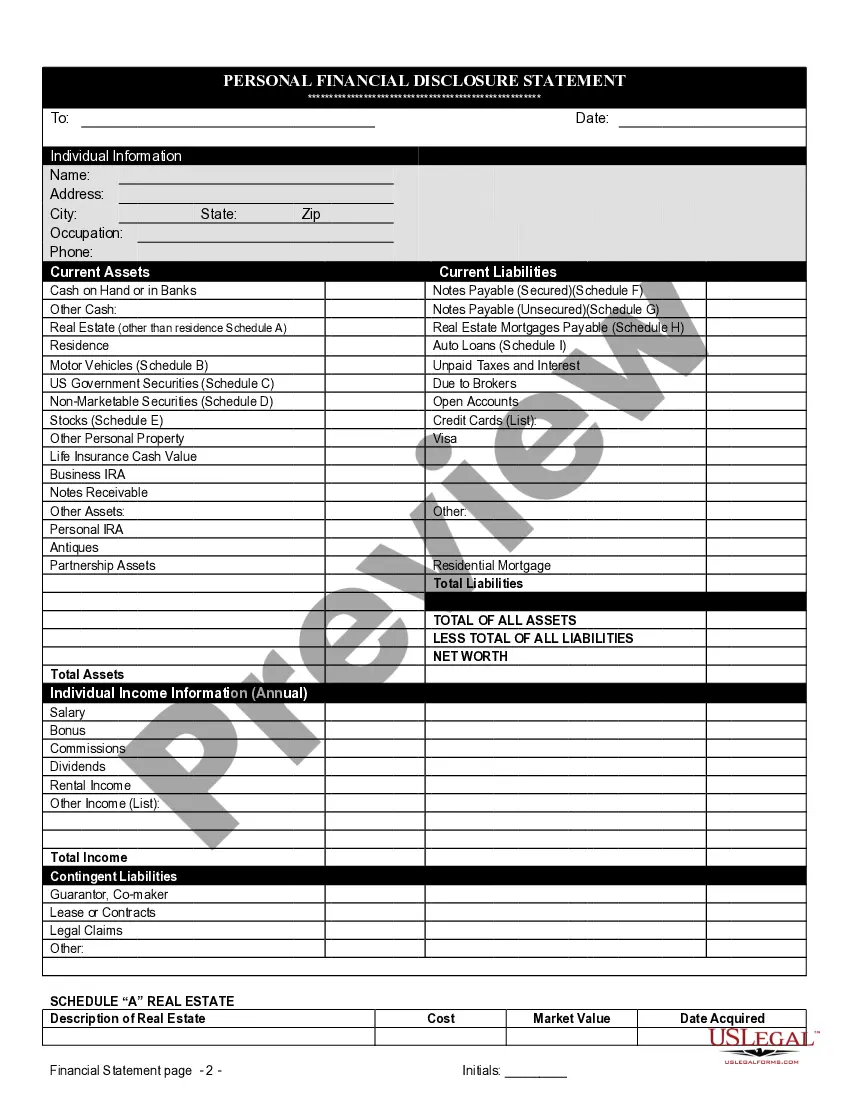

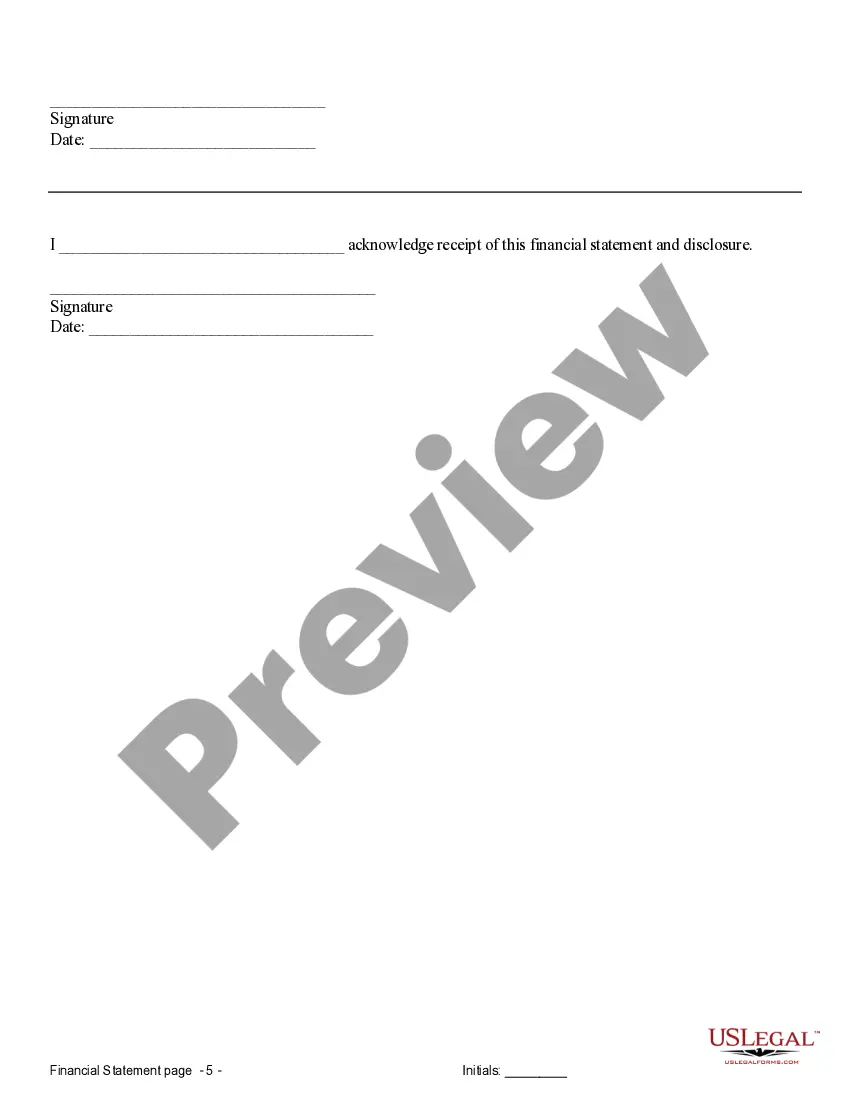

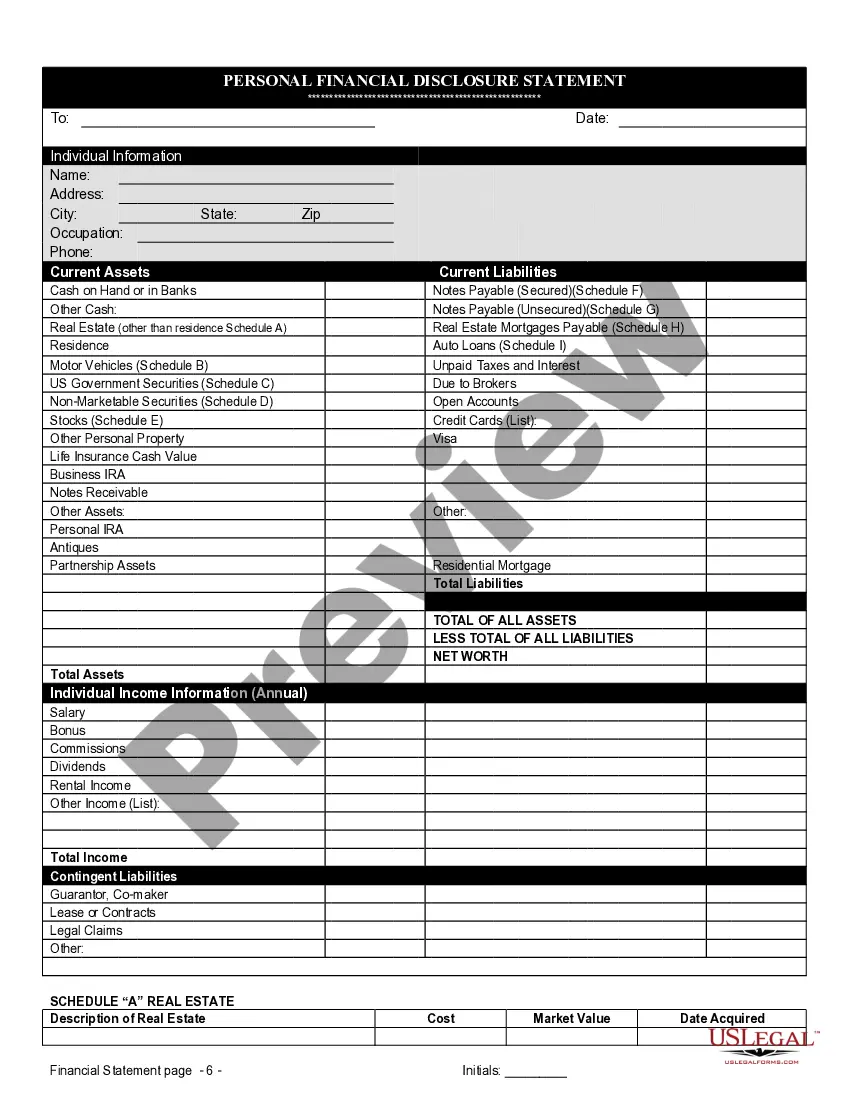

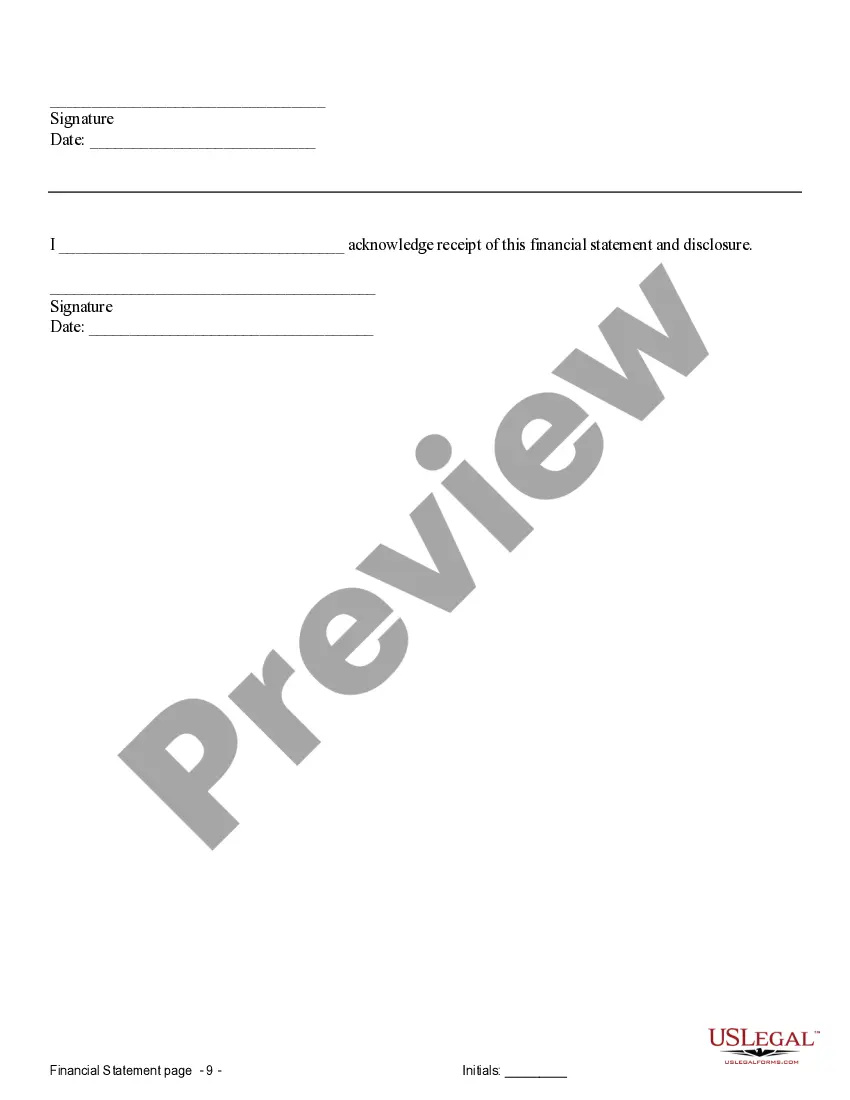

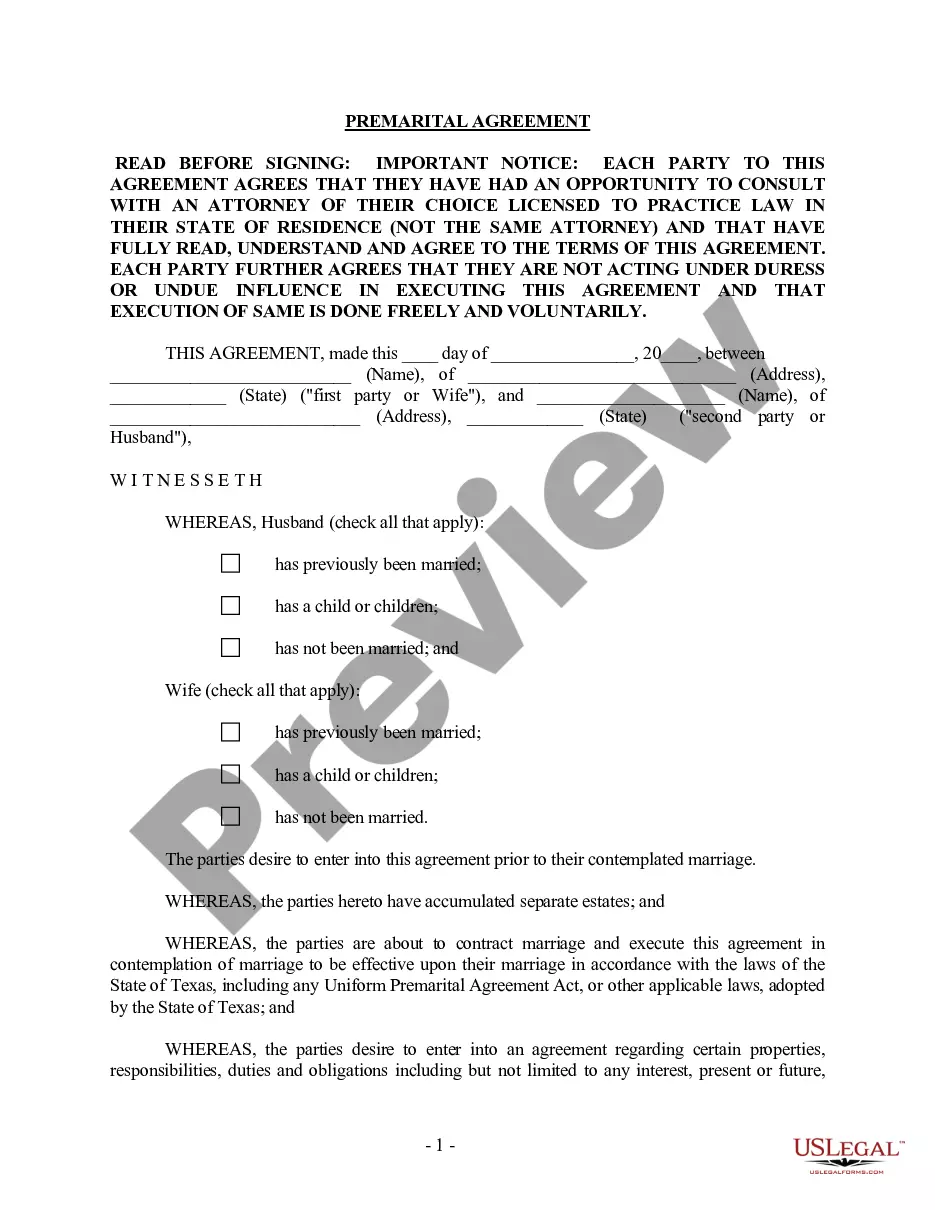

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

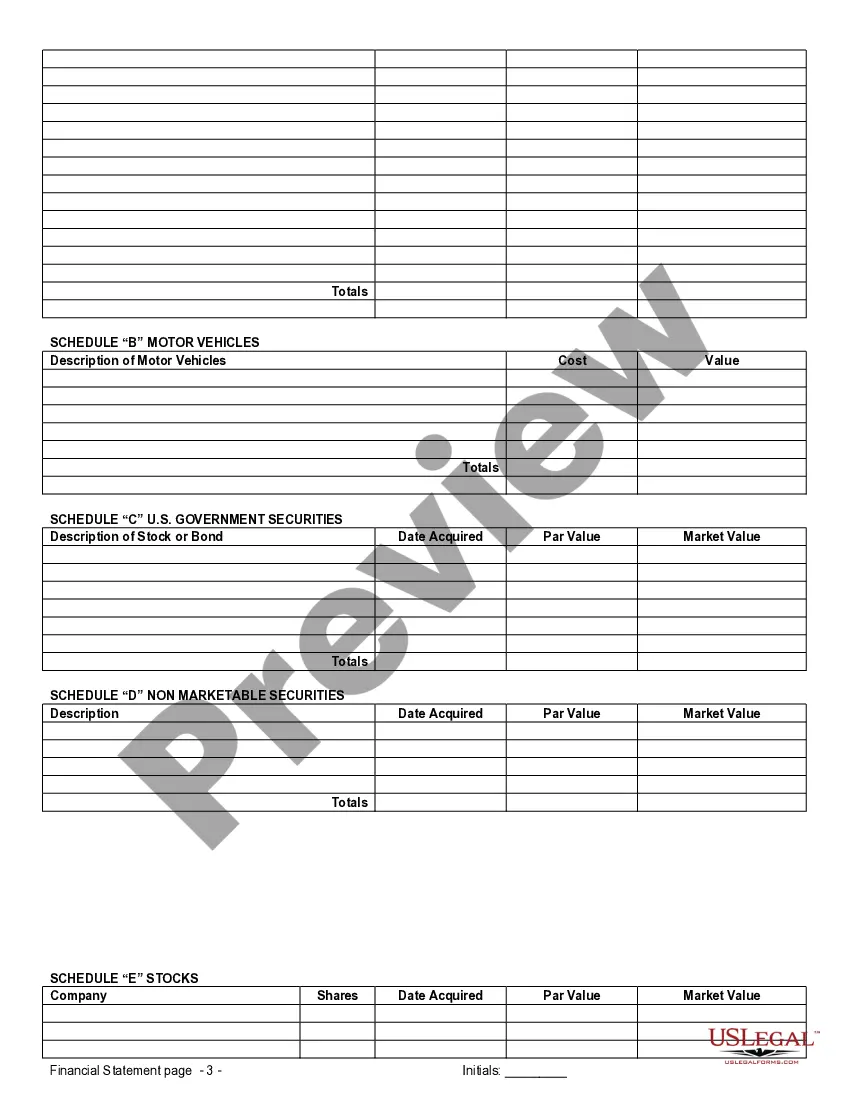

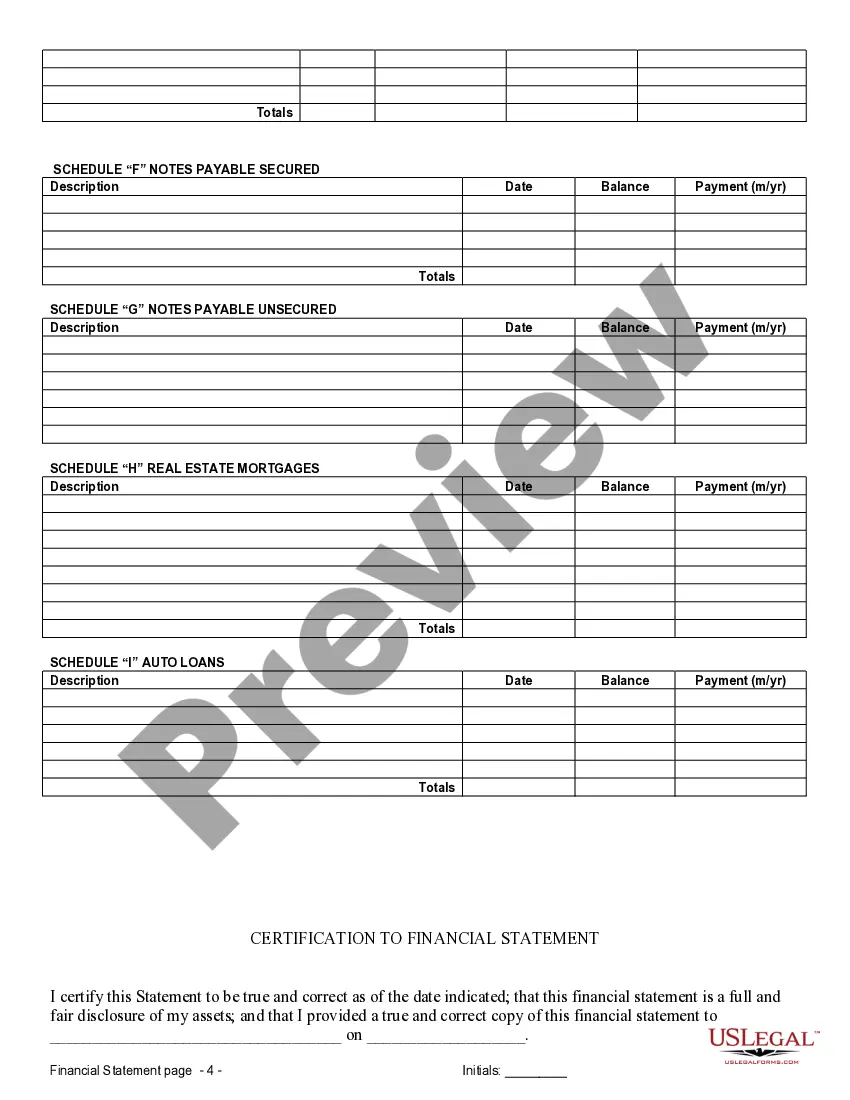

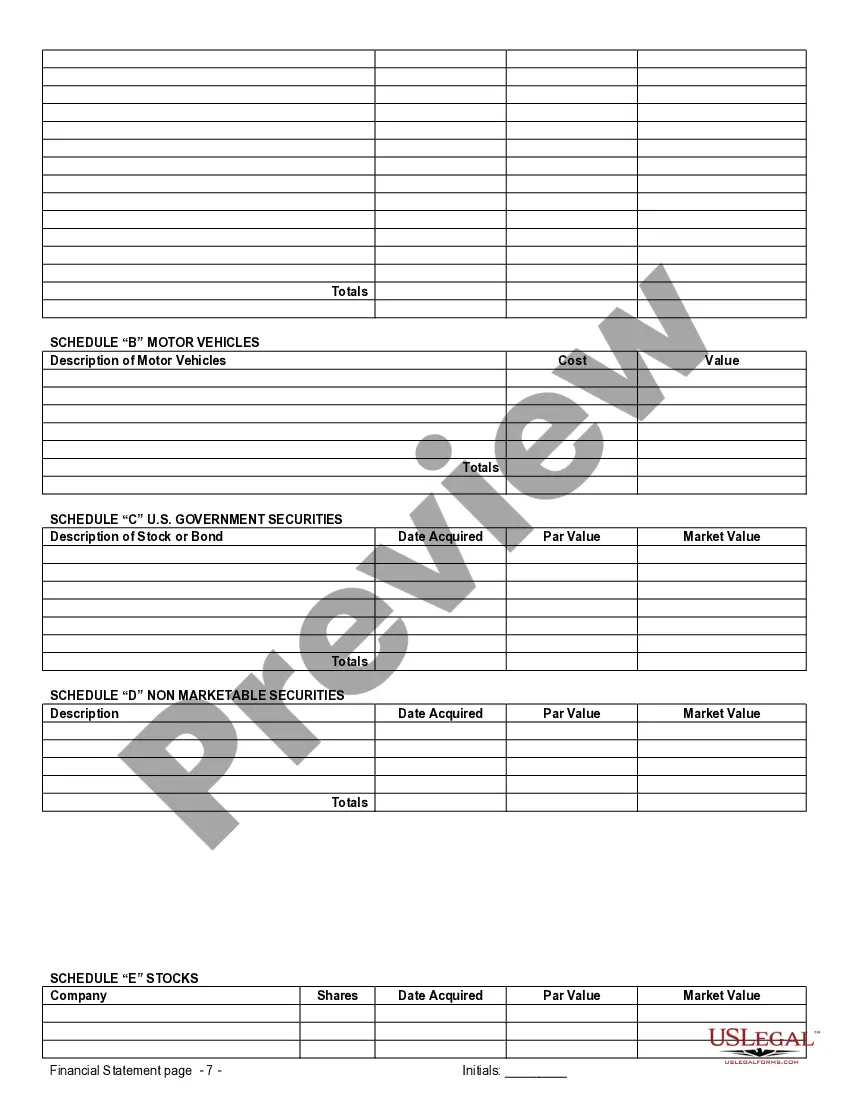

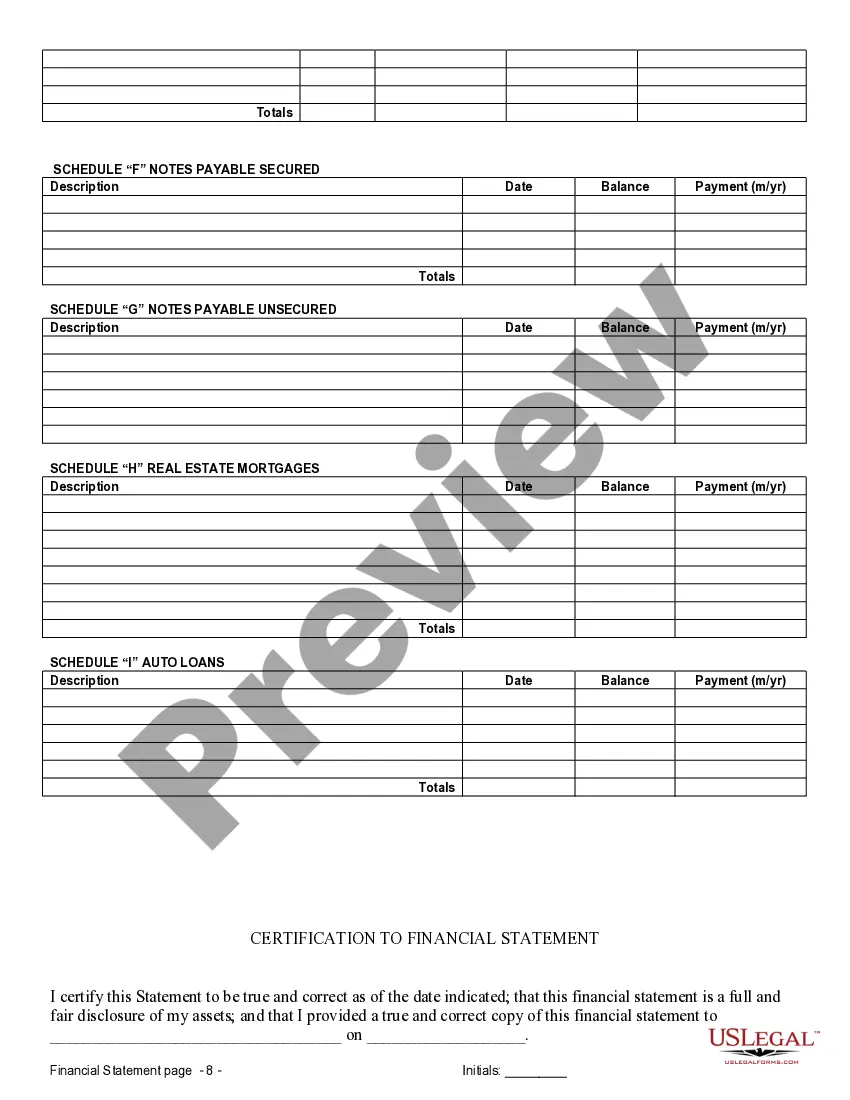

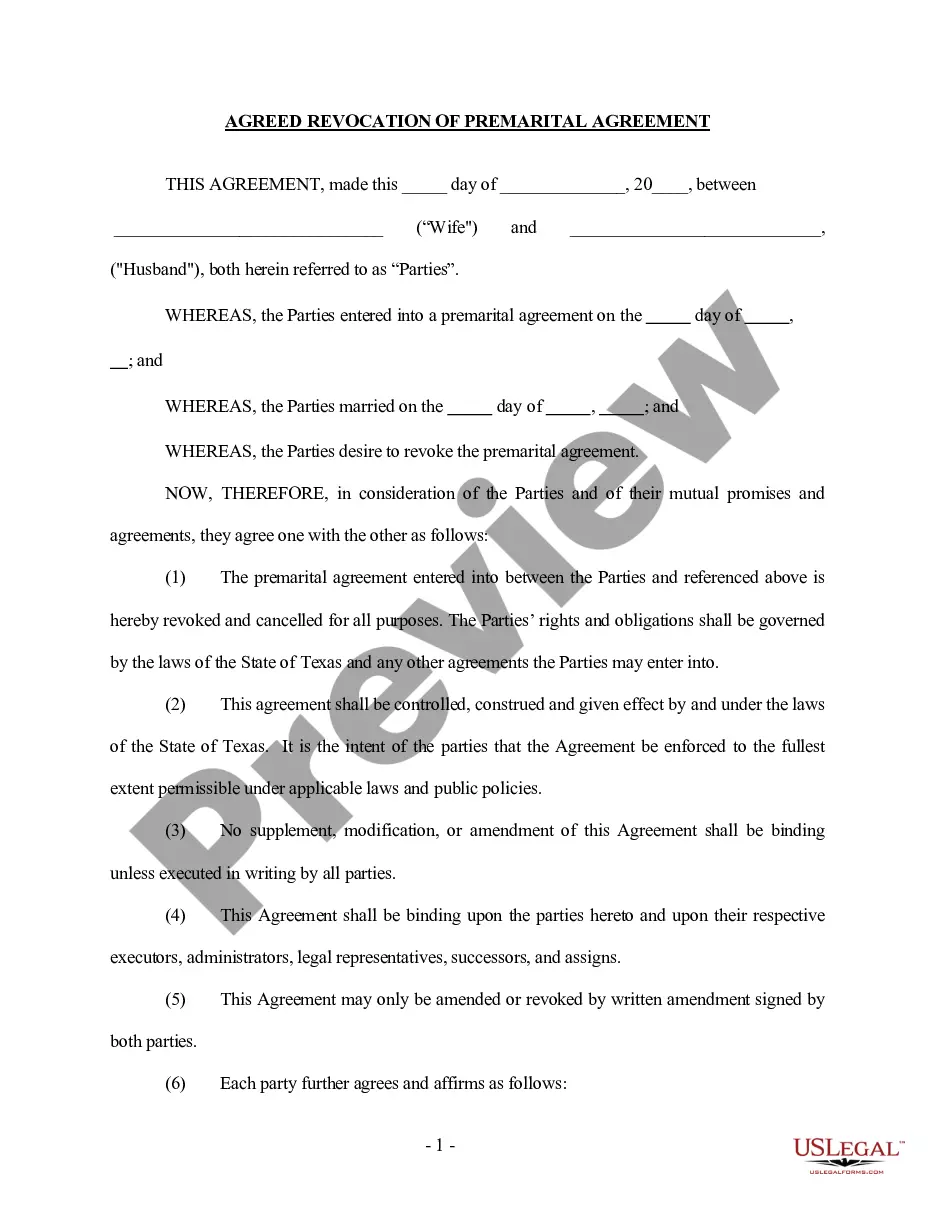

When entering into a prenuptial or premarital agreement in Arlington, Texas, it is essential to include comprehensive and accurate Arlington Texas Financial Statements. These statements serve as a crucial component of the agreement, outlining the financial situation and assets of both parties involved. By