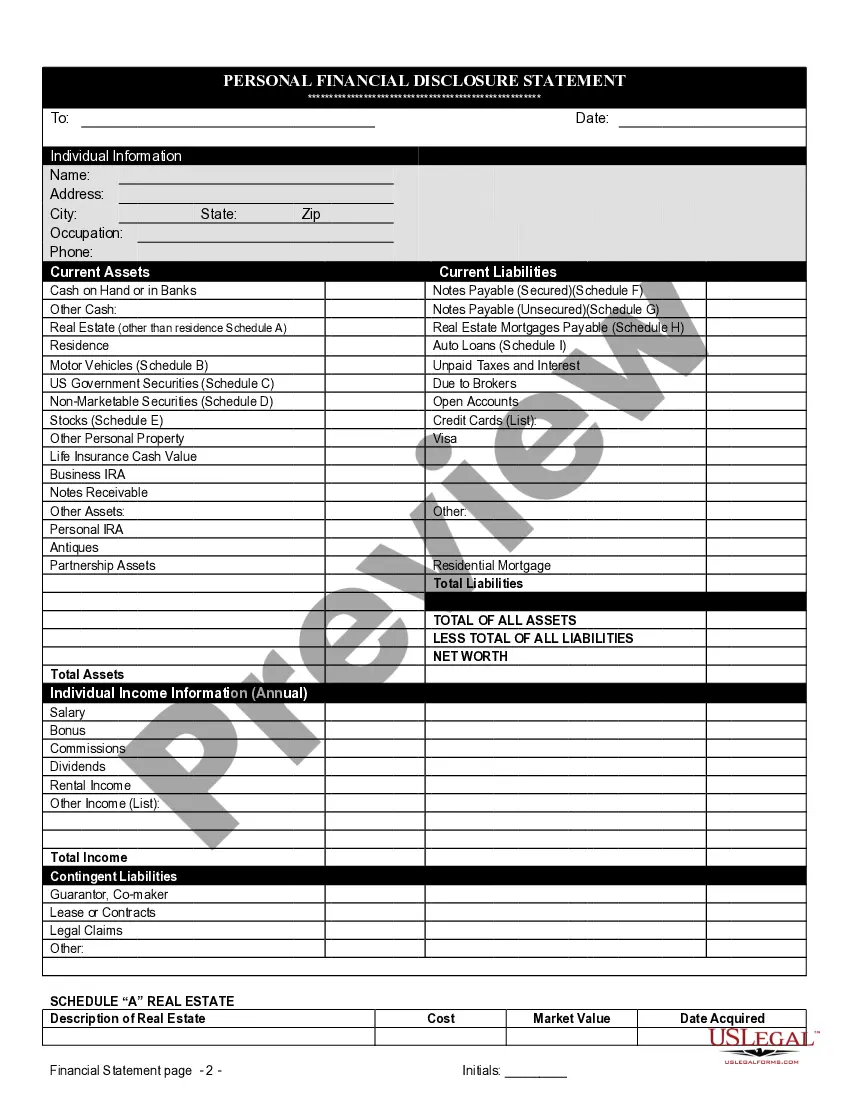

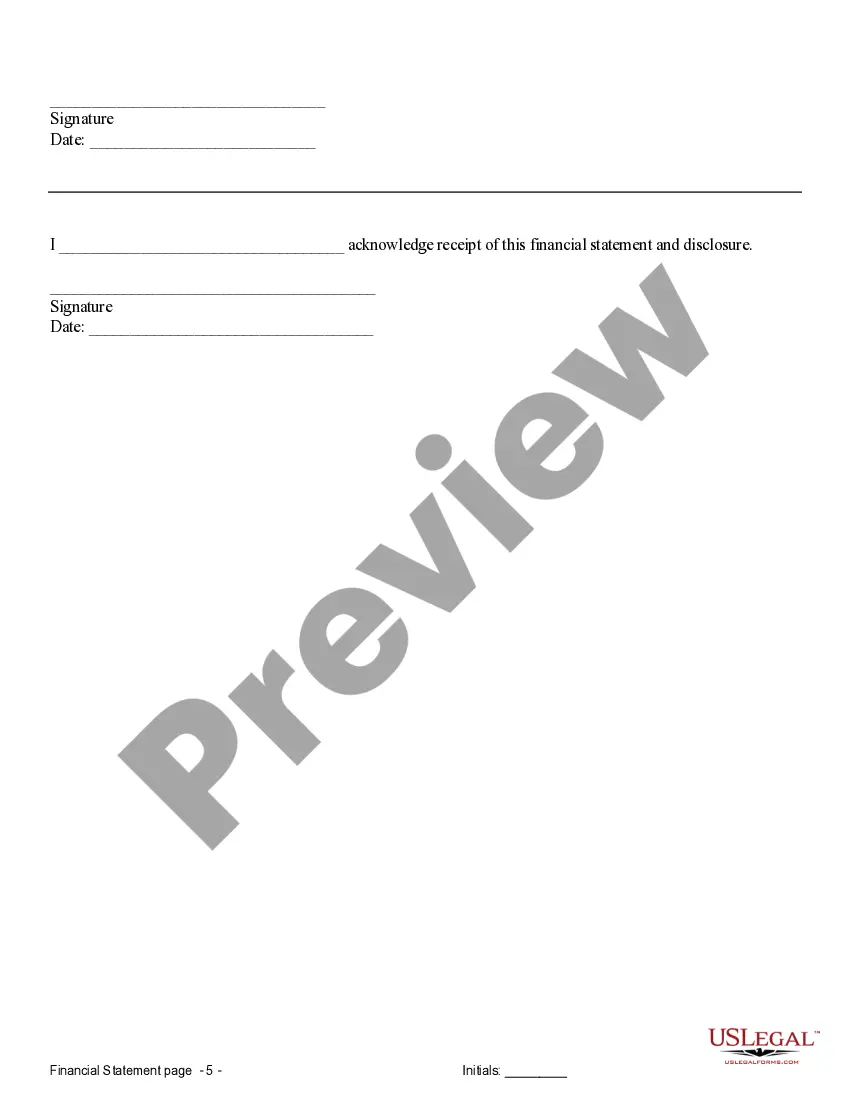

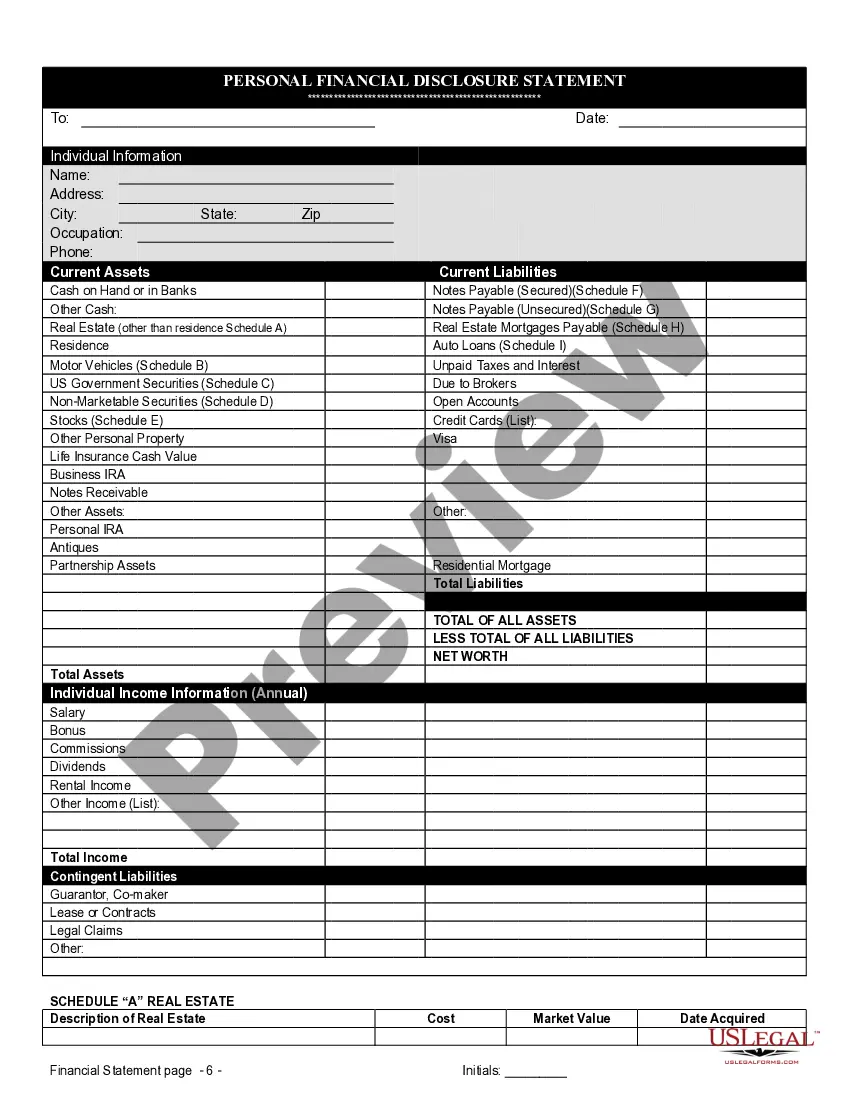

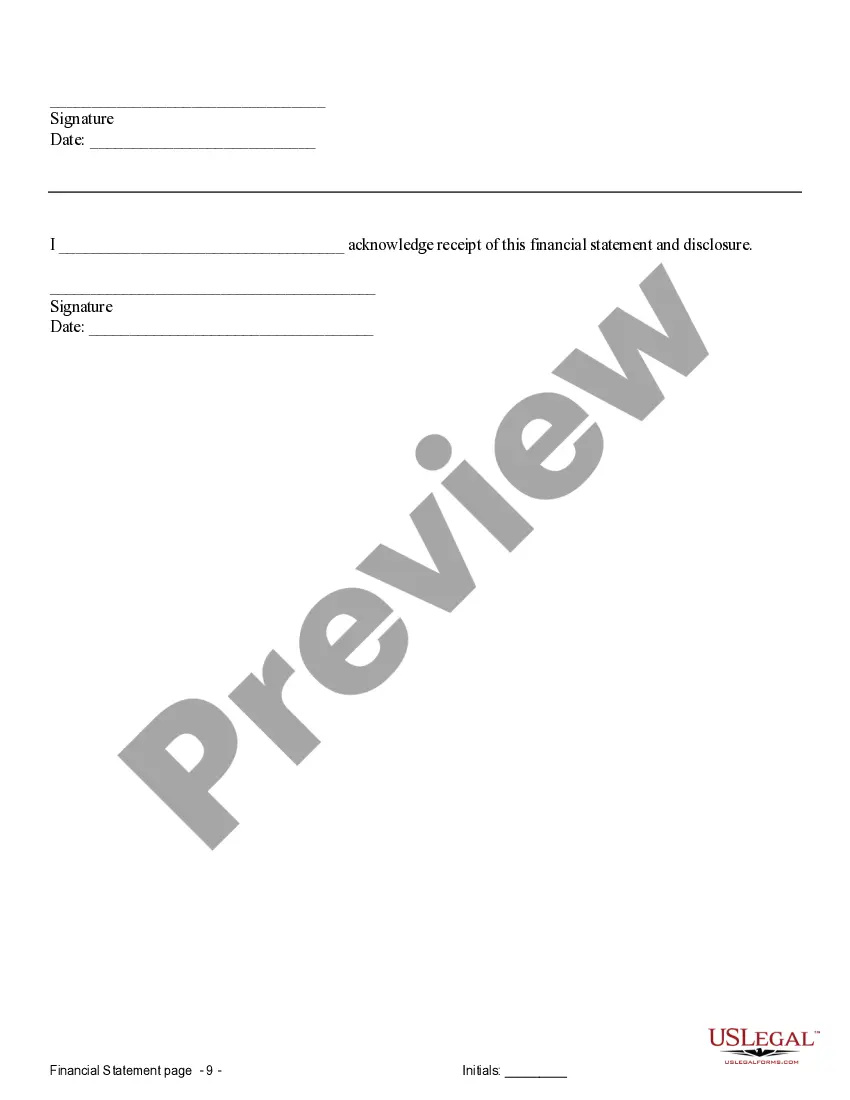

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

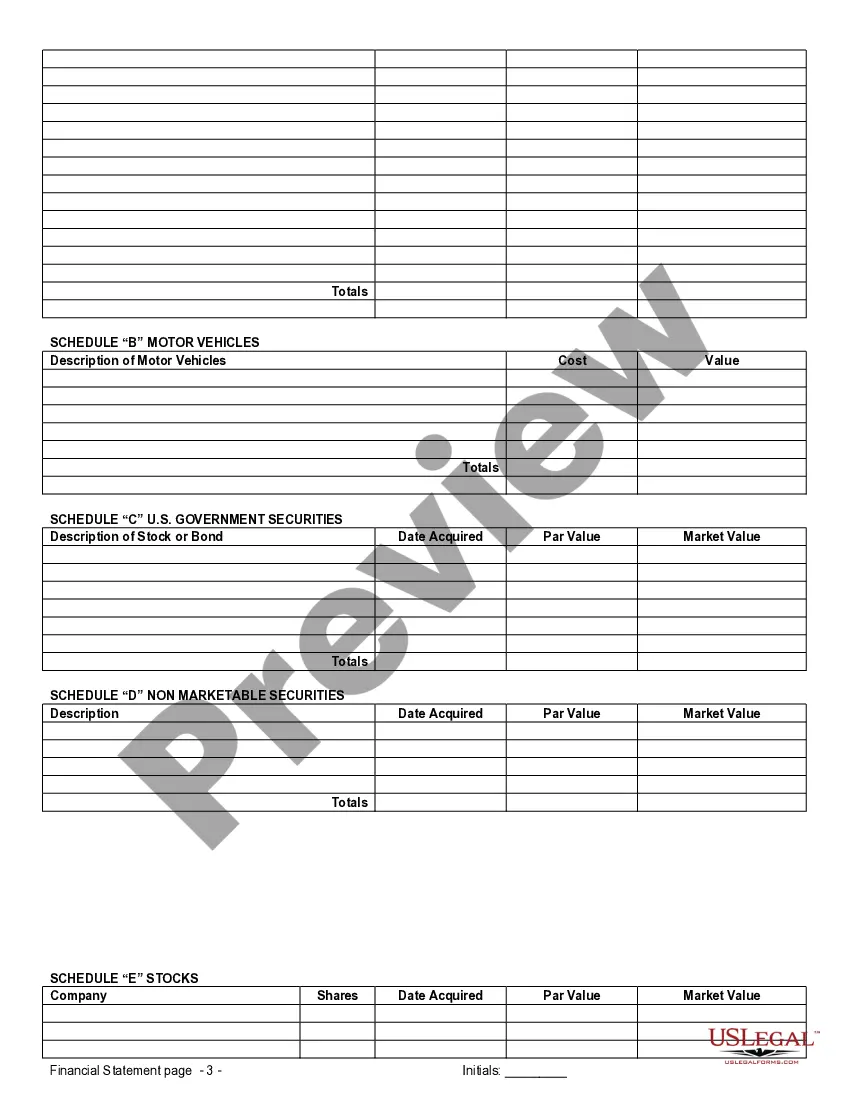

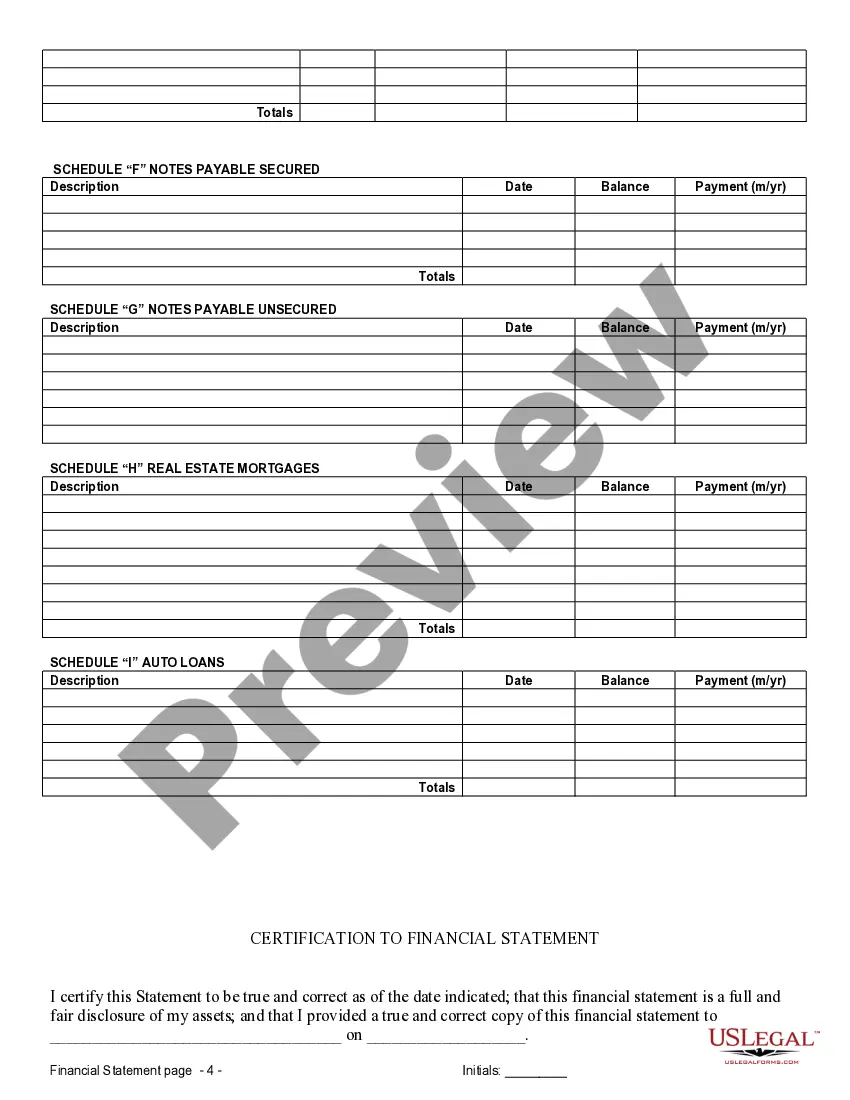

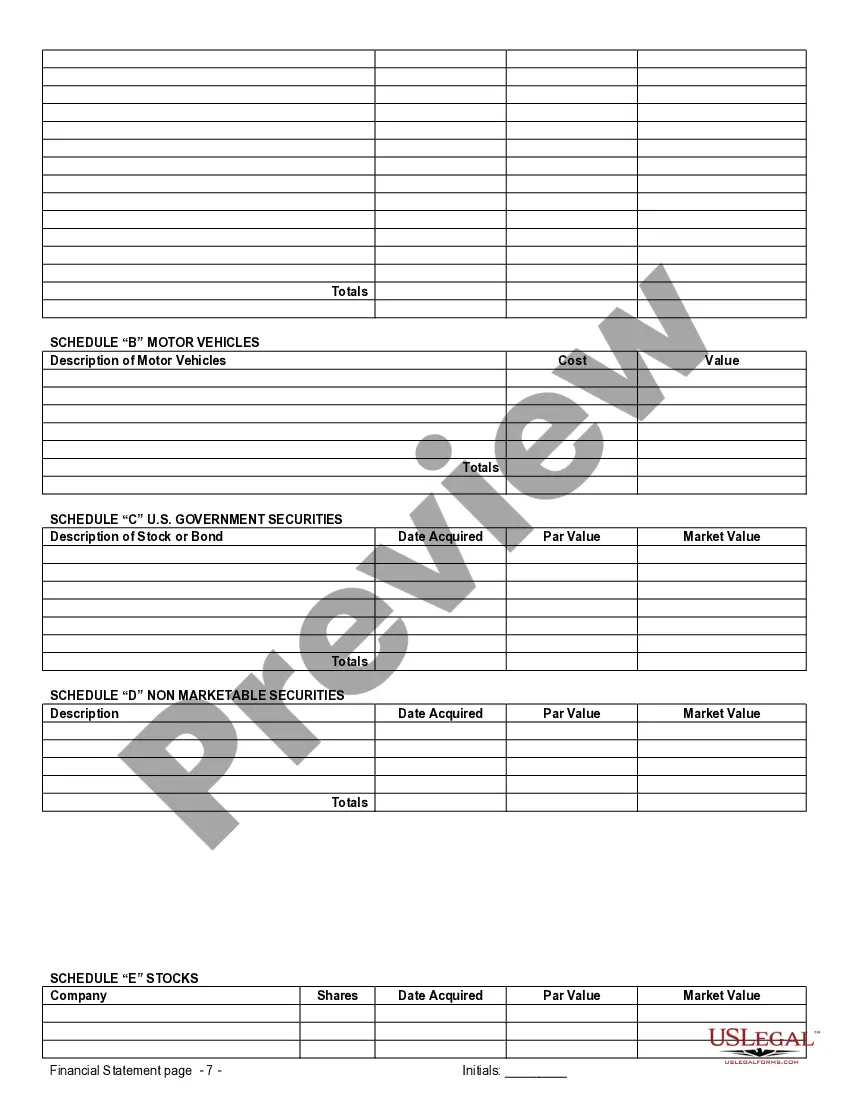

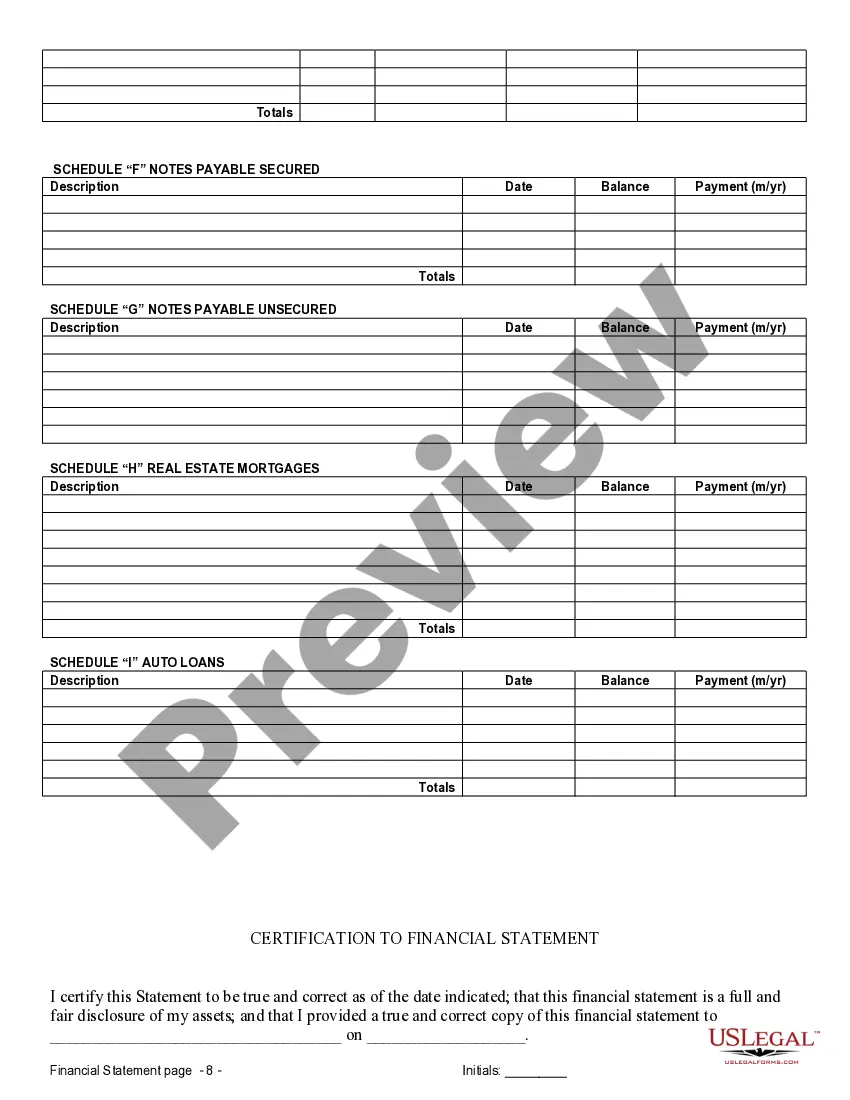

Collin Texas Financial Statements: In the context of a prenuptial or premarital agreement, Collin Texas financial statements play a crucial role in outlining the financial situation of both parties before entering into the marriage. These statements provide a detailed overview of each individual's assets, liabilities, income, and expenses. They serve as a foundation for discussing the division of property and assets in the event of a divorce or separation. Here are some key points to understand about Collin Texas financial statements in connection with a