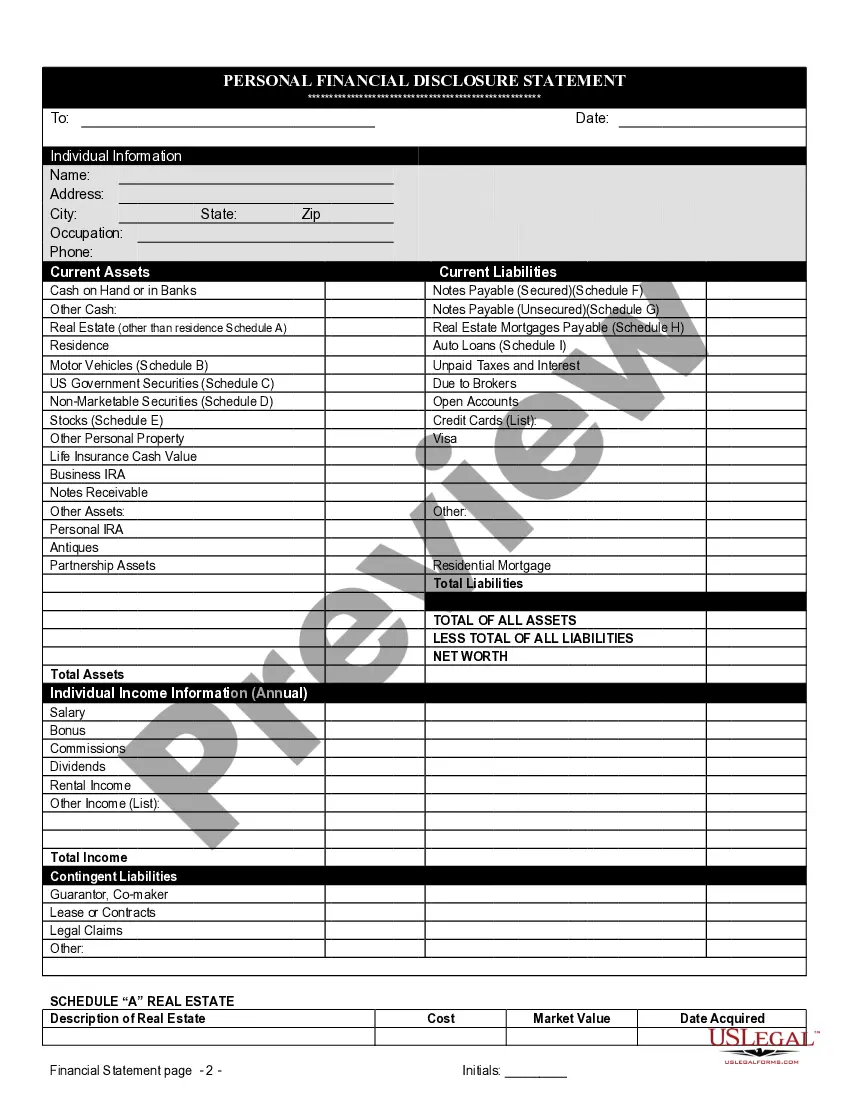

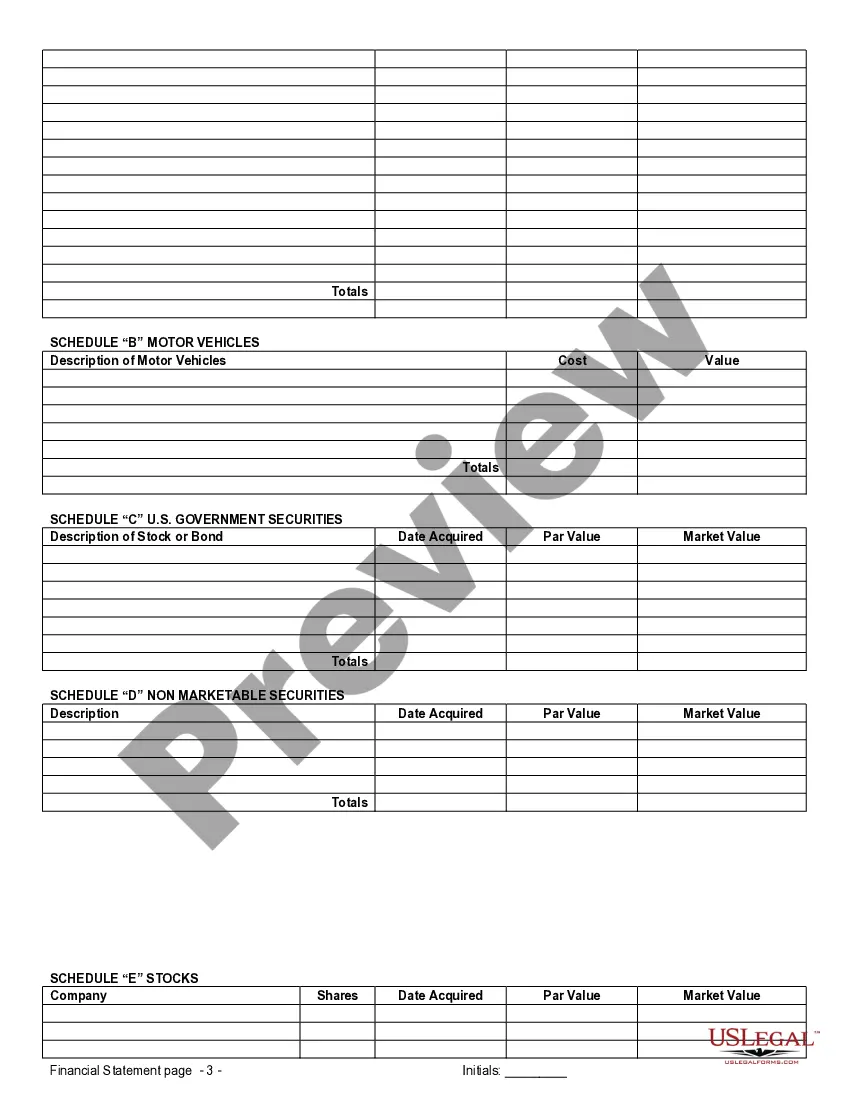

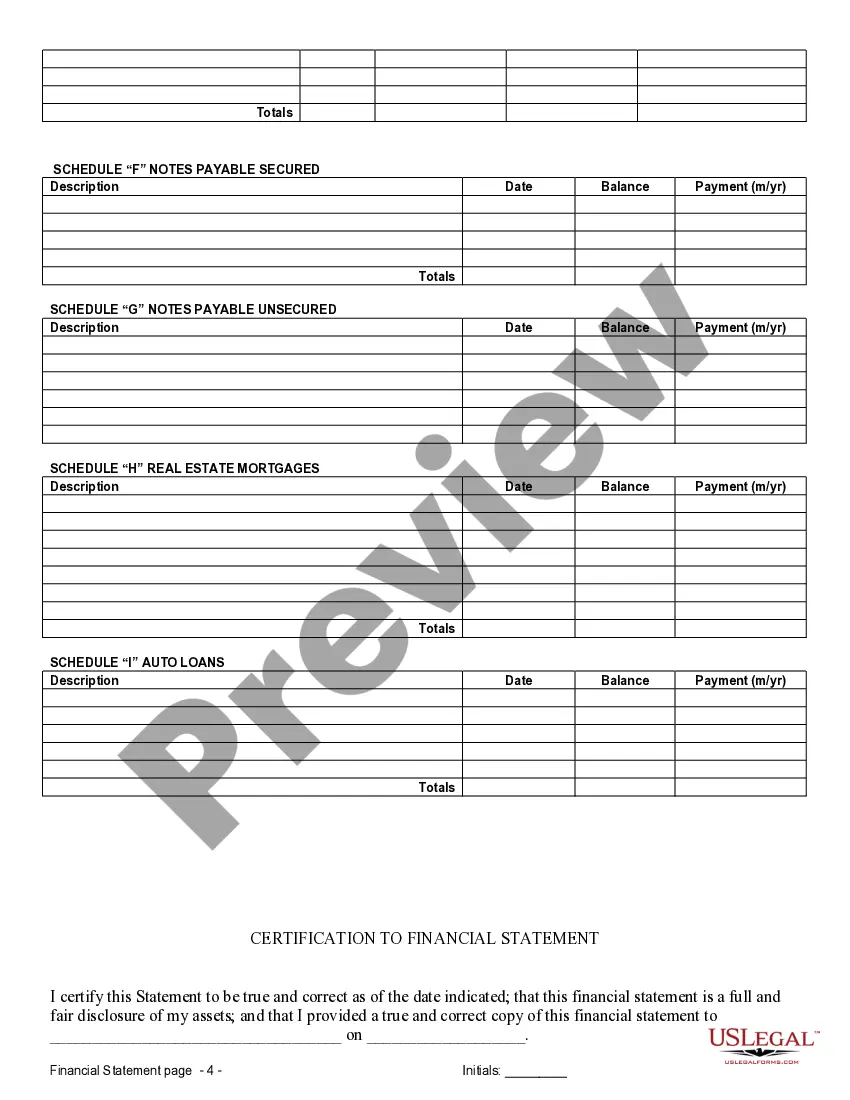

