Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

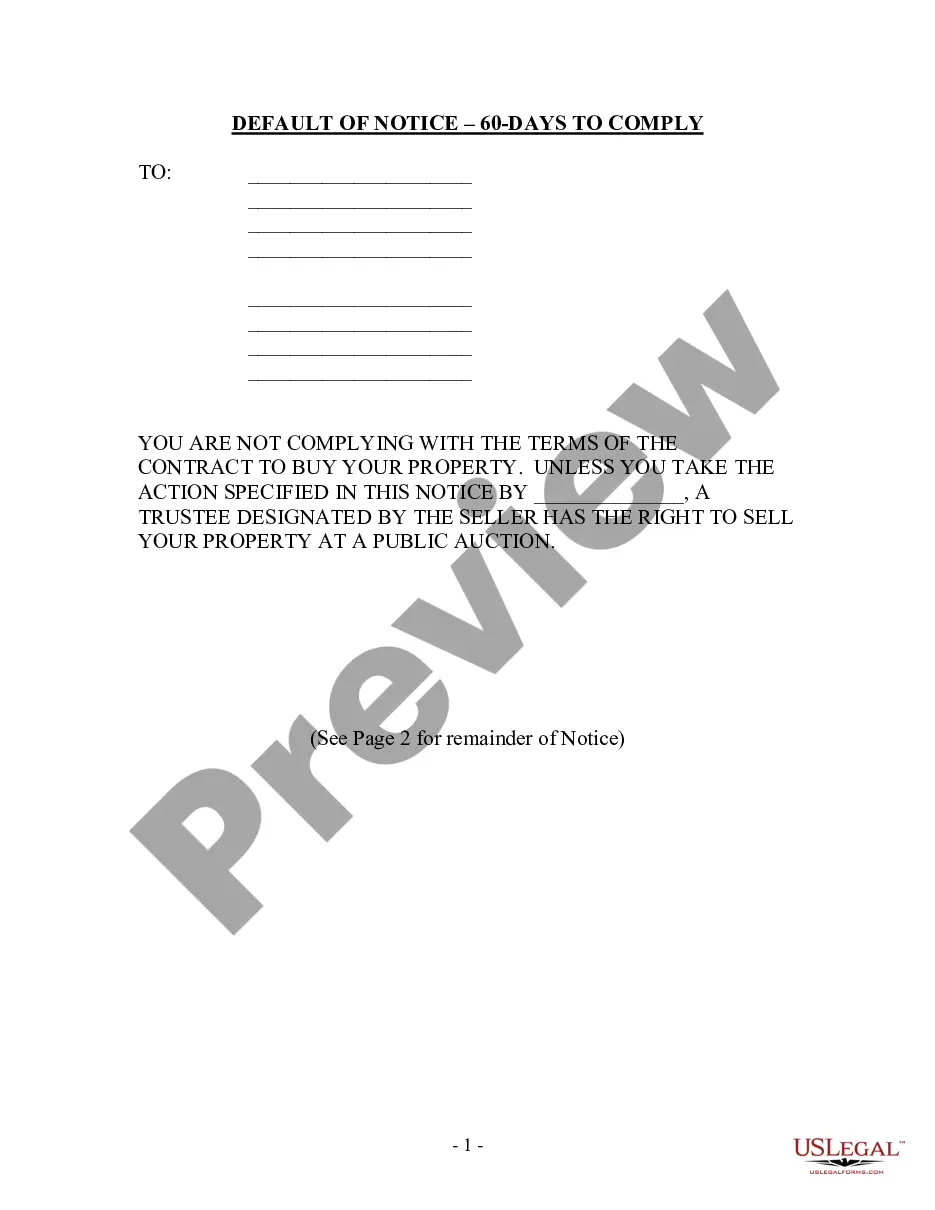

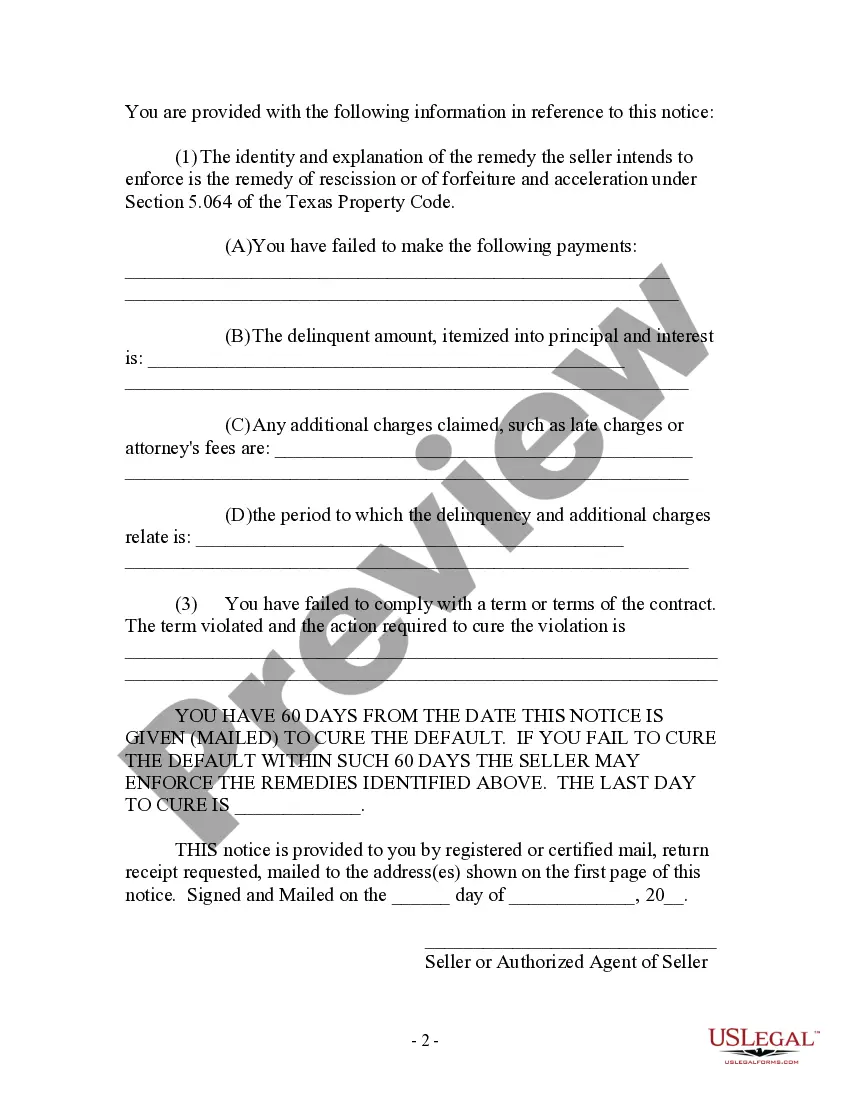

In San Antonio, Texas, a Contract for Deed is a legal agreement between a seller and a purchaser that allows the purchaser to buy a property over an extended period of time by making regular installment payments, rather than obtaining traditional financing. This arrangement can be beneficial for individuals who may not qualify for a mortgage or prefer an alternative method of property acquisition. When the purchaser has paid 40 percent of the total purchase price or has made 48 consecutive payments as stipulated in the Contract for Deed, they have achieved a significant milestone in the payment process. At this point, the seller may issue a Notice of Default to the purchaser if the latter fails to fulfill their obligations outlined in the agreement. The Notice of Default serves as a formal communication from the seller to the purchaser, indicating that the purchaser is in breach of the contract due to non-payment or other violations of the terms and conditions. The notice aims to inform the purchaser of their default status and presents specific remedies or actions required for them to rectify the situation. There might be several types of San Antonio Texas Contract for Deed Notice of Default by Seller to Purchaser where the purchaser has either paid 40 percent or made 48 payments. While the specific names or classifications of these defaults may vary, they generally pertain to different circumstances of the default event. These may include: 1. Late Payment Default: This type of default occurs when the purchaser fails to make their payment by the agreed-upon due date. The seller may issue a Notice of Default to the purchaser if they consistently fail to make timely payments. 2. Delinquency Default: In this scenario, the purchaser falls behind on their payment schedule, whether due to financial hardship or other reasons. A Notice of Default may be issued when the delinquency period reaches a certain threshold, typically outlined in the contract. 