Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

Travis Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments

Description

How to fill out Texas Contract For Deed Notice Of Default By Seller To Purchaser Where Purchaser Paid 40 Percent Or Made 48 Payments?

If you have previously utilized our service, sign in to your account and retrieve the Travis Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser has disbursed 40 percent or made 48 installments on your device by clicking the Download button. Ensure that your subscription is active. Otherwise, renew it according to your payment schedule.

If this is your inaugural experience with our service, follow these straightforward steps to acquire your document.

You have continuous access to all documents you have purchased: you can find them in your profile within the My documents menu whenever you need to access them again. Leverage the US Legal Forms service to quickly discover and save any template for your personal or business requirements!

- Ensure you’ve found a suitable document. Browse the description and utilize the Preview feature, if available, to confirm if it suits your needs. If it doesn’t meet your criteria, use the Search tab above to discover the correct one.

- Purchase the template. Hit the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to finalize the transaction.

- Download your Travis Texas Contract for Deed Notice of Default by Seller to Purchaser where Purchaser paid 40 percent or made 48 payments. Select the file format for your document and store it on your device.

- Complete your sample. Print it out or utilize professional online editors to fill it out and sign it electronically.

Form popularity

FAQ

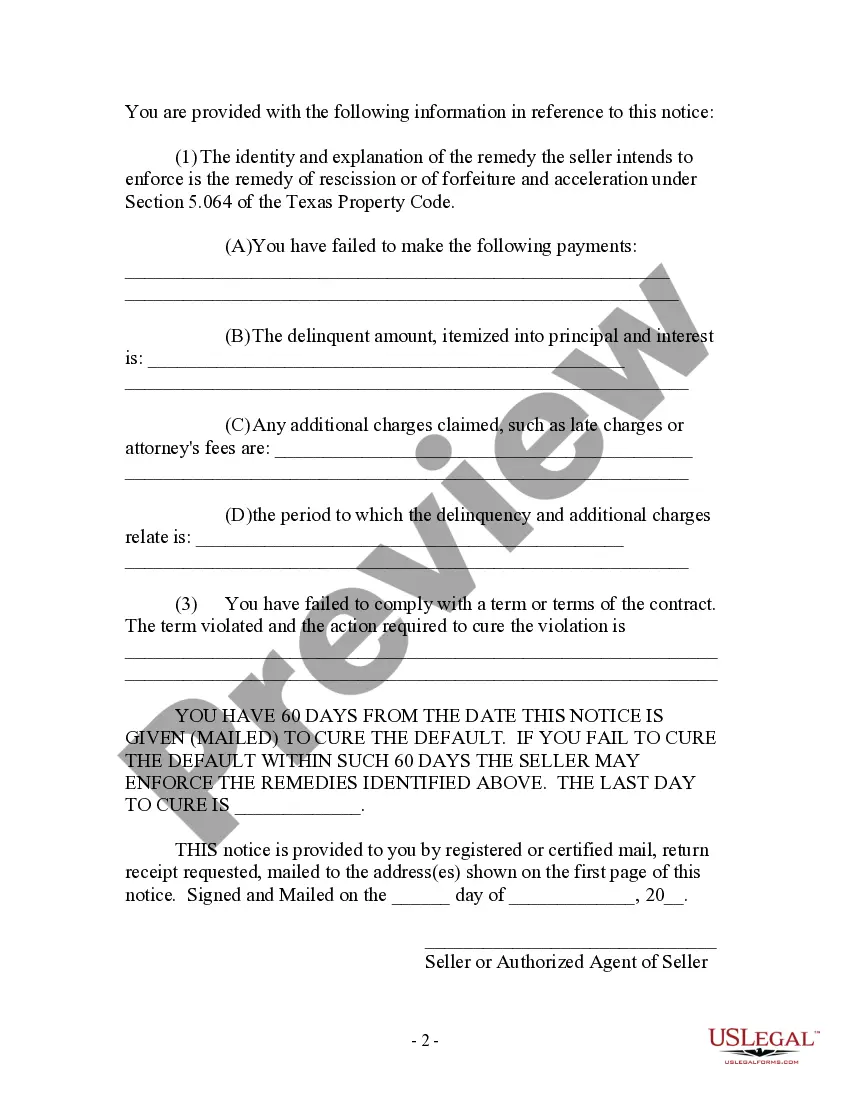

The 40 or 48 rule in Texas refers to the idea that a buyer who has made at least 40% of the payments or has completed 48 payments on a property is likely entitled to certain legal protections. If a buyer defaults after reaching these thresholds, sellers must provide a formal notice before taking any further steps. This concept helps protect buyers and ensures fair treatment in the Travis Texas Contract for Deed process. Understanding this rule can be essential for both parties in a contract.

If a seller does not record the Travis Texas Contract for Deed, they may face significant legal challenges. Recording the contract protects the seller's interest and establishes their claim to the property. Without proper documentation, buyers might not recognize the seller's rights, potentially leading to disputes. It is crucial for sellers to record the contract to ensure their rights are upheld.

