Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

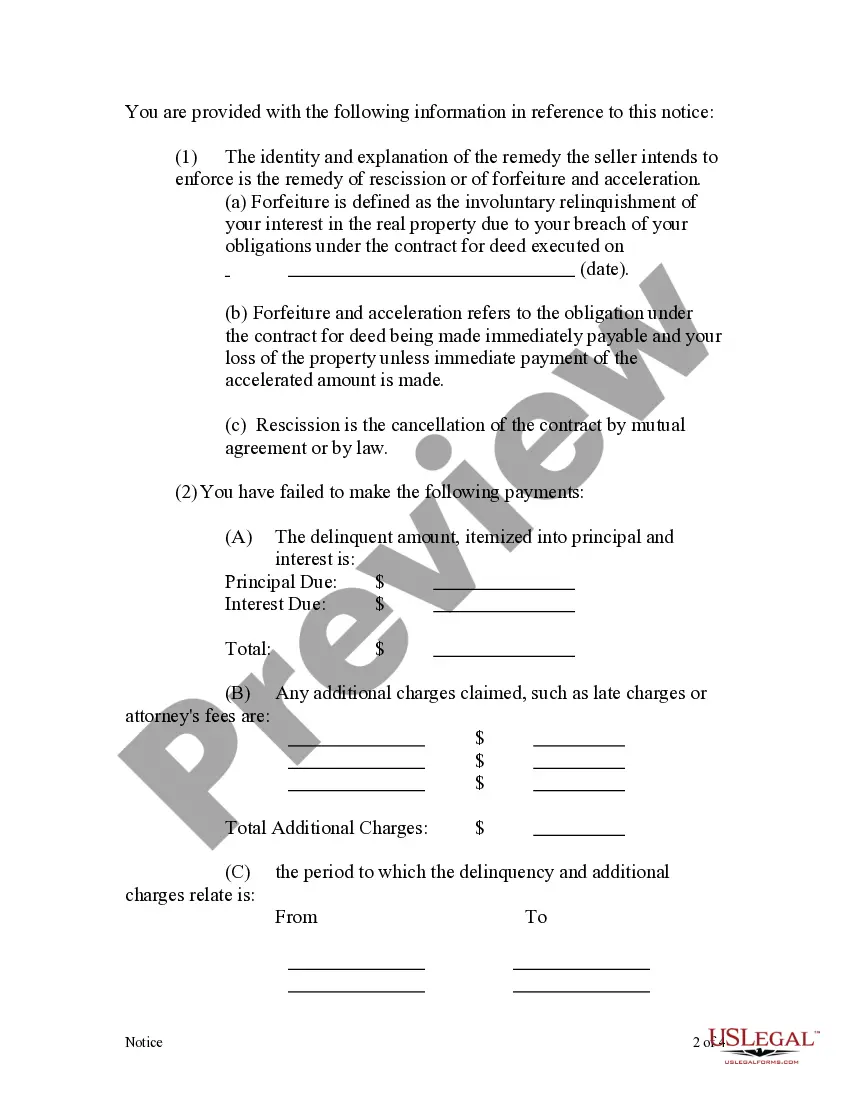

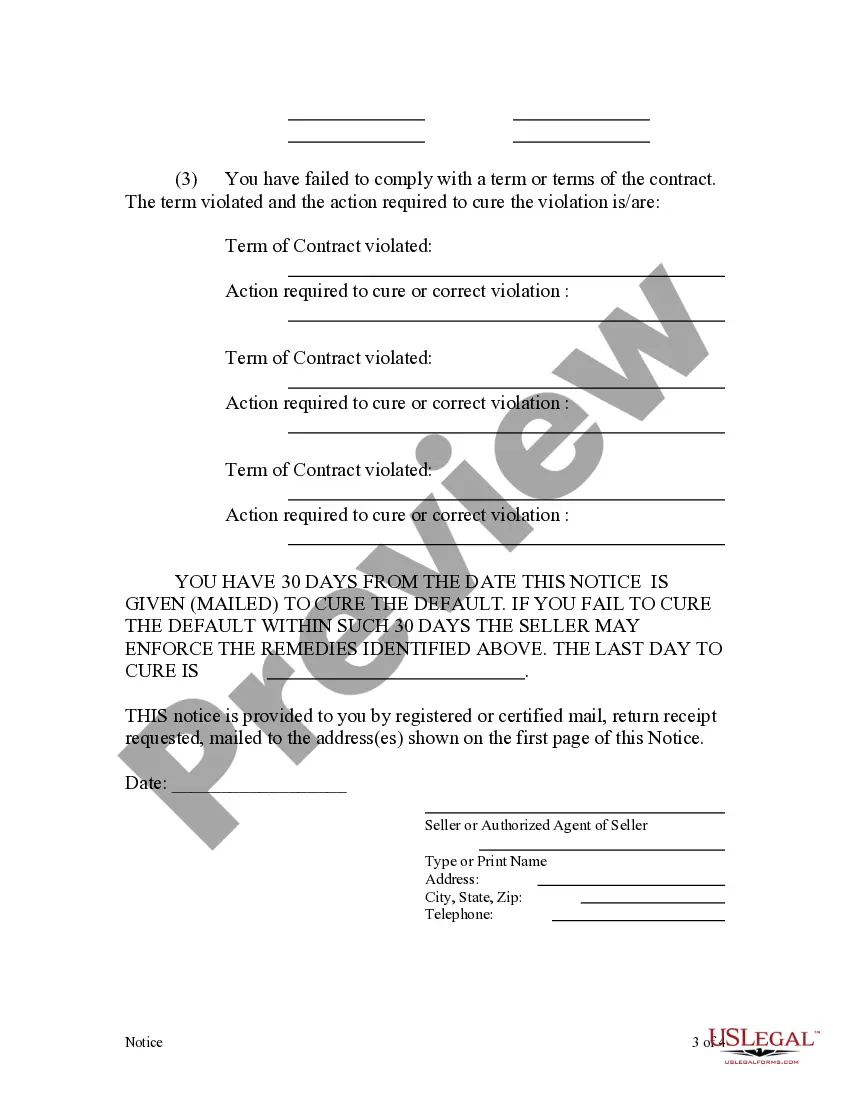

Description: Harris Texas Contract for Deed Notice of Default by Seller to Purchaser When entering into a contract for deed in Harris, Texas, it is crucial for both the seller and purchaser to understand their rights and obligations. Occasionally, unforeseen circumstances arise, and either party may find themselves in default. In such cases, the Harris Texas Contract for Deed Notice of Default by Seller to Purchaser becomes essential to ensure a proper resolution of the situation. The Harris Texas Contract for Deed Notice of Default by Seller to Purchaser serves as a formal communication from the seller to the purchaser, indicating that the purchaser has failed to fulfill their contractual obligations. This notice alerts the purchaser of their default, provides details of the default, and outlines the remedies available to the seller if the default is not remedied within a specified timeframe. Types of Harris Texas Contract for Deed Notice of Default by Seller to Purchaser: 1. Payment Default: This type of default occurs when the purchaser fails to make the agreed-upon payments within the specified time frame. The seller can issue a notice stating the delinquent payment amount and the grace period within which the payment should be made. 2. Property Maintenance Default: In cases where the purchaser neglects to maintain the property as required by the contract, the seller may issue a notice of default. This notice would highlight the specific maintenance obligations that have not been met and provide a timeframe for rectification. 3. Insurance Default: If the purchaser fails to obtain or maintain adequate insurance coverage on the property as stipulated in the contract, the seller can issue a notice of default. The notice would explicitly state the insurance requirements and provide the purchaser with an opportunity to comply within a specified period. 4. Breach of other Terms: Apart from the aforementioned defaults, there may be instances where the purchaser violates other terms and conditions outlined in the contract. These could include restrictions on alterations, failure to obtain necessary permits, or violating zoning regulations. A notice of default would outline the specific breach and the timeframe for remedying the violation. In conclusion, the Harris Texas Contract for Deed Notice of Default by Seller to Purchaser is a legal document used to inform the purchaser of their default in fulfilling contractual obligations. There are various types of defaults that can lead to the issuance of this notice, such as payment default, property maintenance default, insurance default, or breach of other terms. By understanding and adhering to the terms of the contract, both parties can