Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

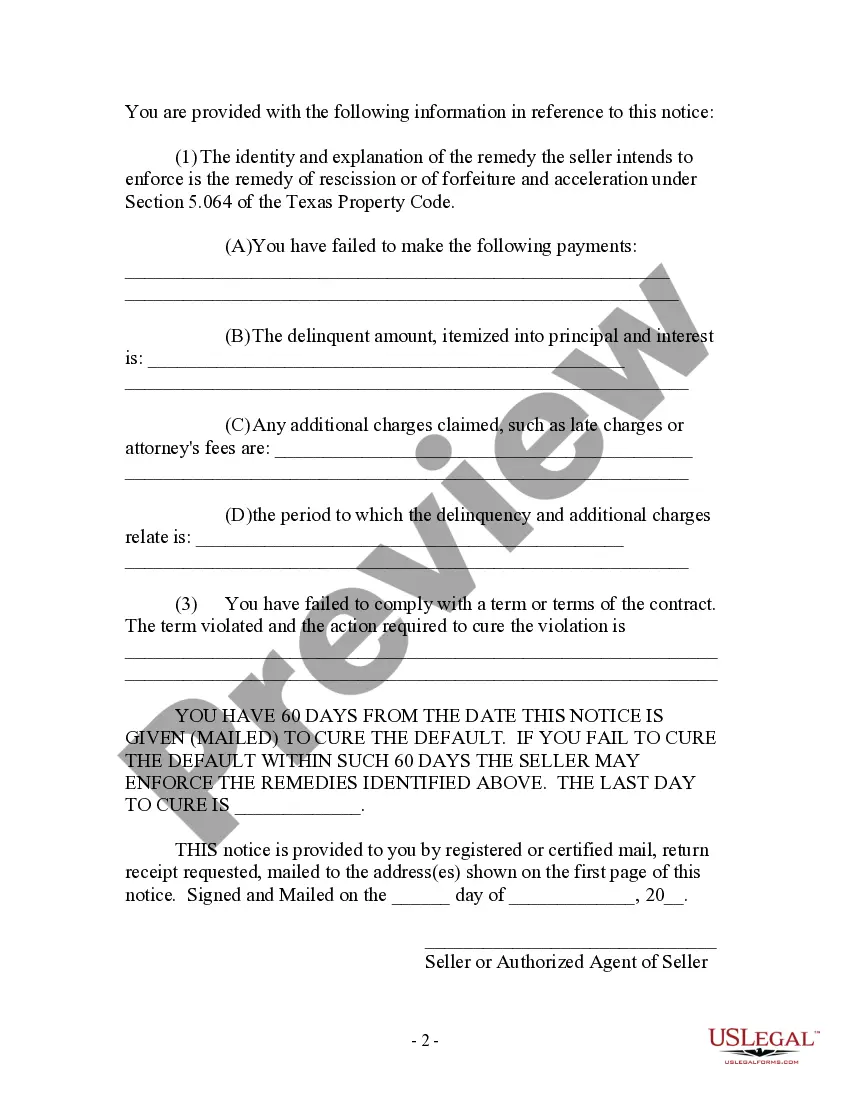

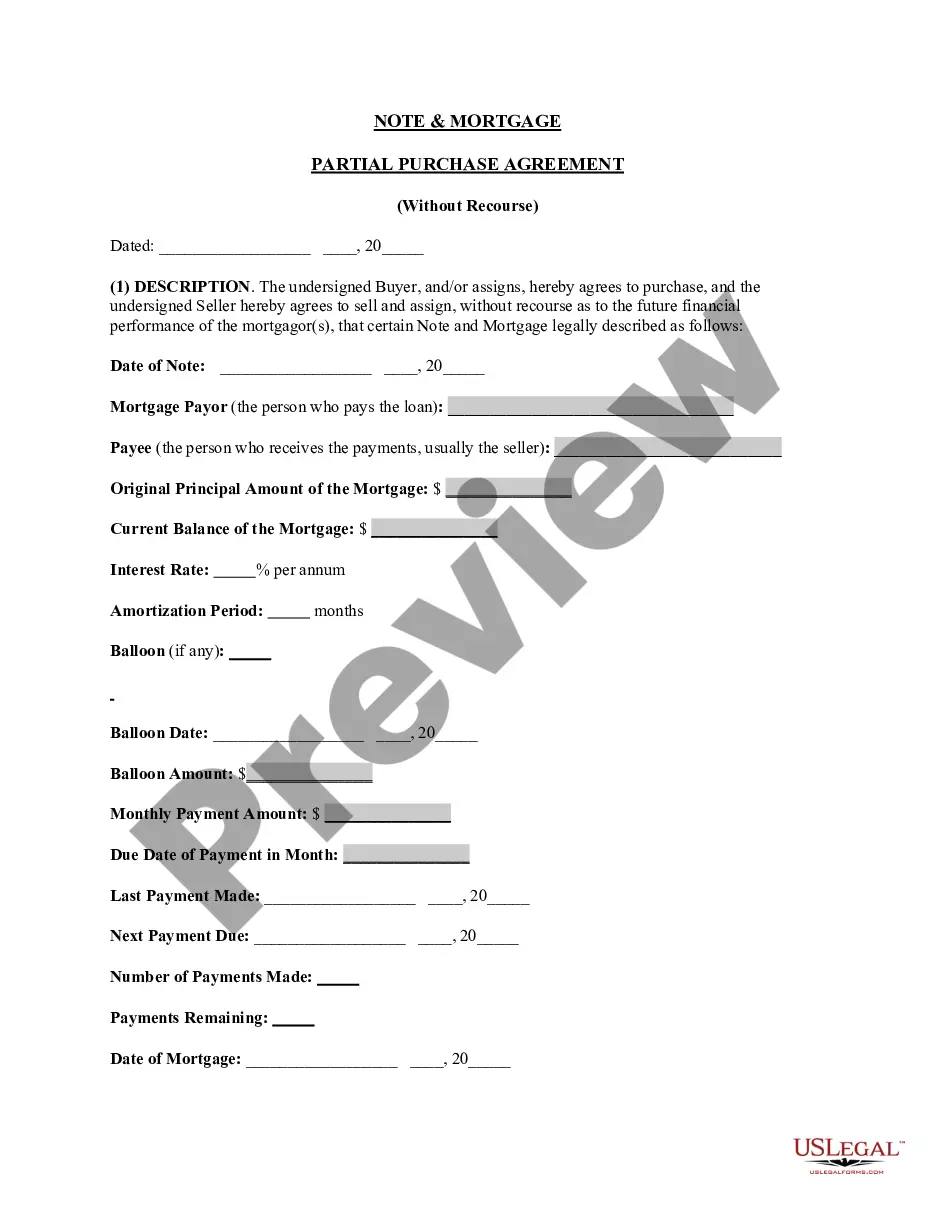

Houston Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments

Description

How to fill out Texas Contract For Deed Notice Of Default By Seller To Purchaser Where Purchaser Paid 40 Percent Or Made 48 Payments?

Utilize the US Legal Forms and gain immediate access to any form template you desire.

Our helpful website features thousands of documents, enabling you to locate and obtain nearly any document sample you may require.

You can save, fill out, and validate the Houston Texas Contract for Deed Notice of Default by Seller to Purchaser, where the Purchaser has paid 40 percent or completed 48 payments in just a few minutes, rather than spending hours online searching for a suitable template.

Using our catalog is a fantastic method to enhance the security of your form submissions.

Navigate to the page with the template you need.

Ensure it is the correct template: check its title and description, and use the Preview function if available. If not, use the Search field to locate the desired one.

- Our experienced legal specialists frequently evaluate all records to ensure that the templates are suitable for a specific area and adhere to current laws and regulations.

- How can you obtain the Houston Texas Contract for Deed Notice of Default by Seller to Purchaser, where the Purchaser has paid 40 percent or completed 48 payments.

- If you possess a profile, simply Log In to your account. The Download option will be activated for all the documents you access.

- Moreover, you can retrieve all previously saved records from the My documents menu.

- If you have not yet registered a profile, follow these steps.

Form popularity

FAQ

They are split between the buyer and the seller and can sometimes be negotiable. Usually, the homebuyer pays somewhere between 2 to 5 percent of the purchase price, but this varies by situation. There are many factors that impact closing costs, two main ones being the location and the property's assigned value.

