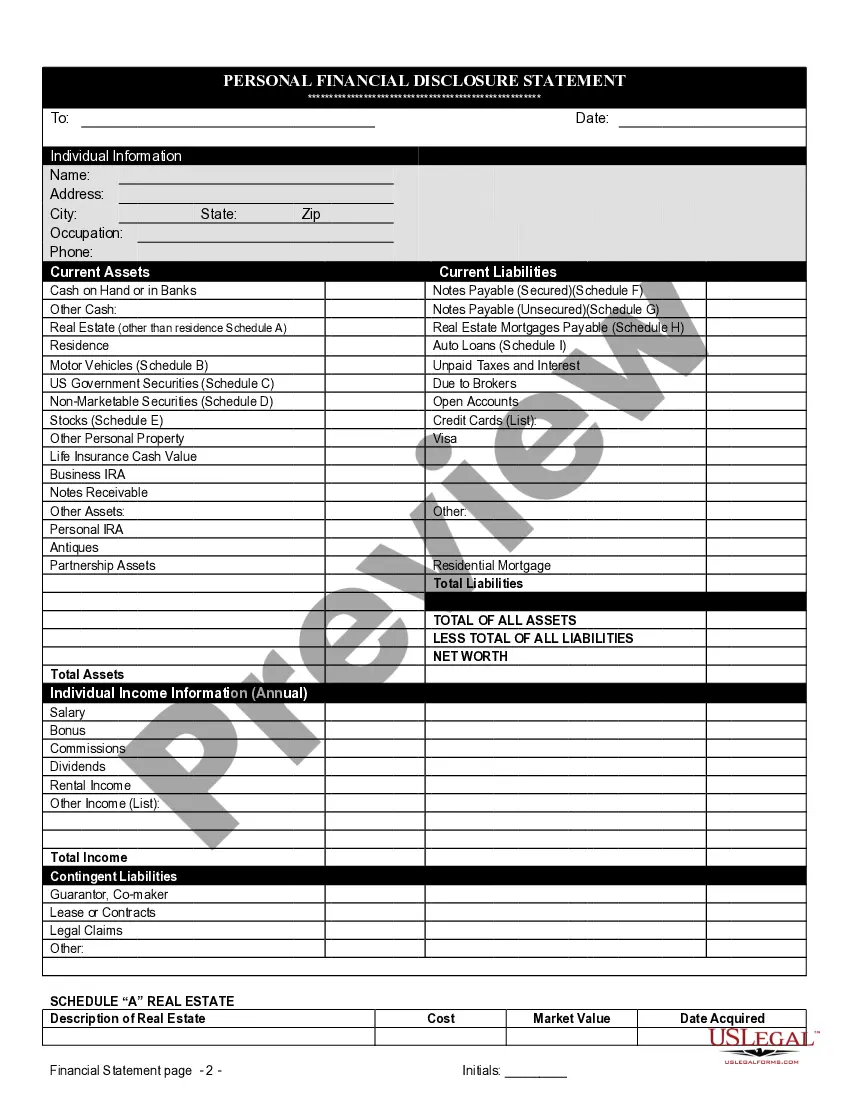

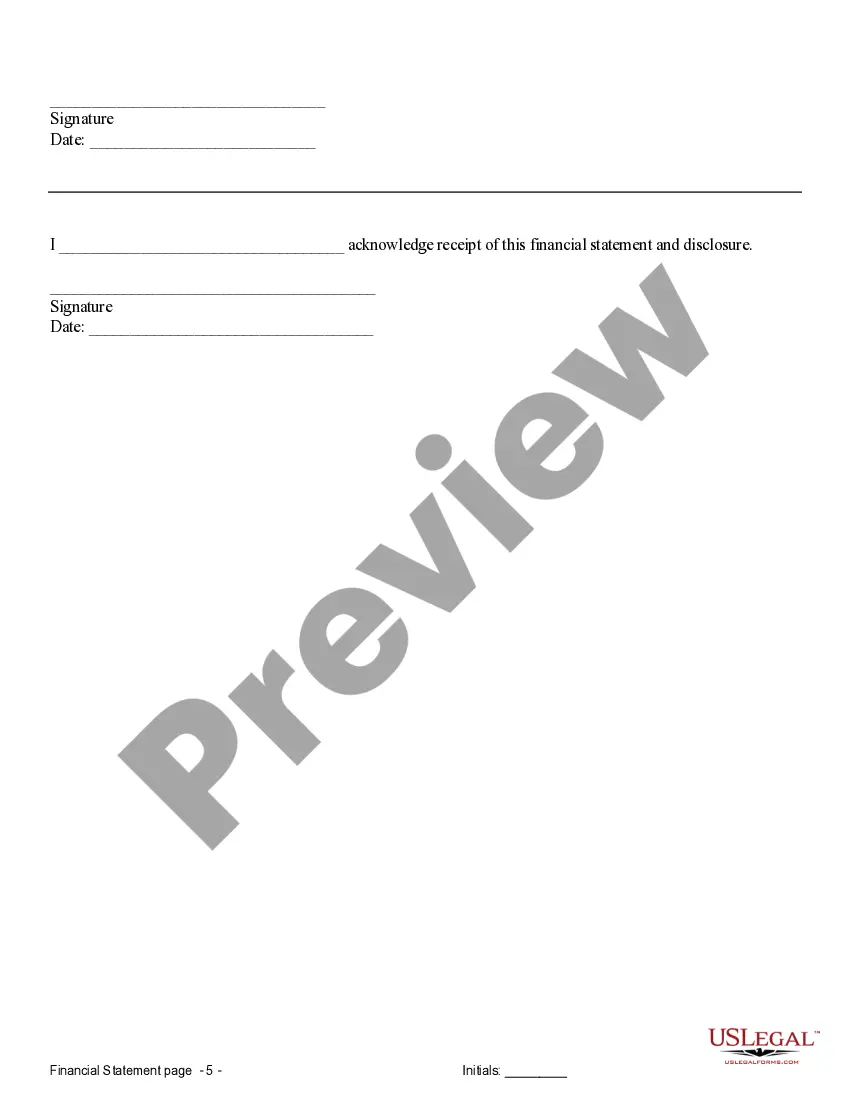

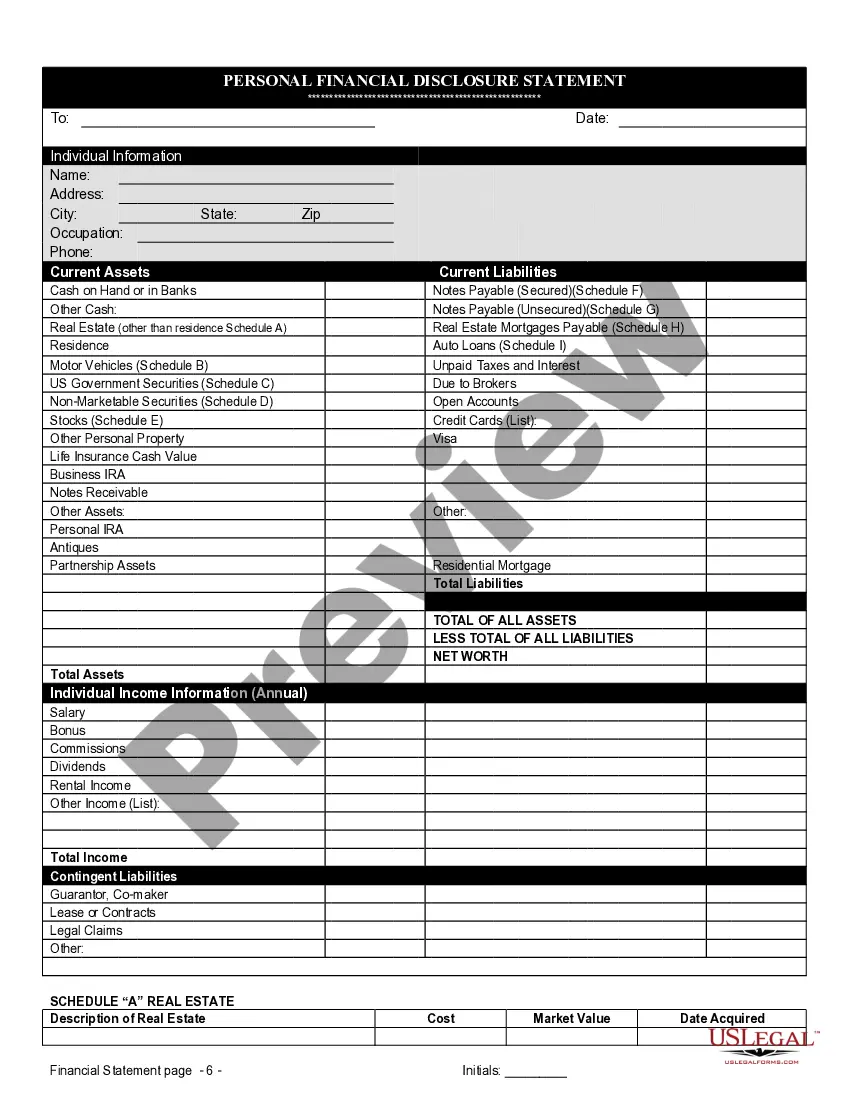

