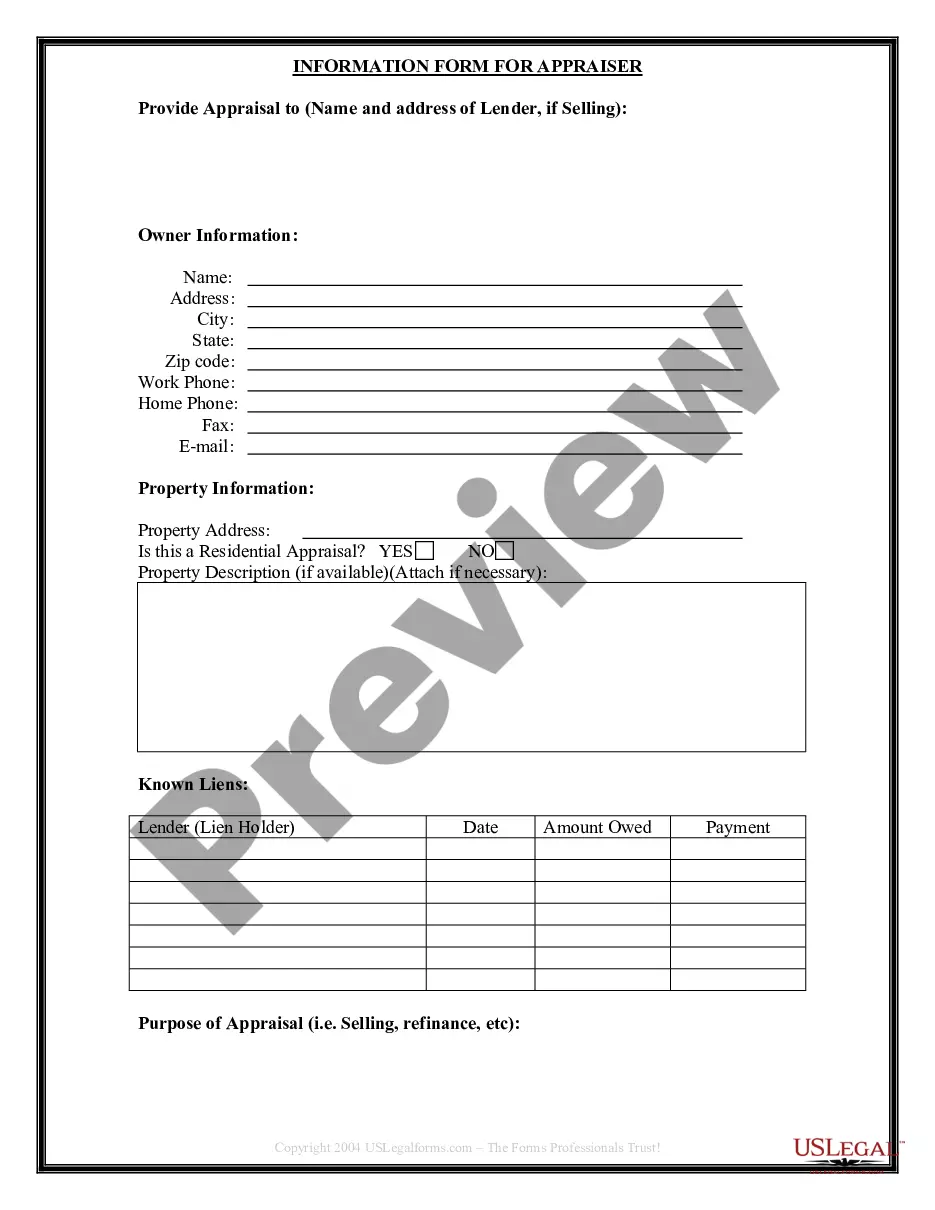

Texas to provide information required by an appraiser in order to conduct an appraisal of the property prior to purchase. The Seller provides this completed form to the Buyer, who furnishes it to the appraiser. This form is designed to make the transaction flow more efficiently.

Sugar Land Texas Seller's Information for Appraiser provided to Buyer is a crucial document that offers essential insights and details about a property being sold in the Sugar Land, Texas area. It is an essential part of the appraisal process, allowing the buyer to gain a comprehensive understanding of the property's history, condition, and value. The information provided assists the appraiser in accurately determining the property's fair market value. The Sugar Land Texas Seller's Information for Appraiser provided to Buyer typically includes: 1. Property Details: This section includes detailed information about the property, such as its address, legal description, square footage, number of bedrooms and bathrooms, and any additional structures like garages or swimming pools. The accurate and complete information helps the appraiser evaluate the property accurately. 2. Ownership History: The document also provides a history of the property's ownership, including the name(s) of previous owners, the duration of their ownership, and any transfers or changes in title. This information gives insight into the property's long-term use, potential improvements, and any known legal issues. 3. Property Improvements: This section outlines any modifications or renovations made to the property over time. Details about these improvements, such as the type of work, dates of completion, and associated costs, enable the appraiser to assess the property's value accurately and determine its overall condition. 4. Recent Comparable Sales: The Sugar Land Texas Seller's Information for Appraiser provided to Buyer often includes a list of recent comparable sales in the area. These properties, similar in size, location, and features, serve as benchmarks for the appraiser to evaluate the subject property's value. This data aids in determining the fair market value based on recent market trends and comparable properties. 5. Property Taxes and Assessments: This section provides information about the property's tax assessment history, including the assessed value, any exemptions or deductions, and the current property tax rate. The appraiser considers this information to assess the property's value in relation to its tax obligations. 6. Disclosures: The document may also include disclosures required by law or outlined in the sales contract. These disclosures may pertain to potential hazards, defects, or other significant issues that could affect the property's value or desirability. This transparency ensures that the buyer receives all relevant details about the property. Other types of Sugar Land Texas Seller's Information for Appraiser provided to Buyer may include additional documents like: — Home Inspection Reports: These reports provide a detailed assessment of the property's condition, identifying any structural or functional issues that may impact the value. — Survey Reports: Surveys outline the property's boundary lines, easements, encroachments, and other relevant details about the land and its characteristics. — HOA Information: If the property is part of a homeowners' association (HOA), the seller may provide the appraiser with information about HOA fees, rules, regulations, and any potential community amenities. Overall, the Sugar Land Texas Seller's Information for Appraiser provided to Buyer allows for a comprehensive evaluation of the subject property, ensuring that the appraiser has access to all relevant information needed to determine its fair market value accurately.