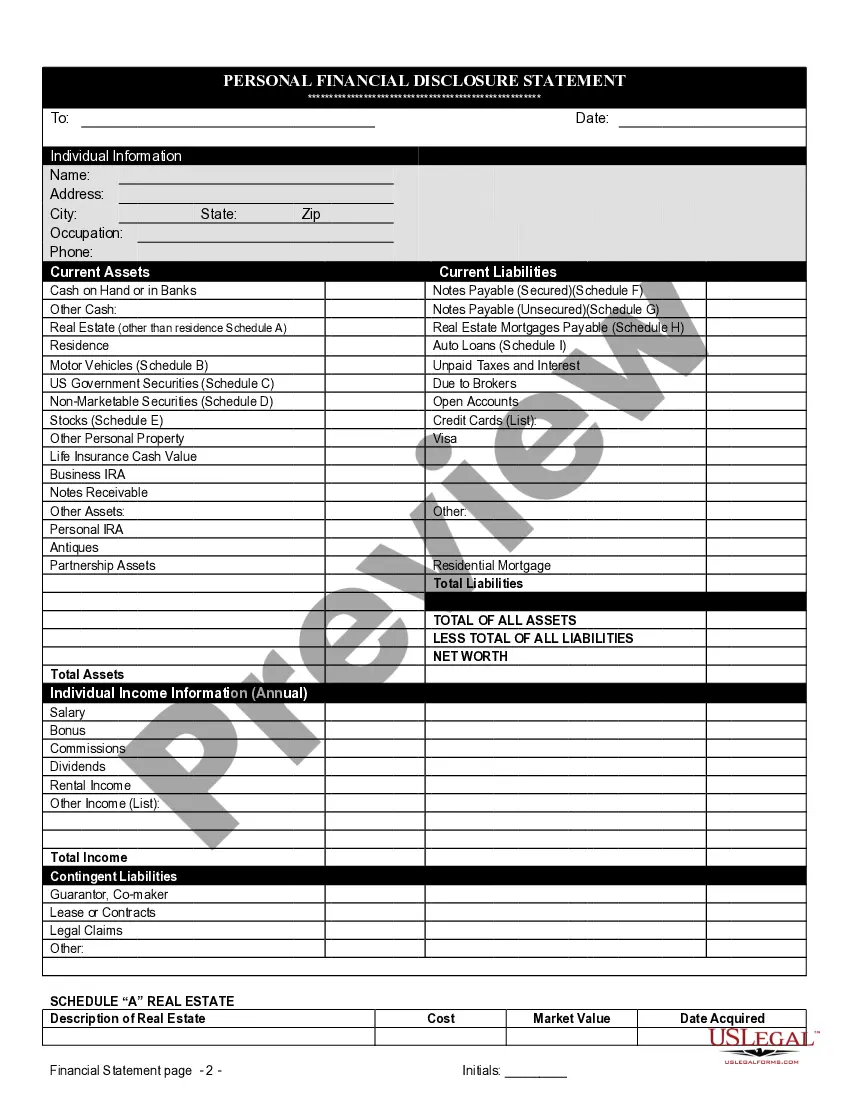

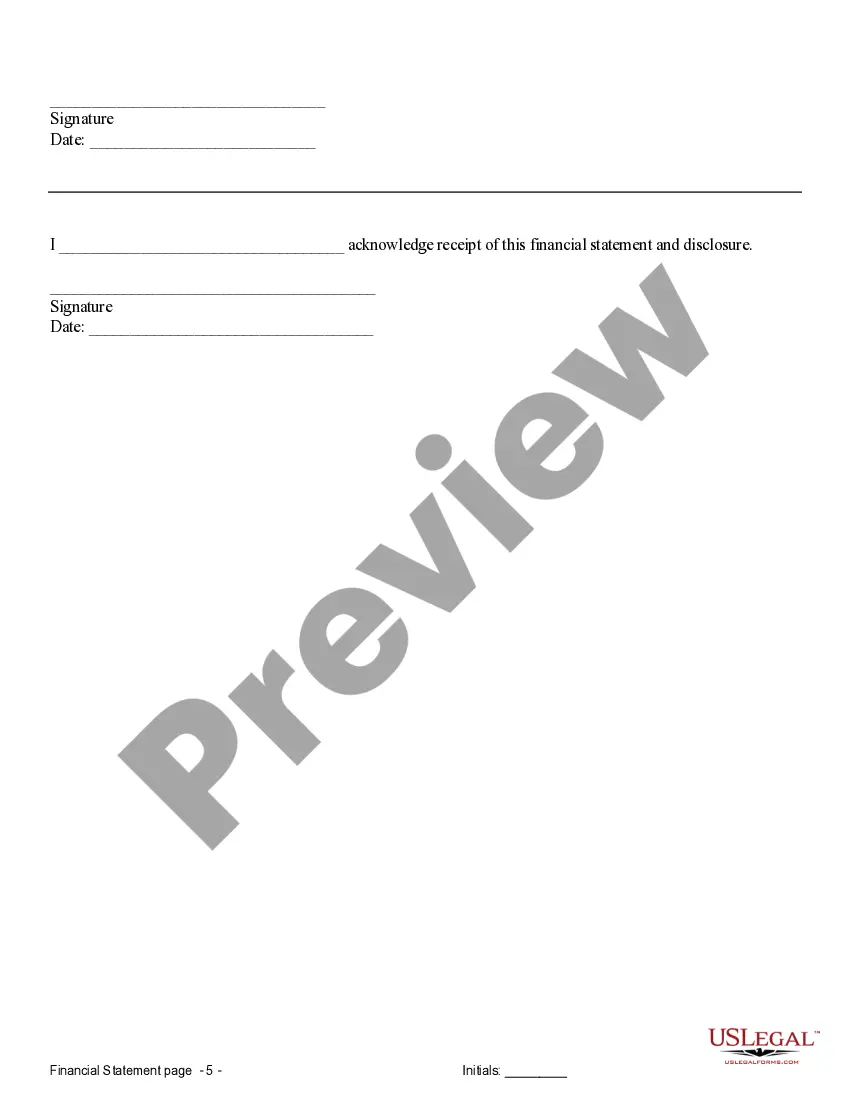

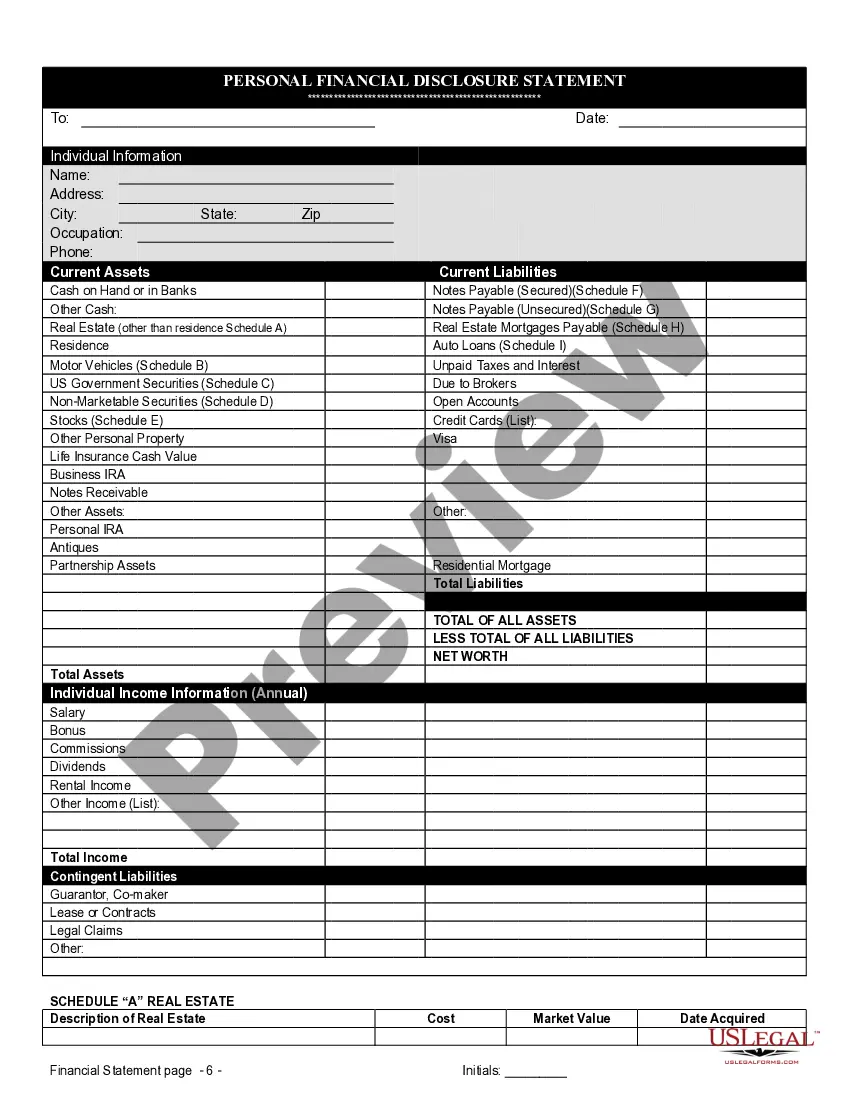

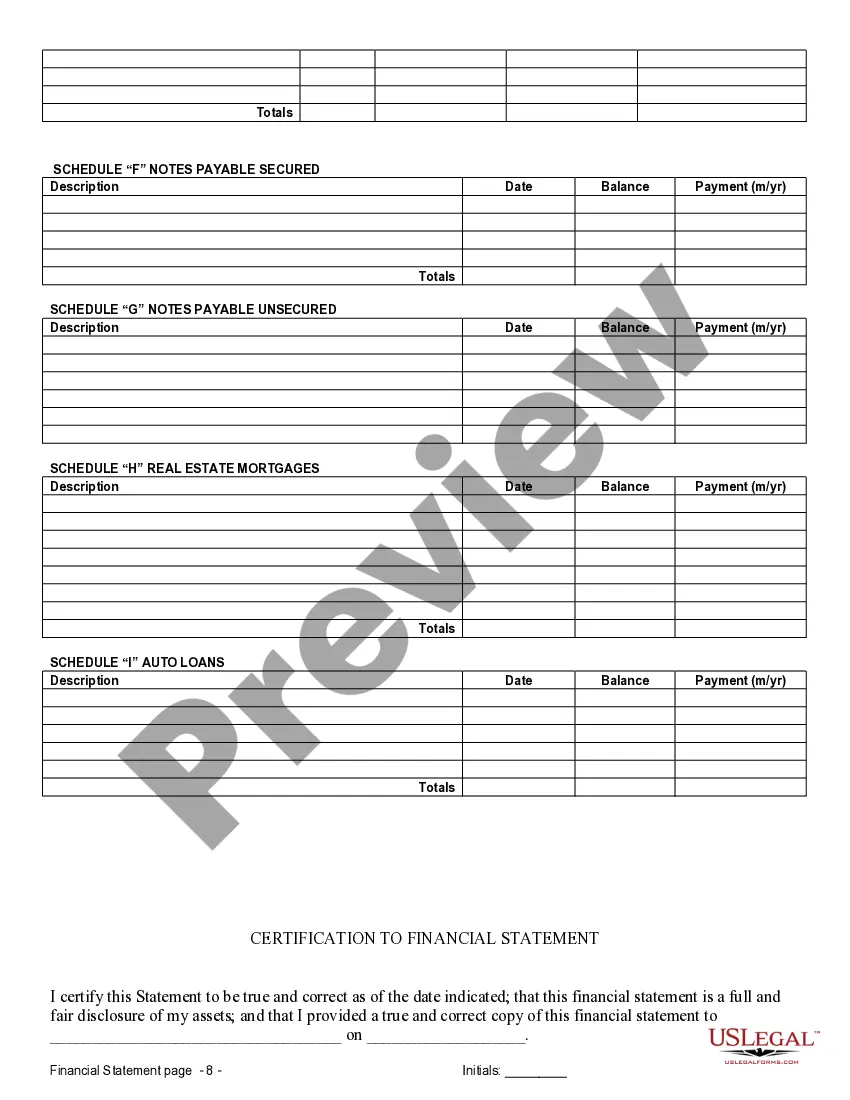

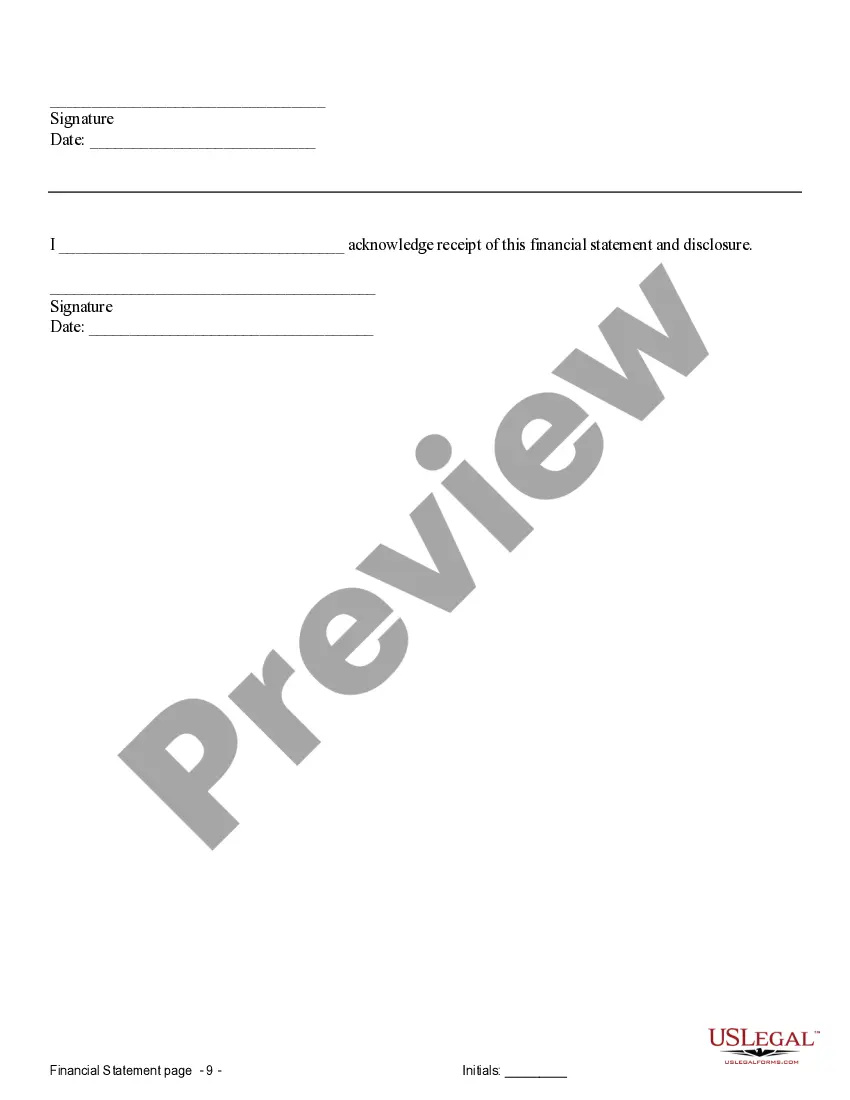

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

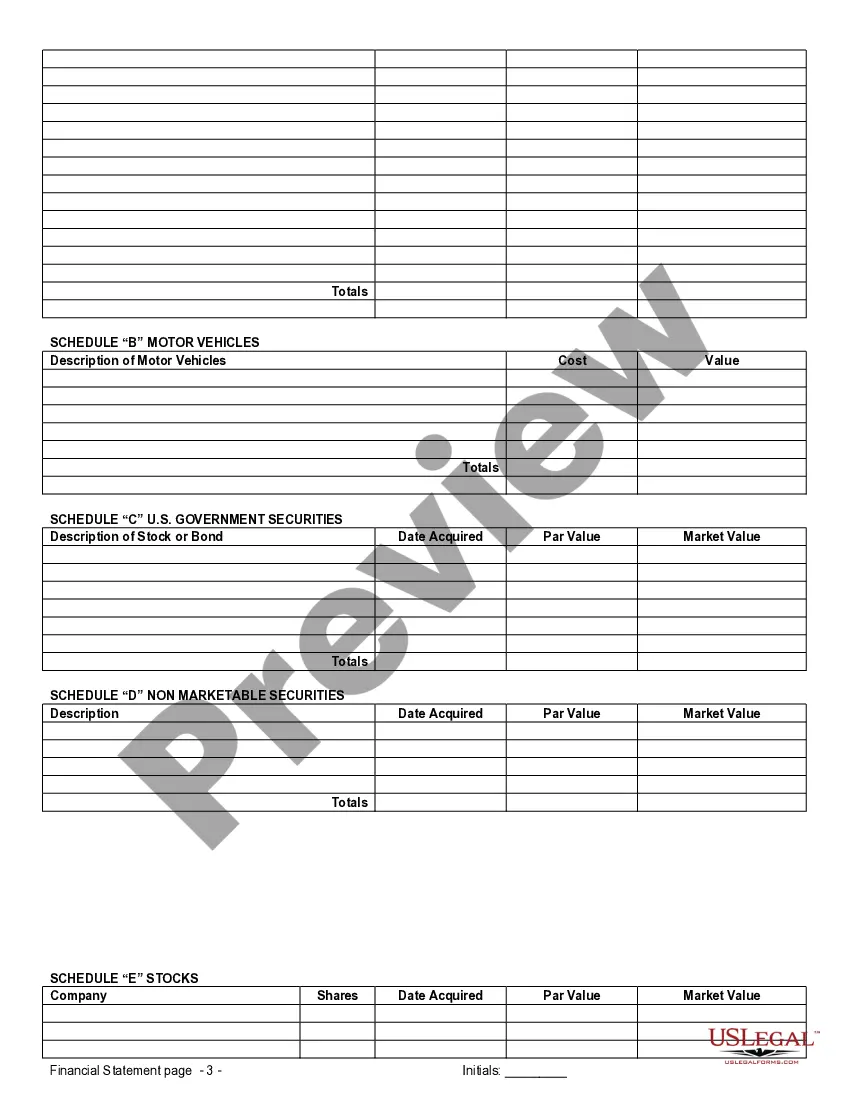

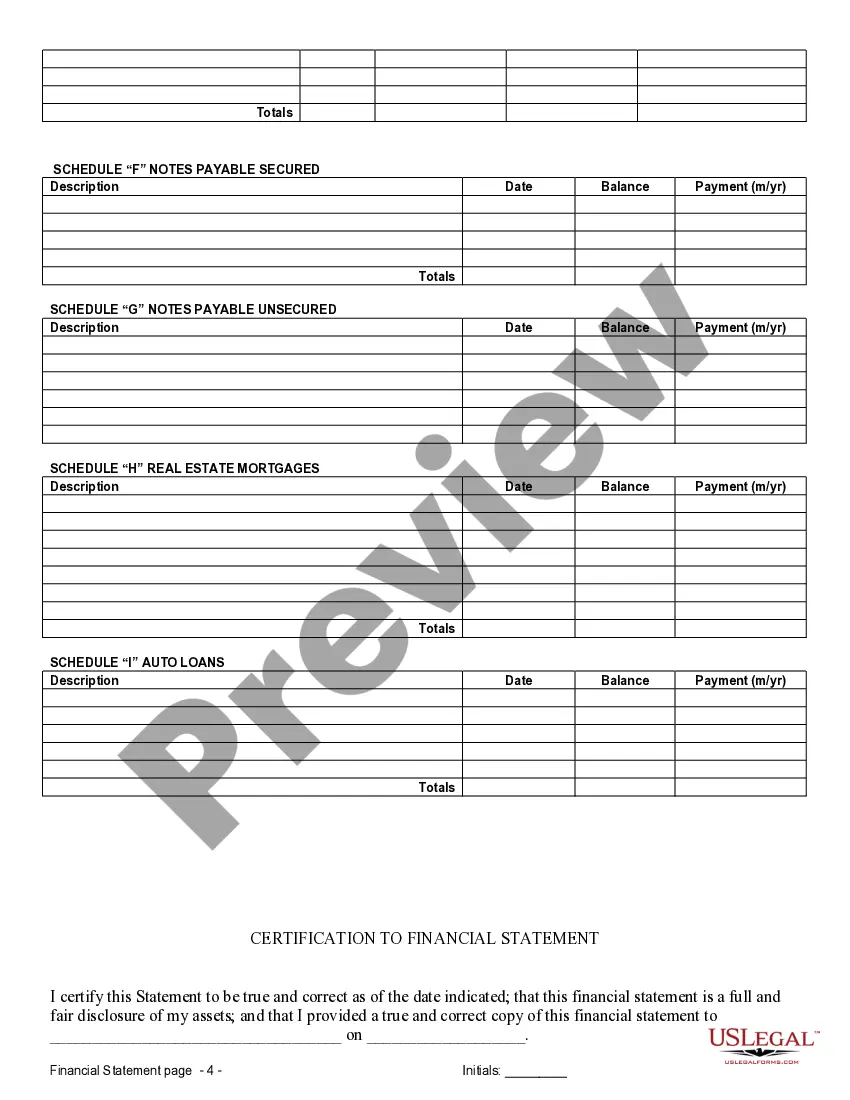

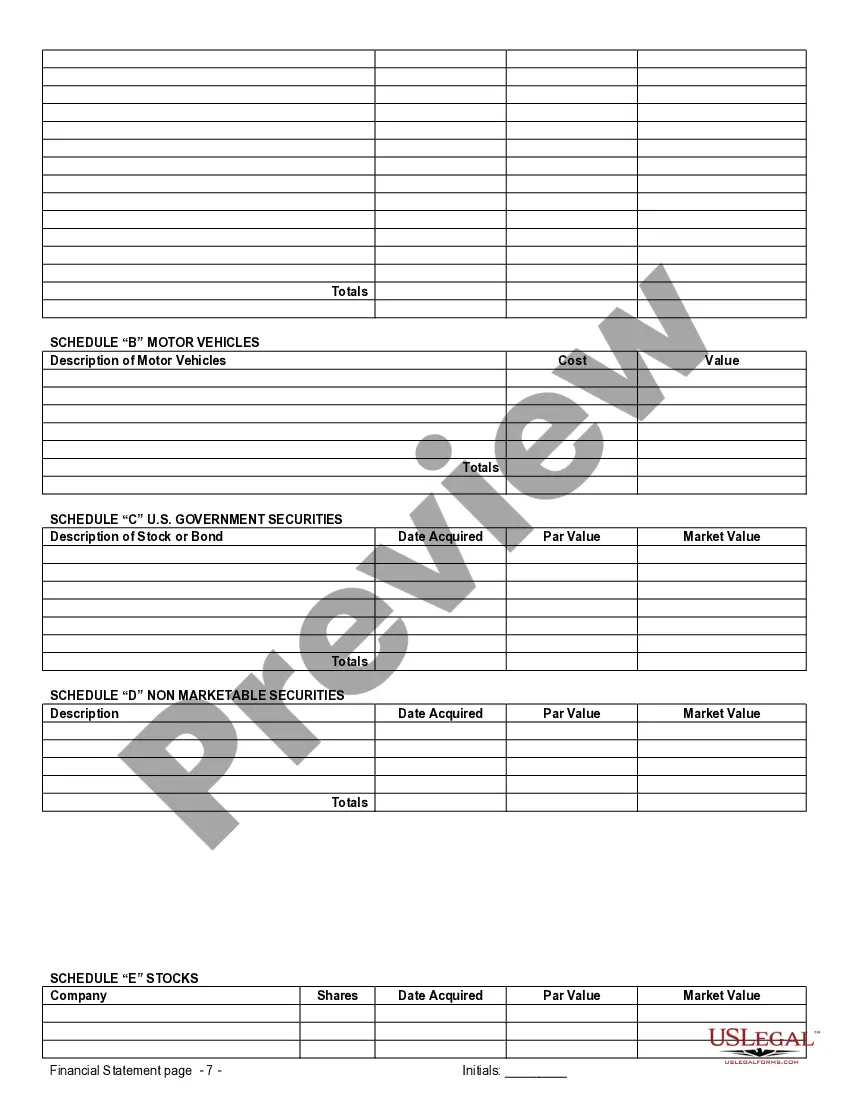

In College Station, Texas, financial statements play a crucial role when considering a prenuptial or premarital agreement. These statements provide valuable insight into each individual's financial situation, assets, and liabilities, ultimately helping both parties make informed decisions regarding their future together. Here, we will explore the various types of financial statements specific to College Station Texas, which are commonly used in connection with prenuptial or premarital agreements. One important type of financial statement used in College Station is the Personal Balance Sheet. This statement provides a comprehensive snapshot