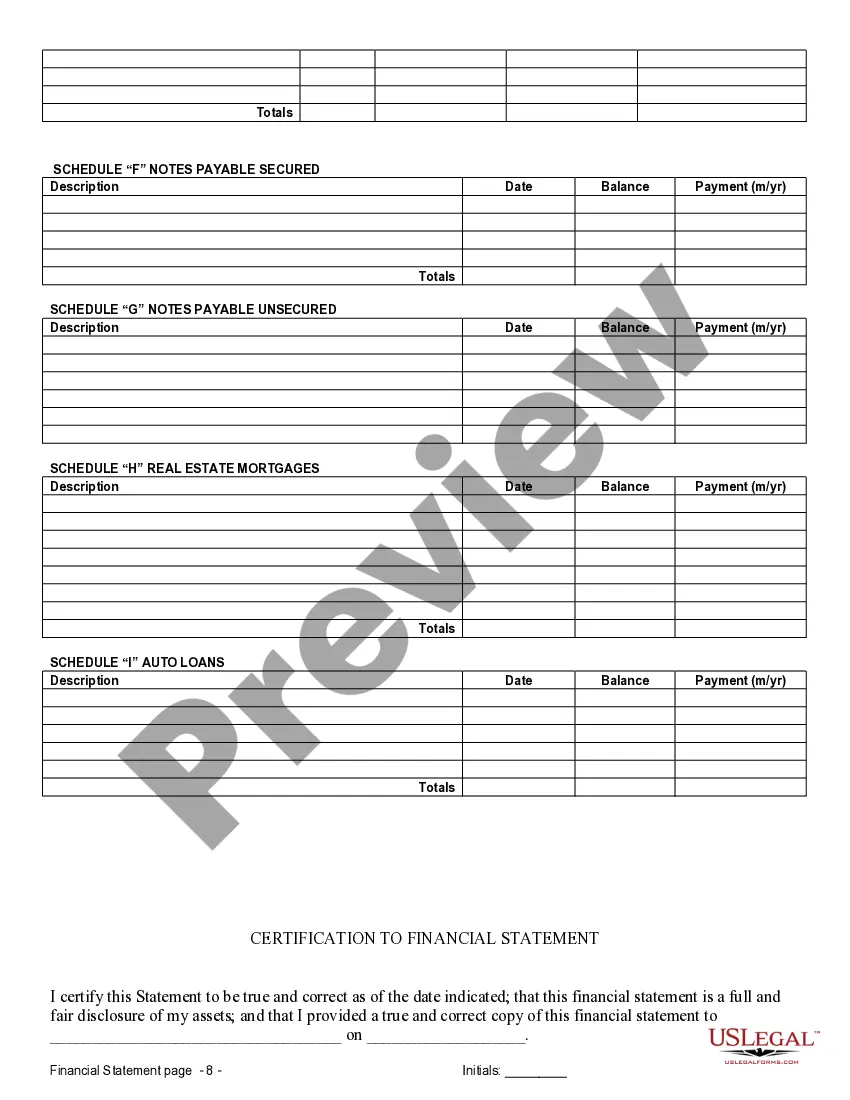

The financial statement disclosure form is for use in connection with the premarital agreement and must be completed accurately and completely. Both parties are required to complete a separate financial statement and provide a copy of the statement to the other party.

