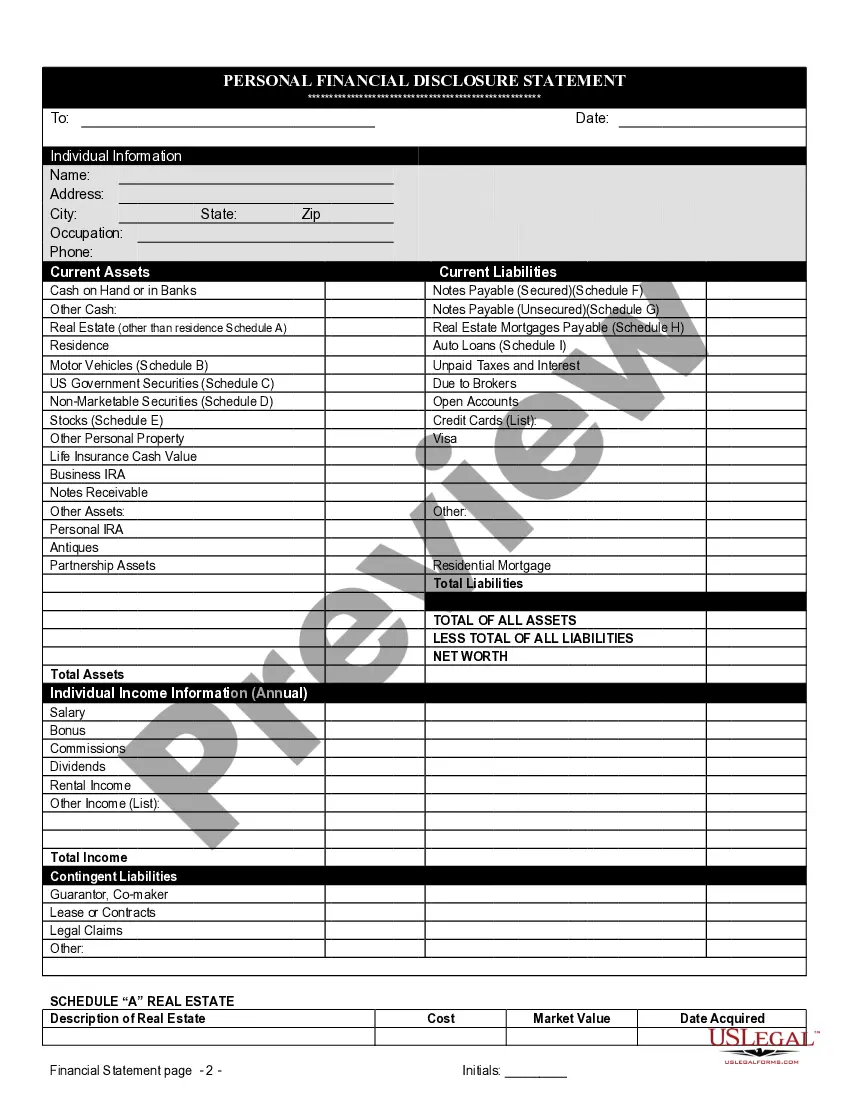

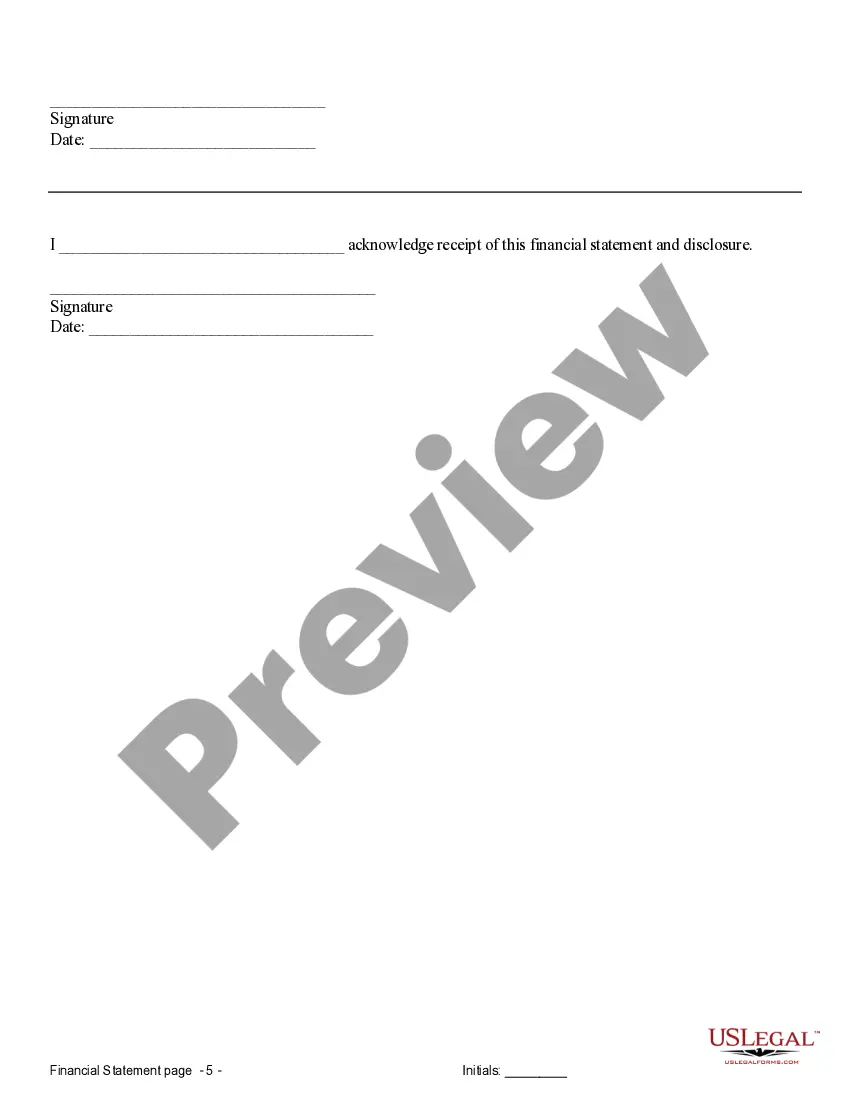

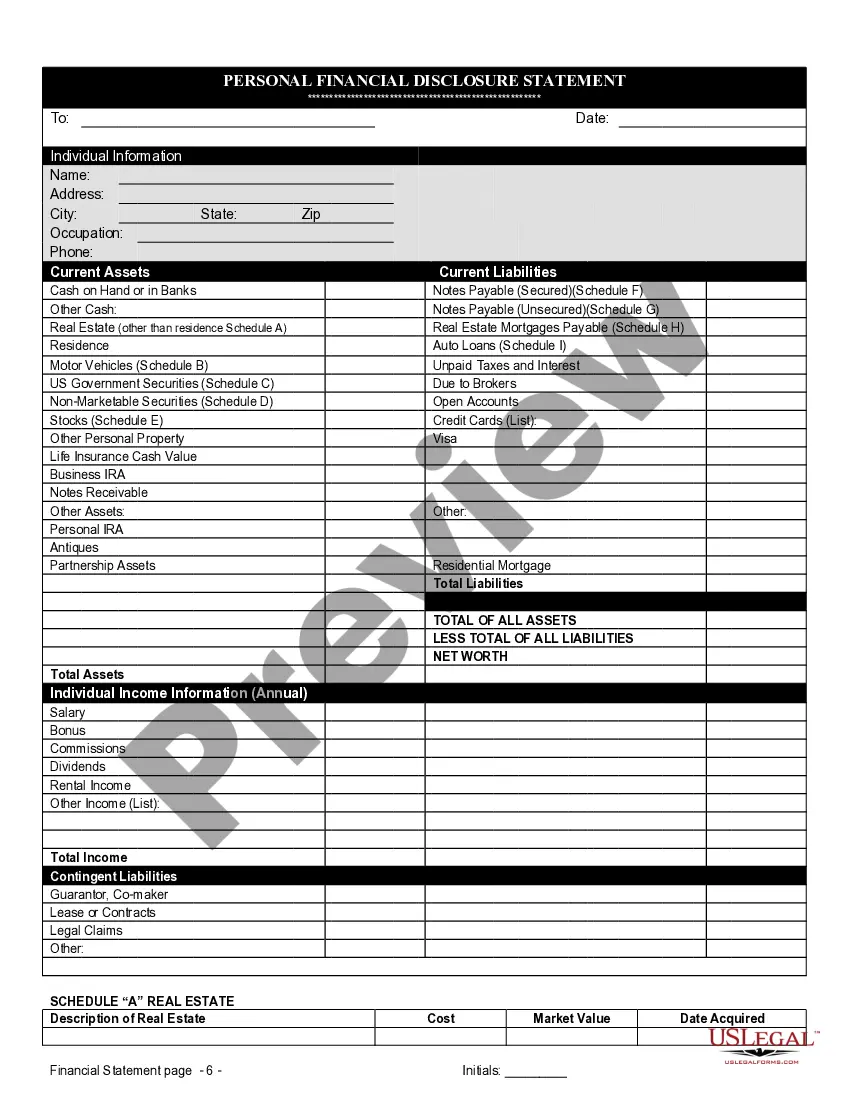

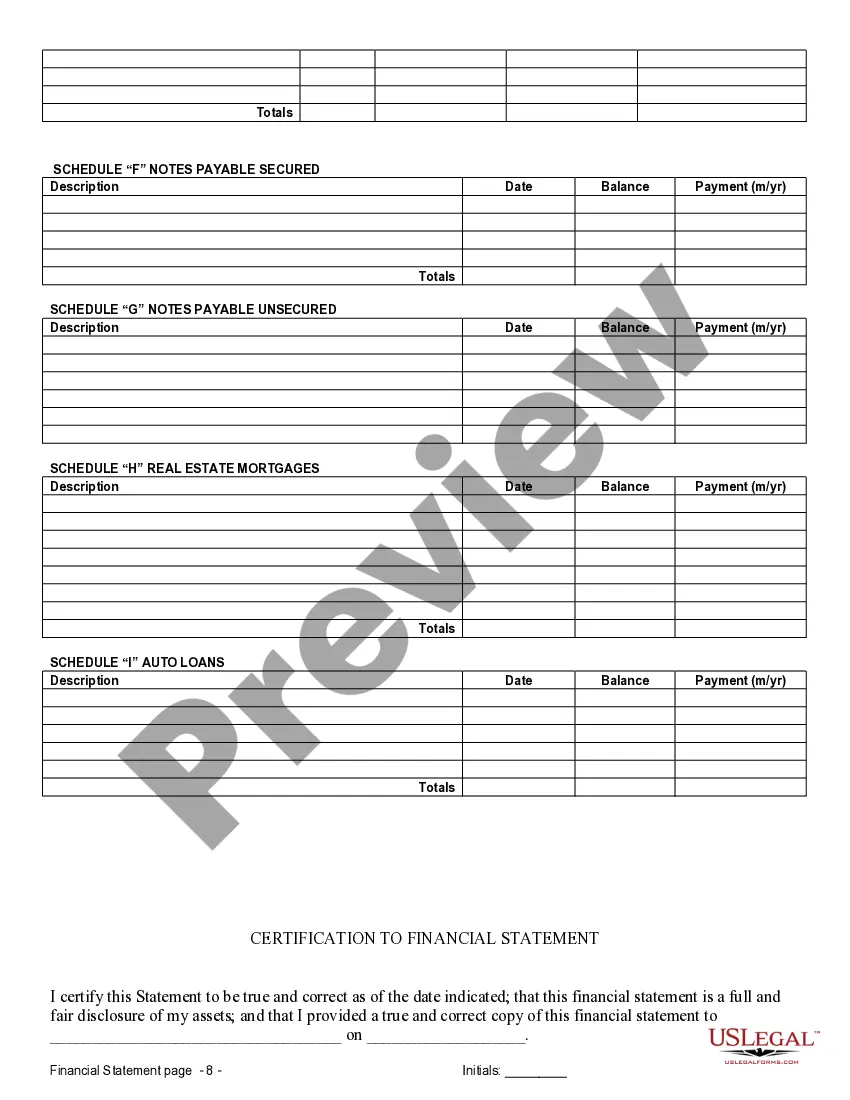

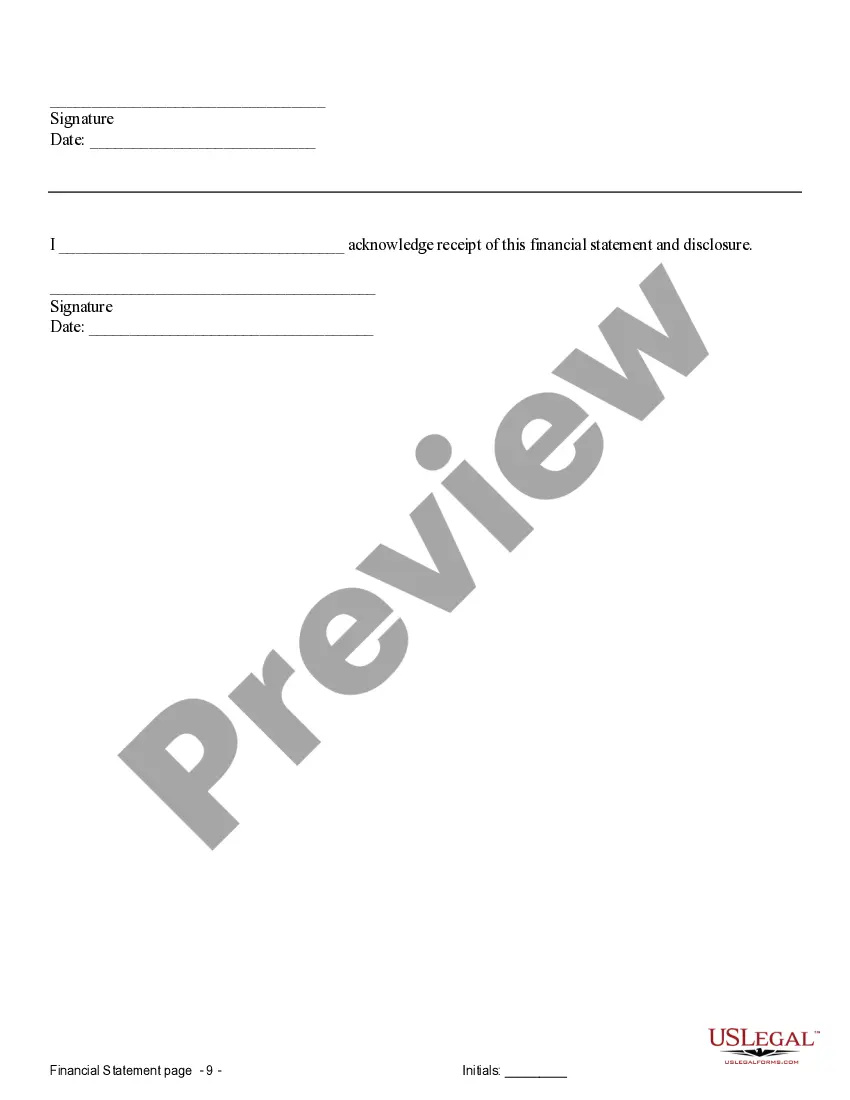

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

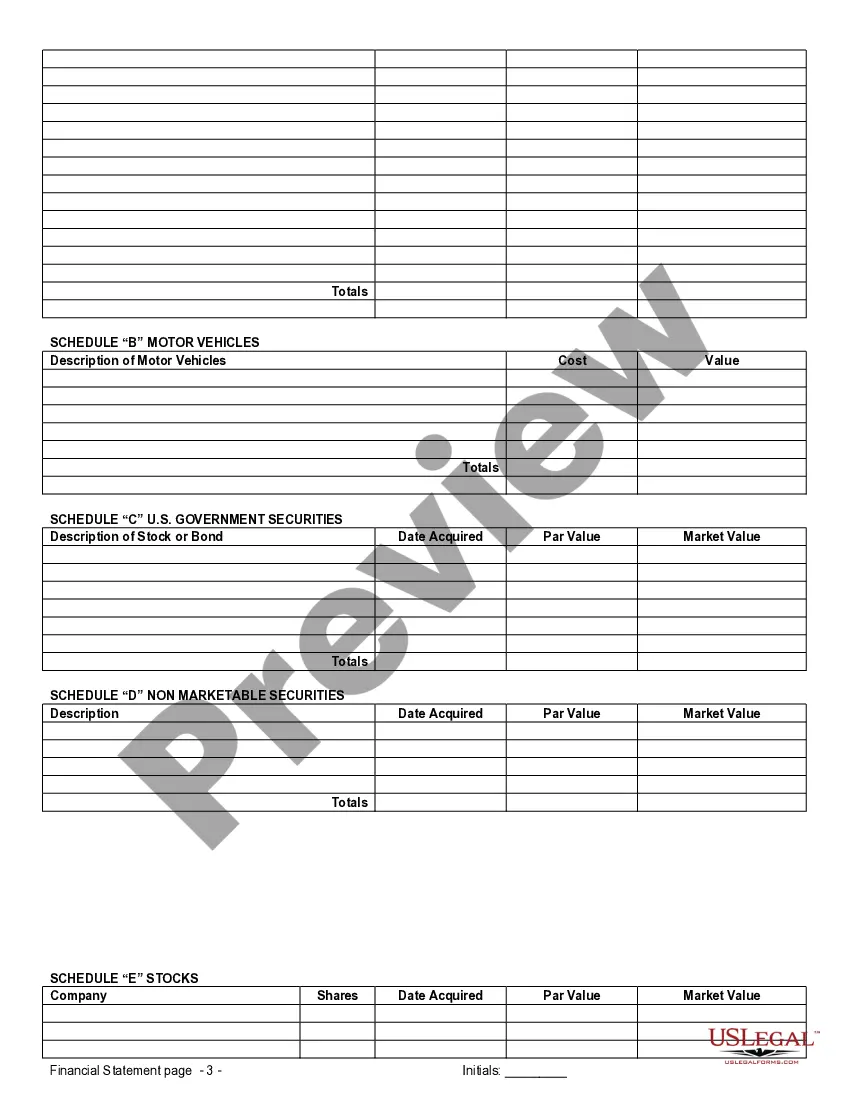

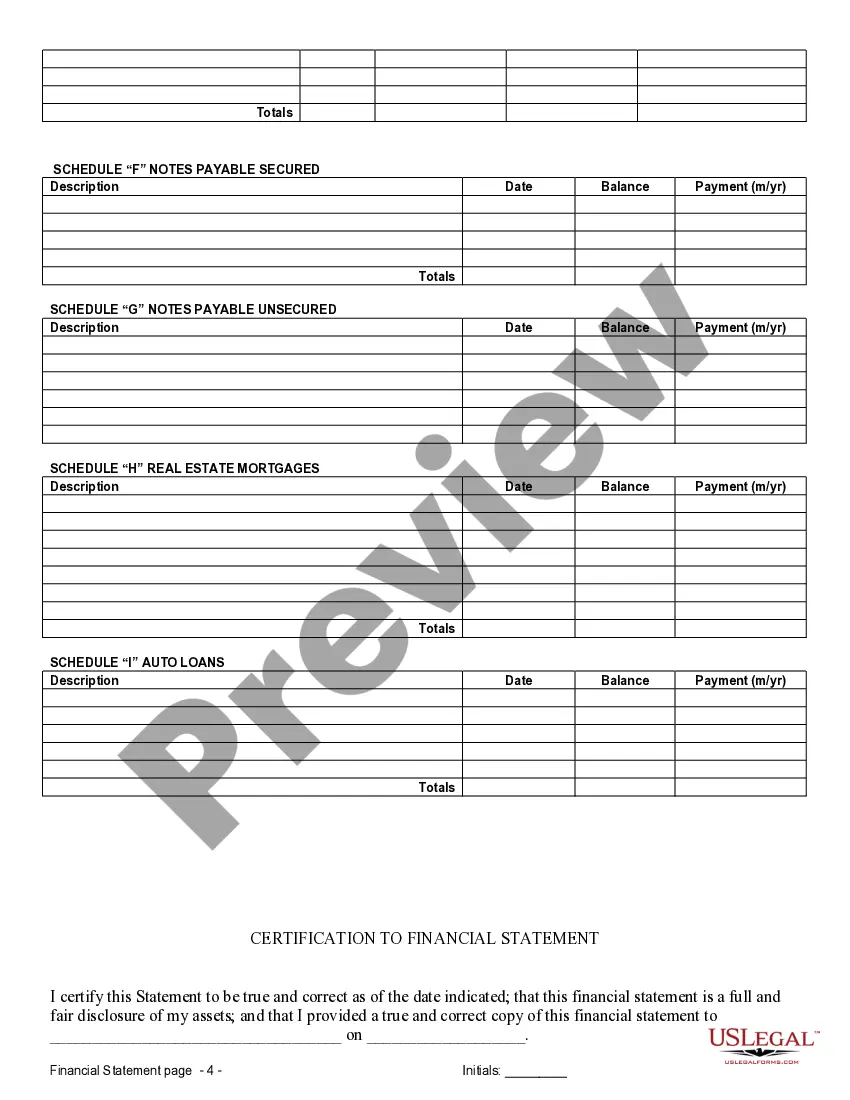

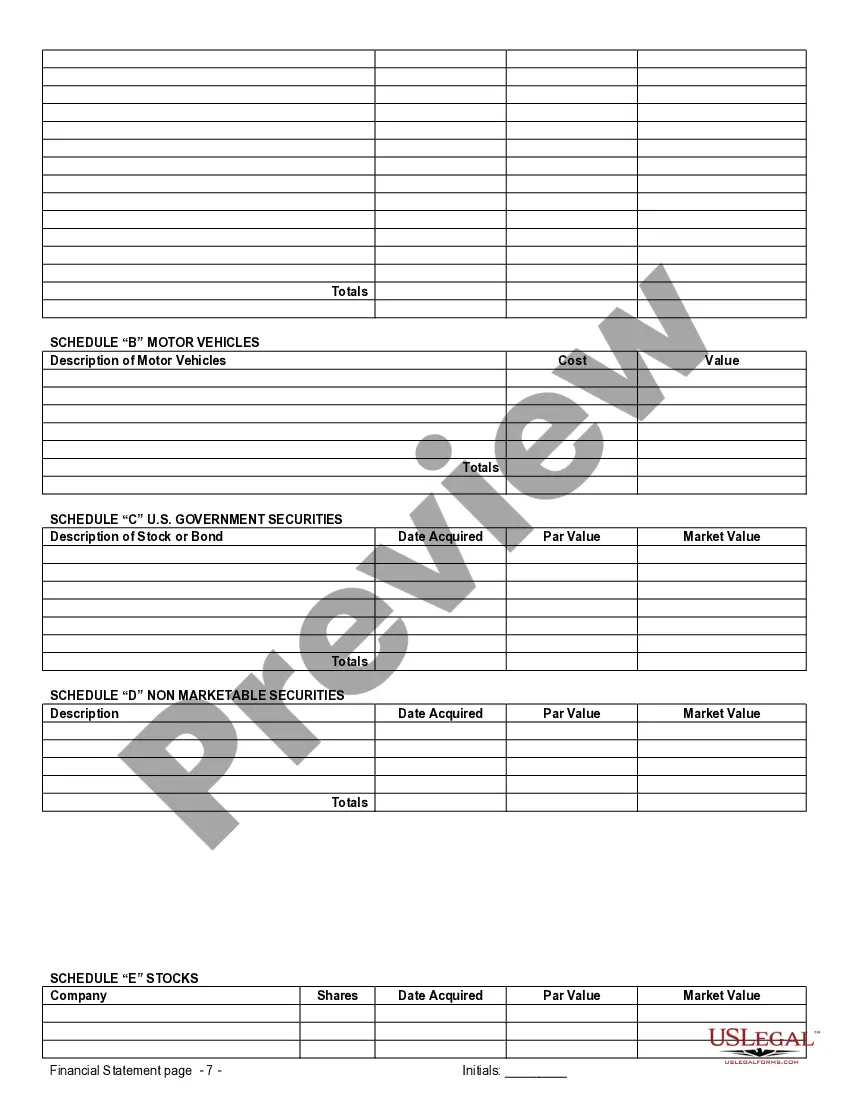

Bexar Texas Financial Statements: A Comprehensive Overview in Connection with Prenuptial Premarital Agreement In the context of a prenuptial or premarital agreement, Bexar Texas financial statements play a crucial role in outlining the financial position and assets of both parties involved. These statements establish a clear picture of each individual's financial standing before entering into a marriage, helping to protect their respective interests in the event of a divorce or separation. In Bexar County, Texas, there are different types of financial statements that are commonly used in