prenuptial or premarital agreement: 1. Purpose: The purpose of Collin Texas financial statements within a prenuptial or premarital agreement is to ensure transparency and full disclosure regarding the financial status of each partner before entering into marriage. It helps establish an equitable arrangement should the marriage end in divorce or separation. 2. Contents: Collin Texas financial statements generally include details such as income, expenses, assets, liabilities, investments, and any ongoing financial commitments. They should be comprehensive and accurately reflect the financial picture of both parties involved. 3. Income-Related Considerations: The statement should provide a clear overview of each party's income, including salaries, bonuses, dividends, rental income, or any other sources. It should outline the frequency and stability of income as well. 4. Asset and Liability Disclosures: Collin Texas financial statements should list all assets, such as real estate properties, vehicles, financial accounts, investments, and personal belongings. Liabilities, such as mortgages, loans, credit card debts, or any ongoing financial obligations, should also be included. 5. Business Interests: If either party owns a business, the financial statement should provide details concerning its value, ownership structure, and any financial considerations related to it. 6. Tax Returns: Often, Collin Texas financial statements may require the disclosure of tax returns for the past few years. This helps evaluate income stability, tax liabilities, and potential tax consequences. Different types of Collin Texas financial statements within a prenuptial or premarital agreement can include: 1. Personal Financial Statement: This statement focuses on an individual's personal finances, including their income, assets, and liabilities solely. 