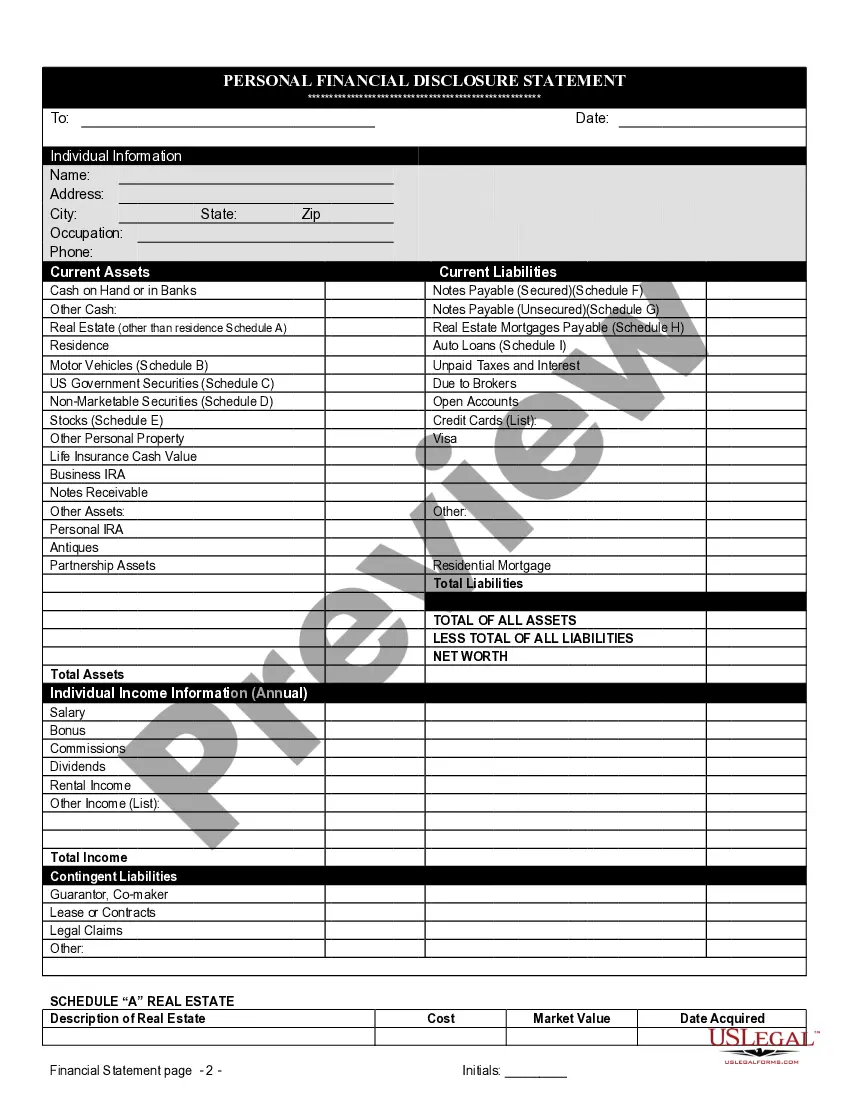

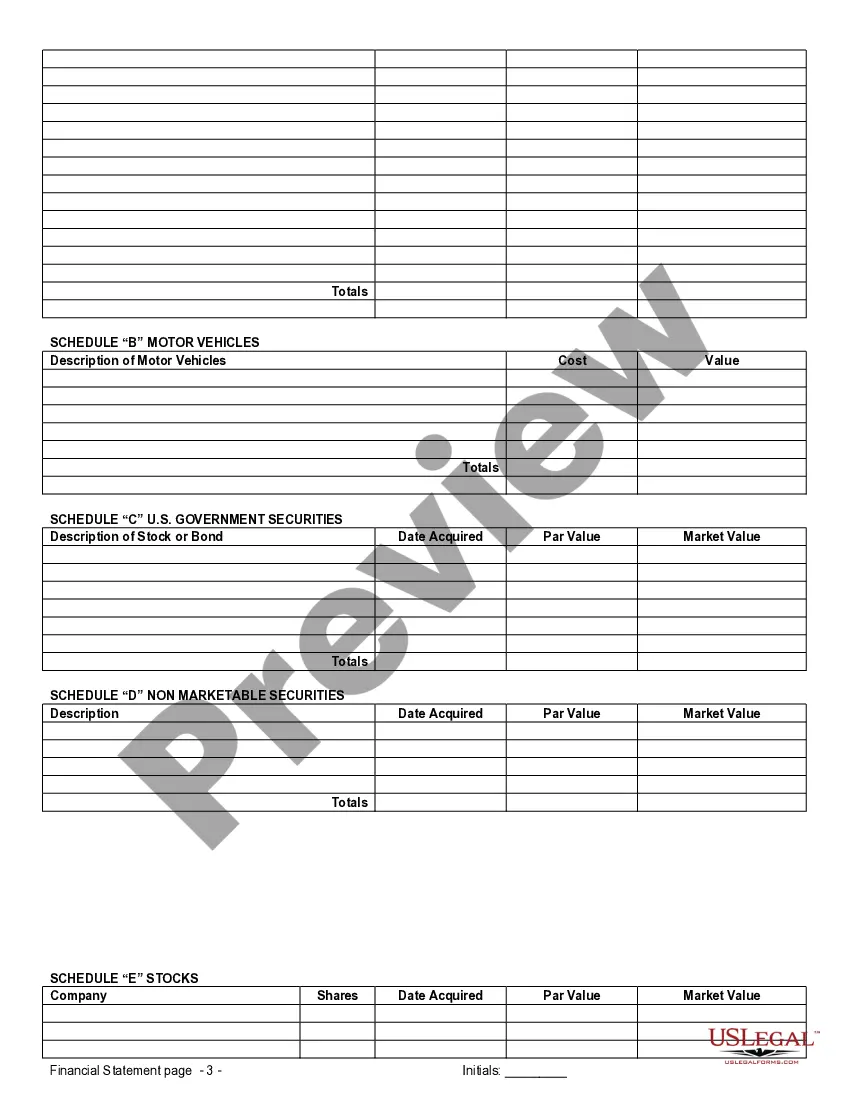

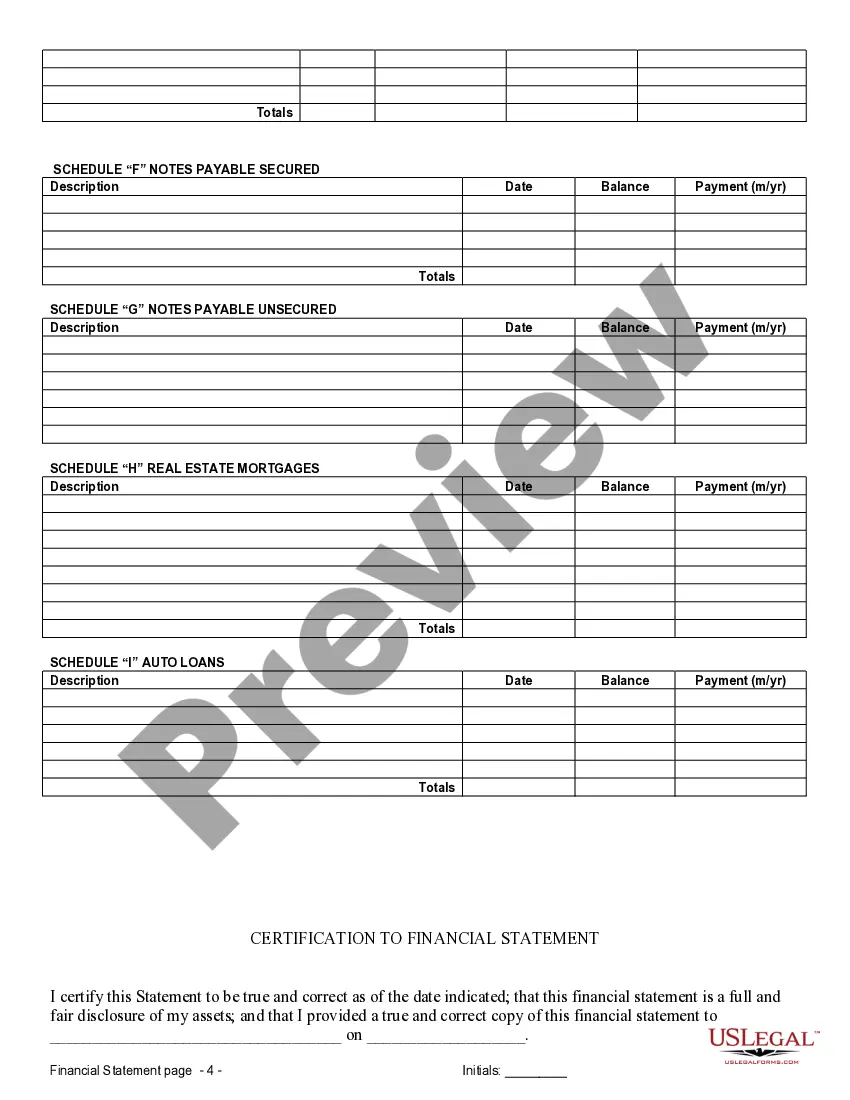

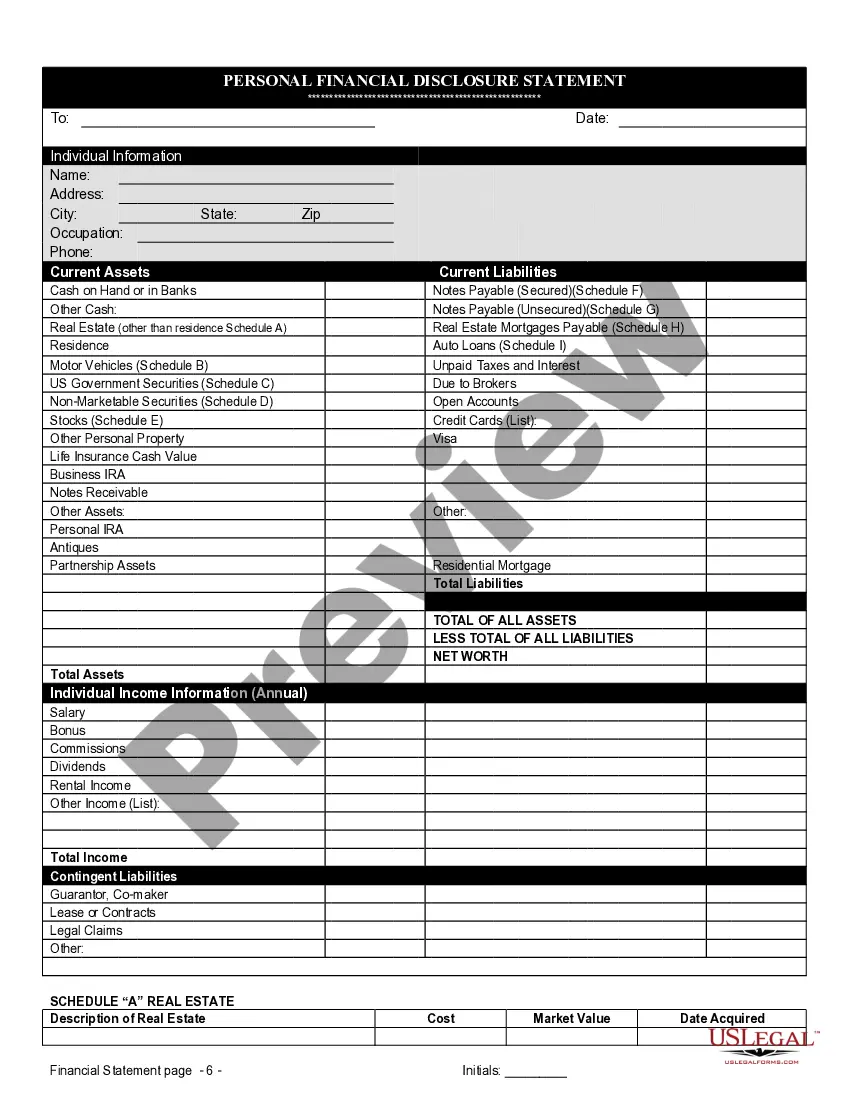

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

Grand Prairie Texas Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Texas Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Utilize the US Legal Forms and gain instant access to any document you need.

Our advantageous platform with a vast array of templates simplifies the process of locating and acquiring nearly any document sample you need.

You can download, complete, and validate the Grand Prairie Texas Financial Statements solely in Relation to Prenuptial Premarital Agreement in just a few minutes instead of spending hours browsing the Internet for a suitable template.

Employing our collection is an excellent method to enhance the security of your form submission. Our seasoned attorneys routinely examine all documents to ensure that the forms are pertinent to a specific area and adhere to updated laws and regulations.

