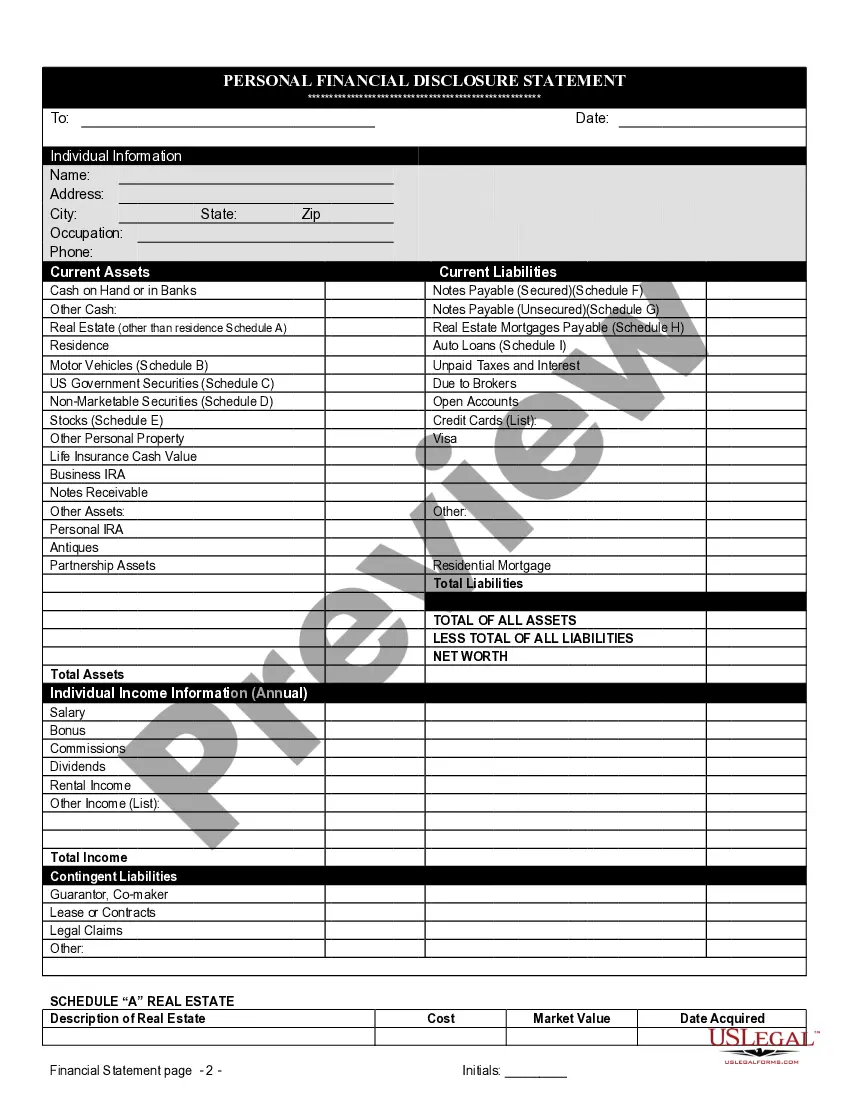

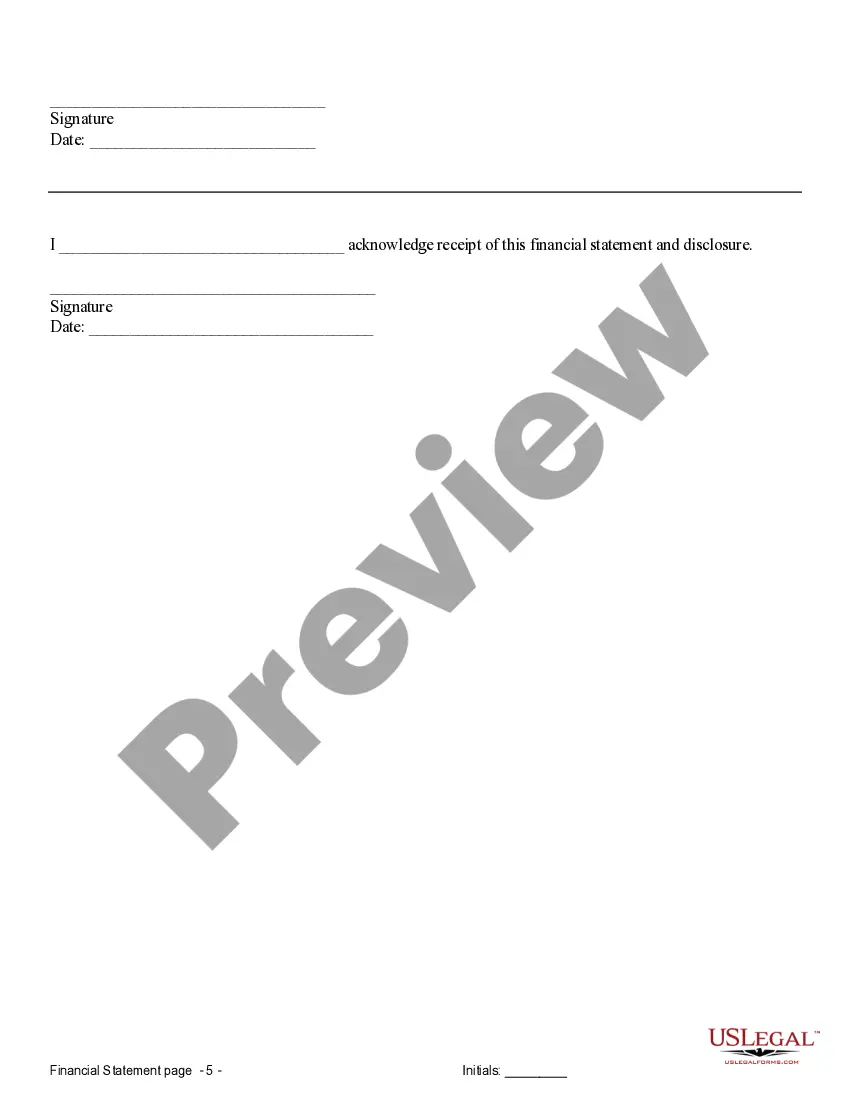

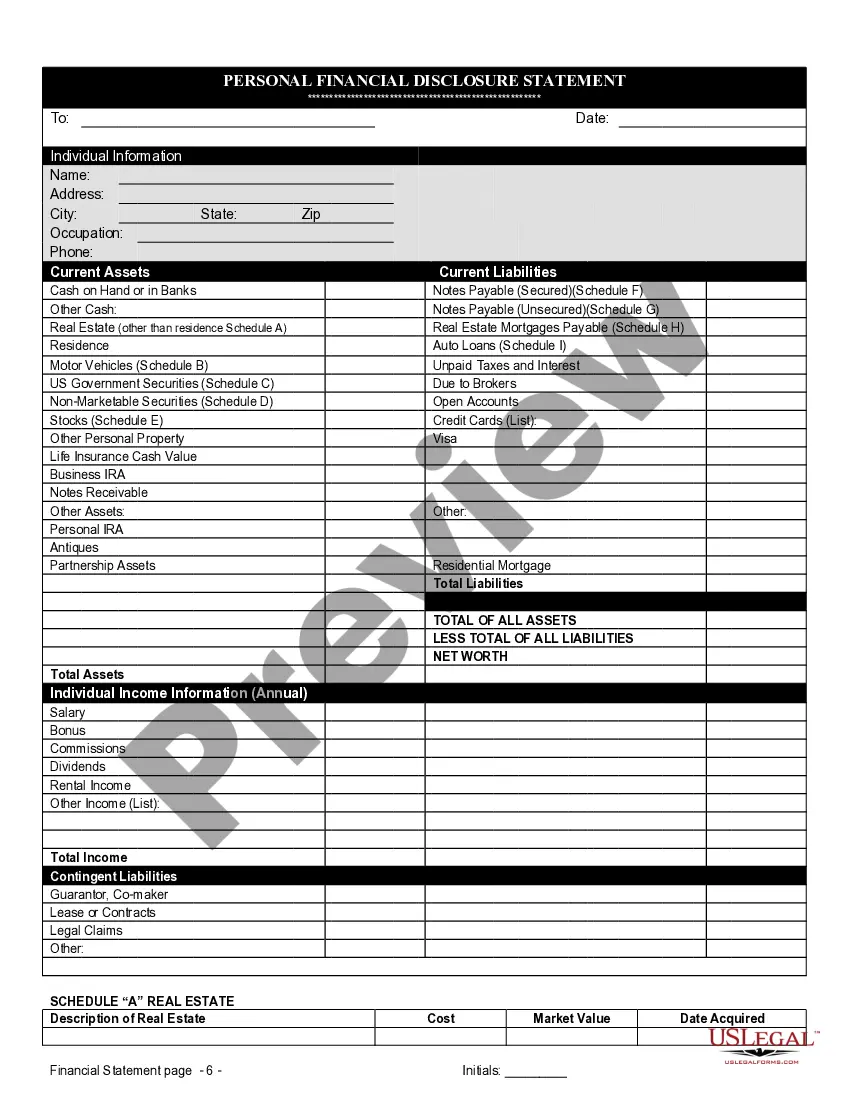

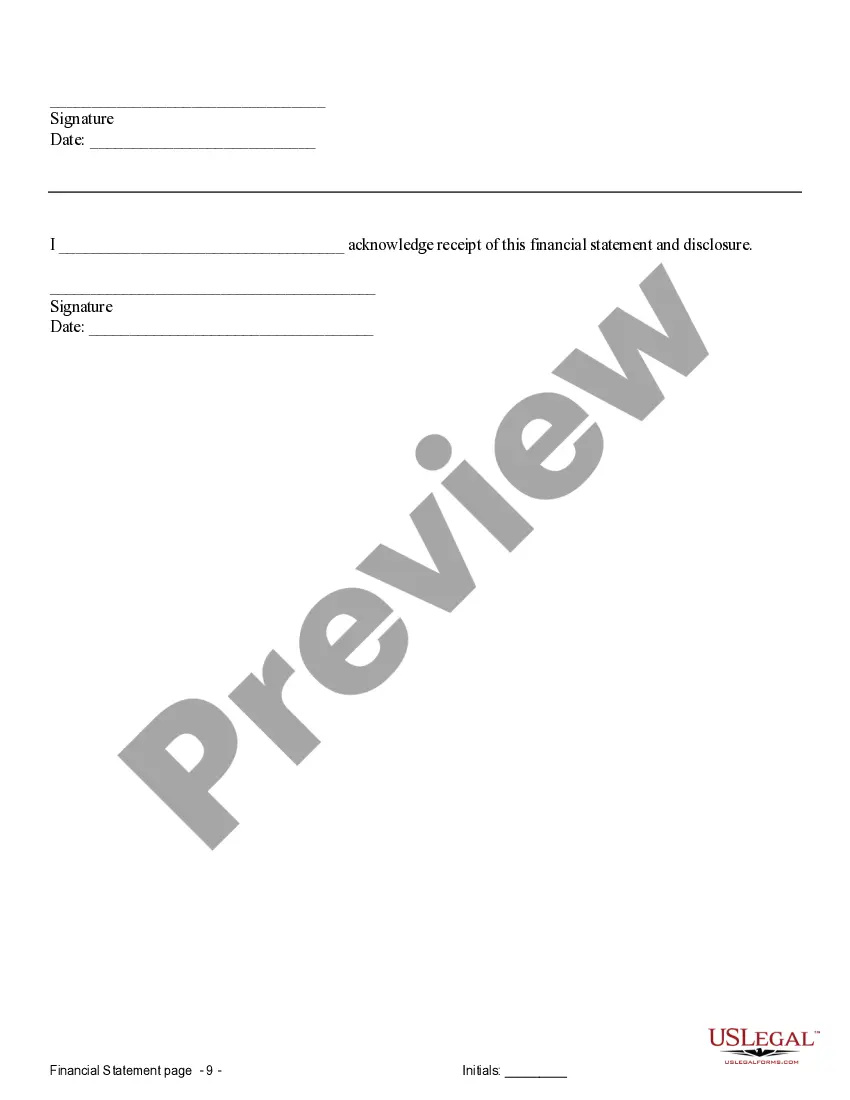

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

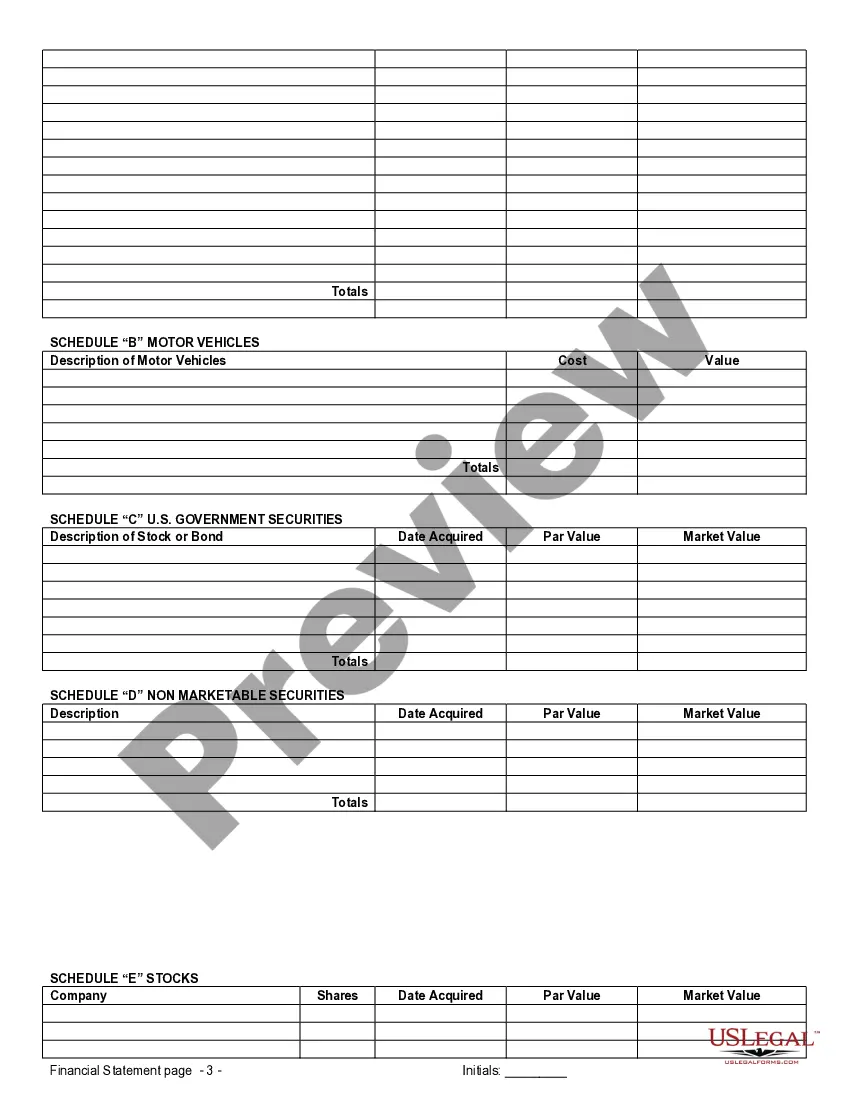

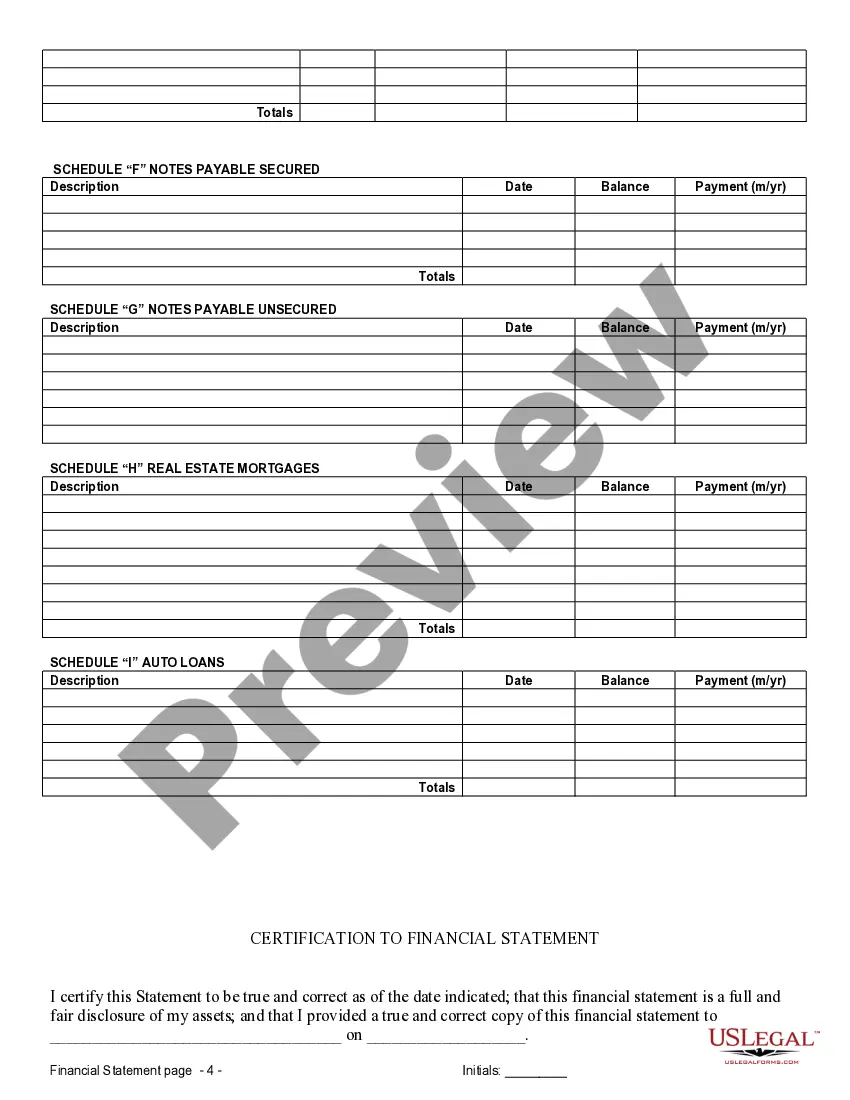

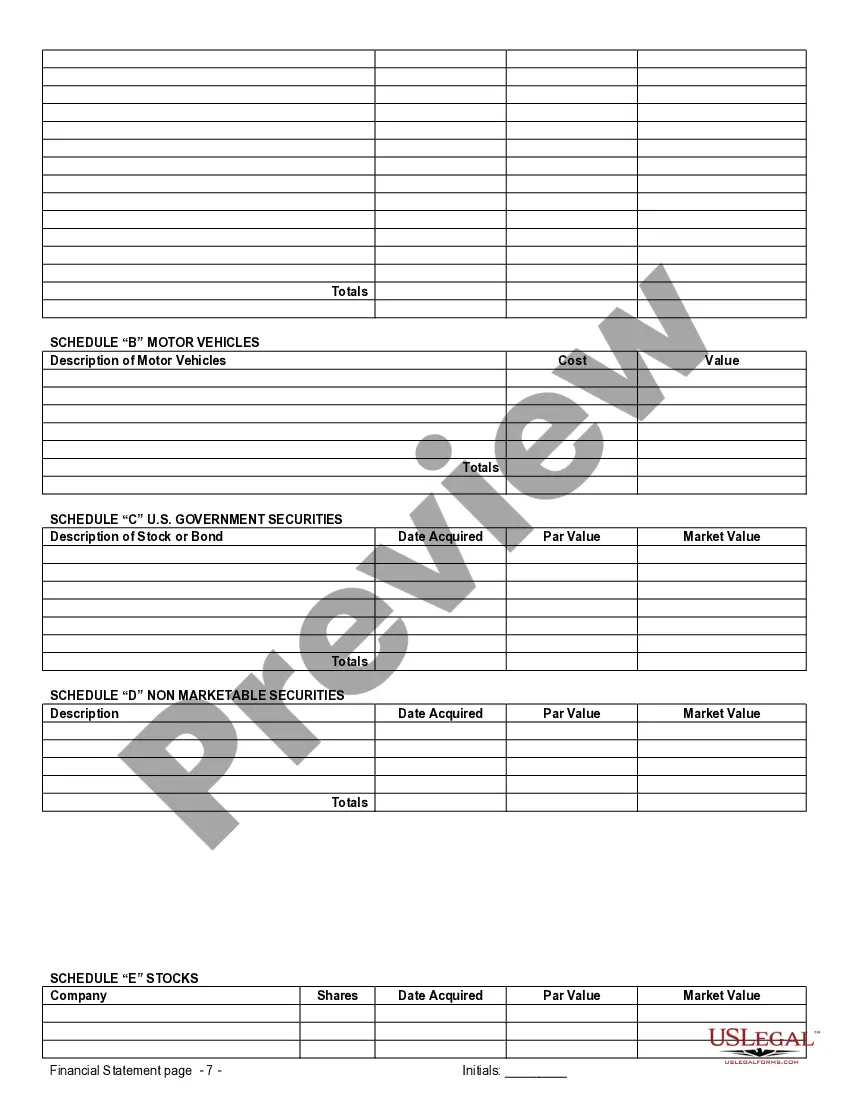

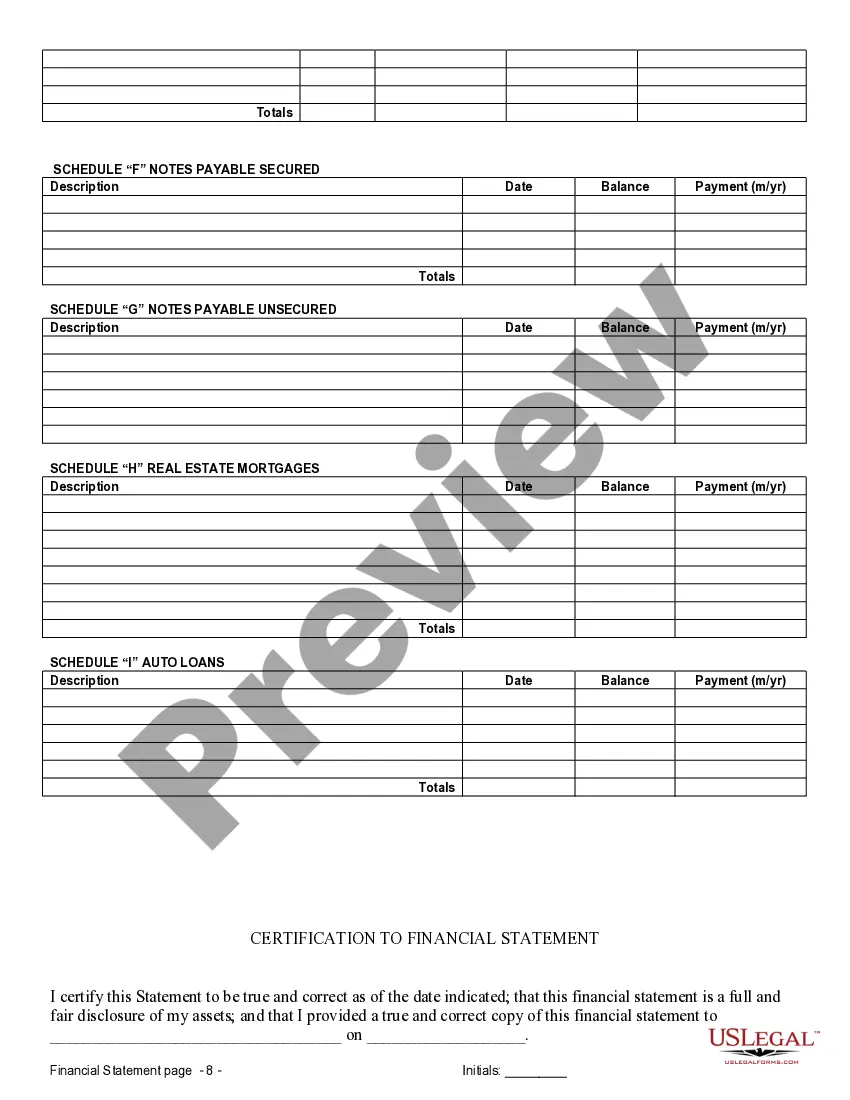

In the context of a prenuptial or premarital agreement in Austin, Texas, financial statements play a crucial role. These statements provide a comprehensive overview of the financial standing of each party entering into the agreement and are essential for ensuring transparency and fairness in the event of a divorce or separation. Financial statements are legally binding documents that outline the assets, liabilities, income, and expenses of each individual involved. They serve as a snapshot of one's financial situation at a particular point in