Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

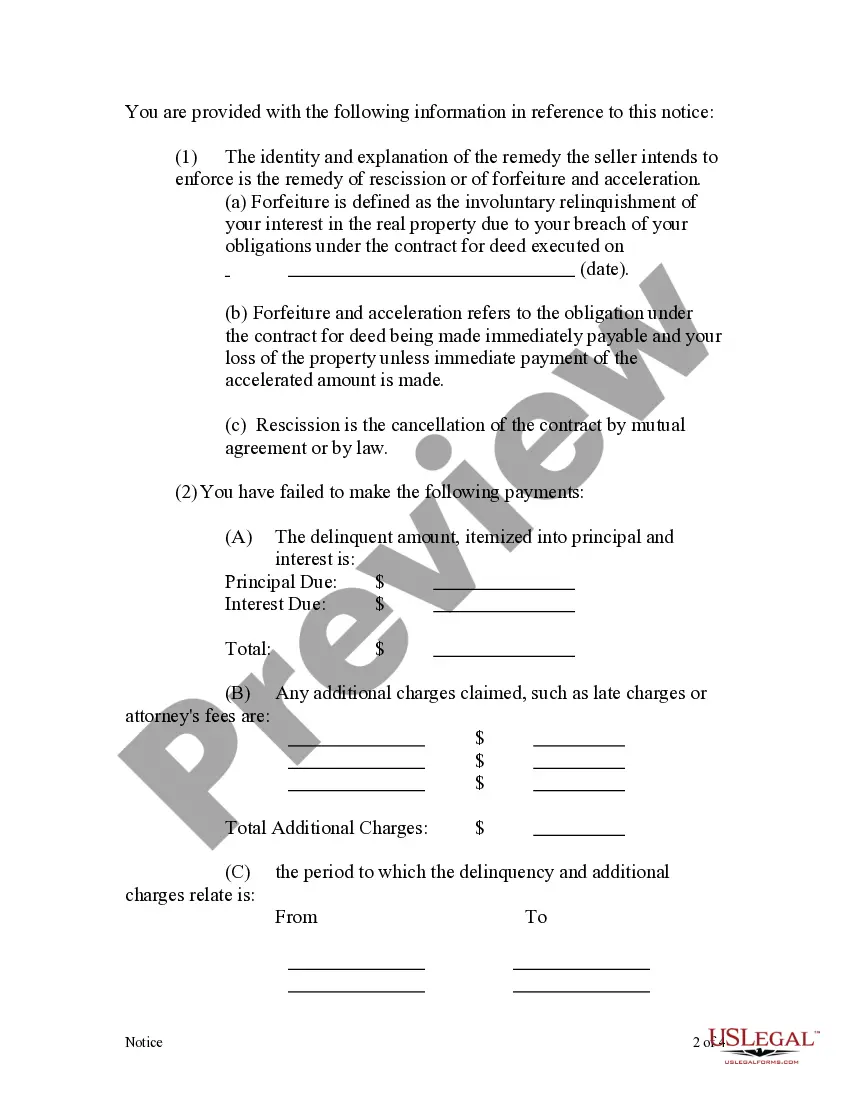

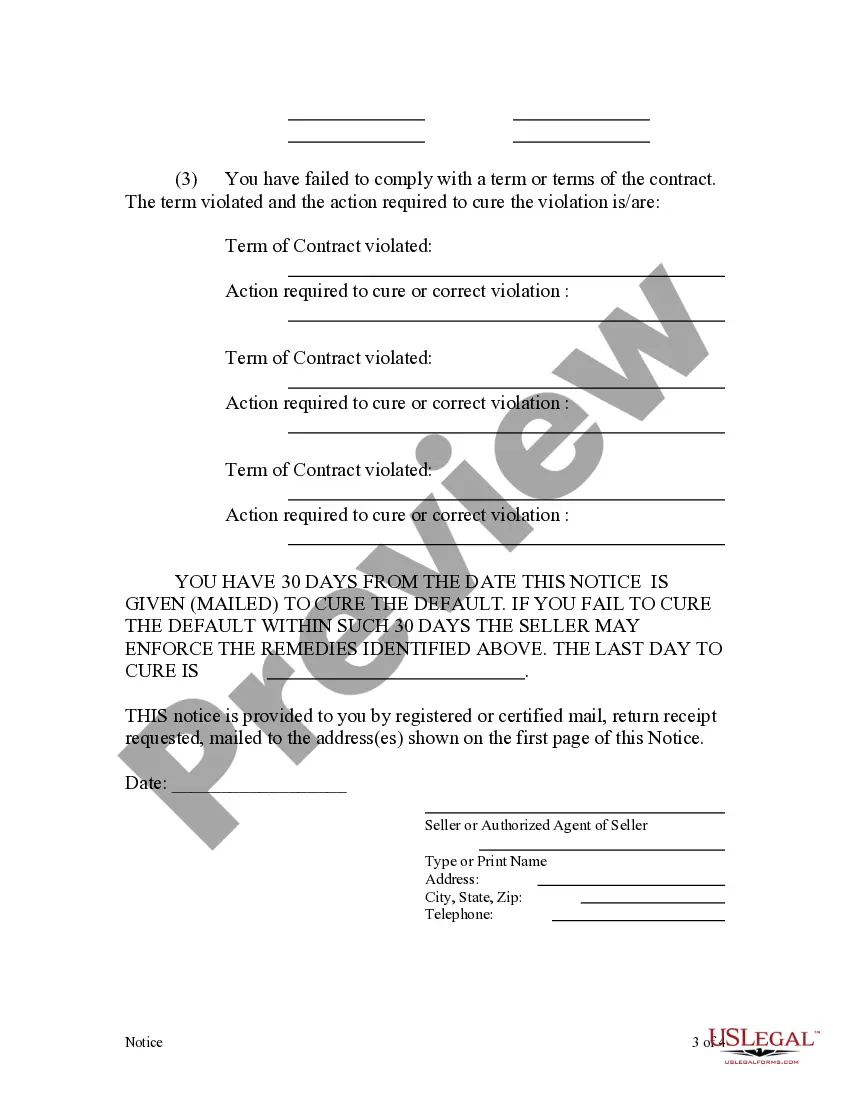

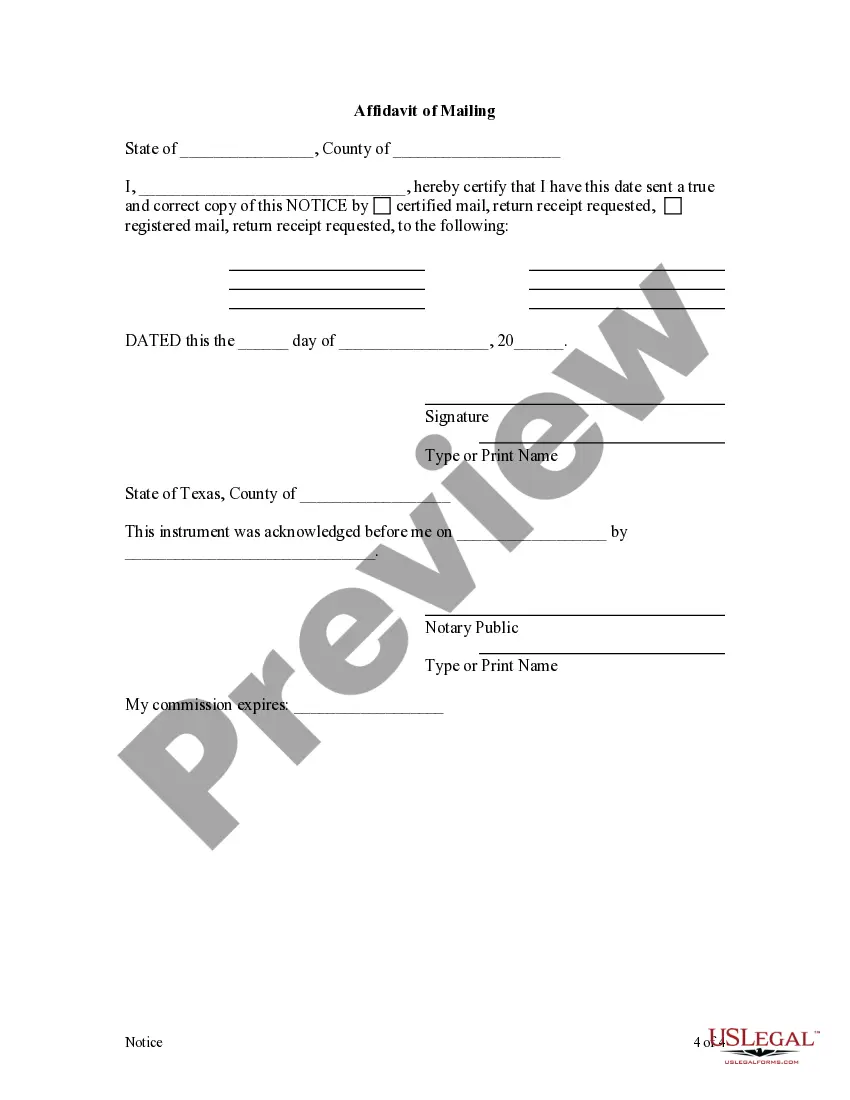

Title: Understanding the Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser Description: The Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser serves as a legal document outlining the rights and responsibilities of both the seller and purchaser in the event of default on a contract for deed agreement. This detailed description will discuss the key aspects of this notice and its significance in Laredo's real estate transactions. 1. Definition and Purpose: The Contract for Deed Notice of Default is a formal notification sent by the seller to the purchaser when the latter fails to fulfill the obligations stated in the contract for deed agreement. It serves as a warning that the purchaser's default may lead to the termination of the contract and potential forfeiture of the property. 2. Default Triggers: Various factors can lead to default, such as non-payment of agreed installments, failure to maintain property insurance, unauthorized alterations to the property, or violation of other specific terms laid out in the contract. 3. Notification Process: The seller must ensure compliance with specific guidelines when issuing the Contract for Deed Notice of Default. This includes providing a written notice to the purchaser, clearly outlining the default, and allowing a designated grace period for resolution or cure of the default. 4. Grace Period and Cure: The grace period, as prescribed by Texas state laws, provides the purchaser with an opportunity to address and rectify the default before more serious consequences are enforced. The notice should specify the duration of the grace period, allowing the purchaser to present a course of action to remedy the default within that timeline. 