If you haven’t created a profile yet, follow the instructions outlined below.

Access the page with the form you need. Ensure it is the document you are seeking: confirm its title and description, and use the Preview feature if it’s accessible. If not, use the Search function to locate the required one.

- How can you obtain the Grand Prairie Texas Financial Statements solely in Relation to Prenuptial Premarital Agreement.

- If you possess an account, simply Log In to your profile. The Download button will be visible on all the documents you view.

- Furthermore, you can locate all your previously saved documents in the My documents section.

Form popularity

FAQ

Yes, you can write a prenup yourself in Texas. However, it is crucial to understand that the document must meet specific legal standards to be enforceable. Many individuals choose to consult professionals for guidance because creating a valid prenup involves complex considerations, including the Grand Prairie Texas Financial Statements only in Connection with Prenuptial Premarital Agreement. US Legal Forms provides templates and resources to help you create a well-structured agreement that meets legal requirements.

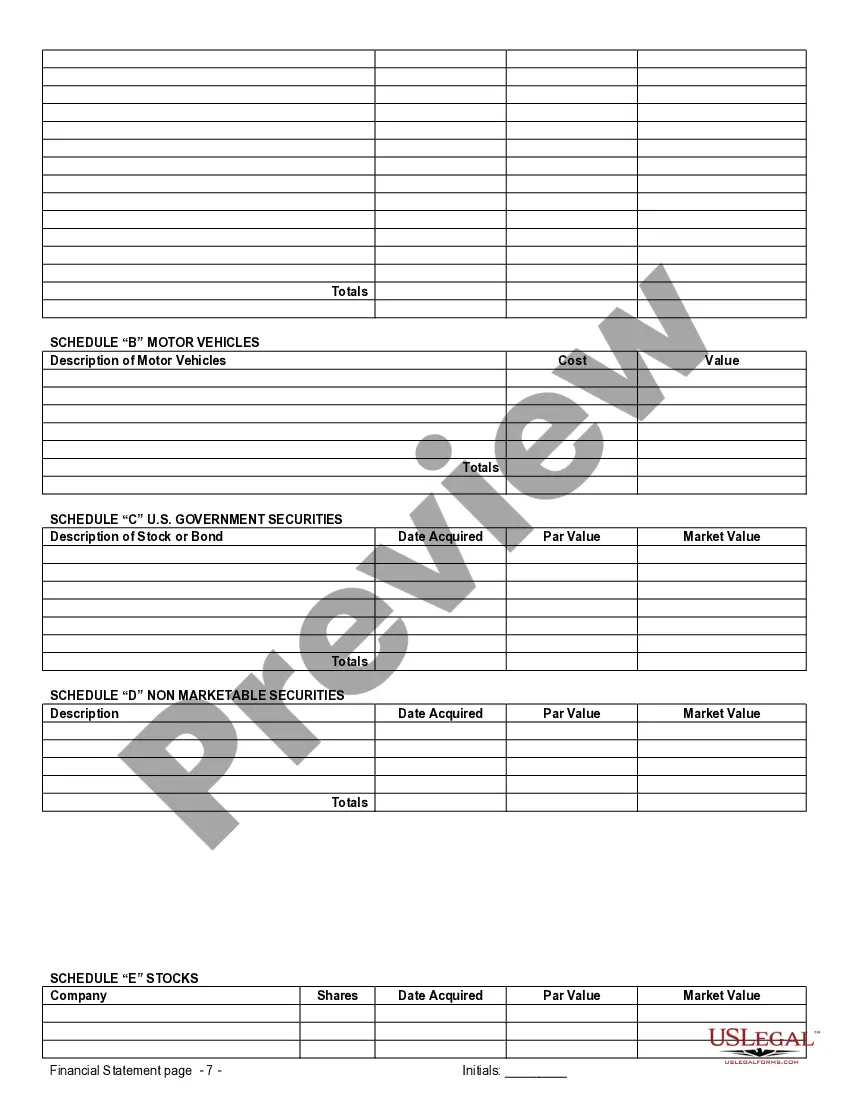

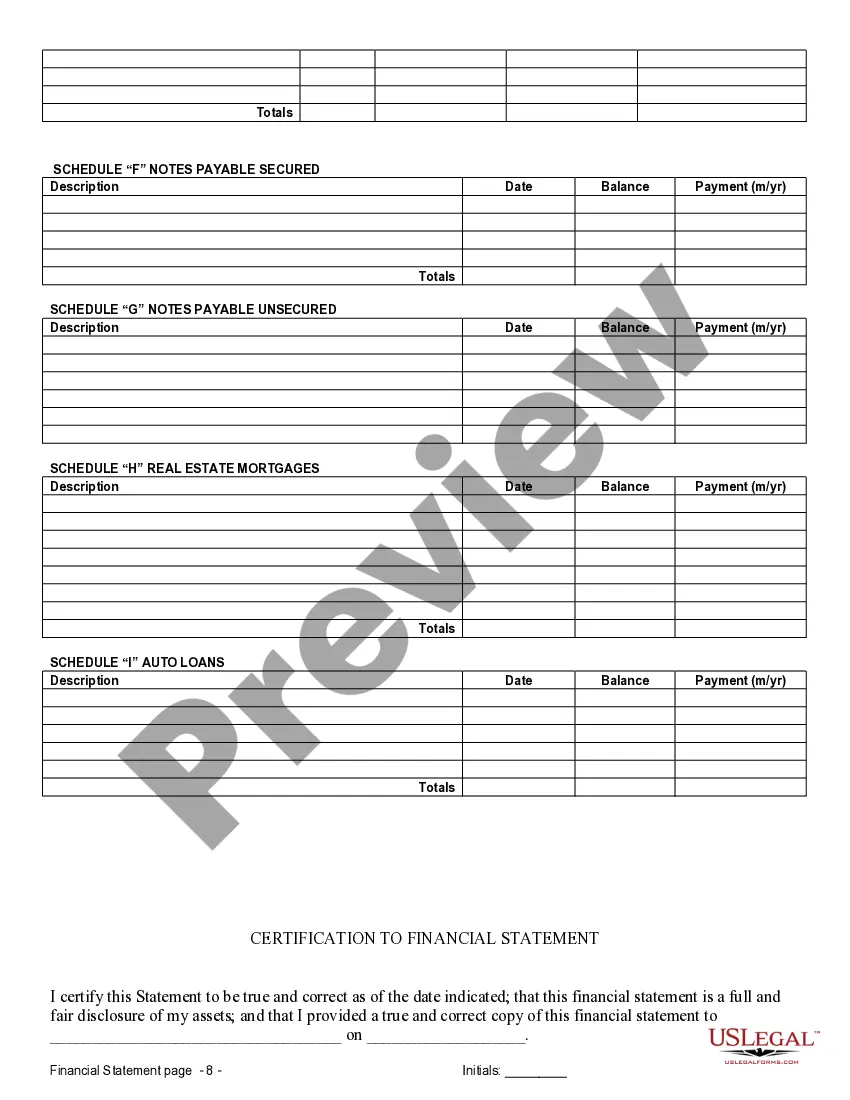

The financial statement of a prenuptial agreement is a comprehensive overview of a couple’s financial status at the time of agreement. It includes assets, liabilities, income, and expenses, ensuring both partners disclose relevant data. By using Grand Prairie Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, this statement not only outlines current finances but also sets the basis for future financial discussions.

Both parties can take advantage of a prenup, especially those with significant assets or entrepreneurial ventures. It also benefits individuals who wish to protect their financial future and ensure clarity in financial matters. By focusing on Grand Prairie Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, couples can tailor their agreements to meet their unique needs.

A prenup is often misperceived as a red flag, signaling distrust. However, it can serve as a practical tool for open communication about finances. By discussing Grand Prairie Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, couples can engage in meaningful discussions that strengthen their relationship rather than weaken it.

