Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

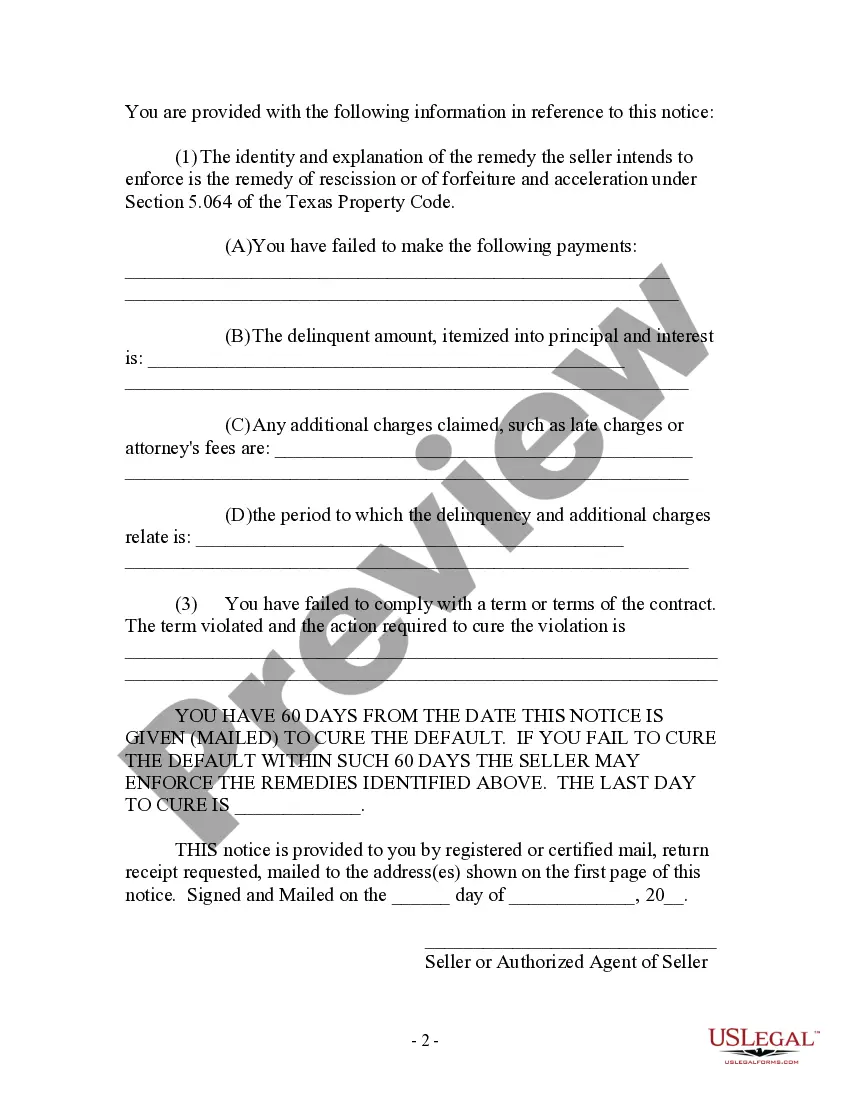

A Brownsville Texas Contract for Deed Notice of Default is an important legal document that arises when a property purchaser fails to meet certain payment obligations outlined in the contract. This notice is issued by the seller to inform the purchaser that they are in default of the contract terms due to either not having paid 40 percent of the agreed purchase price or not completing 48 payments as specified. In this situation, the purchaser has typically entered into a contract for deed agreement, also known as a land contract, installment contract, or agreement for deed. This type of agreement enables the purchaser to make payments towards the purchase of a property directly to the seller, without obtaining a traditional mortgage from a financial institution. If a purchaser fails to meet the required financial milestones of paying 40 percent of the purchase price or completing 48 payments, the seller may issue a Notice of Default. This notice formally notifies the buyer about their default status and provides them with a specific timeframe within which they must rectify the default to avoid potential legal consequences, such as contract termination or foreclosure. Possible variations of Brownsville Texas Contract for Deed Notice of Default by Seller to Purchaser include: 1. Brownsville Texas Contract for Deed Notice of Default — 40 Percent Payment Default: This notice specifically addresses the situation where the purchaser has failed to pay at least 40 percent of the agreed purchase price as per the contract terms. 2. Brownsville Texas Contract for Deed Notice of Default — 48 Payments Default: This notice is issued when the purchaser has not completed the required 48 payments within the stipulated time frame outlined in the contract. It is crucial for both parties involved in a Brownsville Texas Contract for Deed agreement to understand their rights and obligations outlined in the contract terms. Purchasers should be aware of the consequences of failing to meet specific payment milestones, as it can potentially lead to the issuance of a Notice of Default. It is recommended that both parties seek legal advice to navigate through any conflicts or issues that may arise during the contract period.