of an individual's financial standing at a specific point in time. It includes details regarding one's assets, such as real estate properties, bank accounts, investments, and personal possessions. Additionally, the Personal Balance Sheet outlines liabilities such as mortgages, loans, credit card debts, and other outstanding obligations. Another relevant financial statement is the Income Statement, which presents an individual's income and expenses within a specific time frame. This statement provides an overview of the individual's financial stability by detailing sources of income, such as salary, business profits, or investment returns, as well as expenditures, including utilities, rent or mortgage payments, groceries, and other regular expenses. The Income Statement helps assess an individual's financial capacity and potential contributions to the marital estate. In College Station, Texas, the Debt Statement is also an essential financial document utilized in prenuptial or premarital agreements. This statement outlines any outstanding debts an individual may have accrued, such as student loans, credit card debts, or personal loans. It further includes information about the debt's terms, interest rates, and repayment schedules. This statement enables a comprehensive understanding of each party's financial responsibilities and potential impacts on future financial decisions. Additionally, one commonly used financial statement is the Business Financial Statement. If one or both parties own a business or hold significant investments in Texas, this statement provides crucial information about the business's assets, liabilities, income, and expenses. It helps determine the business's overall value, potential future earnings, and any potential risks or obligations associated with it. This statement ensures transparency and fairness when addressing the business's involvement in the prenuptial or premarital agreement. When drafting a prenuptial or premarital agreement in College Station, Texas, these various financial statements serve as vital tools in