including detailed financial information, couples can ensure a fair and thorough understanding of their financial standing before entering into marriage. Arlington Texas Financial Statements in Connection with Prenuptial Premarital Agreements are categorized into different types, each addressing specific aspects of the couple's financial circumstances. Here are some key types of financial statements commonly found in these agreements: 1. Income Statement: This financial statement provides an overview of the income earned by each party individually. It includes details such as salaries, wages, bonuses, rental income, investments, and any other sources of income. 2. Balance Sheet: A balance sheet outlines the assets, liabilities, and net worth of each party involved. It includes detailed information about property, real estate, vehicles, investments, bank accounts, stocks, bonds, loans, credit card debts, and any other financial obligations. 3. Tax Returns: Including previous tax returns to the financial statements offers a historical perspective on the couple's tax liabilities, deductions, and exemptions. This enables transparency and provides an accurate representation of the couple's tax situation. 4. Bank Statements: Including recent bank statements provides an overview of the couple's financial transactions, including deposits, withdrawals, balances, and any outstanding loans. It establishes a clear understanding of the financial activities conducted by each party. 5. Retirement Account Statements: These statements detail any retirement savings, such as 401(k)s, IRAs, or pension plans. They can help determine the distribution of these assets in case of divorce or separation. 6. Business Financial Statements: If either party owns a business, it's crucial to include financial statements related to the business. This includes profit and loss statements, balance sheets, and tax returns relevant to the business's financial health. Including these various types of Arlington Texas Financial Statements in a prenuptial or premarital agreement ensures that both parties have a comprehensive understanding of each other's financial situation before getting married. These documents play a vital role in safeguarding assets, defining property rights, and determining spousal support or alimony in the event of divorce or separation. By