Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser

Description

How to fill out Texas Contract For Deed Notice Of Default By Seller To Purchaser?

Are you in search of a reliable and cost-effective provider of legal forms to obtain the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser? US Legal Forms is your ideal choice.

Whether you need a straightforward agreement to establish rules for living with your partner or a set of documents to facilitate your divorce proceedings in court, we have you covered. Our platform features over 85,000 current legal document templates for personal and business applications. All the templates we provide are specific and tailored to meet the needs of particular states and regions.

To download the form, you must sign in to your account, find the necessary form, and click the Download button next to it. Please take into account that you can access your previously purchased form templates at any time from the My documents section.

Is this your first visit to our platform? No need to worry. You can create an account with great ease, but before doing that, ensure to complete the following.

Now you can set up your account. Then choose the subscription option and advance to payment. Once payment is completed, download the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser in any available format. You can return to the site at any time and redownload the form at no additional cost.

Acquiring current legal documents has never been simpler. Try US Legal Forms today, and forget about wasting your precious time searching for legal documents online once and for all.

- Verify if the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser complies with the laws of your state and local area.

- Review the description of the form (if available) to learn who and what the form is meant for.

- Restart your search if the form does not suit your legal circumstances.

Form popularity

FAQ

To draw up a contract for a deed, begin by outlining the property details, payment terms, and responsibilities of both parties. Clearly state the conditions under which ownership will transfer. It is highly recommended to use a professional service or legal assistance to ensure all legal requirements are met. Online resources like uslegalforms can assist you in crafting a contract that adheres to the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser.

Yes, you can write your own land contract, but it is crucial to ensure it complies with local laws and includes all necessary terms and conditions. Many individuals choose to use templates or legal services to safeguard against potential issues, especially with a complex document like a contract for deed. Using platforms such as uslegalforms can simplify the process by providing tailored contracts that align with the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser.

A deed is a legal document that transfers ownership of property, while a contract for deed is an arrangement where the buyer pays for the property over time without immediate transfer of ownership. In essence, with a contract for deed, the seller retains legal title until the purchaser fulfills certain conditions. Understanding these distinctions can give you clarity on your options in real estate transactions, particularly within the context of the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser.