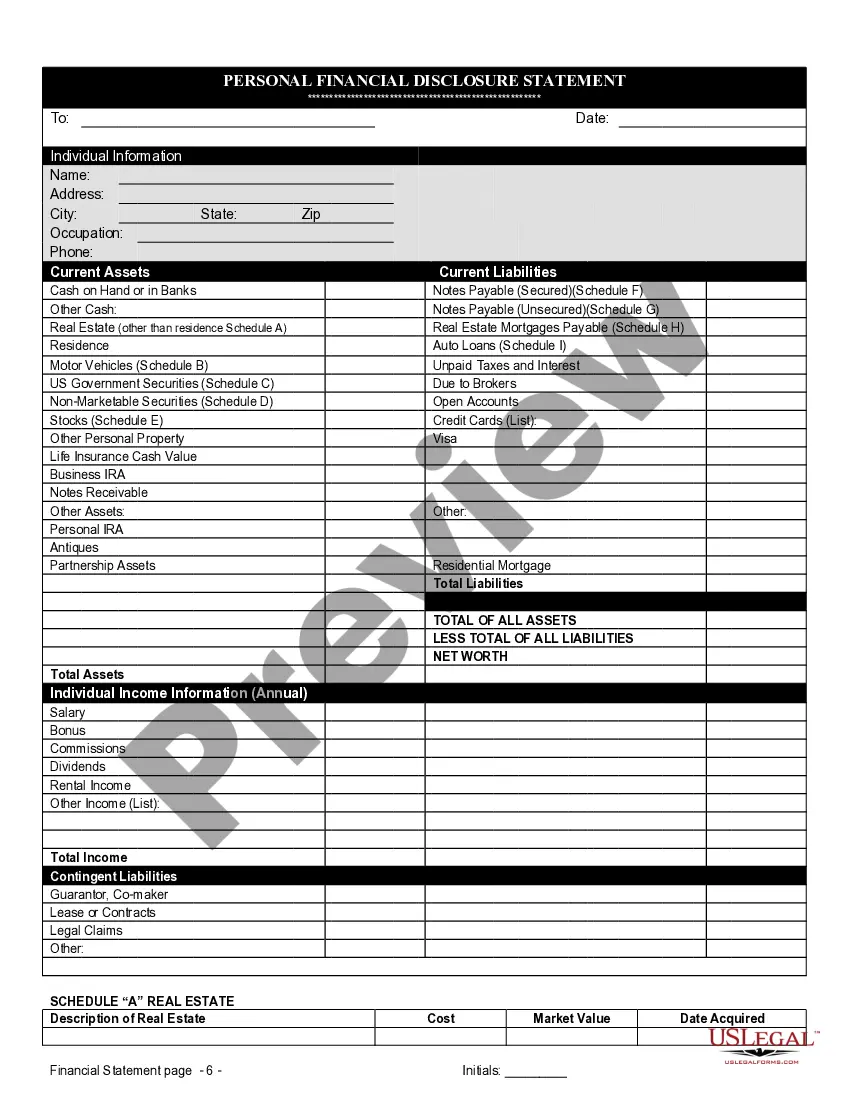

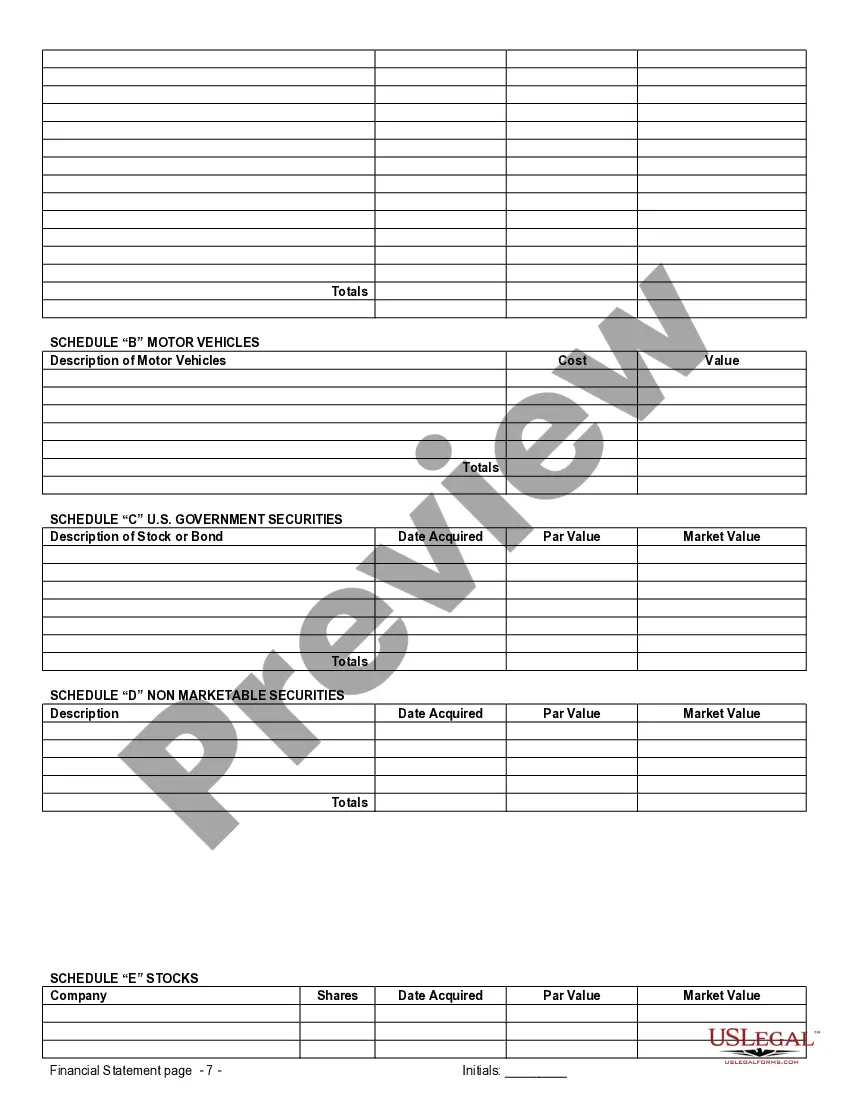

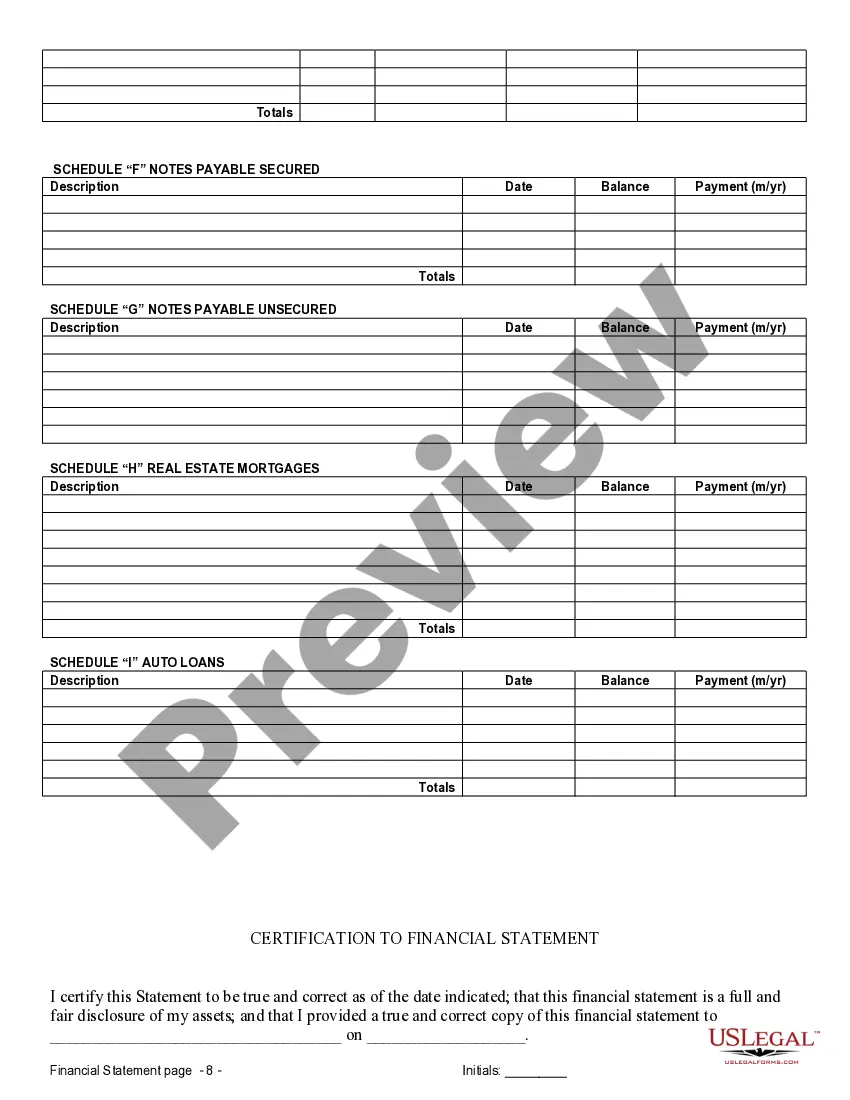

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Texas Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Regardless of one's social or occupational position, completing legal-related documents is a regrettable requirement in the current professional landscape.