avoid default situations and maintain a mutually beneficial agreement.Description: Harris Texas Contract for Deed Notice of Default by Seller to Purchaser When entering into a contract for deed in Harris, Texas, it is crucial for both the seller and purchaser to understand their rights and obligations. Occasionally, unforeseen circumstances arise, and either party may find themselves in default. In such cases, the Harris Texas Contract for Deed Notice of Default by Seller to Purchaser becomes essential to ensure a proper resolution of the situation. The Harris Texas Contract for Deed Notice of Default by Seller to Purchaser serves as a formal communication from the seller to the purchaser, indicating that the purchaser has failed to fulfill their contractual obligations. This notice alerts the purchaser of their default, provides details of the default, and outlines the remedies available to the seller if the default is not remedied within a specified timeframe. Types of Harris Texas Contract for Deed Notice of Default by Seller to Purchaser: 1. Payment Default: This type of default occurs when the purchaser fails to make the agreed-upon payments within the specified time frame. The seller can issue a notice stating the delinquent payment amount and the grace period within which the payment should be made. 2. Property Maintenance Default: In cases where the purchaser neglects to maintain the property as required by the contract, the seller may issue a notice of default. This notice would highlight the specific maintenance obligations that have not been met and provide a timeframe for rectification. 3. Insurance Default: If the purchaser fails to obtain or maintain adequate insurance coverage on the property as stipulated in the contract, the seller can issue a notice of default. The notice would explicitly state the insurance requirements and provide the purchaser with an opportunity to comply within a specified period. 4. Breach of other Terms: Apart from the aforementioned defaults, there may be instances where the purchaser violates other terms and conditions outlined in the contract. These could include restrictions on alterations, failure to obtain necessary permits, or violating zoning regulations. A notice of default would outline the specific breach and the timeframe for remedying the violation. In conclusion, the Harris Texas Contract for Deed Notice of Default by Seller to Purchaser is a legal document used to inform the purchaser of their default in fulfilling contractual obligations. There are various types of defaults that can lead to the issuance of this notice, such as payment default, property maintenance default, insurance default, or breach of other terms. By understanding and adhering to the terms of the contract, both parties can avoid default situations and maintain a mutually beneficial agreement.