2. Combined Financial Statement: A combined statement presents a comprehensive overview of the couple's financial situation, combining both partners' income, assets, and liabilities. 3. Schedule of Assets and Liabilities: This statement itemizes assets and liabilities in detail, providing a categorized breakdown for easier assessment. 4. Cash Flow Statement: This statement highlights income and expenses over a specified period, offering insights into individual or joint cash flows. It is essential to consult with legal professionals experienced in family law and prenuptial agreements within the jurisdiction of Collin Texas to ensure compliance with local regulations and the accurate preparation of financial statements.Collin Texas Financial Statements: In the context of a prenuptial or premarital agreement, Collin Texas financial statements play a crucial role in outlining the financial situation of both parties before entering into the marriage. These statements provide a detailed overview of each individual's assets, liabilities, income, and expenses. They serve as a foundation for discussing the division of property and assets in the event of a divorce or separation. Here are some key points to understand about Collin Texas financial statements in connection with a prenuptial or premarital agreement: 1. Purpose: The purpose of Collin Texas financial statements within a prenuptial or premarital agreement is to ensure transparency and full disclosure regarding the financial status of each partner before entering into marriage. It helps establish an equitable arrangement should the marriage end in divorce or separation. 2. Contents: Collin Texas financial statements generally include details such as income, expenses, assets, liabilities, investments, and any ongoing financial commitments. They should be comprehensive and accurately reflect the financial picture of both parties involved. 