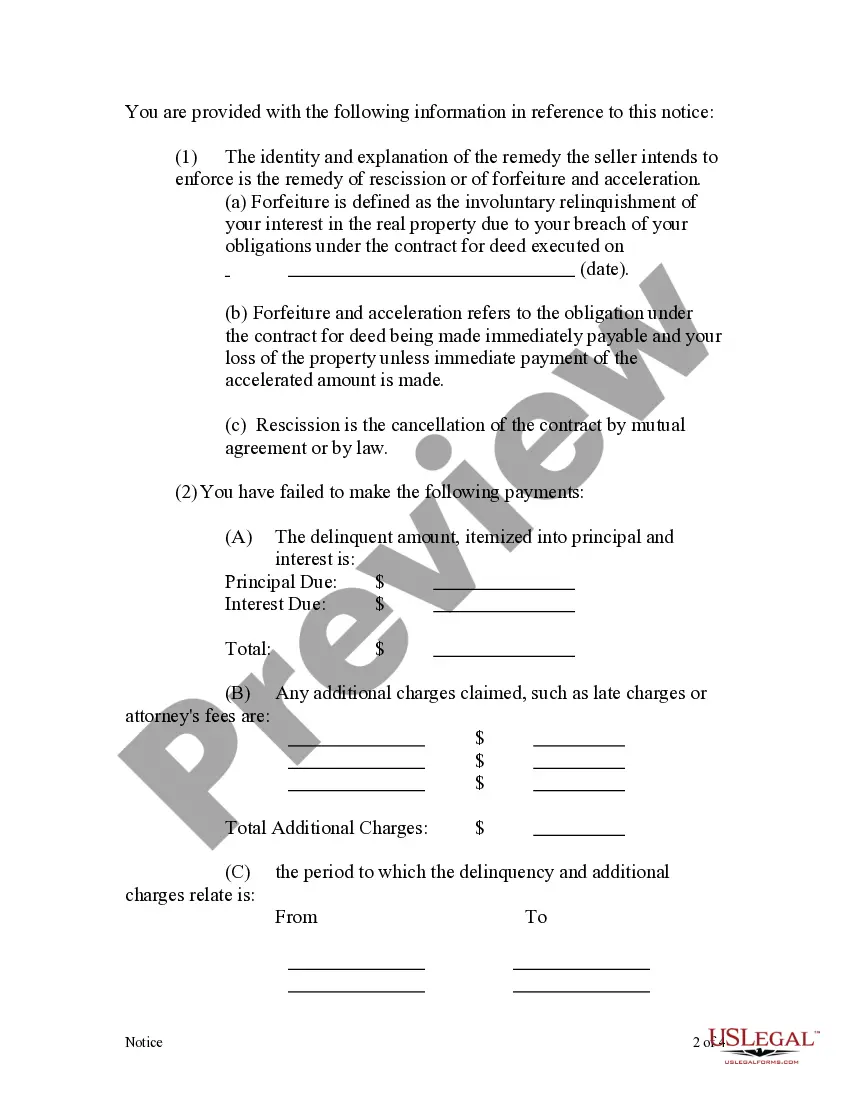

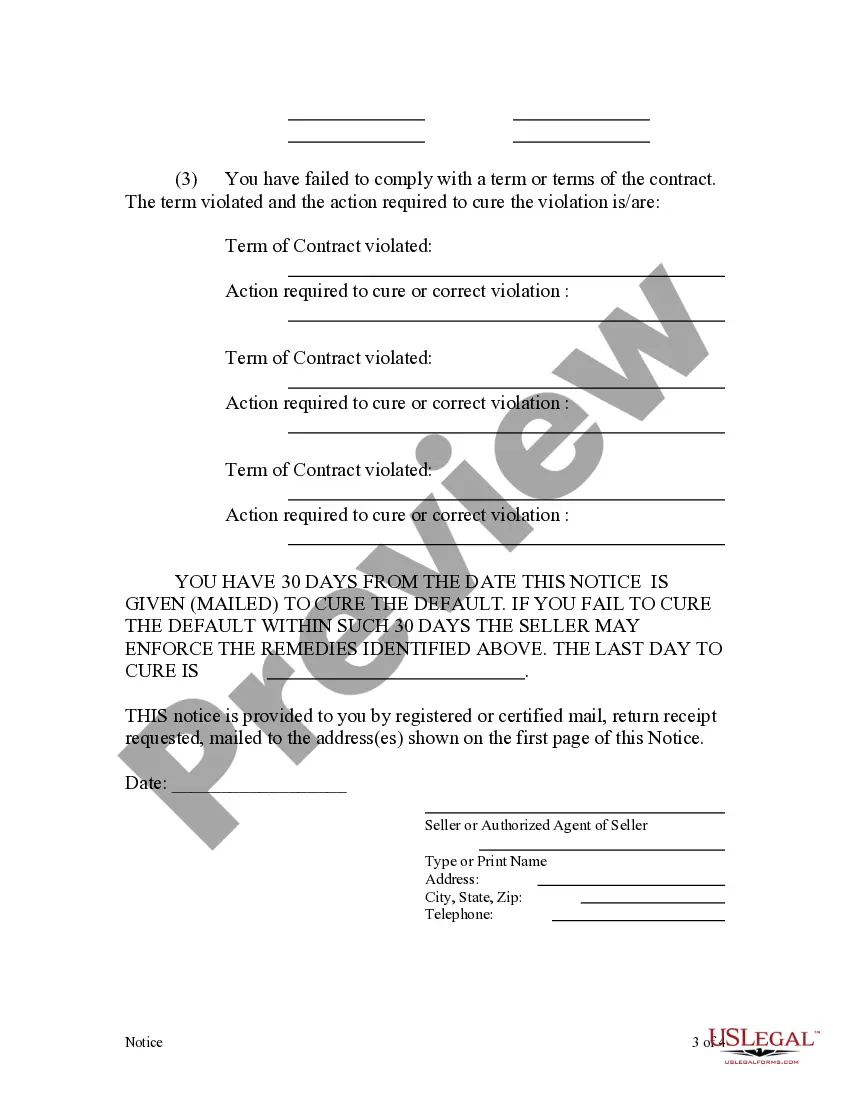

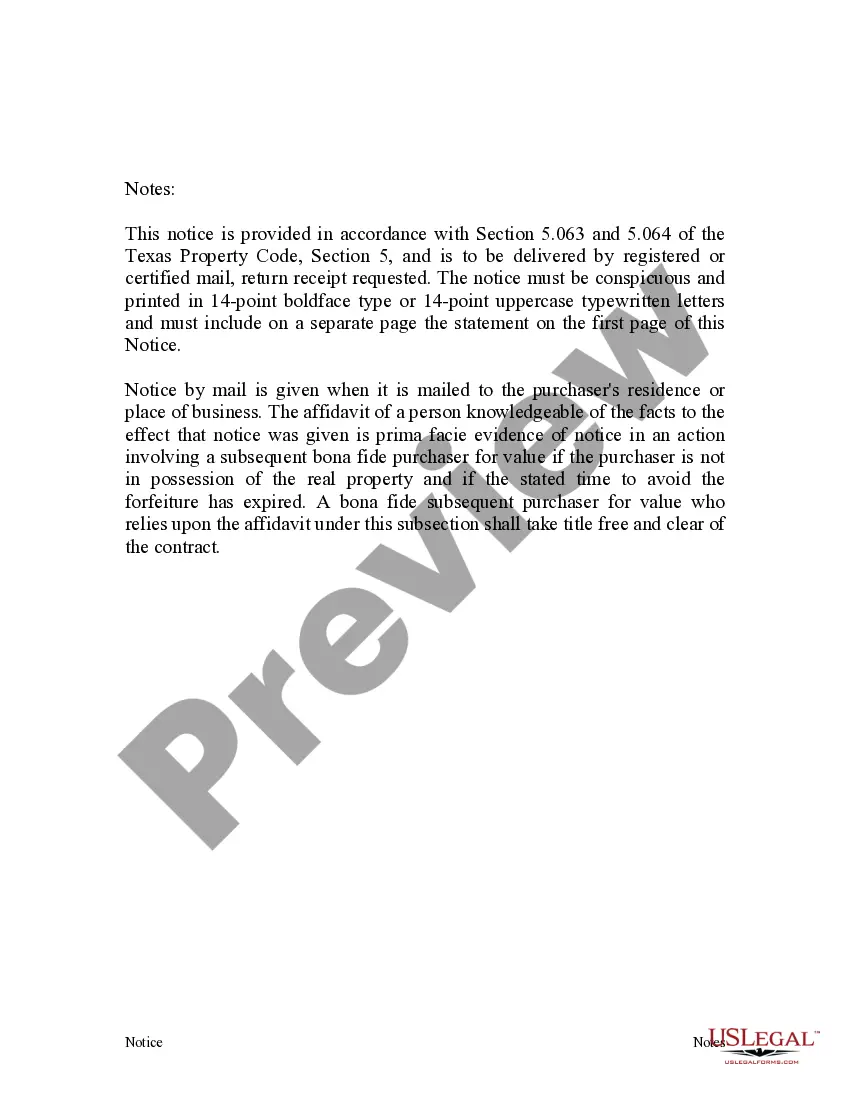

If a contract for deed is in default, the seller must follow specific steps outlined in the contract and Texas law. Typically, this involves providing a formal notice of default to the purchaser, allowing them a chance to rectify the situation within a specific timeframe. Once this period lapses without resolution, the seller can reclaim possession and equitable title to the property. For a comprehensive understanding, consider referencing the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser.

Yes, contracts for deeds are legal in Texas, provided they comply with state laws. Nevertheless, buyers and sellers should understand their rights and obligations under this arrangement. Utilizing resources like the uslegalforms platform can help you find templates and legal guidance to navigate the intricacies of the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser effectively.

Yes, you can execute a contract for deed in Texas. However, it’s important to follow Texas laws and provide all required disclosures to ensure a valid transaction. Be sure to research any requirements specific to your situation, including the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser, to safeguard your interests and uphold legal standards.

One disadvantage of a contract for deed is that the buyer does not hold the title to the property until the final payment is made. This means the seller retains legal ownership, which can be risky for the buyer if the seller defaults or declares bankruptcy. Another disadvantage involves potential difficulties in obtaining financing. Lenders may be hesitant to finance a property sold under a contract for deed, affecting the buyer's future investment options.

When a seller is in default of the terms, the buyer may face risks, including the possibility of losing their investment. The buyer can issue a formal notice of default under the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser, which can lead to legal action if necessary. Engaging legal assistance can help navigate these complexities and determine the best course of action.

Defaulting on a contract for deed can lead to severe consequences for the buyer. The seller can initiate a notice of default and potentially reclaim the property, as detailed in the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser. Buyers must understand their rights and seek a resolution, such as renegotiating terms or addressing overdue payments.

If a seller fails to record the contract for deed in Texas, they may jeopardize their legal standing. The purchaser may not receive clear title to the property, which can complicate ownership rights significantly under the Odessa Texas Contract for Deed Notice of Default by Seller to Purchaser. It is important for both parties to ensure proper recording to protect their interests.