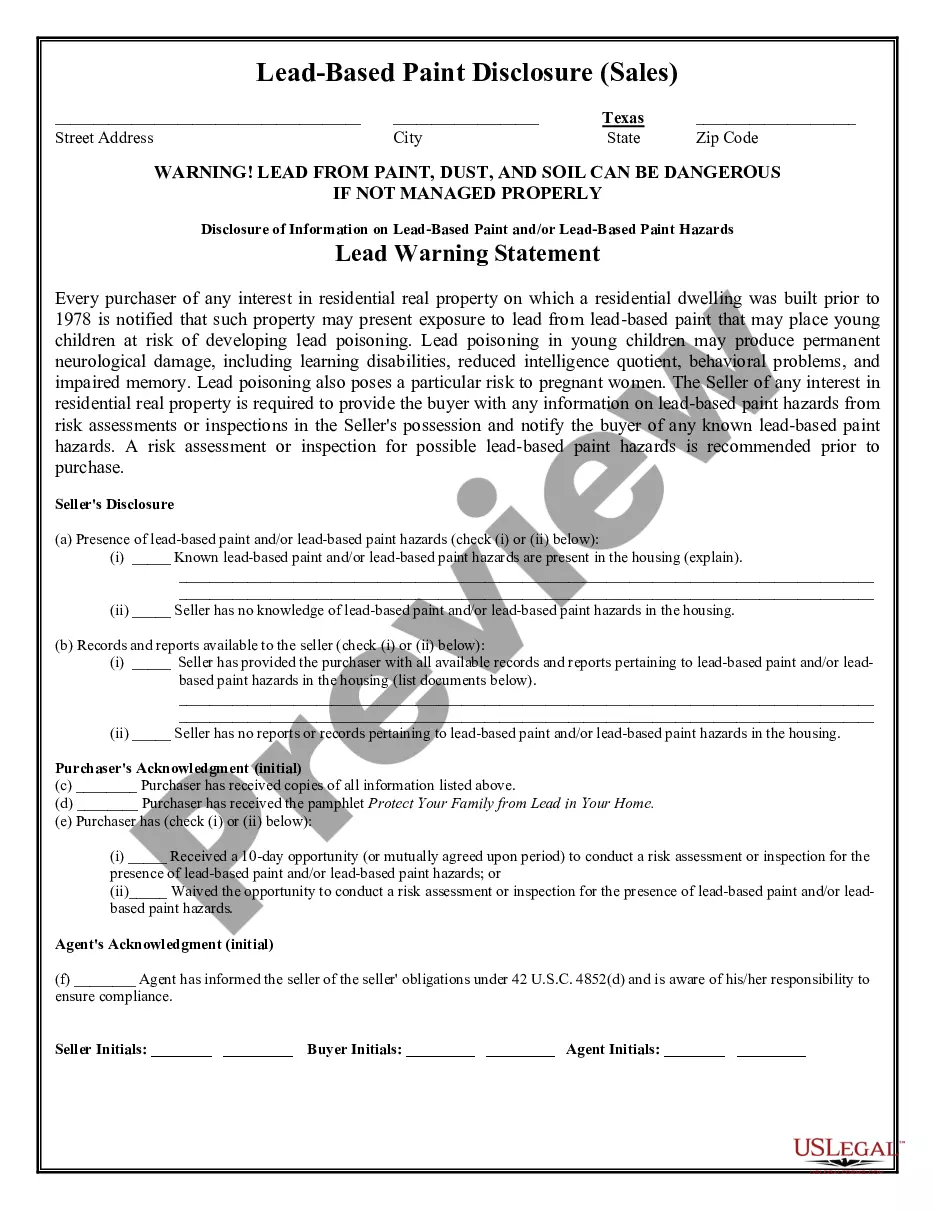

The Wichita Falls Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is an essential document when engaging in a residential land contract or executory contract. This statement serves as a detailed and transparent record of the financial transactions and obligations between the seller and purchaser throughout the year. It outlines the overall financial health and progress of the contract, assuring the purchaser of the seller's commitment to fulfilling contractual obligations. In the context of a Wichita Falls Texas Contract for Deed, several specific types of annual accounting statements may be utilized, depending on the nature of the agreement. These variations include: 1. Residential Land Contract Annual Accounting Statement: This statement is specifically tailored for residential land contracts, where the seller provides financing to the purchaser. It details the amount and source of funds received from the purchaser, including down payments and monthly installments. Additionally, it comprehensively lists all expenses related to the property, such as property taxes, insurance premiums, and maintenance costs. 2. Executory Contract Annual Accounting Statement: In the case of an executory contract, where the seller retains legal ownership until the terms of the contract are fulfilled, a different set of accounting rules may apply. This annual accounting statement captures the financial transactions related to the executory contract, including any changes in the terms or conditions and payments made by the purchaser. Regardless of the specific type, a Wichita Falls Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser typically entails the following key components: a. Buyer and Seller Information: It includes the legal names, contact details, and addresses of both the buyer and seller. b. Contract Details: This section provides a summary of the main contract terms, including the purchase price, installment amounts, interest rates (if applicable), and contract duration. c. Payment Summary: The statement showcases a detailed breakdown of all payments made by the buyer to the seller, specifying the amount paid, date, and purpose (e.g., principal, interest, taxes, insurance). d. Credits and Debits: Any adjustments made during the year, such as credits for early payments or debits for late payments, are clearly documented in this section. e. Expenses: All expenses explicitly related to the property, such as property taxes, insurance premiums, and maintenance costs, are accounted for individually. f. Outstanding Balance: The statement includes a clear calculation of the outstanding balance remaining on the contract, considering payments made, interest accrued, and any other relevant adjustments. g. Seller's Certification: The seller signs this section, certifying the accuracy and completeness of the accounting provided in the statement. h. Purchaser's Acknowledgment: The buyer acknowledges receipt of the annual accounting statement by signing this section. The Wichita Falls Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a vital document for ensuring transparency and trust between the seller and purchaser in residential land contracts or executory contracts. Its detailed and comprehensive nature serves to protect both parties' interests, while also fulfilling legal obligations