3. Breach of Contract Default: This type of default includes violations of any other terms and conditions established in the Contract for Deed, aside from payment-related matters. For example, failure to maintain the property, unauthorized alterations, or failure to pay property taxes can be grounds for a Notice of Default. 4. Non-Compliance Default: If the purchaser fails to fulfill any additional responsibilities outlined in the contract, such as obtaining homeowners insurance, adhering to zoning regulations, or obtaining proper licenses or permits, the seller may issue a Notice of Default. Regardless of the specific type of default, the Notice of Default serves as a formal warning to the purchaser, providing them an opportunity to cure the default condition within a specified period. The notice typically outlines the steps the purchaser must take to resolve the default, including the required actions, timelines, and potential consequences if they fail to rectify the situation. It's worth noting that the exact terminology, procedures, and remedies may vary based on the specific language and provisions of the Contract for Deed and applicable state and local laws. Therefore, it is crucial for both parties to thoroughly review the contract and seek legal advice if necessary to ensure a comprehensive understanding of their rights and obligations.In San Antonio, Texas, a Contract for Deed is a legal agreement between a seller and a purchaser that allows the purchaser to buy a property over an extended period of time by making regular installment payments, rather than obtaining traditional financing. This arrangement can be beneficial for individuals who may not qualify for a mortgage or prefer an alternative method of property acquisition. When the purchaser has paid 40 percent of the total purchase price or has made 48 consecutive payments as stipulated in the Contract for Deed, they have achieved a significant milestone in the payment process. At this point, the seller may issue a Notice of Default to the purchaser if the latter fails to fulfill their obligations outlined in the agreement. The Notice of Default serves as a formal communication from the seller to the purchaser, indicating that the purchaser is in breach of the contract due to non-payment or other violations of the terms and conditions. The notice aims to inform the purchaser of their default status and presents specific remedies