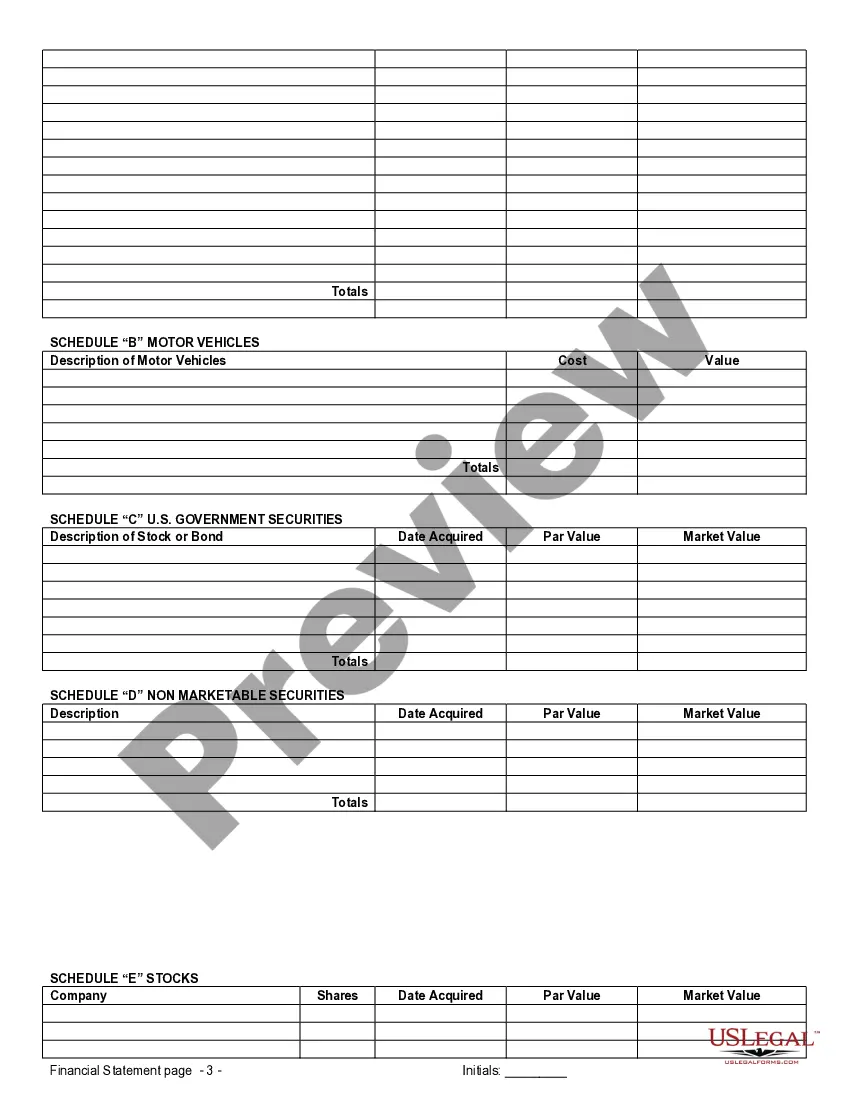

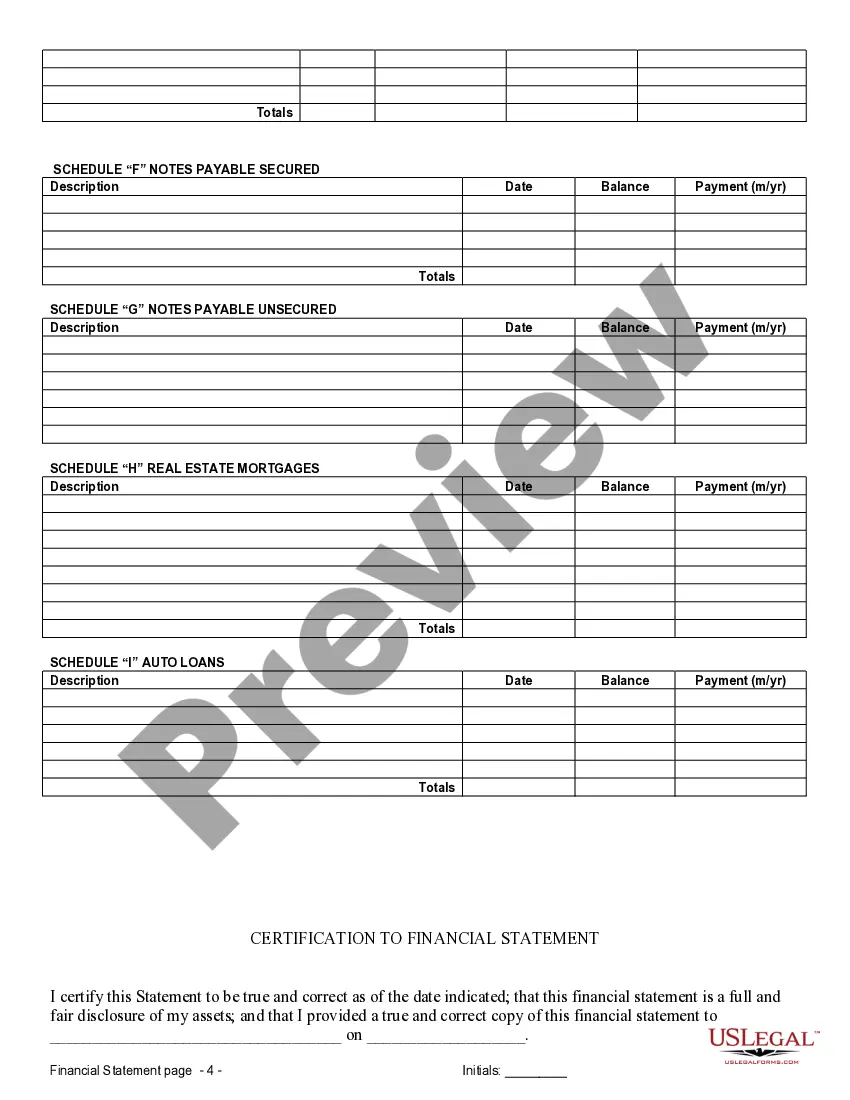

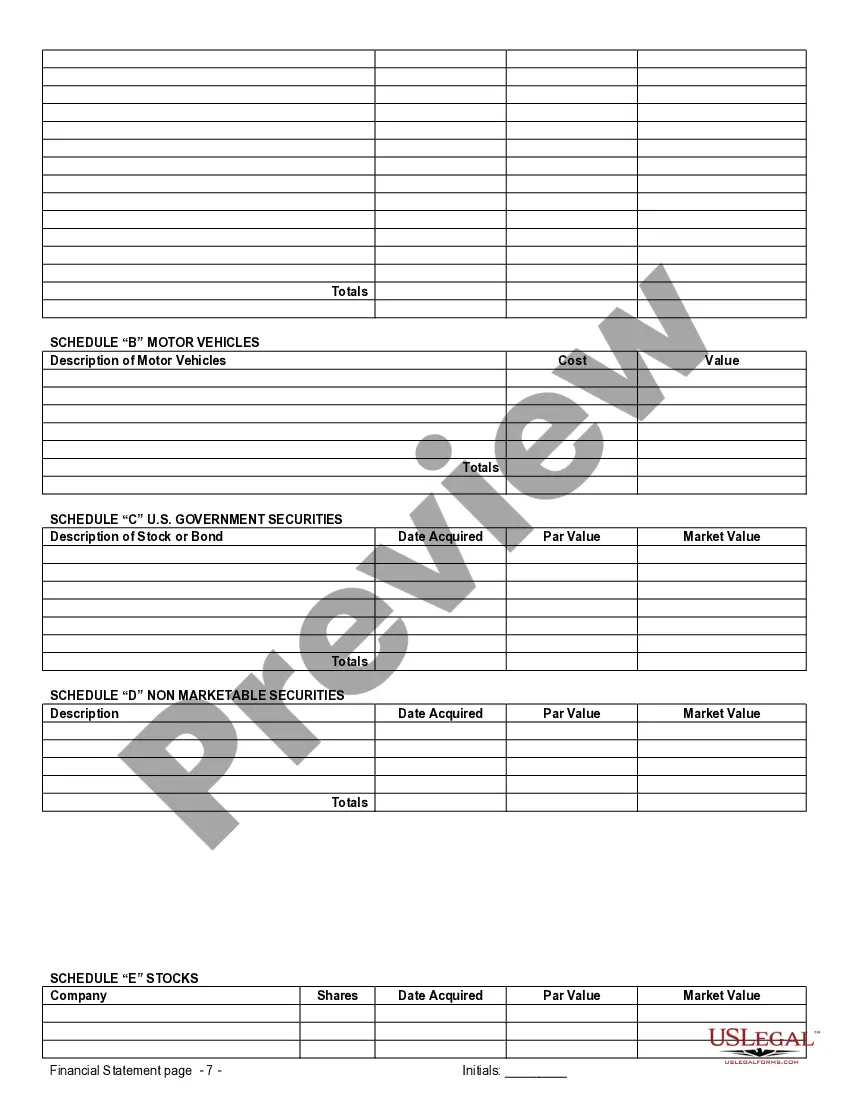

Lewisville Texas Financial Statements in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Lewisville, Texas, it is crucial to have a comprehensive understanding of the financial situation of both parties involved. One key aspect in this process is the requirement for Lewisville Texas Financial Statements, which provide an accurate and detailed reflection of each party's financial standing. These financial statements play a vital role in ensuring transparency, fairness, and protection of each party's interests during the drafting and enforcement of a prenuptial agreement. There are various types of Lewisville Texas Financial Statements that can be utilized to fulfill the requirements of the prenuptial agreement. Understanding the purpose and characteristics of each type is important to ensure compliance with legal regulations. The following are the main types of financial statements commonly used in connection with a prenuptial or premarital agreement in Lewisville, Texas: 1. Personal Income Statement: This statement entails a detailed breakdown of an individual's income, including salary, bonuses, commissions, investments, rental income, and any other recurring sources of income. It provides an overview of the earnings and financial contributions one brings into the marriage. 2. Personal Balance Sheet: A personal balance sheet represents an individual's assets, liabilities, and net worth. It includes a comprehensive list of possessions such as real estate, vehicles, investments, retirement accounts, bank accounts, and any outstanding debts or loans. This statement allows for an evaluation of the individual's financial position and potential contributions to the marital estate. 