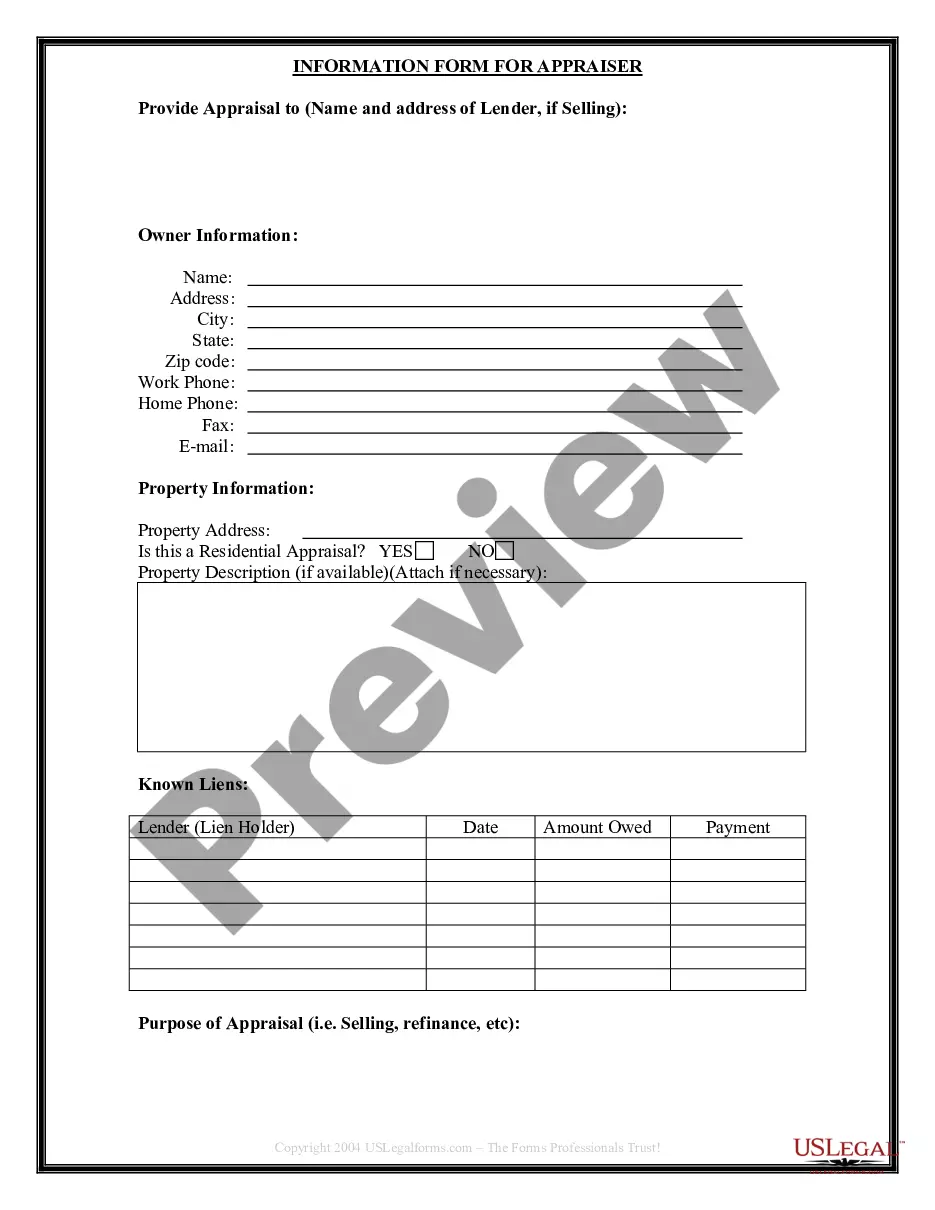

Texas to provide information required by an appraiser in order to conduct an appraisal of the property prior to purchase. The Seller provides this completed form to the Buyer, who furnishes it to the appraiser. This form is designed to make the transaction flow more efficiently.