connection with prenuptial or premarital agreements: 1. Bexar Texas Personal Financial Statement: This type of financial statement provides a comprehensive overview of an individual's personal finances. It includes details of income, savings, investments, debts, liabilities, and any other relevant financial information. Personal financial statements are essential for assessing an individual's net worth and financial stability before getting into a marriage contract. 2. Bexar Texas Business Financial Statement: If either party owns or operates a business in Bexar County, Texas, a business financial statement may be required. This statement provides a detailed analysis of the company's financial health, including income, expenses, assets, and liabilities. It may also include information on business valuation, intellectual property, or third-party partnerships. Including business financial statements in a prenuptial or premarital agreement helps define the separation of business assets and potential financial obligations in case of a divorce. 3. Bexar Texas Retirement Account Statements: Retirement accounts, such as 401(k)s, IRAs, or pensions, are important components of a person's financial portfolio. Including retirement account statements in a prenuptial or premarital agreement ensures that both parties have a clear understanding of each other's retirement savings, contributions, and any associated terms. These statements may also outline the distribution or division of retirement assets in case of a divorce or separation. 4. Bexar Texas Real Estate and Property Statements: Real estate properties, such as primary residences, vacation homes, or investment properties, are often substantial assets that need to be considered in a prenuptial or premarital agreement. Bexar Texas financial statements should include relevant property documents, such as deeds, titles, and mortgage agreements. These statements also provide information about the current