in the state of Texas.The Wichita Falls Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is an essential document when engaging in a residential land contract or executory contract. This statement serves as a detailed and transparent record of the financial transactions and obligations between the seller and purchaser throughout the year. It outlines the overall financial health and progress of the contract, assuring the purchaser of the seller's commitment to fulfilling contractual obligations. In the context of a Wichita Falls Texas Contract for Deed, several specific types of annual accounting statements may be utilized, depending on the nature of the agreement. These variations include: 1. Residential Land Contract Annual Accounting Statement: This statement is specifically tailored for residential land contracts, where the seller provides financing to the purchaser. It details the amount and source of funds received from the purchaser, including down payments and monthly installments. Additionally, it comprehensively lists all expenses related to the property, such as property taxes, insurance premiums, and maintenance costs. 2. Executory Contract Annual Accounting Statement: In the case of an executory contract, where the seller retains legal ownership until the terms of the contract are fulfilled, a different set of accounting rules may apply. This annual accounting statement captures the financial transactions related to the executory contract, including any changes in the terms or conditions and payments made by the purchaser. Regardless of the specific type, a Wichita Falls Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser typically entails the following key components: a. Buyer and Seller Information: It includes the legal names, contact details, and addresses of both the buyer and seller. b. Contract Details: This section provides a summary of the main contract terms, including the purchase price, installment amounts, interest rates (if applicable), and contract duration. c. Payment Summary: The statement showcases a detailed breakdown of all payments made by the buyer to the seller, specifying the amount paid, date, and purpose (e.g., principal, interest, taxes, insurance). d. Credits and Debits: Any adjustments made during the year, such as credits for early payments or debits for late payments, are clearly documented in this section. e. Expenses: All expenses explicitly related to the property, such as property taxes, insurance premiums, and maintenance costs, are accounted for individually. f. Outstanding Balance: The statement includes a clear calculation of the outstanding balance remaining on the contract, considering payments made, interest accrued, and any other relevant adjustments. g. Seller's Certification: The seller signs this section, certifying the accuracy and completeness of the accounting provided in the statement. h. Purchaser's Acknowledgment: The buyer acknowledges receipt of the annual accounting statement by signing this section. The Wichita Falls Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a vital document for ensuring transparency and trust between the seller and purchaser in residential land contracts or executory contracts. Its detailed and comprehensive nature serves to protect both parties' interests, while also fulfilling legal obligations in the state of Texas.