or actions required for them to rectify the situation. There might be several types of San Antonio Texas Contract for Deed Notice of Default by Seller to Purchaser where the purchaser has either paid 40 percent or made 48 payments. While the specific names or classifications of these defaults may vary, they generally pertain to different circumstances of the default event. These may include: 1. Late Payment Default: This type of default occurs when the purchaser fails to make their payment by the agreed-upon due date. The seller may issue a Notice of Default to the purchaser if they consistently fail to make timely payments. 2. Delinquency Default: In this scenario, the purchaser falls behind on their payment schedule, whether due to financial hardship or other reasons. A Notice of Default may be issued when the delinquency period reaches a certain threshold, typically outlined in the contract. 3. Breach of Contract Default: This type of default includes violations of any other terms and conditions established in the Contract for Deed, aside from payment-related matters. For example, failure to maintain the property, unauthorized alterations, or failure to pay property taxes can be grounds for a Notice of Default. 4. Non-Compliance Default: If the purchaser fails to fulfill any additional responsibilities outlined in the contract, such as obtaining homeowners insurance, adhering to zoning regulations, or obtaining proper licenses or permits, the seller may issue a Notice of Default. Regardless of the specific type of default, the Notice of Default serves as a formal warning to the purchaser, providing them an opportunity to cure the default condition within a specified period. The notice typically outlines the steps the purchaser must take to resolve the default, including the required actions, timelines, and potential consequences if they fail to rectify the situation. It's worth noting that the exact terminology, procedures, and remedies may vary based on the specific language and provisions of the Contract for Deed and applicable state and local laws. Therefore, it is crucial for both parties to thoroughly review the contract and seek legal advice if necessary to ensure a comprehensive understanding of their rights and obligations.