time, usually prior to marriage. Various types of financial statements may be included in connection with a prenuptial or premarital agreement in Austin, Texas, including but not limited to: 1. Personal Balance Sheet: This statement lists all assets and liabilities owned individually by each partner before marriage. It includes items such as savings accounts, investments, real estate properties, vehicles, debts, loans, and credit card balances. 2. Statement of Income: This document outlines the sources of income for each individual, including salaries, wages, bonuses, dividends, rental income, or any other form of earnings. 3. Business Financial Statements: If either party owns a business, separate business financial statements may be required. These statements present the financial position of the business, including profit and loss statements, cash flow statements, and balance sheets, providing a thorough understanding of the business's financial health. 4. Retirement Account Statements: Retirement account statements, such as 401(k), IRA, or pension statements, are vital for disclosing the status of retirement savings before entering into the marital union. 5. Tax Returns: Copies of recent tax returns, typically for the past three to five years, are often required to understand the parties' tax history and facilitate the determination of potential tax implications upon divorce or separation. 6. Bank Account Statements: Providing bank account statements allows for an accurate assessment of current cash reserves, regular expenses, and financial habits. 7. Investment Account Statements: Statements from investment accounts, such as brokerage or mutual fund accounts, are necessary to determine the value of investments and potential income derived from them. 8. Real Estate Documents: Copies of deeds, mortgage statements, property tax records, and other real estate-related documents help determine property ownership, value, and potential liabilities. 