utilizing accurate financial statements in conjunction with the prenuptial or premarital agreement, couples can establish a framework that protects their financial interests and fosters transparency and trust in their relationship.When entering into a prenuptial or premarital agreement in Arlington, Texas, it is essential to include comprehensive and accurate Arlington Texas Financial Statements. These statements serve as a crucial component of the agreement, outlining the financial situation and assets of both parties involved. By including detailed financial information, couples can ensure a fair and thorough understanding of their financial standing before entering into marriage. Arlington Texas Financial Statements in Connection with Prenuptial Premarital Agreements are categorized into different types, each addressing specific aspects of the couple's financial circumstances. Here are some key types of financial statements commonly found in these agreements: 1. Income Statement: This financial statement provides an overview of the income earned by each party individually. It includes details such as salaries, wages, bonuses, rental income, investments, and any other sources of income. 2. Balance Sheet: A balance sheet outlines the assets, liabilities, and net worth of each party involved. It includes detailed information about property, real estate, vehicles, investments, bank accounts, stocks, bonds, loans, credit card debts, and any other financial obligations. 3. Tax Returns: Including previous tax returns to the financial statements offers a historical perspective on the couple's tax liabilities, deductions, and exemptions. This enables transparency and provides an accurate representation of the couple's tax situation. 4. Bank Statements: Including recent bank statements provides an overview of the couple's financial transactions, including deposits, withdrawals, balances, and any outstanding loans. It establishes a clear understanding of the financial activities conducted by each party. 5. Retirement Account Statements: These statements detail any retirement savings, such as 401(k)s, IRAs, or pension plans. They can help determine the distribution of these assets in case of divorce or separation. 6. Business Financial Statements: If either party owns a business, it's crucial to include financial statements related to the business. This includes profit and loss statements, balance sheets, and tax returns relevant to the business's financial health. Including these various types of Arlington Texas Financial Statements in a prenuptial or premarital agreement ensures that both parties have a comprehensive understanding of each other's financial situation before getting married. These documents play a vital role in safeguarding assets, defining property rights, and determining spousal support or alimony in the event of divorce or separation. By utilizing accurate financial statements in conjunction with the prenuptial or premarital agreement, couples can establish a framework that protects their financial interests and fosters transparency and trust in their relationship.