3. Business Financial Statements: If either or both parties own businesses or have significant ownership interests in entities, it is essential to provide business financial statements. These statements may include profit and loss statements, balance sheets, cash flow statements, and tax returns for the business. Detailing these documents helps evaluate the business's value and potential income distribution. 4. Tax Returns: To gain a comprehensive understanding of an individual's financial history, tax returns for the past several years are often required. These returns provide insight into incomes, deductions, investments, and other financial activities. They assist in assessing the party's financial stability and verifying the accuracy of other financial statements presented. 5. Retirement Account Statements: Retirement accounts, such as 401(k), IRAs, pensions, or other investment portfolios, play a significant role in a couple's financial future. Providing retirement account statements showcases the value, contribution amounts, and beneficiary designations of these accounts. When preparing Lewisville Texas Financial Statements, accuracy, completeness, and accountability are crucial. It is essential to disclose all relevant financial information to ensure a fair evaluation of each party's financial situation. Failure to disclose financial information accurately may lead to the prenuptial agreement being challenged or deemed unenforceable in the future. In conclusion, Lewisville Texas Financial Statements are a critical component of the prenuptial agreement process in Lewisville, Texas. These statements provide an overview of each party's financial situation, ensuring transparency and fair decision-making during the drafting and enforcement of a prenuptial or premarital agreement. By including various types of financial statements such as personal income statements, personal balance sheets, business financial statements, tax returns, and retirement account statements, both parties can make informed decisions