3. Income-Related Considerations: The statement should provide a clear overview of each party's income, including salaries, bonuses, dividends, rental income, or any other sources. It should outline the frequency and stability of income as well. 4. Asset and Liability Disclosures: Collin Texas financial statements should list all assets, such as real estate properties, vehicles, financial accounts, investments, and personal belongings. Liabilities, such as mortgages, loans, credit card debts, or any ongoing financial obligations, should also be included. 5. Business Interests: If either party owns a business, the financial statement should provide details concerning its value, ownership structure, and any financial considerations related to it. 6. Tax Returns: Often, Collin Texas financial statements may require the disclosure of tax returns for the past few years. This helps evaluate income stability, tax liabilities, and potential tax consequences. Different types of Collin Texas financial statements within a prenuptial or premarital agreement can include: 1. Personal Financial Statement: This statement focuses on an individual's personal finances, including their income, assets, and liabilities solely. 2. Combined Financial Statement: A combined statement presents a comprehensive overview of the couple's financial situation, combining both partners' income, assets, and liabilities. 3. Schedule of Assets and Liabilities: This statement itemizes assets and liabilities in detail, providing a categorized breakdown for easier assessment. 4. Cash Flow Statement: This statement highlights income and expenses over a specified period, offering insights into individual or joint cash flows. It is essential to consult with legal professionals experienced in family law and prenuptial agreements within the jurisdiction of Collin Texas to ensure compliance with local regulations and the accurate preparation of financial statements.