market value, outstanding debts, or other financial obligations related to the properties. It is critical to ensure that the Bexar Texas financial statements included in a prenuptial or premarital agreement are accurate, detailed, and up-to-date. Both parties should disclose all relevant financial information transparently and consult with legal and financial professionals experienced in family law to guarantee the agreement's validity and fairness. By having a comprehensive understanding of each other's financial positions, couples can create a prenuptial or premarital agreement that protects their interests, promotes financial clarity, and helps foster a healthier relationship.Bexar Texas Financial Statements: A Comprehensive Overview in Connection with Prenuptial Premarital Agreement In the context of a prenuptial or premarital agreement, Bexar Texas financial statements play a crucial role in outlining the financial position and assets of both parties involved. These statements establish a clear picture of each individual's financial standing before entering into a marriage, helping to protect their respective interests in the event of a divorce or separation. In Bexar County, Texas, there are different types of financial statements that are commonly used in connection with prenuptial or premarital agreements: 1. Bexar Texas Personal Financial Statement: This type of financial statement provides a comprehensive overview of an individual's personal finances. It includes details of income, savings, investments, debts, liabilities, and any other relevant financial information. Personal financial statements are essential for assessing an individual's net worth and financial stability before getting into a marriage contract. 2. Bexar Texas Business Financial Statement: If either party owns or operates a business in Bexar County, Texas, a business financial statement may be required. This statement provides a detailed analysis of the company's