Dallas Texas Seller's Information for Appraiser provided to Buyer serves as an important tool in real estate transactions, ensuring transparency and accurate property valuation. This comprehensive documentation equips the appraiser with essential details about the seller, their property, and its market value. By providing this information, buyers can make informed decisions based on the property's worth and potential. The Dallas Texas Seller's Information for Appraiser provided to Buyer typically includes several key elements: 1. Property Details: This section outlines essential details about the property, such as its address, legal description, plot size, property type (single-family home, condo, etc.), and any unique features that may influence its value. 2. Seller Information: This segment provides information about the sellers, including their names, contact details, and any essential background details relevant to the sale. It is crucial for buyers to know who they are dealing with and have a reliable point of contact throughout the process. 3. Purchase Agreement: The appraiser needs access to the executed purchase agreement, including the agreed-upon purchase price, financing terms, and any contingencies or special conditions. This document helps the appraiser validate the value of the property within the context of the agreed-upon terms. 4. Property Condition: Detailed information regarding the property's condition is vital for accurate appraisal. This includes disclosing any known structural or mechanical issues, recent repairs or renovations, and the general state of the property. This transparency gives the appraiser a clear understanding of the property's present condition and can impact its ultimate value. 5. Comparable Sales: The seller's information often includes a list of recent comparable sales (comps) in the same neighborhood or vicinity. These comps provide valuable data for the appraiser to assess the fair market value of the property being appraised. 6. Property Upgrades: This section highlights any recent upgrades or improvements made to the property, such as renovated kitchens, bathrooms, or additions. These enhancements can potentially increase the value of the property, and providing this information helps the appraiser better evaluate its worth. 7. Neighborhood Information: Key details about the property's neighborhood can provide context for the appraiser. This includes information about local schools, amenities, transportation options, and any unique neighborhood characteristics that may influence the property value. Different types of Dallas Texas Seller's Information for Appraiser may vary slightly depending on the specific requirements of the real estate market or appraiser guidelines. However, the above-mentioned elements generally remain consistent in most cases, ensuring a comprehensive and detailed report that assists appraisers in accurately determining the value of a property in Dallas, Texas.

Dallas Texas Seller's Information for Appraiser provided to Buyer serves as an important tool in real estate transactions, ensuring transparency and accurate property valuation. This comprehensive documentation equips the appraiser with essential details about the seller, their property, and its market value. By providing this information, buyers can make informed decisions based on the property's worth and potential. The Dallas Texas Seller's Information for Appraiser provided to Buyer typically includes several key elements: 1. Property Details: This section outlines essential details about the property, such as its address, legal description, plot size, property type (single-family home, condo, etc.), and any unique features that may influence its value. 2. Seller Information: This segment provides information about the sellers, including their names, contact details, and any essential background details relevant to the sale. It is crucial for buyers to know who they are dealing with and have a reliable point of contact throughout the process. 3. Purchase Agreement: The appraiser needs access to the executed purchase agreement, including the agreed-upon purchase price, financing terms, and any contingencies or special conditions. This document helps the appraiser validate the value of the property within the context of the agreed-upon terms. 4. Property Condition: Detailed information regarding the property's condition is vital for accurate appraisal. This includes disclosing any known structural or mechanical issues, recent repairs or renovations, and the general state of the property. This transparency gives the appraiser a clear understanding of the property's present condition and can impact its ultimate value. 5. Comparable Sales: The seller's information often includes a list of recent comparable sales (comps) in the same neighborhood or vicinity. These comps provide valuable data for the appraiser to assess the fair market value of the property being appraised. 6. Property Upgrades: This section highlights any recent upgrades or improvements made to the property, such as renovated kitchens, bathrooms, or additions. These enhancements can potentially increase the value of the property, and providing this information helps the appraiser better evaluate its worth. 7. Neighborhood Information: Key details about the property's neighborhood can provide context for the appraiser. This includes information about local schools, amenities, transportation options, and any unique neighborhood characteristics that may influence the property value. Different types of Dallas Texas Seller's Information for Appraiser may vary slightly depending on the specific requirements of the real estate market or appraiser guidelines. However, the above-mentioned elements generally remain consistent in most cases, ensuring a comprehensive and detailed report that assists appraisers in accurately determining the value of a property in Dallas, Texas.