regarding their financial futures.Lewisville Texas Financial Statements in Connection with Prenuptial Premarital Agreement When entering into a prenuptial or premarital agreement in Lewisville, Texas, it is crucial to have a comprehensive understanding of the financial situation of both parties involved. One key aspect in this process is the requirement for Lewisville Texas Financial Statements, which provide an accurate and detailed reflection of each party's financial standing. These financial statements play a vital role in ensuring transparency, fairness, and protection of each party's interests during the drafting and enforcement of a prenuptial agreement. There are various types of Lewisville Texas Financial Statements that can be utilized to fulfill the requirements of the prenuptial agreement. Understanding the purpose and characteristics of each type is important to ensure compliance with legal regulations. The following are the main types of financial statements commonly used in connection with a prenuptial or premarital agreement in Lewisville, Texas: 1. Personal Income Statement: This statement entails a detailed breakdown of an individual's income, including salary, bonuses, commissions, investments, rental income, and any other recurring sources of income. It provides an overview of the earnings and financial contributions one brings into the marriage. 2. Personal Balance Sheet: A personal balance sheet represents an individual's assets, liabilities, and net worth. It includes a comprehensive list of possessions such as real estate, vehicles, investments, retirement accounts, bank accounts, and any outstanding debts or loans. This statement allows for an evaluation of the individual's financial position and potential contributions to the marital estate. 