Frequently, it’s nearly unattainable for an individual lacking any legal expertise to formulate such documents from scratch, primarily due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms proves to be beneficial.

Ensure the form you selected is appropriate for your locality, as the laws of one region may not apply to another.

Examine the document and read through a brief overview (if available) of the situations for which the document may be utilized.

- Our service provides an extensive catalog of over 85,000 ready-to-use state-specific forms that cater to virtually every legal scenario.

- US Legal Forms is also a superb resource for associates or legal advisors aiming to enhance their efficiency by using our DIY documents.

- Whether you need the Carrollton Texas Financial Statements solely in relation to the Prenuptial Premarital Agreement or any other document applicable in your jurisdiction, with US Legal Forms, everything is readily available.

- Here's how to swiftly obtain the Carrollton Texas Financial Statements solely related to the Prenuptial Premarital Agreement using our reliable service.

- If you are already a member, you can proceed to Log In to your account to access the desired form.

- However, if you are new to our platform, be sure to follow these steps before acquiring the Carrollton Texas Financial Statements solely related to the Prenuptial Premarital Agreement.

Form popularity

FAQ

When creating a prenuptial agreement in Carrollton, Texas, you often need to provide financial statements, including bank statements. These Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement are crucial for ensuring transparency about assets and liabilities. By sharing this information, both parties can make informed decisions, which helps in reducing misunderstandings in the future. Using platforms like uslegalforms can streamline this process, allowing you to gather and submit the necessary documentation easily.

Yes, a prenuptial agreement can successfully keep assets separate. By defining property ownership and how assets will be treated in the event of a divorce, couples can protect their individual assets. This structure is particularly important for those with significant pre-marital investments. Reference to Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement will enhance the effectiveness of these protections.

Certainly, a prenuptial agreement can keep finances separate. The document can specify which assets belong to each party, thus safeguarding individual wealth. Clear terms around financial management prevent disputes in the future. Engaging with Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement ensures that separation terms are defined.

The financial statement of a prenuptial agreement details each party's assets, debts, and income. This statement serves as a foundation for the agreement, outlining financial rights and obligations. It helps both partners understand their financial landscape before entering marriage. For complete and accurate Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, seek professional assistance.

Yes, financial disclosure is typically required for a prenuptial agreement. Both parties should provide an honest account of their financial situation, including assets, liabilities, and income. This transparency helps ensure that the prenuptial agreement is enforceable in court. If you are considering Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, full financial disclosure is crucial.

Yes, a prenuptial agreement can help keep debt separate. By clearly outlining which party is responsible for specific debts, couples can protect themselves from each other's financial liabilities. This clarity is vital, especially when individuals enter the marriage with existing debt. Consultations regarding Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement can assist in structuring these provisions.

To legally keep finances separate in marriage, it’s essential to create a clear prenuptial agreement. This document outlines each partner's financial rights and obligations, ensuring mutual understanding and protection. Maintaining separate bank accounts and documenting all financial transactions can also support this goal. Utilizing Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement can further clarify financial arrangements.

Yes, a prenuptial agreement can effectively keep all finances separate. By specifying how assets and income will be handled, couples can ensure clarity and protection for both parties. This arrangement is beneficial in situations where one or both partners have significant assets. Understanding the terms around Carrollton Texas Financial Statements only in Connection with Prenuptial Premarital Agreement can facilitate this process.

If a prenuptial agreement doesn't appeal to you, consider alternative methods such as cohabitation agreements or living trusts. These tools can provide financial security while every party understands their rights. Engaging in honest conversations about finances can also help in setting clear expectations. Additionally, Carrollton Texas Financial Statements only in connection with prenuptial premarital agreements can guide you in preparing relevant financial documentation without formal prenuptial agreements.

A financial statement for a prenuptial agreement details each party's assets, liabilities, and income. This transparent disclosure helps both partners understand their financial situations before entering into marriage. Including a financial statement fosters trust and can aid in negotiations. Therefore, using Carrollton Texas Financial Statements only in connection with prenuptial premarital agreements ensures that all financial details are comprehensively documented.