Under Texas law, a forged deed is void. However, a deed procured by fraud is voidable rather than void. The legal terms ?Void? and ?Voidable? sound alike, but they are vastly different. A void instrument passes no title, and is treated as a nullity.

Yes. A seller can back out of an accepted offer or before closing, as long as there are no specific clauses that state otherwise.

Contracts for deed and leases combined with an option to purchase residential property are strictly regulated in Texas by Subchapter D of Chapter 5 of the Texas Property Code (hereinafter ?Subchapter D?).

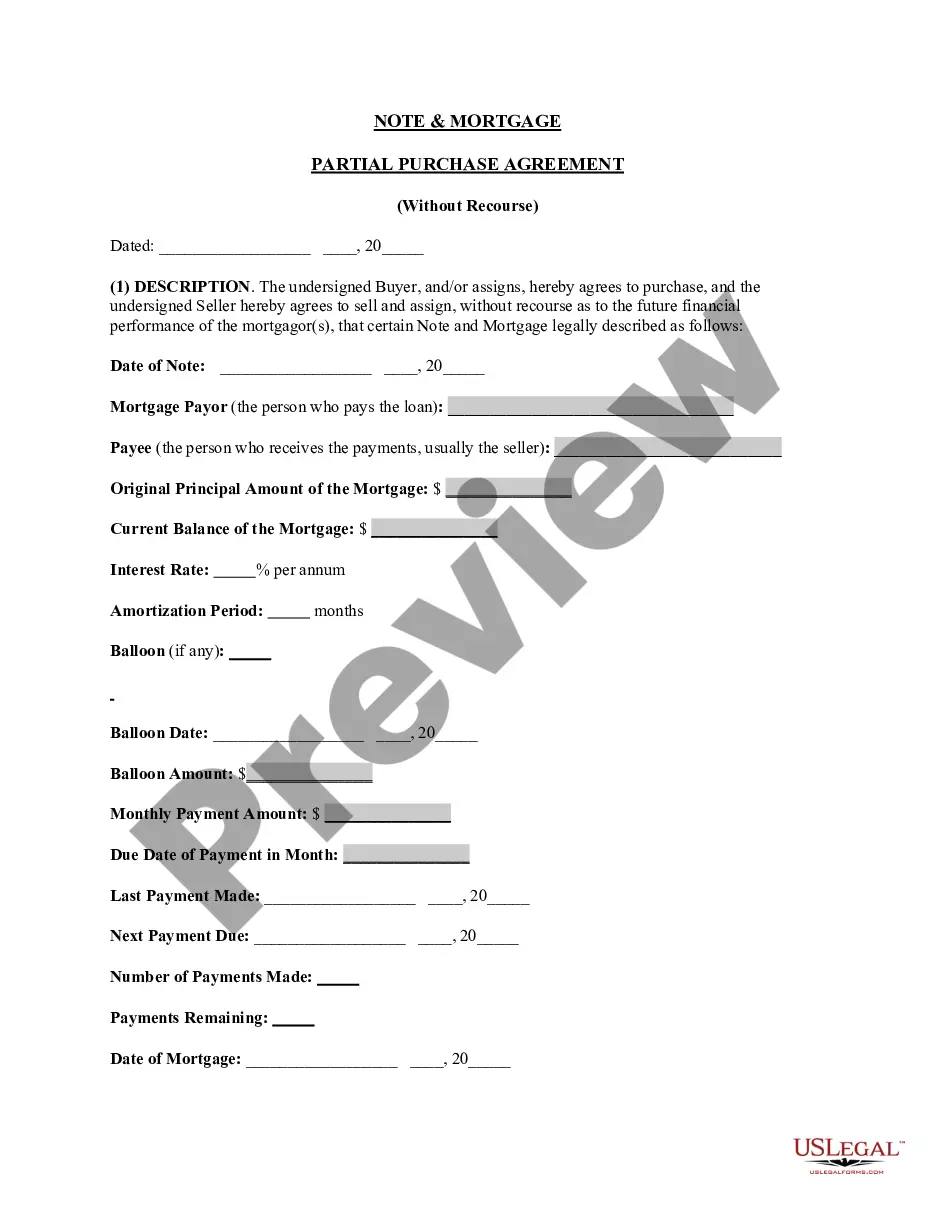

Record (file) your contract for deed in the deed records of the county where the property is located. Once recorded, the contract is treated the same as warranty deed with a vendor's lien. If you get behind on payments, the seller must post, file, and serve notice of sale as a foreclosure before you can be removed.

If the seller breaches, then the buyer can sue for compensation, return of their good-faith deposit, and reasonable expenses. The buyer can also request that the contract be terminated. If the buyer breaches, then the seller can often terminate the contract and sue for money damages.

If you've paid more than 40% or made more than 48 payments, or if you recorded your contract in the property records and you defaulted on payment after Sept. 1, 2015, you have the right to cure within 60 days of the notice. If not, the seller can post, file, and serve notice of sale as a foreclosure.

Until the unrecord deed is processed, and title transferred, the holders of the title still own the property. They can mortgage the property or sell it. The plan for the children to receive and record the deed may not have legal authority.