Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

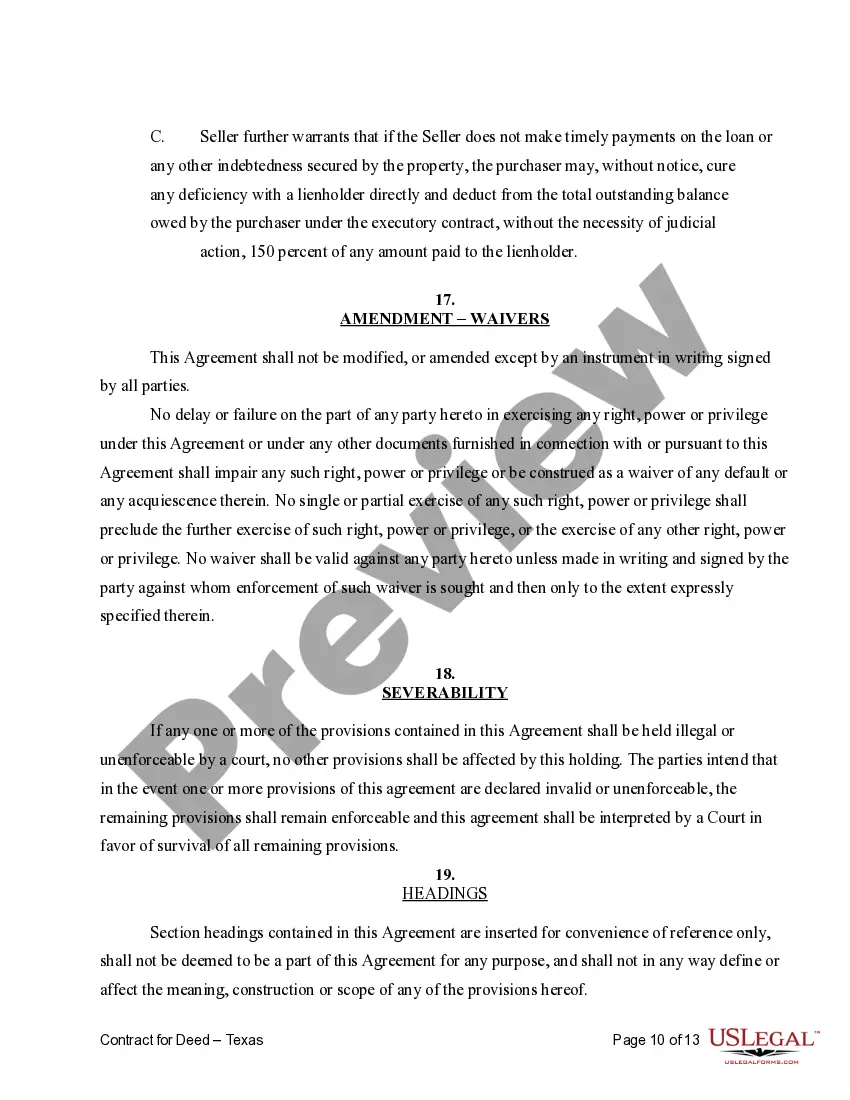

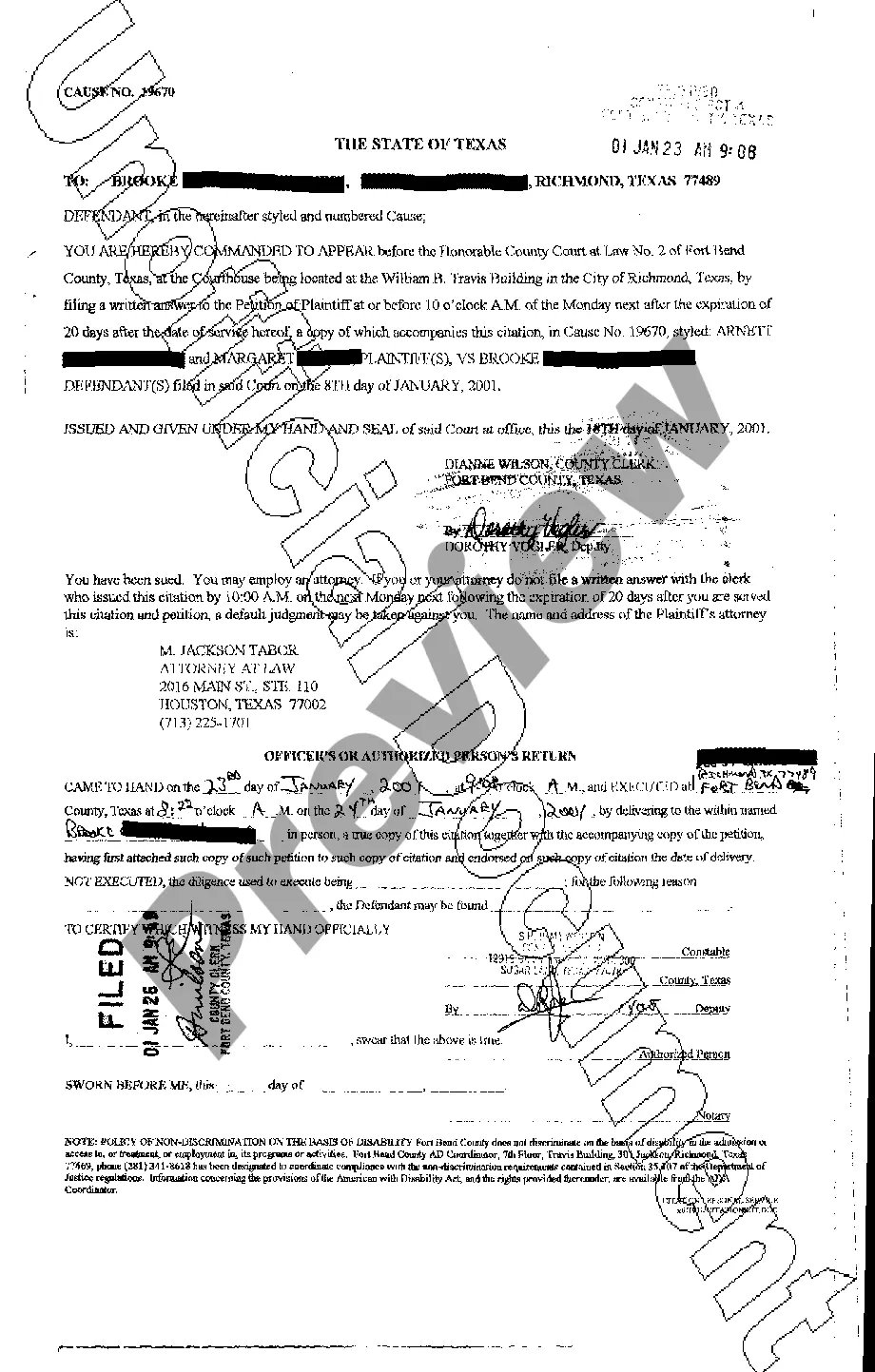

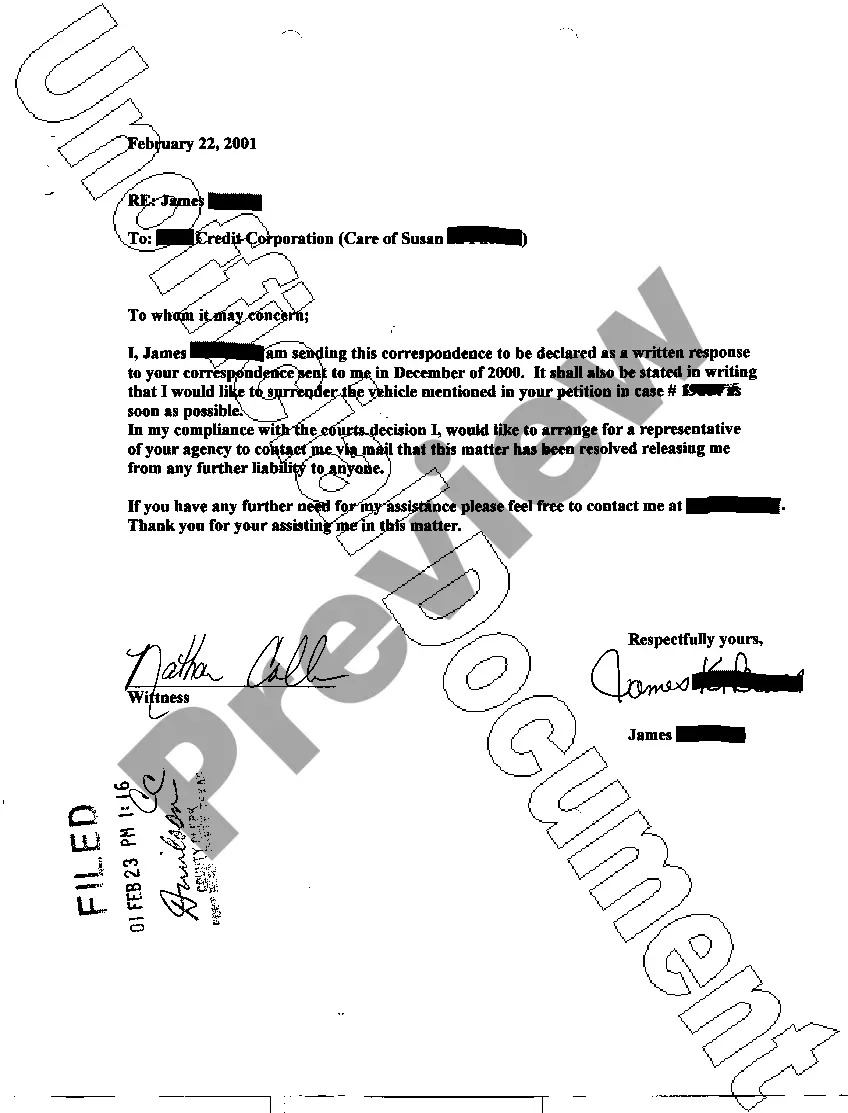

The Houston Texas Agreement or Contract for Deed, also known as a Land or Executory Contract, is a legal document used for the sale of real estate property. This agreement serves as an alternative to traditional mortgage financing and is commonly used for residential purposes in Houston, Texas. It outlines the terms and conditions of the sale, including the purchase price, payment schedule, interest rate, and other relevant details. The Houston Texas Agreement or Contract for Deed is structured in such a way that the seller retains legal ownership of the property until the buyer fulfills all the payment obligations specified in the agreement. This means that the buyer possesses equitable or beneficial ownership rights while paying off the property. Once the full payment is made, the seller then transfers the legal title to the buyer. There are different types of Houston Texas Agreement or Contract for Deed, designed to cater to various specific situations and requirements. Some of these types may include: 1. Installment or Term Contract: This type of contract allows the buyer to purchase the property by making regular installments over a specified period. The contract typically includes an agreed-upon interest rate and clearly outlines the payment schedule. 