facilitating open discussions about finances, obligations, and expectations. They provide transparency, ensuring that both parties have a clear understanding of each other's financial circumstances, and allow them to make informed decisions regarding their assets and financial responsibilities. It is crucial to consult with an experienced family law attorney in College Station, Texas, who can guide you through the process of preparing the necessary financial statements in connection with a prenuptial or premarital agreement. With their expertise, they can ensure that all relevant financial information is accurately disclosed, protecting your interests and promoting a fair outcome for both parties involved.In College Station, Texas, financial statements play a crucial role when considering a prenuptial or premarital agreement. These statements provide valuable insight into each individual's financial situation, assets, and liabilities, ultimately helping both parties make informed decisions regarding their future together. Here, we will explore the various types of financial statements specific to College Station Texas, which are commonly used in connection with prenuptial or premarital agreements. One important type of financial statement used in College Station is the Personal Balance Sheet. This statement provides a comprehensive snapshot of an individual's financial standing at a specific point in time. It includes details regarding one's assets, such as real estate properties, bank accounts, investments, and personal possessions. Additionally, the Personal Balance Sheet outlines liabilities such as mortgages, loans, credit card debts, and other outstanding obligations. Another relevant financial statement is the Income Statement, which presents an individual's income and expenses within a specific time frame. This statement provides an overview of the individual's financial stability by detailing sources of income, such as salary, business profits, or investment returns, as well as expenditures, including utilities, rent or mortgage