5. Termination Rights: If the default remains unresolved within the grace period, the seller may exercise their right to terminate the contract. Terminating the contract may result in the restoration of the seller's ownership rights and the potential forfeiture of payments made by the purchaser. Types of Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser: 1. Payment Default Notice: This notice is issued when the purchaser fails to make the agreed-upon payment within the specified timeframe, which could include monthly installments, interest payments, and property tax obligations. 2. Insurance Default Notice: When a purchaser fails to maintain the required property insurance or other insurance obligations as per the contract for deed, this notice is issued. 3. Property Condition Default Notice: If the purchaser makes unauthorized alterations to the property or fails to adhere to the specified property maintenance requirements, the seller can issue this notice. In conclusion, the Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser is an essential legal mechanism for protecting the rights of both parties involved in a contract for deed transaction. By understanding the implications and potential consequences of default, parties can navigate their obligations and work towards resolving any issues in a timely manner.Title: Understanding the Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser Description: The Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser serves as a legal document outlining the rights and responsibilities of both the seller and purchaser in the event of default on a contract for deed agreement. This detailed description will discuss the key aspects of this notice and its significance in Laredo's real estate transactions. 1. Definition and Purpose: The Contract for Deed Notice of Default is a formal notification sent by the seller to the purchaser when the latter fails to fulfill the obligations stated in the contract for deed agreement. It serves as a warning that the purchaser's default may lead to the termination of the contract and potential forfeiture of the property. 2. Default Triggers: Various factors can lead to default, such as non-payment of agreed installments, failure to maintain property insurance, unauthorized alterations to the property, or violation of other specific terms laid out in the contract. 