The buyer on a recorded executory contract gets the warranties that would come with a general warranty deed unless otherwise limited by the contract. Id. The seller that fails to transfer recorded, legal title after receipt of final payment can be subject to large liquidated damages statutory penalties. Id.

A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

Cancelling for any reason: When you sign, the seller must inform you of your right to cancel for any reason within 14 days of signing. If you cancel, the notice must be written, signed, dated, and include the date of cancellation. Send it by certified mail, or hand deliver it to the seller (get receipt for delivery!).

While a buyer can use any form of written notice to terminate the contract, a buyer's agent asked to help the buyer give the appropriate notice should use the promulgated form.

Buyers have closing costs as well as sellers. In addition to the down payment for their loan, they often will pay another 2-3% of the sales price. Because of this, it is not uncommon for the buyer to request that you give them a credit at settlement to help cover their closing costs.

1. What is a Deed of Sale? A Deed of Sale is a contract where the seller delivers property to the buyer and the buyer pays the purchase price. The Deed of Sale results in ownership over the property being transferred to the buyer upon its delivery.

Who Pays Closing Costs in Colorado? As mentioned, buyers usually pay most of the closing costs on home sales. Colorado is the 15th priciest state when it comes to closing costs.

?Most definitely,? says Denise Supplee, operations director of SparkRental. That's because in the laws governing real estate transactions, there's something called a ?specific performance? provision. This entitles buyers to force the seller to honor their obligations under the contract.

Canceling a Door-to-Door Sale To obtain a full refund, you must do this before midnight of the third business day after the sale. Keep a copy of the form. Even if you miss the three-day deadline, your sale may be void if the salesperson failed to make certain disclosures or if certain other conditions are met. See Tex.