9. Debt Statements: Statements detailing any outstanding debts, such as student loans, car loans, or mortgages, are essential for understanding existing financial obligations and potential future responsibility. When drafting a prenuptial or premarital agreement in Austin, Texas, it is imperative to include financial statements specific to the jurisdiction's legal requirements. These statements serve as vital evidence in court if the agreement is ever challenged or disputed, ensuring that each party's financial interests and assets are thoroughly documented and protected.In the context of a prenuptial or premarital agreement in Austin, Texas, financial statements play a crucial role. These statements provide a comprehensive overview of the financial standing of each party entering into the agreement and are essential for ensuring transparency and fairness in the event of a divorce or separation. Financial statements are legally binding documents that outline the assets, liabilities, income, and expenses of each individual involved. They serve as a snapshot of one's financial situation at a particular point in time, usually prior to marriage. Various types of financial statements may be included in connection with a prenuptial or premarital agreement in Austin, Texas, including but not limited to: 1. Personal Balance Sheet: This statement lists all assets and liabilities owned individually by each partner before marriage. It includes items such as savings accounts, investments, real estate properties, vehicles, debts, loans, and credit card balances. 2. Statement of Income: This document outlines the sources of income for each individual, including salaries, wages, bonuses, dividends, rental income, or any other form of earnings. 