3. Business Financial Statements: If either or both parties own businesses or have significant ownership interests in entities, it is essential to provide business financial statements. These statements may include profit and loss statements, balance sheets, cash flow statements, and tax returns for the business. Detailing these documents helps evaluate the business's value and potential income distribution. 4. Tax Returns: To gain a comprehensive understanding of an individual's financial history, tax returns for the past several years are often required. These returns provide insight into incomes, deductions, investments, and other financial activities. They assist in assessing the party's financial stability and verifying the accuracy of other financial statements presented. 5. Retirement Account Statements: Retirement accounts, such as 401(k), IRAs, pensions, or other investment portfolios, play a significant role in a couple's financial future. Providing retirement account statements showcases the value, contribution amounts, and beneficiary designations of these accounts. When preparing Lewisville Texas Financial Statements, accuracy, completeness, and accountability are crucial. It is essential to disclose all relevant financial information to ensure a fair evaluation of each party's financial situation. Failure to disclose financial information accurately may lead to the prenuptial agreement being challenged or deemed unenforceable in the future. In conclusion, Lewisville Texas Financial Statements are a critical component of the prenuptial agreement process in Lewisville, Texas. These statements provide an overview of each party's financial situation, ensuring transparency and fair decision-making during the drafting and enforcement of a prenuptial or premarital agreement. By including various types of financial statements such as personal income statements, personal balance sheets, business financial statements, tax returns, and retirement account statements, both parties can make informed decisions regarding their financial futures.