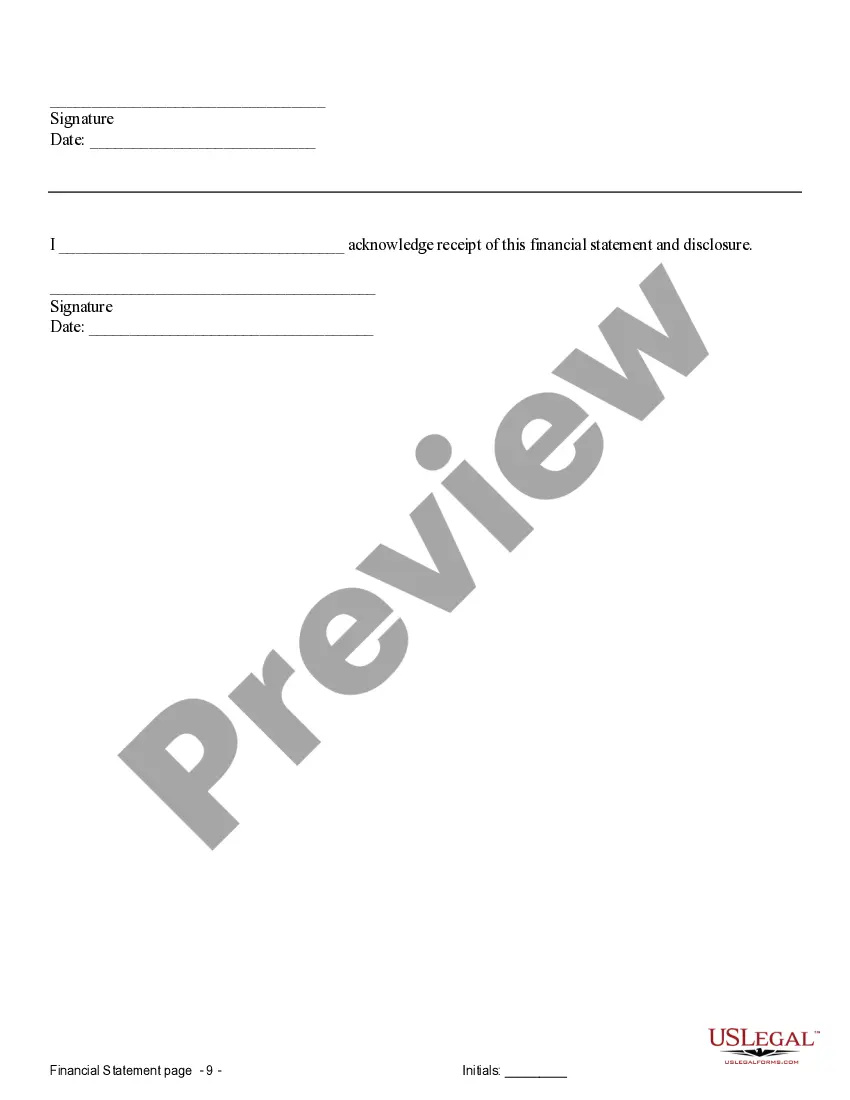

Yes, financial disclosure is a critical component of any effective prenuptial agreement. Both parties should fully disclose their financial situations to ensure fairness and transparency. Utilizing Grand Prairie Texas Financial Statements only in Connection with Prenuptial Premarital Agreement reinforces this requirement, ensuring both parties are informed and protected.

While many think that a prenup focuses solely on premarital assets, it can also describe how future earnings and acquisitions will be handled. This means that it provides clarity on both current and future financial matters. Incorporating Grand Prairie Texas Financial Statements only in Connection with Prenuptial Premarital Agreement can help in establishing these terms, promoting transparency and mutual understanding.

A financial disclosure typically includes details about income, debts, assets, and expenses. For instance, if you own a home or have investments, those must be listed clearly. In the context of Grand Prairie Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, this disclosure helps both parties understand their financial landscape before marriage.

Yes, Texas recognizes prenuptial agreements as legal and enforceable contracts. These agreements allow individuals to determine how their assets and liabilities will be managed in the event of divorce or death. To ensure that your prenuptial agreement is valid and meets legal standards, it is important to include relevant financial information, such as Grand Prairie Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, and to seek legal counsel during the process.

To be valid in Texas, a prenuptial agreement must be in writing and signed by both parties. It should include complete financial disclosures and must be entered voluntarily without any pressure. Moreover, a solid document can incorporate specific details and Grand Prairie Texas Financial Statements only in Connection with Prenuptial Premarital Agreement, allowing each party to understand their rights clearly. Legal guidance is beneficial to achieve this.

A prenuptial agreement can be declared invalid in Texas if it lacks the necessary signatures, was entered into without adequate disclosure of finances, or was signed under duress. Additionally, if the agreement is shockingly unfair or unreasonable at the time of its enforcement, a court may deem it unenforceable. Therefore, creating a valid prenup involves ensuring complete transparency, including accurate Grand Prairie Texas Financial Statements only in Connection with Prenuptial Premarital Agreement.