3. Business Financial Statements: If either party owns a business, separate business financial statements may be required. These statements present the financial position of the business, including profit and loss statements, cash flow statements, and balance sheets, providing a thorough understanding of the business's financial health. 4. Retirement Account Statements: Retirement account statements, such as 401(k), IRA, or pension statements, are vital for disclosing the status of retirement savings before entering into the marital union. 5. Tax Returns: Copies of recent tax returns, typically for the past three to five years, are often required to understand the parties' tax history and facilitate the determination of potential tax implications upon divorce or separation. 6. Bank Account Statements: Providing bank account statements allows for an accurate assessment of current cash reserves, regular expenses, and financial habits. 7. Investment Account Statements: Statements from investment accounts, such as brokerage or mutual fund accounts, are necessary to determine the value of investments and potential income derived from them. 8. Real Estate Documents: Copies of deeds, mortgage statements, property tax records, and other real estate-related documents help determine property ownership, value, and potential liabilities. 9. Debt Statements: Statements detailing any outstanding debts, such as student loans, car loans, or mortgages, are essential for understanding existing financial obligations and potential future responsibility. When drafting a prenuptial or premarital agreement in Austin, Texas, it is imperative to include financial statements specific to the jurisdiction's legal requirements. These statements serve as vital evidence in court if the agreement is ever challenged or disputed, ensuring that each party's financial interests and assets are thoroughly documented and protected.