financial health, including income, expenses, assets, and liabilities. It may also include information on business valuation, intellectual property, or third-party partnerships. Including business financial statements in a prenuptial or premarital agreement helps define the separation of business assets and potential financial obligations in case of a divorce. 3. Bexar Texas Retirement Account Statements: Retirement accounts, such as 401(k)s, IRAs, or pensions, are important components of a person's financial portfolio. Including retirement account statements in a prenuptial or premarital agreement ensures that both parties have a clear understanding of each other's retirement savings, contributions, and any associated terms. These statements may also outline the distribution or division of retirement assets in case of a divorce or separation. 4. Bexar Texas Real Estate and Property Statements: Real estate properties, such as primary residences, vacation homes, or investment properties, are often substantial assets that need to be considered in a prenuptial or premarital agreement. Bexar Texas financial statements should include relevant property documents, such as deeds, titles, and mortgage agreements. These statements also provide information about the current market value, outstanding debts, or other financial obligations related to the properties. It is critical to ensure that the Bexar Texas financial statements included in a prenuptial or premarital agreement are accurate, detailed, and up-to-date. Both parties should disclose all relevant financial information transparently and consult with legal and financial professionals experienced in family law to guarantee the agreement's validity and fairness. By having a comprehensive understanding of each other's financial positions, couples can create a prenuptial or premarital agreement that protects their interests, promotes financial clarity, and helps foster a healthier relationship.