2. Balloon Contract: In a balloon contract, the buyer makes smaller periodic payments leading up to a larger, final payment known as the balloon payment. This final payment is usually a significant portion of the purchase price and is made at the end of the contract term. 3. Wraparound Contract: A wraparound contract is used when the buyer takes over the seller's existing mortgage while making additional payments to the seller. The buyer effectively "wraps" their payments around the existing mortgage, with the seller acting as an intermediary. 4. Lease-Purchase Contract: This type of contract combines a lease agreement and an option to purchase the property at a later date. The buyer rents the property for a specific period, with a portion of the rental payments often being applied towards the eventual purchase price. It is essential to consult with a qualified legal professional when entering into a Houston Texas Agreement or Contract for Deed to ensure compliance with applicable laws and to protect the rights and interests of both parties involved.The Houston Texas Agreement or Contract for Deed, also known as a Land or Executory Contract, is a legal document used for the sale of real estate property. This agreement serves as an alternative to traditional mortgage financing and is commonly used for residential purposes in Houston, Texas. It outlines the terms and conditions of the sale, including the purchase price, payment schedule, interest rate, and other relevant details. The Houston Texas Agreement or Contract for Deed is structured in such a way that the seller retains legal ownership of the property until the buyer fulfills all the payment obligations specified in the agreement. This means that the buyer possesses equitable or beneficial ownership rights while paying off the property. Once the full payment is made, the seller then transfers the legal title to the buyer. There are different types of Houston Texas Agreement or Contract for Deed, designed to cater to various specific situations and requirements. Some of these types may include: 1. Installment or Term Contract: This type of contract allows the buyer to purchase the property by making regular installments over a specified period. The contract typically includes an agreed-upon interest rate and clearly outlines the payment schedule. 2. Balloon Contract: In a balloon contract, the buyer makes smaller periodic payments leading up to a larger, final payment known as the balloon payment. This final payment is usually a significant portion of the purchase price and is made at the end of the contract term. 3. Wraparound Contract: A wraparound contract is used when the buyer takes over the seller's existing mortgage while making additional payments to the seller. The buyer effectively "wraps" their payments around the existing mortgage, with the seller acting as an intermediary. 4. Lease-Purchase Contract: This type of contract combines a lease agreement and an option to purchase the property at a later date. The buyer rents the property for a specific period, with a portion of the rental payments often being applied towards the eventual purchase price. It is essential to consult with a qualified legal professional when entering into a Houston Texas Agreement or Contract for Deed to ensure compliance with applicable laws and to protect the rights and interests of both parties involved.