3. Notification Process: The seller must ensure compliance with specific guidelines when issuing the Contract for Deed Notice of Default. This includes providing a written notice to the purchaser, clearly outlining the default, and allowing a designated grace period for resolution or cure of the default. 4. Grace Period and Cure: The grace period, as prescribed by Texas state laws, provides the purchaser with an opportunity to address and rectify the default before more serious consequences are enforced. The notice should specify the duration of the grace period, allowing the purchaser to present a course of action to remedy the default within that timeline. 5. Termination Rights: If the default remains unresolved within the grace period, the seller may exercise their right to terminate the contract. Terminating the contract may result in the restoration of the seller's ownership rights and the potential forfeiture of payments made by the purchaser. Types of Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser: 1. Payment Default Notice: This notice is issued when the purchaser fails to make the agreed-upon payment within the specified timeframe, which could include monthly installments, interest payments, and property tax obligations. 2. Insurance Default Notice: When a purchaser fails to maintain the required property insurance or other insurance obligations as per the contract for deed, this notice is issued. 3. Property Condition Default Notice: If the purchaser makes unauthorized alterations to the property or fails to adhere to the specified property maintenance requirements, the seller can issue this notice. In conclusion, the Laredo Texas Contract for Deed Notice of Default by Seller to Purchaser is an essential legal mechanism for protecting the rights of both parties involved in a contract for deed transaction. By understanding the implications and potential consequences of default, parties can navigate their obligations and work towards resolving any issues in a timely manner.