payments, groceries, and other regular expenses. The Income Statement helps assess an individual's financial capacity and potential contributions to the marital estate. In College Station, Texas, the Debt Statement is also an essential financial document utilized in prenuptial or premarital agreements. This statement outlines any outstanding debts an individual may have accrued, such as student loans, credit card debts, or personal loans. It further includes information about the debt's terms, interest rates, and repayment schedules. This statement enables a comprehensive understanding of each party's financial responsibilities and potential impacts on future financial decisions. Additionally, one commonly used financial statement is the Business Financial Statement. If one or both parties own a business or hold significant investments in Texas, this statement provides crucial information about the business's assets, liabilities, income, and expenses. It helps determine the business's overall value, potential future earnings, and any potential risks or obligations associated with it. This statement ensures transparency and fairness when addressing the business's involvement in the prenuptial or premarital agreement. When drafting a prenuptial or premarital agreement in College Station, Texas, these various financial statements serve as vital tools in facilitating open discussions about finances, obligations, and expectations. They provide transparency, ensuring that both parties have a clear understanding of each other's financial circumstances, and allow them to make informed decisions regarding their assets and financial responsibilities. It is crucial to consult with an experienced family law attorney in College Station, Texas, who can guide you through the process of preparing the necessary financial statements in connection with a prenuptial or premarital agreement. With their expertise, they can ensure that all relevant financial information is accurately disclosed, protecting your interests and promoting a fair outcome for both parties involved.